Scalper1 News

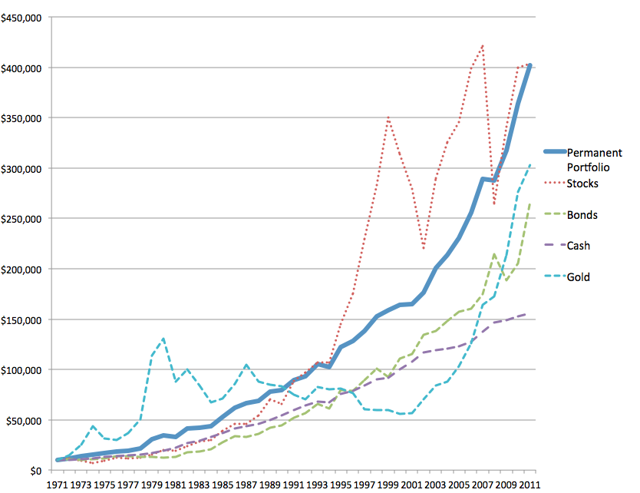

Summary Harry Browne’s simple concept of the permanent portfolio is still valid and is a low volatility method of passive investing. PRPFX does not closely follow the original concept of the PP and the current allocation is closer to stock picking than passive investing. PRPFX has become too volatile to be considered as a safe, long-term investment. Constructing your own PP with ETFs is cheaper than the mutual fund fees and allows you to stick with the original concept. While the concept is still valid today, it needs to be modernized in terms of internationalizing the asset classes and not putting all of the PP into one country. The Permanent Portfolio Concept In the early 80s, the idea of the permanent portfolio was created by Harry Browne and Terry Coxon and was laid out in a series of books written by the two. The whole concept is based upon the idea that nobody knows exactly what will happen in the future, and your investments should reflect this fact. The permanent portfolio calls for splitting the assets equally into 4 parts: 25% stocks, 25% bonds, 25% cash, and 25% gold. The portfolio would be rebalanced once a year, or if any one asset rises too much during the year. The purpose of this allocation is to have at least one portion of your portfolio doing well, regardless of the economic environment at the time. Harry Browne referred to 4 different general economic scenarios that the portfolio would address: inflation, deflation, prosperity, and depression/recession. The world around us is not quite that simple however, and today we see a hodgepodge of these 4 scenarios. There is deflation in things like oil, gold, silver, and smartphone technology, at the same time as inflation in medical care, college tuition, and certain food items. You cannot label today’s economy with only one term such as inflationary or deflationary. As Jim Rickards says , inflation and deflation are now locked into a very equally matched game of tug-of-war, since high amounts of force and tension on both sides will result in the rope being tugged nowhere despite all of the forces at play. Because of this, the permanent portfolio concept is even more relevant today than in the past. The 25% allocation to gold is enough to give most financial advisors the shivers, but when you look at the results of the PP compared to each of its components individually, it makes a lot more sense. (click to enlarge) Basically you end up with conservative gains and a lot less volatility overall. I would compare the PP strategy to riding a bicycle with training wheels on a flat path while wearing a helmet, elbow pads, and knee pads. You could certainly still crash, but you won’t be as scraped and banged-up as if you had gone all in with the stock market, for example, and it won’t be too terribly difficult to pick yourself up and be headed back down the path. So with this in mind, let’s look at the mutual fund that was based on Browne’s concepts and the flaws that it currently has. Permanent Portfolio Fund – PRPFX This is the flagship fund from the Permanent Portfolio Family of Funds. The fund was founded in 1982 by Terry Coxon and John Chandler. The allocation is quite a bit different than the original PP concept. It is only loosely based around the 25% x 4 allocation, as it has 6 asset classes made up of 36% US dollar assets, 20% gold, 15% aggressive growth stocks, 15% real estate and natural resource stocks, and 10% Swiss franc assets and 5% silver. The biggest problem with this allocation is the great over-emphasis on commodities. The purpose of having 1/4 gold in the PP concept is to act as something that will go up in periods of severe inflation and/or economic turmoil. Adding natural resource stocks and physical silver just adds more volatility that isn’t even necessary. Extra volatility is exactly what you don’t want for a long-term, wealth compounding fund. Take a look at the level of volatility since 2011. (click to enlarge) Does this look like a steady, conservative fund that you can dollar-cost average into every month and compound your wealth with? No investor should accept this level of volatility on something that is supposed to be safe and conservative. But let’s not get too caught up in the short-term price, let’s look at how PRPFX did since 2000 compared to the Dow and the S&P 500. (click to enlarge) As you can see, PRPFX beat the two indexes over the long run, so if you bought this fund in the year 2000 then you deserve a pat on the back. However, if you are looking to start a position or continue an existing position in this fund, you are in for a bumpy ride. Instead of safely biking down a straight path with training wheels and pads on, you will be wearing no safety equipment and speeding further across a very hilly/curvy terrain. The distinction always needs to be made between investing and speculating when it comes any particular security, and in the case of PRPFX the inherent problem with the allocation is that commodities and particularly natural resource stocks are speculative in nature. So mixing these things in with bonds and bank deposits creates a problem. Take some of the mining stocks the fund holds for example, BHP , Vale S.A. (NYSE: VALE ) and Peabody Energy (NYSE: BTU ). BHP is the biggest mining company in the world, but even this fact does not stop it from being volatile and thus speculative in nature. It does not belong in a portfolio of money that you can’t afford to lose. In the cases of Vale S.A. and Peabody, the first company went down 40% over the year 2014 and the second went down 62%. (click