Scalper1 News

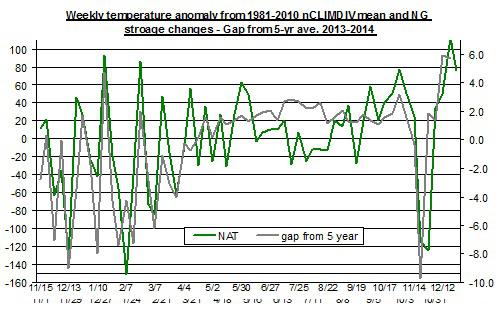

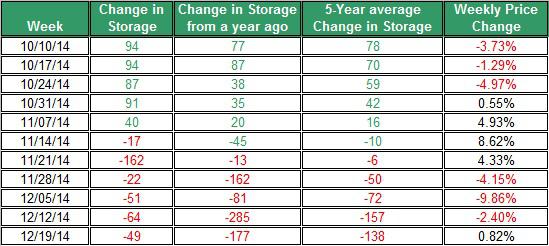

Summary The extraction from storage is projected to be lower than normal again this week. The temperatures are projected to come down in the next two weeks, but this isn’t expected to bring back up UNG. Contango is likely to keep UNG below natural gas prices. The price of The United States Natural Gas ETF (NYSEARCA: UNG ) took another fall in the past week to its lowest level in recent months. The ETF did bounce back earlier this week, but is still down for the month by nearly 24%. The ongoing low oil prices may have contributed to weakness of UNG, but the main issue will remain in changes in weather expectations . The level of underground storage is also likely to play a role in the progress of UNG. This was the case last week. This week’s extraction is likely to also be lower than normal for the season. As I pointed out in the past , the changes in the weather are likely to play a significant role in the changes in U.S. storage levels. Last week’s lower-than-expected withdrawal may have contributed to the drop in UNG on the day of the publication. I say this with caution because the linear correlation between the changes in UNG and storage tends to be low. Nonetheless, there are occasions when the market seems to react to this news, as seems to be the case last week. Looking forward, the storage is expected to show another lower than normal extraction due to last week’s higher than normal average temperature, as presented in the chart below. Source of data: EIA and national climate data center The chart shows the progress of the deviation in the national weather from normal and the weekly changes in natural gas storage with respect to the 5 year average (The data only refer to 2012/2013 and 2014 winter time). Moreover, the linear correlation between the two data sets is a strong and positive linear correlation of 0.62. Last week, the deviation from normal temperatures was, on average, 4.9. So all things being equal, we are likely to see another lower than normal extraction. Keep in mind that even if natural gas prices were to recover, the ongoing Contango in the future markets is likely to result in UNG underperforming natural gas for the near term. Cold weather ahead For the next two weeks, however, temperatures are projected to fall below average temperature throughout the Northeast and Midwest. Nonetheless, on a national level, the heating degrees for this week are expected to be slightly below normal and last year’s levels. This could suggest the demand for heating purposes in the residential/commercial sectors, while may rise in the coming days, won’t necessarily increase more than normal for this time of the year. The recent withdrawal from storage was 49 Bcf, which was well below the 5-year average and last year’s extraction of 138 Bcf and 177 Bcf, respectively. The table below summarizes the changes in storage in the past few weeks and the comparison to last year and the 5-year average levels. Source of data EIA Following the recent extraction the underground natural gas storage is at 3,246 Bcf. This is nearly 5% higher than last year’s storage level and only 5% below the 5-year average. Over the next couple of weeks we are likely to see another lower than normal extraction from storage, which could fuel another fall in the price of UNG or at the very least keep it from recovering. But if temperatures start coming down to below normal levels, UNG may change course and start to rally. Scalper1 News

Summary The extraction from storage is projected to be lower than normal again this week. The temperatures are projected to come down in the next two weeks, but this isn’t expected to bring back up UNG. Contango is likely to keep UNG below natural gas prices. The price of The United States Natural Gas ETF (NYSEARCA: UNG ) took another fall in the past week to its lowest level in recent months. The ETF did bounce back earlier this week, but is still down for the month by nearly 24%. The ongoing low oil prices may have contributed to weakness of UNG, but the main issue will remain in changes in weather expectations . The level of underground storage is also likely to play a role in the progress of UNG. This was the case last week. This week’s extraction is likely to also be lower than normal for the season. As I pointed out in the past , the changes in the weather are likely to play a significant role in the changes in U.S. storage levels. Last week’s lower-than-expected withdrawal may have contributed to the drop in UNG on the day of the publication. I say this with caution because the linear correlation between the changes in UNG and storage tends to be low. Nonetheless, there are occasions when the market seems to react to this news, as seems to be the case last week. Looking forward, the storage is expected to show another lower than normal extraction due to last week’s higher than normal average temperature, as presented in the chart below. Source of data: EIA and national climate data center The chart shows the progress of the deviation in the national weather from normal and the weekly changes in natural gas storage with respect to the 5 year average (The data only refer to 2012/2013 and 2014 winter time). Moreover, the linear correlation between the two data sets is a strong and positive linear correlation of 0.62. Last week, the deviation from normal temperatures was, on average, 4.9. So all things being equal, we are likely to see another lower than normal extraction. Keep in mind that even if natural gas prices were to recover, the ongoing Contango in the future markets is likely to result in UNG underperforming natural gas for the near term. Cold weather ahead For the next two weeks, however, temperatures are projected to fall below average temperature throughout the Northeast and Midwest. Nonetheless, on a national level, the heating degrees for this week are expected to be slightly below normal and last year’s levels. This could suggest the demand for heating purposes in the residential/commercial sectors, while may rise in the coming days, won’t necessarily increase more than normal for this time of the year. The recent withdrawal from storage was 49 Bcf, which was well below the 5-year average and last year’s extraction of 138 Bcf and 177 Bcf, respectively. The table below summarizes the changes in storage in the past few weeks and the comparison to last year and the 5-year average levels. Source of data EIA Following the recent extraction the underground natural gas storage is at 3,246 Bcf. This is nearly 5% higher than last year’s storage level and only 5% below the 5-year average. Over the next couple of weeks we are likely to see another lower than normal extraction from storage, which could fuel another fall in the price of UNG or at the very least keep it from recovering. But if temperatures start coming down to below normal levels, UNG may change course and start to rally. Scalper1 News

Scalper1 News