Scalper1 News

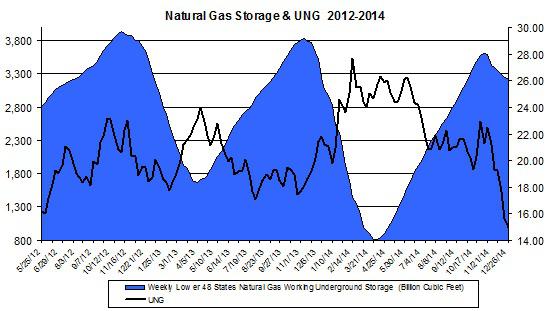

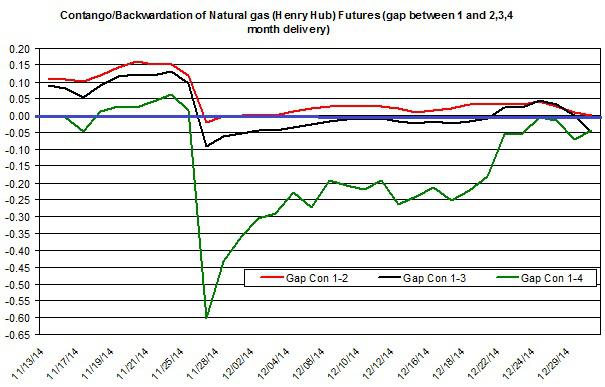

Summary The natural gas storage is projected to be lower than normal by the end of March. The short-term weather outlook is uncertain, but suggests warmer-than-normal weather, which could bring UNG back down. The extraction from storage is expected to be lower than normal this week. The price of The United States Natural Gas ETF (NYSEARCA: UNG ) ended the year with another tumble, as it dipped below $15 at one point. Currently, the price is around $15 – the lowest level UNG reached in the past couple of years. The high uncertainty around the weather forecasts for January didn’t stop investors from pulling out of UNG. The hotter-than-normal weather and slow rise in production maintains UNG at its current low level. Keep in mind, however, the natural gas storage is still low for the season, and is likely to remain low by the end of March. Storage extractions remain slow The last few storage reports showed that the extractions were very low for this time of the year. We could start seeing a trend developing in recent weeks. The chart below presents the changes in the natural gas underground storage and the price of UNG in the past couple of years. (Data Source: EIA, Google Finance) As you can see, the slope in storage this winter seems less steep than in previous winters. This could indicate that the natural gas market doesn’t heat up as it did last winter. The natural gas futures markets also show a trend – the once-high Backwardation for the four-month contracts recorded at the end of November has almost entirely dissipated. Currently, the future markets are mostly still in Backwardation, however, the gaps are very small. (Data Source: EIA) So the markets still expect a modest gain, at best, in the price of natural gas in the near term. After all, the EIA still expects the spot price to average at $4 during January. Long-time investors in natural gas know that this market view could change very promptly if the weather conditions change or any other unexpected event were to come to fruition. Looking forward, the EIA projects inventories will reach to 1,431 Bcf by the end of the extraction season (the end of March), which is still 225 Bcf below the 5-year average. Some analysts still expect the storage levels will rise to 4,000 Bcf by the end of the year – I remain skeptical about this outlook. Next week’s extraction from storage is likely to be lower than normal again, because last week’s deviation from normal temperatures was, on average, 7.12. This measurement tends to have a strong positive correlation (0.62) with the changes in the gap between the 5-year average extraction and current extraction. Another issue to consider is the ongoing growing natural gas production – current estimates are for a 3.1% gain in output in 2015, year over year. This growth rate will be slower than in 2014, but will still reduce the pressure on UNG prices. The rise in production continues, albeit the number of rigs remains low: Based on the recent update from Baker Hughes , the natural gas rotary rig count rose by 2 rigs to reach 340 rigs – nearly 9% below the levels recorded back in 2013. The drop in natural gas prices also had an adverse impact on natural gas producers such as Chesapeake Energy (NYSE: CHK ) – the company’s stock dropped by 11% during the past couple of months. For Chesapeake Energy, the plunge in oil prices also took its toll on its stock in recent weeks. Over the next two weeks, temperatures are expected to be above normal in the west and normal in other parts of the U.S., including the Northeast and the Midwest. Based on the National Oceanic and Atmospheric Administration , January’s weather remains highly uncertain, however. By the middle of January, the NOAA projects higher-than-normal temperatures in many parts of the U.S., including the West and the Northeast. NOAA also estimates below-normal temperatures in some regions, such as central and southern Great Plains. The hotter-than-normal weather and the slow extraction from storage are keeping UNG down. But the natural gas market won’t need much to drive UNG back up, including sharp changes in weather, a slowdown in output or a rise in the pace of depletion. For more see: ” Is Chesapeake Regaining Our Confidence? ” Scalper1 News

