Scalper1 News

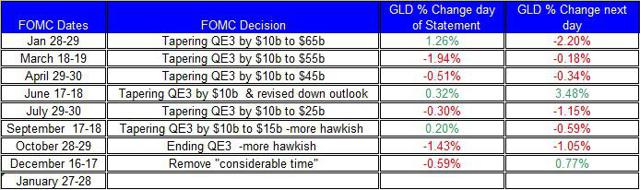

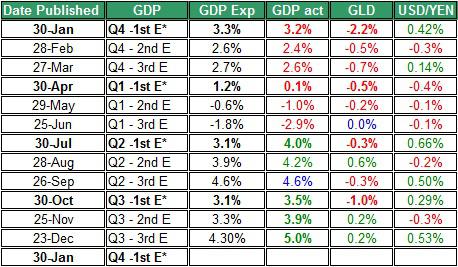

The rise in uncertainty in Europe over the recent Greek elections results in ECB’s QE program play in favor of GLD. Will the upcoming FOMC meeting and GDP update for the fourth quarter impact the direction of GLD? The market has revised down the probabilities of a rate hike in the coming FOMC meetings. The results of the latest elections in Greece along with ECB’s decision to start its quantitative easing program have provided back-wind for the SPDR Gold Trust ETF (NYSEARCA: GLD ). Let’s examine the recent developments in Europe and the upcoming reports in the U.S. including FOMC statement and GDP update. The latest news about election results in Greece, in which the extreme left party Syriza won, is likely to bring this country one step closer towards leaving the European Union, could stir up the markets, raise the uncertainty levels and depreciate the Euro against leading currencies. But it’s not likely to have substantial long-term adverse ramifications on the EU, as suggested in this analysis . This news along with ECB’s decision to implement a $1.3 trillion QE program could still drive higher the demand for precious metals investments including GLD, which tend to strive when central banks devalue their currency and the uncertainty level in the markets rise. Nonetheless, bear in mind that the ongoing rally of the U.S. Dollar against the Euro and other currencies will eventually curb down the rise in the price of GLD. This week the FOMC will convene for the first time this year. In the previous meeting back in December, the FOMC concluded its meeting with the decision to repurpose the term “considerable time” with respect to the timing of the rate hike; the FOMC kept the term as a reference point to its current policy – the normalization process will continue to be data dependent and a rate hike won’t happen anytime soon with the key word being patience: “… the Committee judges that it can be patient in beginning to normalize the stance of monetary policy.” Moreover, in the press conference that followed, FOMC Chair Yellen also pointed out that the FOMC is likely to raise rates in the next couple of meetings. (click to enlarge) Source of data: FOMC’s site and Bloomberg This time, the FOMC meeting will include a press conference or an update for the economic progress of the U.S. But the last updates by the IMF and World Bank showed that the U.S. economy is likely to grow in 2015 by 3.6% and 3.2%, respectively. In both cases, these organizations revised up their assessments from their previous estimates, in part, due to low oil prices. The current low oil prices are also likely to bring down GLD – after all potential rise in inflation is among the main reasons for people to invest in gold assets such as GLD. Well, this doesn’t seem to be the case. Despite the expected higher growth in GDP, the markets have started to revise their expectations about the next rate hike of the FOMC. According to the CME , the probability of a rate hike in the June meeting is currently only 12% – a month ago this probability was around 30%. Further, the implied probability of a rate hike in the July meeting has been updated from 57% a month ago to 28%. So the markets have updated their projections based on the current low inflation. The low inflation could eventually result in the FOMC pushing forward the first and subsequent rate hikes. Such a scenario is likely to keep pushing up the price of GLD: After all, low cash rate tends to translate to low long-term treasury yields. If U.S. treasury yields remain low, this could contribute to the short-term recovery of GLD. But the upcoming FOMC meeting isn’t likely to stir up the markets considering Yellen’s promise not to rock the boat in the next two meetings. Therefore, the market reaction is likely to moderate and GLD isn’t expected to do much – we could see a similar reaction as we did in the last meeting. Another report to consider is the upcoming GDP report – first estimate for the last quarter of the year. The current estimates are for the GDP report to show a gain of 3.1%. In the past, these reports didn’t seem to have much of a strong impact on the prices of GLD, as you can see in the table below. Source of data taken from Bloomberg and BEA Nonetheless, this report is still likely to influence FOMC members with respect to their rate decision. If the U.S. economy keeps showing a steady growth, this is likely to bring the FOMC closer to pushing the trigger on the rate hike. Despite the latest developments in Europe, the direction of GLD is mostly related to the changes in U.S. including the FOMC’s policy and the progress of the U.S. economy. If the FOMC were to push forward its first rate hike, this could keep up the price of GLD. For more see: What are the advantages of GLD? Scalper1 News

