Scalper1 News

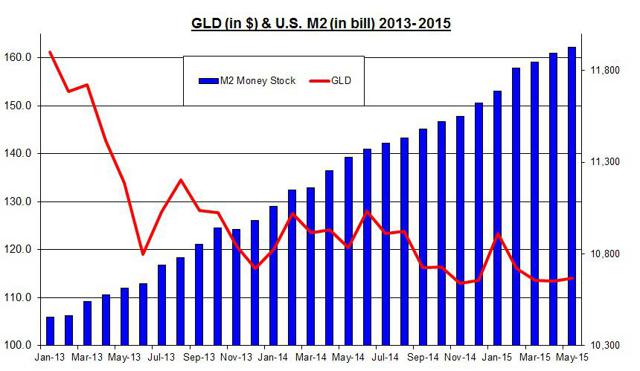

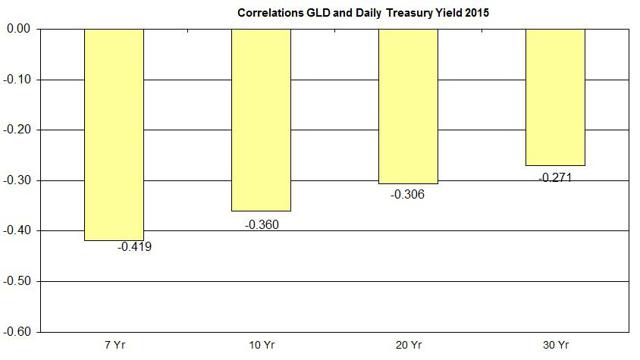

Summary The FOMC will convene again next week. If the FOMC hints about raising rates anytime soon, this could drag down GLD. The recovery of the U.S. dollar and rise in long-term treasury yields will keep pressuring down GLD. The recent strong labor report brought up the odds of the FOMC coming closer towards raising rates. It also cooled down the gold market. Nonetheless, the SPDR Gold Trust ETF (NYSEARCA: GLD ) is still flat for the year even though the U.S. dollar and long-term yields have picked up again in recent weeks. The FOMC isn’t expected to make any big changes in the upcoming meeting. But the price of GLD could start coming down again if the FOMC even drops a hint about raising rates in its upcoming meeting. The better-than-expected non-farm payroll report along with the sharp rise in JOLTS – number of job openings reached 5.38 million while market expectations were set at 5.03 million – have both driven a bit higher the implied probabilities of a rate hike in September to 33% and for December to 70%. The FOMC will convene on June 16-17 and release the press statement on June 17 accompanied with a press conference and release updated economic outlook. On the one hand, the GDP contracted back in Q1 and inflation is still contained below 2%. On the other hand, the U.S. labor market continues to show recovery, and there are possible speculative bubbles in the housing and stock markets, which could be popped once interest rates start to rise again. In the meantime, even though the FOMC is considering normalizing its monetary policy, this doesn’t mean the M2 isn’t growing – as of May, M2 is up by 5.3% year on year. This higher M2 comes despite the tumble in oil prices in the past few months. But the rise in M2, which is another indication for the changes in U.S. inflation, hasn’t driven up the price of GLD in recent years, as presented in the chart below. Moreover, the core PCE , which is the indicator the FOMC follows, has gone down to 1.2% – the lowest level in over a year. This low level doesn’t vote well for the FOMC to turn hawkish in the coming meeting. (click to enlarge) Source: FRED, Google Finance Despite the rise in M2, the U.S. money base remained relatively flat and rose by only 0.7% year over year. But this hasn’t resulted in a sharp rise in the money base as it was the case back when the FOMC implemented QE1, QE2, and QE3. After ending QE3, the FOMC only continued purchasing new bonds to substitute expiring bonds in order to maintain its big balance sheet. Thus, it would take a 180-degree change in the FOMC’s policy for the gold market to heat up again. The weakness of the Euro and other major currencies mainly due to ECB’s QE program, the Greek bailout talks also play a minor role in keeping the Euro weak, is likely to further drive up the U.S. dollar, which doesn’t help the price of gold or the price of GLD. Another factor that could keep slowly bringing down GLD is the recovery of long-term treasury yields, which have picked up in recent weeks. The correlations among GLD and long-term yields, as seen below, are negative and strong and suggest that if yields keep rising, GLD could also start to come down. (click to enlarge) Source: U.S Department of Treasury and Bloomberg Final note The upcoming FOMC meeting could be another nail in the gold market’s coffin – especially if the FOMC turns more hawkish by improving its outlook and providing a clearer picture about raising rates. Currently, the market doesn’t expect the FOMC to make any major changes to the policy and the Fed could remain dovish, which helps to keep GLD from tumbling. The major shift is only likely to occur closer to the end of the year – when the FOMC is more likely to raise rate, assuming the U.S. economy continues to progress in its current pace. Until then, the stronger U.S. dollar and higher long-term treasury yields are likely to keep GLD slowly dwindling. For more, please see: 3 Questions About