to enlarge) Again, these are not the kind of companies you want to have in a portfolio that you expect to draw from in retirement or further down the road. The heavy weighting towards commodities does the fund well when the commodities themselves are in the midst of a bull market, but when the commodities are in a long period of decline it’s very detrimental to the long term investing approach. If you want to implement the original concept, you can do so using ETFs that will result in lower expense ratios compared to the expense ratio of .75% for PRPFX. Below is an example of a cheaper method of using the original 4 x 4 concept with ETFs: 25% Vanguard S&P 500 ETF- VOO -Expense ratio .05% 25% Vanguard Long-Term Bonds ETF- BLV -Expense ratio .10% 25% Vanguard Short-Term Bonds ETF- BSV -Expense ratio .10% 25% iShares Gold Trust ETF- IAU -Expense ratio .25% Or simply keep this component in physical gold held directly. Even with low expense ETFs, there is still a problem with this allocation. The problem is that all 4 areas are U.S. based which means you are putting all of your eggs into the American basket. Most people would see no problem with that today, since America is where the action is at. But the point of diversifying is to spread your risk out by not having it all in one place. Never forget the untimely proclamation made by Yale economist Irving Fisher, “Stock prices have reached what looks like a permanent high plateau… I expect to see the stock market a good deal higher than it is today within a few months.” This statement was made on October 19th, 1929, which was a mere 10 days before the infamous Black Friday. Just because things look promising today doesn’t mean that they will stay that way tomorrow. A lot can happen in a short time, and if a crash happens you wouldn’t want all of your portfolio exposed to the country where the crash takes place. The ETF choices for foreign diversification are not as vast as they are for domestic ETFs, but even with limited choices it could be easier than owning something like international bonds directly. Below is an example of such a portfolio: 25% iShares MSCI China ETF- MCHI 25% WisdomTree Asia Local Debt ETF- ALD 25% Australian Dollar Trust ETF- FAX 25% iShares Gold Trust ETF-IAU or physical gold You don’t want to just randomly pick a mix of countries, obviously Greek bonds and Russian rubles are not smart choices right now. Go for countries that have the least amount of economic/political chaos and that have decent reputations for economic freedom. Also, don’t spend the time back testing different ETFs in order to find the optimal allocation for the future. This defeats the whole purpose of admitting that you don’t know exactly how the future will play out. If you are ready to admit this, then the PP concept might be just for you. Scalper1 News

Summary Harry Browne’s simple concept of the permanent portfolio is still valid and is a low volatility method of passive investing. PRPFX does not closely follow the original concept of the PP and the current allocation is closer to stock picking than passive investing. PRPFX has become too volatile to be considered as a safe, long-term investment. Constructing your own PP with ETFs is cheaper than the mutual fund fees and allows you to stick with the original concept. While the concept is still valid today, it needs to be modernized in terms of internationalizing the asset classes and not putting all of the PP into one country. The Permanent Portfolio Concept In the early 80s, the idea of the permanent portfolio was created by Harry Browne and Terry Coxon and was laid out in a series of books written by the two. The whole concept is based upon the idea that nobody knows exactly what will happen in the future, and your investments should reflect this fact. The permanent portfolio calls for splitting the assets equally into 4 parts: 25% stocks, 25% bonds, 25% cash, and 25% gold. The portfolio would be rebalanced once a year, or if any one asset rises too much during the year. The purpose of this allocation is to have at least one portion of your portfolio doing well, regardless of the economic environment at the time. Harry Browne referred to 4 different general economic scenarios that the portfolio would address: inflation, deflation, prosperity, and depression/recession. The world around us is not quite that simple however, and today we see a hodgepodge of these 4 scenarios. There is deflation in things like oil, gold, silver, and smartphone technology, at the same time as inflation in medical care, college tuition, and certain food items. You cannot label today’s economy with only one term such as inflationary or deflationary. As Jim Rickards says , inflation and deflation are now locked into a very equally matched game of tug-of-war, since high amounts of force and tension on both sides will result in the rope being tugged nowhere despite all of the forces at play. Because of this, the permanent portfolio concept is even more relevant today than in the past. The 25% allocation to gold is enough to give most financial advisors the shivers, but when you look at the results of the PP compared to each of its components individually, it makes a lot more sense. (click to enlarge) Basically you end up with conservative gains and a lot less volatility overall. I would compare the PP strategy to riding a bicycle with training wheels on a flat path while wearing a helmet, elbow pads, and knee pads. You could certainly still crash, but you won’t be as scraped and banged-up as if you had gone all in with the stock market, for example, and it won’t be too terribly