Atmos Energy Outlook Gains Strength As Natural Gas Prices Remain Low

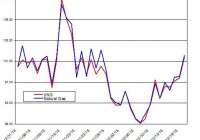

Southern natural gas utility Atmos Energy (NYSE: ATO ) reported FQ1 earnings for the period ending December 31 earlier this month that missed on diluted EPS as warm weather weighed on its revenue result. The lower-than-expected result didn’t faze investors, however, and the company’s share price set a new 10-year high last week as bearish market sentiment and declining interest rate increase expectations drove investors into utilities. Back in October, I highlighted the company’s attractive geographic footprint, concluding that [I]ts outlook contains a number of potential drivers to additional earnings growth, including the strong likelihood of a colder than normal winter across much of its service area resulting from this year’s El Nino event, increased demand for natural gas across the country in response to falling prices, and the implementation of a federal regulation that will spur additional demand for natural gas by electric utilities. While potential investors are unlikely to be interested in the company’s relatively low dividend yield, existing investors should remain in their positions despite the high valuation due to the number of potential positive catalysts on offer. While the expected cold weather has yet to materialize, natural gas prices have continued to decline in the interim, prompting continued consumption growth. The company’s share price has gained by 21% in the meantime (see figure). This article re-considers Atmos Energy as a potential long investment opportunity, given the turmoil that has hit the energy markets since October. ATO data by YCharts FQ1 earnings report Atmos Energy reported FQ1 revenue of $906.2 million, down 4% from the same quarter of the previous year as warmer-than-normal temperatures prevailed across its service areas. While the regulated segment reported higher revenue following a rate increase, this was offset by reduced demand resulting from the presence of 29% fewer heating degree days in the company’s operating area. Natural gas distribution throughput declined by 18% YoY as a result, although falling natural gas prices (the average price in the quarter was 26% lower YoY) and higher storage demand (up 37% YoY) caused pipeline transportation volumes to increase by 7% over the same period. Finally, the company ended the most recent quarter with 1.2% more customers than it had at the end of the same quarter of the previous year. The company’s cost of revenue declined by 20.7% YoY on low natural gas prices. This caused its gross profit to increase from $423.3 million to $443.8 million over the same period despite the revenue decline. The regulated distribution segment again reported the largest gross profit at $333.5 million, up from $323.8 million in the same quarter of the previous year. The regulated pipeline segment reported the largest overall gain, however, with gross income of $94.7 million versus $83.6 million YoY. The company attributed most of this gain to the recovery of continued reliability investments, reflecting the positive regulatory environments that it has the advantage of operating within. The non-regulated natural gas delivery segment reported gross income of $15.8 million, down slightly from $16 million YoY, although its average unit margin rose to $0.12 from $0.10 over the same period. O&M expenses increased to $124.8 million from $118.6 million YoY as the company took advantage of unseasonably warm weather to get a head start on some of its maintenance and preparation work. Operating income came in at $196.2 million, up from $187.7 million YoY. Net income came in at $102.9 million versus $97.6 million in the same period of the previous year, resulting in non-adjusted EPS of $1.00 versus $0.96 over the same period. The regulated segments’ contributions to net income increased by $5.5 million on higher rates and increased pipeline demand, although this was partially offset by a $2.6 million YoY timing-related reduction to the non-regulated segment’s contribution. While the non-adjusted EPS result was in-line with the consensus analyst estimate, Atmos Energy included unrealized margins in this result that, if excluded, brought its adjusted net income down to $95.6 million, or a diluted EPS of $0.93. This compared to results of $92.8 million and $0.91, respectively, for the same quarter of the previous year. While the adjusted result came in below expectations, the fact that much of the miss was attributed to income timing at the non-regulated segment prompted the company to move ahead with a quarterly dividend payment of $0.42/share (2.4% forward yield) that marked a 7.7% annual increase. Furthermore, since weather-normalization mechanisms cover 97% of the company’s utility margins, the negative impacts of a continued warm winter on its cash flows should be muted. Outlook Atmos Energy’s management was upbeat about the company’s outlook despite the FQ1 earnings miss, announcing during the subsequent earnings call that it is maintaining its adjusted EPS guidance range of $3.20-$3.40. The midpoint of this range would only represent a 5% increase over the FY 2015 result, below the company’s long-term annual target of 6-8% earnings growth. The primary driver for FY 2015 growth is still expected to be driven by capex, with the company maintaining its previous target of up to $1.1 billion for FY 2016. These are in turn expected to result in an increase to operating income of up to $125 million for the fiscal year via new rate outcomes. Atmos Energy’s capex growth beyond FY 2016 will be heavily influenced by natural gas prices. The company benefits from low prices in two ways. First, its regulated distribution segment should experience steady demand growth from customers encountering reduced heating costs. This will provide Atmos with capex growth opportunities in the forms of increased infrastructure needs and reliability spending. This capex will ultimately justify higher rates for Atmos, supporting its future revenue and gross income. So long as natural gas prices remain low, however, the higher rates will not necessarily result in reduced demand by customers since the rate