Gold Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The FOMC will convene again next week. If the FOMC hints about raising rates anytime soon, this could drag down GLD. The recovery of the U.S. dollar and rise in long-term treasury yields will keep pressuring down GLD. The recent strong labor report brought up the odds of the FOMC coming closer towards raising rates. It also cooled down the gold market. Nonetheless, the SPDR Gold Trust ETF (NYSEARCA: GLD ) is still flat for the year even though the U.S. dollar and long-term yields have picked up again in recent weeks. The FOMC isn’t expected to make any big changes in the upcoming meeting. But the price of GLD could start coming down again if the FOMC even drops a hint about raising rates in its upcoming meeting. The better-than-expected non-farm payroll report along with the sharp rise in JOLTS – number of job openings reached 5.38 million while market expectations were set at 5.03 million – have both driven a bit higher the implied probabilities of a rate hike in September to 33% and for December to 70%. The FOMC will convene on June 16-17 and release the press statement on June 17 accompanied with a press conference and release updated economic outlook. On the one hand, the GDP contracted back in Q1 and inflation is still contained below 2%. On the other hand, the U.S. labor market continues to show recovery, and there are possible speculative bubbles in the housing and stock markets, which could be popped once interest rates start to rise again. In the meantime, even though the FOMC is considering normalizing its monetary policy, this doesn’t mean the M2 isn’t growing – as of May, M2 is up by 5.3% year on year. This higher M2 comes despite the tumble in oil prices in the past few months. But the rise in M2, which is another indication for the changes in U.S. inflation, hasn’t driven up the price of GLD in recent years, as presented in the chart below. Moreover, the core PCE , which is the indicator the FOMC follows, has gone down to 1.2% – the lowest level in over a year. This low level doesn’t vote well for the FOMC to turn hawkish in the coming meeting. (click to enlarge) Source: FRED, Google Finance Despite the rise in M2, the U.S. money base remained relatively flat and rose by only 0.7% year over year. But this hasn’t resulted in a sharp rise in the money base as it was the case back when the FOMC implemented QE1, QE2, and QE3. After ending QE3, the FOMC only continued purchasing new bonds to substitute expiring bonds in order to maintain its big balance sheet. Thus, it would take a 180-degree change in the FOMC’s policy for the gold market to heat up again. The weakness of the Euro and other major currencies mainly due to ECB’s QE program, the Greek bailout talks also play a minor role in keeping the Euro weak, is likely to further drive up the U.S. dollar, which doesn’t help the price of gold or the price of GLD. Another factor that could keep slowly bringing down GLD is the recovery of long-term treasury yields, which have picked up in recent weeks. The correlations among GLD and long-term yields, as seen below, are negative and strong and suggest that if yields keep rising, GLD could also start to come down. (click to enlarge) Source: U.S Department of Treasury and Bloomberg Final note The upcoming FOMC meeting could be another nail in the gold market’s coffin – especially if the FOMC turns more hawkish by improving its outlook and providing a clearer picture about raising rates. Currently, the market doesn’t expect the FOMC to make any major changes to the policy and the Fed could remain dovish, which helps to keep GLD from tumbling. The major shift is only likely to occur closer to the end of the year – when the FOMC is more likely to raise rate, assuming the U.S. economy continues to progress in its current pace. Until then, the stronger U.S. dollar and higher long-term treasury yields are likely to keep GLD slowly dwindling. For more, please see: 3 Questions About Gold Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News