Scalper1 News

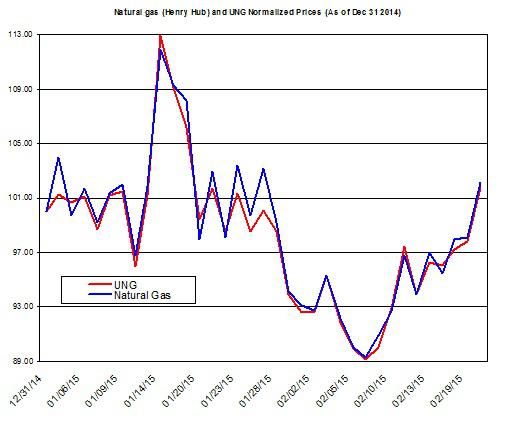

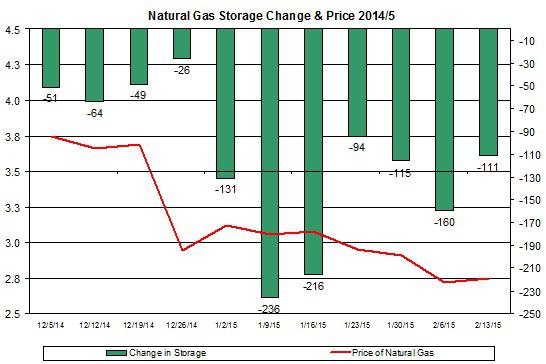

Summary The price of UNG have risen by 10% since the beginning of the month. The colder-than-normal weather is pushing up the price of UNG. The storage is projected to be 7% higher than the 5-year average by the end of the extraction season. Even though the energy market – mainly oil – continues to struggle, the natural gas market showed some early signs of recovery in recent weeks; shares of the United States Natural Gas ETF (NYSEARCA: UNG ) added 10% to their value since the beginning of the month. Will the ongoing colder-than-normal weather could keep pushing up the price of UNG? Despite the contango in natural gas futures markets, this hasn’t had a strong adverse impact on the price of UNG. Since the beginning of the year, the price of UNG underperformed the price of natural gas by only 0.4%. Looking forward, if the contango continues to expand, this could widen the gap between natural gas prices and UNG prices. (Data Source: EIA and Google Finance) In the past week, the extraction from storage was close to market expectations with a 111 Bcf withdrawal, which brought the total storage levels to 2,157 Bcf. This is 2.8% higher than the 5-year average and 45.8% above the levels recorded in the same week last year. The low extraction from storage was despite the spike in demand for natural gas in the northeast in recent weeks. In the past week, the demand for natural gas spiked by 23.1%, and was nearly 21.2% higher than the demand listed in the same week in 2014. Most of the gain was in the residential and commercial sectors. (Data Source: EIA) Assuming the extraction from storage were to remain 15% lower than the 5-year average (during the past 14 weeks, on average, the withdrawal from storage was 17% lower than the 5-year average), this could bring the storage levels to around 1,800 Bcf by the beginning of April (the time of injection season). This will be roughly 7-8% higher than normal. This week, the extraction from storage is likely to be, yet again, well below the 5-year average: The average deviation from temperatures was 5.07, which implies lower demand for natural gas for heating purposes than normal. In the next two weeks, temperatures are projected much lower than normal, mainly in the Midwest and Northeast. This means, at face value, another spike in demand for natural gas in the near term. This assessment is also strengthened by the expected sharp rise in heating degree days across the U.S. From the supply side, gross production remained flat, and most of the gain in supply came from higher imports from Canada. The recent update from Baker Hughes showed a cut down of 11 gas rigs in the last week, so the total rigs reached 289 rigs. So on the one hand, the rise in demand and the on the other the stagnation in the production contributed to the rally of UNG in recent weeks. The recent recovery in UNG is driven by lower-than-normal temperatures that are increasing the demand for natural gas for heating purposes. But the extraction from storage is still low and could bring the storage levels to well above normal levels by the end the extraction season. This factor could curb the recovery of UNG down the line. In the short term, unless the weather forecasts come to fruition (i.e. the weather will be hotter than expected), the price of UNG is likely to keep pushing upward. For more see: ” Has the Weakness in the Oil Market Fueled the Decline of UNG? ” Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The price of UNG have risen by 10% since the beginning of the month. The colder-than-normal weather is pushing up the price of UNG. The storage is projected to be 7% higher than the 5-year average by the end of the extraction season. Even though the energy market – mainly oil – continues to struggle, the natural gas market showed some early signs of recovery in recent weeks; shares of the United States Natural Gas ETF (NYSEARCA: UNG ) added 10% to their value since the beginning of the month. Will the ongoing colder-than-normal weather could keep pushing up the price of UNG? Despite the contango in natural gas futures markets, this hasn’t had a strong adverse impact on the price of UNG. Since the beginning of the year, the price of UNG underperformed the price of natural gas by only 0.4%. Looking forward, if the contango continues to expand, this could widen the gap between natural gas prices and UNG prices. (Data Source: EIA and Google Finance) In the past week, the extraction from storage was close to market expectations with a 111 Bcf withdrawal, which brought the total storage levels to 2,157 Bcf. This is 2.8% higher than the 5-year average and 45.8% above the levels recorded in the same week last year. The low extraction from storage was despite the spike in demand for natural gas in the northeast in recent weeks. In the past week, the demand for natural gas spiked by 23.1%, and was nearly 21.2% higher than the demand listed in the same week in 2014. Most of the gain was in the residential and commercial sectors. (Data Source: EIA) Assuming the extraction from storage were to remain 15% lower than the 5-year average (during the past 14 weeks, on average, the withdrawal from storage was 17% lower than the 5-year average), this could bring the storage levels to around 1,800 Bcf by the beginning of April (the time of injection season). This will be roughly 7-8% higher than normal. This week, the extraction from storage is likely to be, yet again, well below the 5-year average: The average deviation from temperatures was 5.07, which implies lower demand for natural gas for heating purposes than normal. In the next two weeks, temperatures are projected much lower than normal, mainly in the Midwest and Northeast. This means, at face value, another spike in demand for natural gas in the near term. This assessment is also strengthened by the expected sharp rise in heating degree days across the U.S. From the supply side, gross production remained flat, and most of the gain in supply came from higher imports from Canada. The recent update from Baker Hughes showed a cut down of 11 gas rigs in the last week, so the total rigs reached 289 rigs. So on the one hand, the rise in demand and the on the other the stagnation in the production contributed to the rally of UNG in recent weeks. The recent recovery in UNG is driven by lower-than-normal temperatures that are increasing the demand for natural gas for heating purposes. But the extraction from storage is still low and could bring the storage levels to well above normal levels by the end the extraction season. This factor could curb the recovery of UNG down the line. In the short term, unless the weather forecasts come to fruition (i.e. the weather will be hotter than expected), the price of UNG is likely to keep pushing upward. For more see: ” Has the Weakness in the Oil Market Fueled the Decline of UNG? ” Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News