Summary The natural gas storage is projected to be lower than normal by the end of March. The short-term weather outlook is uncertain, but suggests warmer-than-normal weather, which could bring UNG back down. The extraction from storage is expected to be lower than normal this week. The price of The United States Natural Gas ETF (NYSEARCA: UNG ) ended the year with another tumble, as it dipped below $15 at one point. Currently, the price is around $15 – the lowest level UNG reached in the past couple of years. The high uncertainty around the weather forecasts for January didn’t stop investors from pulling out of UNG. The hotter-than-normal weather and slow rise in production maintains UNG at its current low level. Keep in mind, however, the natural gas storage is still low for the season, and is likely to remain low by the end of March. Storage extractions remain slow The last few storage reports showed that the extractions were very low for this time of the year. We could start seeing a trend developing in recent weeks. The chart below presents the changes in the natural gas underground storage and the price of UNG in the past couple of years. (Data Source: EIA, Google Finance) As you can see, the slope in storage this winter seems less steep than in previous winters. This could indicate that the natural gas market doesn’t heat up as it did last winter. The natural gas futures markets also show a trend – the once-high Backwardation for the four-month contracts recorded at the end of November has almost entirely dissipated. Currently, the future markets are mostly still in Backwardation, however, the gaps are very small. (Data Source: EIA) So the markets still expect a modest gain, at best, in the price of natural gas in the near term. After all, the EIA still expects the spot price to average at $4 during January. Long-time investors in natural gas know that this market view could change very promptly if the weather conditions change or any other unexpected event were to come to fruition. Looking forward, the EIA projects inventories will reach to 1,431 Bcf by the end of the extraction season (the end of March), which is still 225 Bcf below the 5-year average. Some analysts still expect the storage levels will rise to 4,000 Bcf by the end of the year – I remain skeptical about this outlook. Next week’s extraction from storage is likely to be lower than normal again, because last week’s deviation from normal temperatures was, on average, 7.12. This measurement tends to have a strong positive correlation (0.62) with the changes in the gap between the 5-year average extraction and current extraction. Another issue to consider is the ongoing growing natural gas production – current estimates are for a 3.1% gain in output in 2015, year over year. This growth rate will be slower than in 2014, but will still reduce the pressure on UNG prices. The rise in production continues, albeit the number of rigs remains low: Based on the recent update from Baker Hughes , the natural gas rotary rig count rose by 2 rigs to reach 340 rigs – nearly 9% below the levels recorded back in 2013. The drop in natural gas prices also had an adverse impact on natural gas producers such as Chesapeake Energy (NYSE: CHK ) – the company’s stock dropped by 11% during the past couple of months. For Chesapeake Energy, the plunge in oil prices also took its toll on its stock in recent weeks. Over the next two weeks, temperatures are expected to be above normal in the west and normal in other parts of the U.S., including the Northeast and the Midwest. Based on the National Oceanic and Atmospheric Administration , January’s weather remains highly uncertain, however. By the middle of January, the NOAA projects higher-than-normal temperatures in many parts of the U.S., including the West and the Northeast. NOAA also estimates below-normal temperatures in some regions, such as central and southern Great Plains. The hotter-than-normal weather and the slow extraction from storage are keeping UNG down. But the natural gas market won’t need much to drive UNG back up, including sharp changes in weather, a slowdown in output or a rise in the pace of depletion. For more see: ” Is Chesapeake Regaining Our Confidence? ” Scalper1 News

Scalper1 News