Scalper1 News

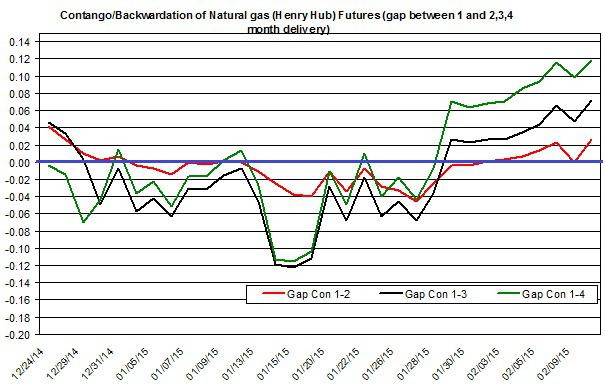

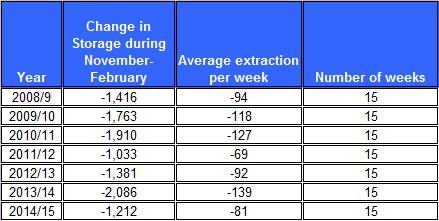

Summary The price of UNG rallied in recent weeks. The colder-than-normal weather could further push up the demand for natural gas. The storage is still expected to be higher than normal by the end of March. The energy market has started to heat up again as the price of The United States Natural Gas ETF, LP (NYSEARCA: UNG ) rose by 4% since the beginning of the month. Let’s review the latest developments in the natural gas market. In the natural gas futures market, there is a change, in which the market is slowly moving from backwardation to contango. The contango in the futures market indicates an expected rise in natural gas prices in the subsequent weeks. But a rise in the contango could also result in UNG underperforming natural gas prices due to roll decay. The chart below presents the changes in the contango/backwardation in the futures market for the coming months. Source of data taken from EIA The weakness in the natural gas market was driven by lower-than-normal demand for heating this winter. During the past several weeks, the average extraction from the natural gas underground storage was around 81 Bcf per week, as indicated in the table below. Source of data taken from EIA In the past week, the EIA reported a 160 Bcf withdrawal from storage, which was slightly below market expectations and lower than the 5-year average – 178 Bcf. The extraction from storage tends to last until the end of March. So we are likely to have only a month and a half more of withdrawals from storage. Next week, the extraction is expected to be close to the 5-year average. The average deviation from temperatures was only around 1.81; this suggests, at face value, an extraction from storage of around 180 Bcf. Since the week-over-week changes also include a lot of noise, these conclusions should be taken with more than a grain of salt. Last week, the demand for natural gas declined by 7.6% and was nearly 20% below the demand recorded the same week last year. Conversely, production continues to slowly pick up (rose by 0.1% in the past week) and is 13% higher than last year. According to the latest news from Baker Hughes (NYSE: BHI ), gas rigs have dropped by 14 to reach 300 rigs. Despite the drop in demand, it’s still well above the supply, which is likely to maintain a high level of volatility in UNG prices in the near term. The demand for natural gas is likely to pick up in the coming weeks on account of expected lower-than-normal weather throughout the East, including the Midwest and Northeast. Moreover, heating degree days are projected to be higher than normal, which could also suggest a rise in demand for natural gas for heating purposes. The big picture, however, still shows the natural gas storage to be slightly above the 5-year average level by April. The EIA also projects, for now, the underground storage to be around 43 Bcf above the 5-year average by the end of March – it will reach a total of 1,699 Bcf. Despite the drop in rig count and only modest gain in production in the past week, the storage continues to fall at a slower pace than normal, which is likely to bring it above the 5-year average by the end of the extraction season. The colder-than-normal weather could bring back up UNG prices in the near term, but this rally may not last long if production keeps building up and demand doesn’t exceed current market expectations. For more see: Contango in Natural Gas Market Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The price of UNG rallied in recent weeks. The colder-than-normal weather could further push up the demand for natural gas. The storage is still expected to be higher than normal by the end of March. The energy market has started to heat up again as the price of The United States Natural Gas ETF, LP (NYSEARCA: UNG ) rose by 4% since the beginning of the month. Let’s review the latest developments in the natural gas market. In the natural gas futures market, there is a change, in which the market is slowly moving from backwardation to contango. The contango in the futures market indicates an expected rise in natural gas prices in the subsequent weeks. But a rise in the contango could also result in UNG underperforming natural gas prices due to roll decay. The chart below presents the changes in the contango/backwardation in the futures market for the coming months. Source of data taken from EIA The weakness in the natural gas market was driven by lower-than-normal demand for heating this winter. During the past several weeks, the average extraction from the natural gas underground storage was around 81 Bcf per week, as indicated in the table below. Source of data taken from EIA In the past week, the EIA reported a 160 Bcf withdrawal from storage, which was slightly below market expectations and lower than the 5-year average – 178 Bcf. The extraction from storage tends to last until the end of March. So we are likely to have only a month and a half more of withdrawals from storage. Next week, the extraction is expected to be close to the 5-year average. The average deviation from temperatures was only around 1.81; this suggests, at face value, an extraction from storage of around 180 Bcf. Since the week-over-week changes also include a lot of noise, these conclusions should be taken with more than a grain of salt. Last week, the demand for natural gas declined by 7.6% and was nearly 20% below the demand recorded the same week last year. Conversely, production continues to slowly pick up (rose by 0.1% in the past week) and is 13% higher than last year. According to the latest news from Baker Hughes (NYSE: BHI ), gas rigs have dropped by 14 to reach 300 rigs. Despite the drop in demand, it’s still well above the supply, which is likely to maintain a high level of volatility in UNG prices in the near term. The demand for natural gas is likely to pick up in the coming weeks on account of expected lower-than-normal weather throughout the East, including the Midwest and Northeast. Moreover, heating degree days are projected to be higher than normal, which could also suggest a rise in demand for natural gas for heating purposes. The big picture, however, still shows the natural gas storage to be slightly above the 5-year average level by April. The EIA also projects, for now, the underground storage to be around 43 Bcf above the 5-year average by the end of March – it will reach a total of 1,699 Bcf. Despite the drop in rig count and only modest gain in production in the past week, the storage continues to fall at a slower pace than normal, which is likely to bring it above the 5-year average by the end of the extraction season. The colder-than-normal weather could bring back up UNG prices in the near term, but this rally may not last long if production keeps building up and demand doesn’t exceed current market expectations. For more see: Contango in Natural Gas Market Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News