Scalper1 News

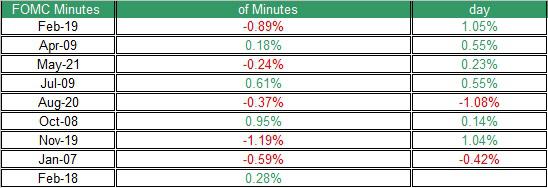

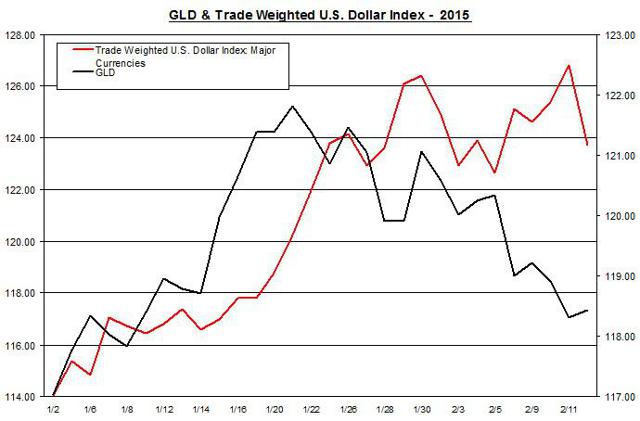

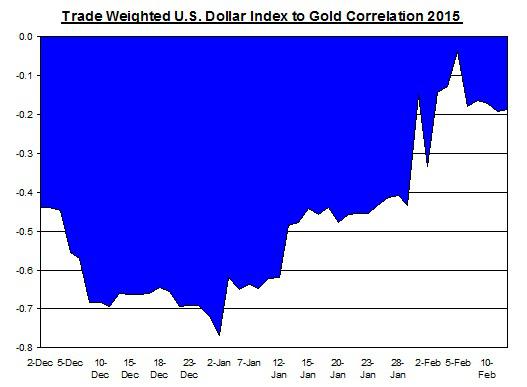

Summary The minutes of the last FOMC meeting were released. The minutes could indicate that the FOMC members have concerns that could postpone the next rate, which could bring back up GLD. The uncertainty in Europe around the Greek debt problem could play in favor of GLD. Since the beginning of the month, shares of the SPDR Gold Trust ETF (NYSEARCA: GLD ) fell by 5.8%. But the recent release of the minutes of the last FOMC meeting and the latest developments in Europe could provide some backwind for the gold ETF. The FOMC minutes revealed that its members wanted to reiterate the importance of remaining patient towards the next rate hike: “Many participants regarded dropping the “patient” language in the statement, whenever that might occur, as risking a shift in market expectations for the beginning of policy firming toward an unduly narrow range of dates. As a result, some expressed the concern that financial markets might overreact, resulting in undesirably tight financial conditions.” This is another indication that even though many of the FOMC members may consider raising rates in the coming months, they still don’t want to commit to a time frame and wish to trend very lightly when it comes to changing their policy. The reaction of GLD, however, was subtle, as prices slightly came up yesterday. Source of data taken from FOMC’s website and Google Finance The minutes also revealed that the FOMC members consider the global economic developments as one of the factors that could determine the Fed’s next move: “The Committee further decided that the postmeeting statement should explicitly acknowledge the role of international developments as one of the factors influencing the Committee’s assessment of progress toward its objectives of maximum employment and 2 percent inflation.” Perhaps the latest problems in Europe and the economic slowdown in other leading countries are starting to shift FOMC members’ opinion towards keeping rates low for a bit longer. Next week, Fed Chair Yellen is expected to testify before Congress; this testimony could provide additional input into what’s next for the Fed and whether there is a chance of a delay in the expected rate hike this summer. The ongoing problems in Europe, mainly the debt problems of Greece, could play in favor for precious metals investments such as GLD. The recent news is that Greece is still scrambling towards reducing some of the austerity measures that were agreed in the past, including reducing the budget surplus from 4.5% to 1.5% of its GDP. Some estimate that Greece could run out of cash by March. Moreover, Greek banks have been losing €2 billion in deposits per week, which will only put more pressure on the recently-elected Syriza government to reach an agreement with the EU. These developments are also likely to pressure down the euro against the U.S. dollar. Stronger dollar The recovery in the U.S. dollar has slowed down in the past few weeks, but the U.S. dollar could see additional gains in the coming months, especially if global economic slowdown persists. Further, as other central banks cut down rates (Bank of Canada and RBA) and implement QE programs (ECB and BOJ); these changes are likely to keep the U.S. dollar stronger. FOMC members voiced their concern over a stronger U.S. dollar: “…the increase in the foreign exchange value of the dollar was expected to be a persistent source of restraint on U.S. net exports, and a few participants pointed to the risk that the dollar could appreciate further.” (click to enlarge) Source of data taken from FRED Even though the recovery of the U.S. dollar at the beginning of the year coincided with the rise of GLD, the linear correlation between the two data sets was still strong and negative at the beginning of the year. Source of data taken from FRED This is only an indication that if the U.S. dollar were to resume its rally, this could have an adverse impact on the price of GLD. For now, the problems in Europe and the economic slowdown in China, which is another concern FOMC members reiterated in the last minutes, could still bring down the U.S. treasury yields. U.S. treasury yields, as I pointed out in the past, tend to have a negative relation with the price of GLD. Nonetheless, yields have gone up in the past several weeks, as the market increased the odds of the FOMC raising its cash rate in the coming months. Therefore, we still have sort of a stalemate when it comes to GLD: Higher uncertainty in Europe, weaker growth in China, and falling prices, which are likely to reduce the odds of the rate hike this summer, are keeping the demand for GLD up. Conversely, the ongoing rise in U.S. treasury yields, stronger U.S. dollar, and the slow recovery in the U.S. economy, partly due to low oil prices, are pressuring down GLD prices. Who will eventually win this stalemate? It’s hard to say at this point. So far, GLD hasn’t done much in the past year, and until the FOMC makes its next move, GLD isn’t likely to budge a whole lot from its current level. We could see some short-term gains, especially as the uncertainty around Greece further unfolds, and if the FOMC continues to voice its concerns over the global economy. For more see: 3 