Scalper1 News

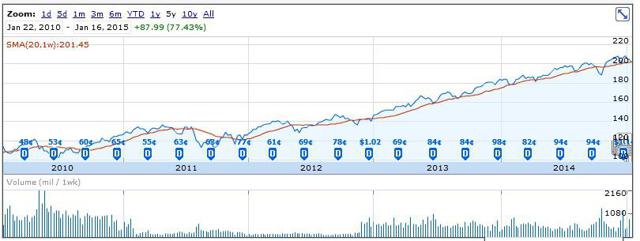

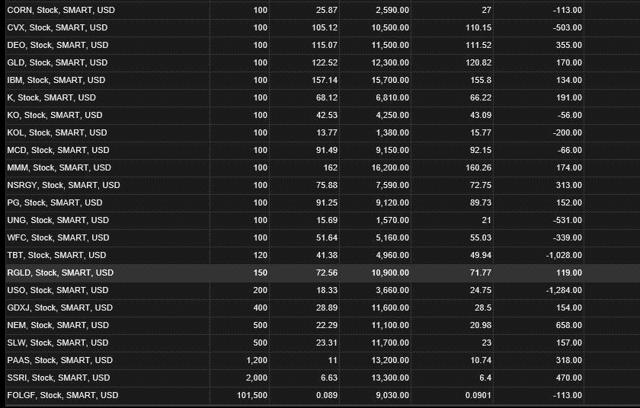

Never go “all-in”, no matter how tempting it may be. Many forex traders got wiped out by using too much leverage trading the Swiss franc last week. “Protect the downside” and “regular re-balancing” have kept my portfolio from big drawdowns and losses. We have added multiple equity positions and precious metal positions to our 1% income portfolio. First thing, let’s go through what happened with the Swiss franc last Friday. The currency’s value had been pegged to the euro since 2011. The pegged price was “1.2:1”, which meant 1.2 Swiss francs bought you 1 euro. Last Friday, the Swiss National Bank announced that it was going to break the peg and allow its currency to trade freely. The franc rallied strongly on the news, and at one point last Friday, the franc was worth 0.85 euro cents, before finishing at practically parity with the euro. The Swiss stock markets fell sharply, but when you factored in the added strength of the franc, the losses in real terms were much less than reported. So why did the Swiss bank announce such a measure? Well, I believe there could be 2 answers. Firstly, the franc has lost a lot of purchasing power since the middle of last year, as the dollar has made massive gains against the euro. Also, secondly, is the Swiss central bank sniffing our quantitative easing in the near future by the European central bank? If QE gets the go-ahead in Europe, then all currencies that are pegged to the euro will also have to undergo devaluation. However, the Swiss franc is seen as a safe haven internationally, so it would have definitely lost its prestige if the currency continued its devaluation against other currencies such as the dollar. The Swiss economy may hurt for a while, but the right decision was made, in my opinion. The purchasing power of the franc has been prioritised, and this is excellent news for its citizens. So what’s the lesson to be learned here? Well, many currency traders got their portfolios wiped out because of last Friday’s action. An investor or trader can never go “all-in”, no matter how tempting the investment or trade may be. I spoke about this in one of my previous articles . Greed can destroy a portfolio overnight, if it is allowed to. The dollar has been rallying strongly since the middle of last year. Moreover, many currency traders thought that the impending QE in Europe would strengthen the dollar even more against the euro and the Swiss franc. Some shorted the Swiss franc en masse in the hope of making a killing. Unfortunately, all that was “killed” was their portfolios. Re-balancing your portfolio is one of the best techniques out there for controlling greed and keeping your portfolio fresh. If you are holding US stocks, the US dollar or US bonds in your portfolio, I would recommend that you rebalance your portfolio. These 3 sectors have risen a lot in the last 12-18 months. Smart investors would take some money off the table in these sectors and deploy extra capital in more depressed sectors. I am not advocating withdrawing all your capital from these sectors, as there may be many more months of upside, but now may be the time to lighten up instead of doubling down. We are living in volatile times, where any move by a country or central bank could have devastating effects on your portfolio if it is not set up correctly. I say all of the above because the sentiment on the US dollar at the moment is extremely bullish. Everyone expects the dollar rally to continue (and it may very well continue) as Europe tries to get a grip on deflation. Nevertheless, surprises can happen in any market, as we witnessed last week. Could China, for example, break its currency’s peg against the US dollar? Many would say this is highly improbable, as China owns huge amounts of dollar reserves. What if the US announced QE4 in the coming months? Would the Chinese let their currency weaken alongside the dollar? These scenarios may never happen, but position sizing and diversification in your portfolio would protect you from all possible outcomes. Another valuable lesson in investing which ties in well with my last point is “protecting the downside”. Professional investors are far more concerned with the downside (risk) than the upside. Losing money is not an option for them. So let’s look at what an investor can do when he or she is sitting on some nice profits. Let’s take a look at the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ), for example. This ETF has gained 80% over the last 5 years, which is a fantastic return for an ETF. How do we protect the downside? (click to enlarge) 1. We take some money off the table and deploy it into a depressed sector, such as the gold mining sector. 2. We buy a put option (like insurance). If the ETF drops, our put option will go up in value. The net result is that we will lose less if the market falls sharply. If the market continues to rise, we will only lose what we paid for the put option. 3. We place a stop loss under the present price of the ETF (the 200-day moving average is used often by professionals). The problem with a stop loss is that it is less effective when there is volatility in the market (violent swings both ways). Protecting the downside and rebalancing my portfolio every once in a while has not only protected my portfolio, but also has grown it. Finally, we added many positions to our 1% portfolio last Thursday and Friday (see screenshot below). We now have in the region of $130k invested in stocks, but will not be investing more into this asset class for the moment, as we feel other asset classes can give us higher returns going forward (rebalancing). We will fill up our Precious Metals & Commodities asset classes with the full $180k each soon enough, as we have unearthed depressed companies in these sectors and low-cost indexes. Stay tuned. (click to enlarge) Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Scalper1 News

