Scalper1 News

My portfolio gained 2.24% points in the fourth quarter. My portfolio’s end of year return was 9.88%. My portfolio beat 2 of 3 selected indices. The fourth quarter and year has ended for my all Vanguard portfolio . The quarterly and year to date reviews are below. Performance: My portfolio in the fourth quarter rebounded from the third quarter . It increased 2.24 percentage points. All three benchmarks performed better this quarter and all out performed my portfolio. The EOY return on my portfolio increased to 9.88%. I am still outperforming two of the indexes. I did so well the first half of the year that even though I slid in the second half I still did well. The table below shows the fourth quarter and YTD returns. 4th Qtr. % change EOY Return Vanguard 2.24% 9.88% S&P 500 5.79% 12.39% DJIA 6.6% 8.4% Russell 2000 10.99% 3.41% Below are the returns of all my positions at the end of the year. I took a piece of advice from a comment in my third quarter paper. I summed up the values of the same ETF in each different account. The table should be easier to read this time. Ticker % Chg Annualized Yield Vanguard Mega Cap Value ETF (NYSEARCA: MGV ) 13.13% 13.94% Vanguard Materials ETF (NYSEARCA: VAW ) 4.13% 6.60% Vanguard Small Cap ETF (NYSEARCA: VB ) 7.22% 10.04% Vanguard Small Cap Growth ETF (NYSEARCA: VBK ) 3.49% 4.57% Vanguard Small Cap Value ETF (NYSEARCA: VBR ) 7.37% 9.23% Vanguard Consumer Discretionary ETF (NYSEARCA: VCR ) 13.90% 15.14% Vanguard Consumer Staples ETF (NYSEARCA: VDC ) 14.24% 15.51% Vanguard Energy ETF (NYSEARCA: VDE ) -6.66% -8.22% Vanguard FTSE Developed Markets ETF (NYSEARCA: VEA ) -6.54% -12.18% Vanguard FTSE All-World ex-US ETF (NYSEARCA: VEU ) -5.71% -10.68% Vanguard Financials ETF (NYSEARCA: VFH ) 13.31% 17.03% Vanguard FTSE Europe ETF (NYSEARCA: VGK ) -4.72% -8.87% Vanguard Information Technology ETF (NYSEARCA: VGT ) 10.76% 56.76% Vanguard Health Care ETF (NYSEARCA: VHT ) 13.89% 18.99% Vanguard Dividend Appreciation (NYSEARCA: VIG ) 11.56% 12.58% Vanguard Industrials ETF (NYSEARCA: VIS ) 8.19% 10.34% Vanguard REIT Index ETF (NYSEARCA: VNQ ) 15.42% 8.44% Vanguard Mid Cap ETF (NYSEARCA: VO ) 9.45% 13.45% Vanguard Mid-Cap Value ETF (NYSEARCA: VOE ) 0.00% 65.22% Vanguard S&P 500 ETF (NYSEARCA: VOO ) 12.61% 18.06% Vanguard Mid-Cap Growth ETF (NYSEARCA: VOT ) 12.51% 17.34% Vanguard FTSE Pacific ETF (NYSEARCA: VPL ) 0.70% 0.84% Vanguard Utilities ETF (NYSEARCA: VPU ) 11.91% 18.33% Vanguard FTSE All-World ex-US Small-Cap ETF (NYSEARCA: VSS ) -4.07% -7.68% Vanguard Total World Stock ETF (NYSEARCA: VT ) -0.17% -0.32% Vanguard Value ETF (NYSEARCA: VTV ) 15.44% 16.83% Vanguard Growth ETF (NYSEARCA: VUG ) 12.48% 17.88% Vanguard Large Cap ETF (NYSEARCA: VV ) 6.49% 31.41% Vanguard FTSE Emerging Markets ETF (NYSEARCA: VWO ) -2.56% -2.77% Vanguard Emerging Markets Government Bond Index ETF (NASDAQ: VWOB ) -0.50% -0.58% Vanguard Extended Market Index ETF (NYSEARCA: VXF ) 6.96% 15.16% Vanguard Total International Stock ETF (NASDAQ: VXUS ) -4.43% -5.31% Vanguard High Dividend Yield ETF (NYSEARCA: VYM ) 11.67% 14.91% Vanguard Telecom Services ETF (NYSEARCA: VOX ) 4.56% 195.86% In the third quarter VTV was the only position that was over 10%. Now 14 ETFs have over a 10% return for the year. VNQ and VDC did the best this year. All the ETFs that are geared towards international stocks are in the red. It seems that every other country is still struggling. The energy sector is struggling too. VDE had the worst return and I lost over 6%. The number of positions that were negative from the third quarter to the end of the year went from 11 to 9. Looking at all my positions one can see why I didn’t do as well as the S&P. The S&P tracks the top 500 companies and is a good representation of the U.S. market. I have a lot of international positions and I already mentioned how all those were negative. Taking out those I would have had a return of over 12.5%. However, I am invested in those because I believe in diversification. Transactions: The fourth quarter was busy for trading. I had 72 trades which was more than the number of trades I had in the third quarter. Most of the trades were in the first few weeks of October as the market was dropping. I like to buy when everyone else sells and hold when everyone buys. I had a few major sells. I finished selling off all my positions in VCLT, BLV, and EDV. Interest rates were still low and when the market dropped in early October government bonds increased. I sold them and used most of profits to invest in VDE. The number of investments remained the same from the third quarter at 34. The chart below shows the ETFs that had more than a 2% weight. This is much different than the weights in the third quarter. The weights are more diverse. 20 ETFs are over 2%. VCLT was replaced by VDE as the highest weight. (click to enlarge) End of year comments: From looking back at my third quarter comments I stuck to my plan in the fourth quarter. When the market dipped at the start of October I was in buying mode and added to all my positions. From the middle of October to the end of the year the market went higher and I stopped trading and let the returns ride. I think overall my strategy worked out. This was the second best thing than to trading individual stocks. Most of my ETFs were positive. There were a few losers, but that’s how it goes. I was at the higher end of my 7-10% prediction. I didn’t expect the S&P to do a lot better, I thought I was closely tied to the market and that my portfolio should have tracked it almost perfectly. At the midpoint of the year my return was already up 9.77%. That means I was flat for the rest of the year. I expected much more at that point. 9.88% still beat 2 of the 3 benchmarks so I can’t be too disappointed. I think I am in a good position for the future. I think my positions in VDE and in the international ETFs will turn around next year. Since my portfolio did well there is nothing from deterring me from continuing the same strategy into next year. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

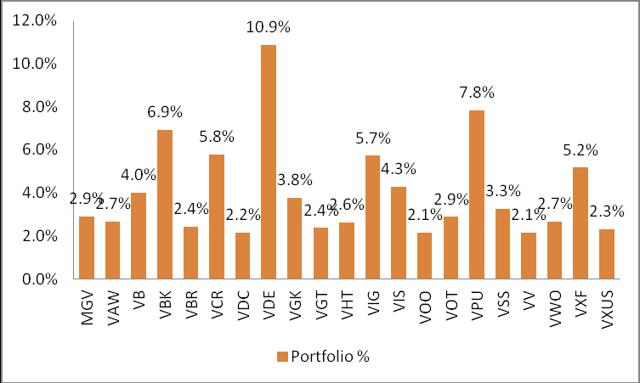

