Beware Of Screens

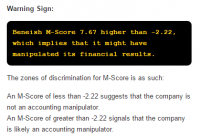

Summary When doing work on IBM recently, we came upon a significant mistake made by one of our data providers. Had we acted on this result without doing due diligence, we would have missed what we consider a profitable trade at best or lost money on puts at worst. Screens represent a general problem: a preponderance of data and a dearth of insight. Use screens as a starting point only. They should be your first tool, not only tool. Investors face a host of risks that they willingly take on. There’s the biggest risk (risk of overpaying), sentiment risk, market obsolescence, risks flowing from the capital structure etc. One of the risks that’s talked about less often is what we call “the input risk”. We know of a few horror stories where people invested based entirely on web based screens and have come to regret it. In this short piece, we want to offer a specific example of why this is such a risk and make a general point about how investors should use these valuable, but limited tools. The advice seems simple, but like a great deal of simple advice, it’s followed infrequently by some. This may be unwelcome news to some people who prefer the magic bullet solution to a systemic problem: doing well at this requires a great deal more work than running a screen. We only publish a portion (sometimes a small portion) of the work we do when analysing a company. There’s actually a great deal going on below the surface here. There are two reasons for keeping most of our work to ourselves. First, we offer it to paying clients. It’s only fair. They paid for it. Second, we believe the wider readership would rather not be subjected to even longer screeds about a given name than we normally impose upon them. For instance, we like to focus on what the sales community (sorry…the ” analyst ” community…) is saying about a particular name, since they often act as a long-run contra indicator. We also like to review the likelihood that a given company is a financial manipulator. We do this in a variety of ways and for obvious reasons. For anyone who’s interested, feel free to on one of the methods we use, developed by professor Messod Beneish . One Example Of How Things Could Have Gone Badly When we started our analysis of IBM (NYSE: IBM ) recently , we started by reviewing a financial website (Gurufocus). Gurufocus is one of our favourite go-to sites and is often very useful, but when it’s mistaken it’s really mistaken. In particular, the site claimed that there was a better than average chance that IBM was a financial manipulator, based on its M-score. When we calculated the score ourselves, we determined that IBM is no more likely to have failed Beneish’s manipulator screen than any other company. Gurufocus responded to our query by saying that it relies on financial results posted by Morningstar, so we should approach that organisation. This is strange because the Morningstar numbers and the Gurufocus numbers don’t agree across the board. In this instance, Gurufocus/Morningstar didn’t include one of the components of IBM’s accounts receivable in March 2014, making it look as though the company’s accounts receivables have ballooned massively over the past four quarters. For the record, when accounts receivables grow massively and rapidly, that’s a huge red flag. The fact is that this didn’t happen at IBM, so that company was unfairly painted with the “manipulator” brush. Source: Gurufocus, July 28, 2015 The actual results are these: Source: Company filings The actual M-Score for IBM is ~-3, which means that it does not fail the screen developed by professor Beneish. If the reader is interested in learning more about the M-Score and professor Beneish’s methodology, feel free to check out some earlier work or have a look at some online resources . If we simply placed a trade based Gurufocus’ findings, we believe we would have injured ourselves and our clients over the coming year. We would have either not bought a company that we’re actually generally bullish on, or we would have lost money on puts. If we didn’t discover the problem with the way accounts receivable was being calculated, we could have come to a faulty conclusion. There’s a lesson about double checking screens here. Conclusion This isn’t to say that such services are not valuable. Sites like Gurufocus and YCharts and others improve productivity tremendously. They help investors search the universe of stocks in seconds. The problem is that if you make investment decisions based on their results alone, you’re taking on unnecessary risk. The proliferation of sites that allow us to aggregate the vast amounts of data available is both a symptom and a cause of the preponderance of data and a (relative) dearth of insight. When starting to invest, we recommend using sites like these as a starting place, and when you find something interesting, immediately go to the actual sources. The fact that so many investors seem frightened of financial statements and their accompanying notes leads us to believe that there’s potential profit to be had if you train yourself accordingly. We’re reminded of how Jim Chanos spotted the Enron debacle first because so few other analysts read the notes to the financial statements published by that company . The SEC website is as available as any other and it should be the place you visit just after hearing about a company through one of the available tools. These screens are great as a first but not final tool. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.