difficult to pick yourself up and be headed back down the path. So with this in mind, let’s look at the mutual fund that was based on Browne’s concepts and the flaws that it currently has. Permanent Portfolio Fund – PRPFX This is the flagship fund from the Permanent Portfolio Family of Funds. The fund was founded in 1982 by Terry Coxon and John Chandler. The allocation is quite a bit different than the original PP concept. It is only loosely based around the 25% x 4 allocation, as it has 6 asset classes made up of 36% US dollar assets, 20% gold, 15% aggressive growth stocks, 15% real estate and natural resource stocks, and 10% Swiss franc assets and 5% silver. The biggest problem with this allocation is the great over-emphasis on commodities. The purpose of having 1/4 gold in the PP concept is to act as something that will go up in periods of severe inflation and/or economic turmoil. Adding natural resource stocks and physical silver just adds more volatility that isn’t even necessary. Extra volatility is exactly what you don’t want for a long-term, wealth compounding fund. Take a look at the level of volatility since 2011. (click to enlarge) Does this look like a steady, conservative fund that you can dollar-cost average into every month and compound your wealth with? No investor should accept this level of volatility on something that is supposed to be safe and conservative. But let’s not get too caught up in the short-term price, let’s look at how PRPFX did since 2000 compared to the Dow and the S&P 500. (click to enlarge) As you can see, PRPFX beat the two indexes over the long run, so if you bought this fund in the year 2000 then you deserve a pat on the back. However, if you are looking to start a position or continue an existing position in this fund, you are in for a bumpy ride. Instead of safely biking down a straight path with training wheels and pads on, you will be wearing no safety equipment and speeding further across a very hilly/curvy terrain. The distinction always needs to be made between investing and speculating when it comes any particular security, and in the case of PRPFX the inherent problem with the allocation is that commodities and particularly natural resource stocks are speculative in nature. So mixing these things in with bonds and bank deposits creates a problem. Take some of the mining stocks the fund holds for example, BHP , Vale S.A. (NYSE: VALE ) and Peabody Energy (NYSE: BTU ). BHP is the biggest mining company in the world, but even this fact does not stop it from being volatile and thus speculative in nature. It does not belong in a portfolio of money that you can’t afford to lose. In the cases of Vale S.A. and Peabody, the first company went down 40% over the year 2014 and the second went down 62%. (click to enlarge) Again, these are not the kind of companies you want to have in a portfolio that you expect to draw from in retirement or further down the road. The heavy weighting towards commodities does the fund well when the commodities themselves are in the midst of a bull market, but when the commodities are in a long period of decline it’s very detrimental to the long term investing approach. If you want to implement the original concept, you can do so using ETFs that will result in lower expense ratios compared to the expense ratio of .75% for PRPFX. Below is an example of a cheaper method of using the original 4 x 4 concept with ETFs: 25% Vanguard S&P 500 ETF- VOO -Expense ratio .05% 25% Vanguard Long-Term Bonds ETF- BLV -Expense ratio .10% 25% Vanguard Short-Term Bonds ETF- BSV -Expense ratio .10% 25% iShares Gold Trust ETF- IAU -Expense ratio .25% Or simply keep this component in physical gold held directly. Even with low expense ETFs, there is still a problem with this allocation. The problem is that all 4 areas are U.S. based which means you are putting all of your eggs into the American basket. Most people would see no problem with that today, since America is where the action is at. But the point of diversifying is to spread your risk out by not having it all in one place. Never forget the untimely proclamation made by Yale economist Irving Fisher, “Stock prices have reached what looks like a permanent high plateau… I expect to see the stock market a good deal higher than it is today within a few months.” This statement was made on October 19th, 1929, which was a mere 10 days before the infamous Black Friday. Just because things look promising today doesn’t mean that they will stay that way tomorrow. A lot can happen in a short time, and if a crash happens you wouldn’t want all of your portfolio exposed to the country where the crash takes place. The ETF choices for foreign diversification are not as vast as they are for domestic ETFs, but even with limited choices it could be easier than owning something like international bonds directly. Below is an example of such a portfolio: 25% iShares MSCI China ETF- MCHI 25% WisdomTree Asia Local Debt ETF- ALD 25% Australian Dollar Trust ETF- FAX 25% iShares Gold Trust ETF-IAU or physical gold You don’t want to just randomly pick a mix of countries, obviously Greek bonds and Russian rubles are not smart choices right now. Go for countries that have the least amount of economic/political chaos and that have decent reputations for economic freedom. Also, don’t spend the time back testing different ETFs in order to find the optimal allocation for the future. This defeats the whole purpose of admitting that you don’t know exactly how the future will play out. If you are ready to admit this, then the PP concept might be just for you. Scalper1 News

Scalper1 News