Never go “all-in”, no matter how tempting it may be. Many forex traders got wiped out by using too much leverage trading the Swiss franc last week. “Protect the downside” and “regular re-balancing” have kept my portfolio from big drawdowns and losses. We have added multiple equity positions and precious metal positions to our 1% income portfolio. First thing, let’s go through what happened with the Swiss franc last Friday. The currency’s value had been pegged to the euro since 2011. The pegged price was “1.2:1”, which meant 1.2 Swiss francs bought you 1 euro. Last Friday, the Swiss National Bank announced that it was going to break the peg and allow its currency to trade freely. The franc rallied strongly on the news, and at one point last Friday, the franc was worth 0.85 euro cents, before finishing at practically parity with the euro. The Swiss stock markets fell sharply, but when you factored in the added strength of the franc, the losses in real terms were much less than reported. So why did the Swiss bank announce such a measure? Well, I believe there could be 2 answers. Firstly, the franc has lost a lot of purchasing power since the middle of last year, as the dollar has made massive gains against the euro. Also, secondly, is the Swiss central bank sniffing our quantitative easing in the near future by the European central bank? If QE gets the go-ahead in Europe, then all currencies that are pegged to the euro will also have to undergo devaluation. However, the Swiss franc is seen as a safe haven internationally, so it would have definitely lost its prestige if the currency continued its devaluation against other currencies such as the dollar. The Swiss economy may hurt for a while, but the right decision was made, in my opinion. The purchasing power of the franc has been prioritised, and this is excellent news for its citizens. So what’s the lesson to be learned here? Well, many currency traders got their portfolios wiped out because of last Friday’s action. An investor or trader can never go “all-in”, no matter how tempting the investment or trade may be. I spoke about this in one of my previous articles . Greed can destroy a portfolio overnight, if it is allowed to. The dollar has been rallying strongly since the middle of last year. Moreover, many currency traders thought that the impending QE in Europe would strengthen the dollar even more against the euro and the Swiss franc. Some shorted the Swiss franc en masse in the hope of making a killing. Unfortunately, all that was “killed” was their portfolios. Re-balancing your portfolio is one of the best techniques out there for controlling greed and keeping your portfolio fresh. If you are holding US stocks, the US dollar or US bonds in your portfolio, I would recommend that you rebalance your portfolio. These 3 sectors have risen a lot in the last 12-18 months. Smart investors would take some money off the table in these sectors and deploy extra capital in more depressed sectors. I am not advocating withdrawing all your capital from these sectors, as there may be many more months of upside, but now may be the time to lighten up instead of doubling down. We are living in volatile times, where any move by a country or central bank could have devastating effects on your portfolio if it is not set up correctly. I say all of the above because the sentiment on the US dollar at the moment is extremely bullish. Everyone expects the dollar rally to continue (and it may very well continue) as Europe tries to get a grip on deflation. Nevertheless, surprises can happen in any market, as we witnessed last week. Could China, for example, break its currency’s peg against the US dollar? Many would say this is highly improbable, as China owns huge amounts of dollar reserves. What if the US announced QE4 in the coming months? Would the Chinese let their currency weaken alongside the dollar? These scenarios may never happen, but position sizing and diversification in your portfolio would protect you from all possible outcomes. Another valuable lesson in investing which ties in well with my last point is “protecting the downside”. Professional investors are far more concerned with the downside (risk) than the upside. Losing money is not an option for them. So let’s look at what an investor can do when he or she is sitting on some nice profits. Let’s take a look at the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ), for example. This ETF has gained 80% over the last 5 years, which is a fantastic return for an ETF. How do we protect the downside? (click to enlarge) 1. We take some money off the table and deploy it into a depressed sector, such as the gold mining sector. 2. We buy a put option (like insurance). If the ETF drops, our put option will go up in value. The net result is that we will lose less if the market falls sharply. If the market continues to rise, we will only lose what we paid for the put option. 3. We place a stop loss under the present price of the ETF (the 200-day moving average is used often by professionals). The problem with a stop loss is that it is less effective when there is volatility in the market (violent swings both ways). Protecting the downside and rebalancing my portfolio every once in a while has not only protected my portfolio, but also has grown it. Finally, we added many positions to our 1% portfolio last Thursday and Friday (see screenshot below). We now have in the region of $130k invested in stocks, but will not be investing more into this asset class for the moment, as we feel other asset classes can give us higher returns going forward (rebalancing). We will fill up our Precious Metals & Commodities asset classes with the full $180k each soon enough, as we have unearthed depressed companies in these sectors and low-cost indexes. Stay tuned. (click to enlarge) Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Scalper1 News

Scalper1 News