Questions About Gold Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The minutes of the last FOMC meeting were released. The minutes could indicate that the FOMC members have concerns that could postpone the next rate, which could bring back up GLD. The uncertainty in Europe around the Greek debt problem could play in favor of GLD. Since the beginning of the month, shares of the SPDR Gold Trust ETF (NYSEARCA: GLD ) fell by 5.8%. But the recent release of the minutes of the last FOMC meeting and the latest developments in Europe could provide some backwind for the gold ETF. The FOMC minutes revealed that its members wanted to reiterate the importance of remaining patient towards the next rate hike: “Many participants regarded dropping the “patient” language in the statement, whenever that might occur, as risking a shift in market expectations for the beginning of policy firming toward an unduly narrow range of dates. As a result, some expressed the concern that financial markets might overreact, resulting in undesirably tight financial conditions.” This is another indication that even though many of the FOMC members may consider raising rates in the coming months, they still don’t want to commit to a time frame and wish to trend very lightly when it comes to changing their policy. The reaction of GLD, however, was subtle, as prices slightly came up yesterday. Source of data taken from FOMC’s website and Google Finance The minutes also revealed that the FOMC members consider the global economic developments as one of the factors that could determine the Fed’s next move: “The Committee further decided that the postmeeting statement should explicitly acknowledge the role of international developments as one of the factors influencing the Committee’s assessment of progress toward its objectives of maximum employment and 2 percent inflation.” Perhaps the latest problems in Europe and the economic slowdown in other leading countries are starting to shift FOMC members’ opinion towards keeping rates low for a bit longer. Next week, Fed Chair Yellen is expected to testify before Congress; this testimony could provide additional input into what’s next for the Fed and whether there is a chance of a delay in the expected rate hike this summer. The ongoing problems in Europe, mainly the debt problems of Greece, could play in favor for precious metals investments such as GLD. The recent news is that Greece is still scrambling towards reducing some of the austerity measures that were agreed in the past, including reducing the budget surplus from 4.5% to 1.5% of its GDP. Some estimate that Greece could run out of cash by March. Moreover, Greek banks have been losing €2 billion in deposits per week, which will only put more pressure on the recently-elected Syriza government to reach an agreement with the EU. These developments are also likely to pressure down the euro against the U.S. dollar. Stronger dollar The recovery in the U.S. dollar has slowed down in the past few weeks, but the U.S. dollar could see additional gains in the coming months, especially if global economic slowdown persists. Further, as other central banks cut down rates (Bank of Canada and RBA) and implement QE programs (ECB and BOJ); these changes are likely to keep the U.S. dollar stronger. FOMC members voiced their concern over a stronger U.S. dollar: “…the increase in the foreign exchange value of the dollar was expected to be a persistent source of restraint on U.S. net exports, and a few participants pointed to the risk that the dollar could appreciate further.” (click to enlarge) Source of data taken from FRED Even though the recovery of the U.S. dollar at the beginning of the year coincided with the rise of GLD, the linear correlation between the two data sets was still strong and negative at the beginning of the year. Source of data taken from FRED This is only an indication that if the U.S. dollar were to resume its rally, this could have an adverse impact on the price of GLD. For now, the problems in Europe and the economic slowdown in China, which is another concern FOMC members reiterated in the last minutes, could still bring down the U.S. treasury yields. U.S. treasury yields, as I pointed out in the past, tend to have a negative relation with the price of GLD. Nonetheless, yields have gone up in the past several weeks, as the market increased the odds of the FOMC raising its cash rate in the coming months. Therefore, we still have sort of a stalemate when it comes to GLD: Higher uncertainty in Europe, weaker growth in China, and falling prices, which are likely to reduce the odds of the rate hike this summer, are keeping the demand for GLD up. Conversely, the ongoing rise in U.S. treasury yields, stronger U.S. dollar, and the slow recovery in the U.S. economy, partly due to low oil prices, are pressuring down GLD prices. Who will eventually win this stalemate? It’s hard to say at this point. So far, GLD hasn’t done much in the past year, and until the FOMC makes its next move, GLD isn’t likely to budge a whole lot from its current level. We could see some short-term gains, especially as the uncertainty around Greece further unfolds, and if the FOMC continues to voice its concerns over the global economy. For more see: 3 Questions About Gold Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News