increases will be offset by the low prices, preventing customers’ bills from increasing on a net basis. Higher natural gas prices, on the other hand, could likewise hurt the company’s revenues by resulting in weak demand, much as weather did in FQ1, but the U.S. Energy Information Agency [EIA] doesn’t expect this to happen before 2018 at the earliest. Henry Hub Natural Gas Spot Price data by YCharts Atmos Energy also benefits from low natural gas prices because of its regulated pipeline segment, which connects both the regulated distribution segment and other large customers to multiple Texan shale gas plays. While shale gas producers are experiencing challenging operating conditions due to the current low price of natural gas, pipeline operators and other distributors are expected to benefit in the form of higher volumes as weak prices spur consumption growth. A trade-off exists in that producers may cease production if prices fall low enough, in which case lower pipeline transmission volumes can be expected to result due to a lack of supply. Atmos Energy’s management stated that it isn’t seeing the type of economic weakness that is associated with declining production, however. This is supported by EIA projections calling for natural gas production to decline in 2016, but only because of lower imported and offshore production volumes; inland production is expected to rise, albeit at a much slower pace than in the past. One potential hurdle to the company’s longer-term capex growth plans was created by the recent decision by the U.S. Supreme Court to prevent the implementation of the U.S. Environmental Protection Agency’s [EPA] Clean Power Plan, which requires the country’s electric utilities to reduce the carbon intensities of their operations, until after a final ruling on the merits of a major legal challenge. The decision, which was split along ideological lines, postponed the Plan’s implementation until 2017 at the earliest. The recent death of Justice Antonin Scalia, who sided with the block, has created additional uncertainty around the Plan. As I discussed in my previous article, Atmos Energy’s pipeline segment could be a big beneficiary of the Plan since the least expensive method of reducing the greenhouse gas emissions of power plants is by replacing coal with natural gas. The Plan’s full implementation wasn’t expected to occur until the end of this decade at the earliest, however, yet the return of cheap natural gas has already prompted the fuel to overtake coal as electricity feedstock. Given the long-term nature of this type of conversion from one fuel source to another, the electric sector’s demand for natural gas can be expected to remain strong in the coming years regardless of the Clean Power Plan’s fate. At this point, its implementation would only cause an already positive demand outlook for natural gas to improve still further. In the short-term the demand outlook for the company’s regulated distribution segment is still positive, although I would note that weather conditions have not been as forecast this winter to date. The number of heating degree days in the company’s service areas have remained below the long-term averages in 2016 to date (down roughly 20% in January and 40% in February to date), although temperatures have been colder on a YoY basis. Previous El Nino events have been associated with colder-than-normal temperatures across the South U.S., including the company’s service areas, through April. This year’s major event has been characterized by its relatively late arrival in terms of weather-related impacts, and some meteorologists believe that its impacts will be felt later in Q1 rather than not at all. Valuation The analyst consensus estimates for Atmos Energy’s diluted EPS results in FY 2016 and FY 2017 have been revised higher over the last several months despite the FQ1 earnings miss and continued warm weather in its service area. The FY 2016 consensus has increased from $3.23 back in July to $3.27 today (investors should note that this is below the midpoint of the company’s guidance range). The FY 2017 has risen by a similar amount over the last 90 days, from $3.45 to $3.49. These estimates are supported by two factors. The first is the strong natural gas demand outlook that I described above. The second is the fact that the recent extension of bonus depreciation by Congress, which has caused some utilities to revise their guidance ranges lower, is not expected by Atmos Energy’s management to have a significant impact on the company’s earnings growth through 2020. The company’s P/E ratios have moved strongly higher in 2016 to date despite the increased earnings expectations due to its share price gains (see figure). The FY 2016 forward ratio has increased from 17.5x in October to 21.1x today. The FY 2017 forward ratio of 20.3x is well above the top of the respective long-term range, let alone its average. The company’s shares are clearly overvalued at this time as a result, despite its positive earnings growth outlook. ATO PE Ratio (NYSE: TTM ) data by YCharts Conclusion Atmos Energy reported FQ1 earnings that came in below analyst expectations as warm weather negatively impacted natural gas distribution throughput and timing issues hurt its non-regulated earnings. Investors have largely ignored the report’s release, however, sending the company’s share price to a new decade high last week in response to an improving long-term operating outlook. Low natural gas prices are continuing to drive demand growth even as production remains steady in the Texan shale gas plays. Meanwhile, prices are also expected to keep customer demand high for the regulated distribution segment by keeping utility bills flat even as higher rates are implemented to finance the company’s planned capex growth. The company’s shares are quite overvalued at this time compared to their long-term valuation levels and I do not recommend initiating a long-term investment in the company at this time. At the same time, however, I do not see any near-term downside to the shares because of the company’s positive outlook, and existing investors should consider holding their shares, as a result. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.