Scalper1 News

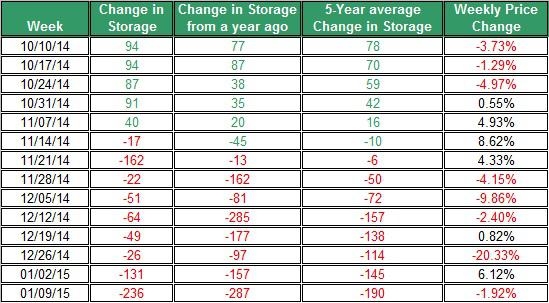

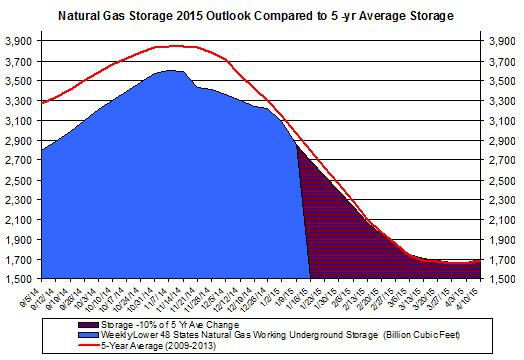

Summary Colder-than-normal weather brought up the price of UNG. EIA still estimates this year’s natural gas price to remain lower than last year’s. This week’s extraction from storage is estimated to be higher than the 5-year average. The recent news of possible Arctic weather in the coming week pushed up back up the price of United States Natural Gas (NYSEARCA: UNG ) to pass $16 at one point. Since then, however, its price resumed its descent. The price of UNG ended last week at $15.69 – representing a 4.6% gain, week over week. Despite the recent rally in UNG, it’s still 16% down in the past month. The cold snap drove up the U.S. consumption by nearly 7%, week over week. Most of this gain was in the residential/commercial sectors. Despite the low prices of natural gas, the U.S. natural gas output is still up by roughly 10% for the year. If prices were to remain low, however, this could eventually curb down the growth rate in the natural gas output in the coming quarters. But the main issue revolves around the potential changes in the demand for natural gas mainly in the residential/commercial sectors. Over the next couple of weeks, the temperatures mainly in the Northeast and Midwest are projected to be lower than normal. In the west coast temperatures are expected to be higher than normal. Conversely, this week, the current outlook for the heating degrees days shows lower than normal levels. Nonetheless, it seems that the low temperatures are likely to keep driving up the demand for natural gas for heating purposes. Let’s turn to the latest from the natural gas storage. Last week’s Energy Information Administration update showed a 236 Bcf extraction from storage – this was 46 Bcf higher than the 5-year average. But it was also 51 Bcf below last year’s extraction. Source: EIA This week’s extraction from storage is likely to be, again, higher than the 5-year average. Keep in mind, last week’s deviation from normal temperatures was, on average, -4.29. The lower-than-normal temperatures may result in higher than normal withdrawal. Even though the changes in storage provide an indication for the changes in the demand and supply for natural gas on a weekly scale, as I pointed out in the past, the relation between the prices changes in UNG and shifts in storage tend to have a low correlation. This is mostly on a week-to-week examination. On broader scale, however, lower extractions from storage tend to keep UNG down and vice versa. Looking forward, if the extractions from storage were to remain roughly 10% lower than the 5-year average, this could bring the natural gas storage in line with the 5-year average by the time the injection season commences. This is shown in the chart below. Source: EIA The EIA also estimates that the natural gas inventories will be roughly in line with the 5-year average by the end of March 2015. On a yearly scale, the EIA still expects natural gas prices to remain low in 2015 – the annual average price is estimated at $3.44; this is roughly 22% lower than the average yearly price in 2014. The uncertainty in the weather forecasts in the next couple of weeks could lead to big swings in the price of UNG – as was the case in recent weeks. Nonetheless, if temperatures don’t fall below current estimates, this could result in UNG resuming its descent. For more see: Has the Weakness in Oil Fueled the Decline of UNG? Scalper1 News

Summary Colder-than-normal weather brought up the price of UNG. EIA still estimates this year’s natural gas price to remain lower than last year’s. This week’s extraction from storage is estimated to be higher than the 5-year average. The recent news of possible Arctic weather in the coming week pushed up back up the price of United States Natural Gas (NYSEARCA: UNG ) to pass $16 at one point. Since then, however, its price resumed its descent. The price of UNG ended last week at $15.69 – representing a 4.6% gain, week over week. Despite the recent rally in UNG, it’s still 16% down in the past month. The cold snap drove up the U.S. consumption by nearly 7%, week over week. Most of this gain was in the residential/commercial sectors. Despite the low prices of natural gas, the U.S. natural gas output is still up by roughly 10% for the year. If prices were to remain low, however, this could eventually curb down the growth rate in the natural gas output in the coming quarters. But the main issue revolves around the potential changes in the demand for natural gas mainly in the residential/commercial sectors. Over the next couple of weeks, the temperatures mainly in the Northeast and Midwest are projected to be lower than normal. In the west coast temperatures are expected to be higher than normal. Conversely, this week, the current outlook for the heating degrees days shows lower than normal levels. Nonetheless, it seems that the low temperatures are likely to keep driving up the demand for natural gas for heating purposes. Let’s turn to the latest from the natural gas storage. Last week’s Energy Information Administration update showed a 236 Bcf extraction from storage – this was 46 Bcf higher than the 5-year average. But it was also 51 Bcf below last year’s extraction. Source: EIA This week’s extraction from storage is likely to be, again, higher than the 5-year average. Keep in mind, last week’s deviation from normal temperatures was, on average, -4.29. The lower-than-normal temperatures may result in higher than normal withdrawal. Even though the changes in storage provide an indication for the changes in the demand and supply for natural gas on a weekly scale, as I pointed out in the past, the relation between the prices changes in UNG and shifts in storage tend to have a low correlation. This is mostly on a week-to-week examination. On broader scale, however, lower extractions from storage tend to keep UNG down and vice versa. Looking forward, if the extractions from storage were to remain roughly 10% lower than the 5-year average, this could bring the natural gas storage in line with the 5-year average by the time the injection season commences. This is shown in the chart below. Source: EIA The EIA also estimates that the natural gas inventories will be roughly in line with the 5-year average by the end of March 2015. On a yearly scale, the EIA still expects natural gas prices to remain low in 2015 – the annual average price is estimated at $3.44; this is roughly 22% lower than the average yearly price in 2014. The uncertainty in the weather forecasts in the next couple of weeks could lead to big swings in the price of UNG – as was the case in recent weeks. Nonetheless, if temperatures don’t fall below current estimates, this could result in UNG resuming its descent. For more see: Has the Weakness in Oil Fueled the Decline of UNG? Scalper1 News

Scalper1 News