The rise in uncertainty in Europe over the recent Greek elections results in ECB’s QE program play in favor of GLD. Will the upcoming FOMC meeting and GDP update for the fourth quarter impact the direction of GLD? The market has revised down the probabilities of a rate hike in the coming FOMC meetings. The results of the latest elections in Greece along with ECB’s decision to start its quantitative easing program have provided back-wind for the SPDR Gold Trust ETF (NYSEARCA: GLD ). Let’s examine the recent developments in Europe and the upcoming reports in the U.S. including FOMC statement and GDP update. The latest news about election results in Greece, in which the extreme left party Syriza won, is likely to bring this country one step closer towards leaving the European Union, could stir up the markets, raise the uncertainty levels and depreciate the Euro against leading currencies. But it’s not likely to have substantial long-term adverse ramifications on the EU, as suggested in this analysis . This news along with ECB’s decision to implement a $1.3 trillion QE program could still drive higher the demand for precious metals investments including GLD, which tend to strive when central banks devalue their currency and the uncertainty level in the markets rise. Nonetheless, bear in mind that the ongoing rally of the U.S. Dollar against the Euro and other currencies will eventually curb down the rise in the price of GLD. This week the FOMC will convene for the first time this year. In the previous meeting back in December, the FOMC concluded its meeting with the decision to repurpose the term “considerable time” with respect to the timing of the rate hike; the FOMC kept the term as a reference point to its current policy – the normalization process will continue to be data dependent and a rate hike won’t happen anytime soon with the key word being patience: “… the Committee judges that it can be patient in beginning to normalize the stance of monetary policy.” Moreover, in the press conference that followed, FOMC Chair Yellen also pointed out that the FOMC is likely to raise rates in the next couple of meetings. (click to enlarge) Source of data: FOMC’s site and Bloomberg This time, the FOMC meeting will include a press conference or an update for the economic progress of the U.S. But the last updates by the IMF and World Bank showed that the U.S. economy is likely to grow in 2015 by 3.6% and 3.2%, respectively. In both cases, these organizations revised up their assessments from their previous estimates, in part, due to low oil prices. The current low oil prices are also likely to bring down GLD – after all potential rise in inflation is among the main reasons for people to invest in gold assets such as GLD. Well, this doesn’t seem to be the case. Despite the expected higher growth in GDP, the markets have started to revise their expectations about the next rate hike of the FOMC. According to the CME , the probability of a rate hike in the June meeting is currently only 12% – a month ago this probability was around 30%. Further, the implied probability of a rate hike in the July meeting has been updated from 57% a month ago to 28%. So the markets have updated their projections based on the current low inflation. The low inflation could eventually result in the FOMC pushing forward the first and subsequent rate hikes. Such a scenario is likely to keep pushing up the price of GLD: After all, low cash rate tends to translate to low long-term treasury yields. If U.S. treasury yields remain low, this could contribute to the short-term recovery of GLD. But the upcoming FOMC meeting isn’t likely to stir up the markets considering Yellen’s promise not to rock the boat in the next two meetings. Therefore, the market reaction is likely to moderate and GLD isn’t expected to do much – we could see a similar reaction as we did in the last meeting. Another report to consider is the upcoming GDP report – first estimate for the last quarter of the year. The current estimates are for the GDP report to show a gain of 3.1%. In the past, these reports didn’t seem to have much of a strong impact on the prices of GLD, as you can see in the table below. Source of data taken from Bloomberg and BEA Nonetheless, this report is still likely to influence FOMC members with respect to their rate decision. If the U.S. economy keeps showing a steady growth, this is likely to bring the FOMC closer to pushing the trigger on the rate hike. Despite the latest developments in Europe, the direction of GLD is mostly related to the changes in U.S. including the FOMC’s policy and the progress of the U.S. economy. If the FOMC were to push forward its first rate hike, this could keep up the price of GLD. For more see: What are the advantages of GLD? Scalper1 News

Scalper1 News