My portfolio gained 2.24% points in the fourth quarter. My portfolio’s end of year return was 9.88%. My portfolio beat 2 of 3 selected indices. The fourth quarter and year has ended for my all Vanguard portfolio . The quarterly and year to date reviews are below. Performance: My portfolio in the fourth quarter rebounded from the third quarter . It increased 2.24 percentage points. All three benchmarks performed better this quarter and all out performed my portfolio. The EOY return on my portfolio increased to 9.88%. I am still outperforming two of the indexes. I did so well the first half of the year that even though I slid in the second half I still did well. The table below shows the fourth quarter and YTD returns. 4th Qtr. % change EOY Return Vanguard 2.24% 9.88% S&P 500 5.79% 12.39% DJIA 6.6% 8.4% Russell 2000 10.99% 3.41% Below are the returns of all my positions at the end of the year. I took a piece of advice from a comment in my third quarter paper. I summed up the values of the same ETF in each different account. The table should be easier to read this time. Ticker % Chg Annualized Yield Vanguard Mega Cap Value ETF (NYSEARCA: MGV ) 13.13% 13.94% Vanguard Materials ETF (NYSEARCA: VAW ) 4.13% 6.60% Vanguard Small Cap ETF (NYSEARCA: VB ) 7.22% 10.04% Vanguard Small Cap Growth ETF (NYSEARCA: VBK ) 3.49% 4.57% Vanguard Small Cap Value ETF (NYSEARCA: VBR ) 7.37% 9.23% Vanguard Consumer Discretionary ETF (NYSEARCA: VCR ) 13.90% 15.14% Vanguard Consumer Staples ETF (NYSEARCA: VDC ) 14.24% 15.51% Vanguard Energy ETF (NYSEARCA: VDE ) -6.66% -8.22% Vanguard FTSE Developed Markets ETF (NYSEARCA: VEA ) -6.54% -12.18% Vanguard FTSE All-World ex-US ETF (NYSEARCA: VEU ) -5.71% -10.68% Vanguard Financials ETF (NYSEARCA: VFH ) 13.31% 17.03% Vanguard FTSE Europe ETF (NYSEARCA: VGK ) -4.72% -8.87% Vanguard Information Technology ETF (NYSEARCA: VGT ) 10.76% 56.76% Vanguard Health Care ETF (NYSEARCA: VHT ) 13.89% 18.99% Vanguard Dividend Appreciation (NYSEARCA: VIG ) 11.56% 12.58% Vanguard Industrials ETF (NYSEARCA: VIS ) 8.19% 10.34% Vanguard REIT Index ETF (NYSEARCA: VNQ ) 15.42% 8.44% Vanguard Mid Cap ETF (NYSEARCA: VO ) 9.45% 13.45% Vanguard Mid-Cap Value ETF (NYSEARCA: VOE ) 0.00% 65.22% Vanguard S&P 500 ETF (NYSEARCA: VOO ) 12.61% 18.06% Vanguard Mid-Cap Growth ETF (NYSEARCA: VOT ) 12.51% 17.34% Vanguard FTSE Pacific ETF (NYSEARCA: VPL ) 0.70% 0.84% Vanguard Utilities ETF (NYSEARCA: VPU ) 11.91% 18.33% Vanguard FTSE All-World ex-US Small-Cap ETF (NYSEARCA: VSS ) -4.07% -7.68% Vanguard Total World Stock ETF (NYSEARCA: VT ) -0.17% -0.32% Vanguard Value ETF (NYSEARCA: VTV ) 15.44% 16.83% Vanguard Growth ETF (NYSEARCA: VUG ) 12.48% 17.88% Vanguard Large Cap ETF (NYSEARCA: VV ) 6.49% 31.41% Vanguard FTSE Emerging Markets ETF (NYSEARCA: VWO ) -2.56% -2.77% Vanguard Emerging Markets Government Bond Index ETF (NASDAQ: VWOB ) -0.50% -0.58% Vanguard Extended Market Index ETF (NYSEARCA: VXF ) 6.96% 15.16% Vanguard Total International Stock ETF (NASDAQ: VXUS ) -4.43% -5.31% Vanguard High Dividend Yield ETF (NYSEARCA: VYM ) 11.67% 14.91% Vanguard Telecom Services ETF (NYSEARCA: VOX ) 4.56% 195.86% In the third quarter VTV was the only position that was over 10%. Now 14 ETFs have over a 10% return for the year. VNQ and VDC did the best this year. All the ETFs that are geared towards international stocks are in the red. It seems that every other country is still struggling. The energy sector is struggling too. VDE had the worst return and I lost over 6%. The number of positions that were negative from the third quarter to the end of the year went from 11 to 9. Looking at all my positions one can see why I didn’t do as well as the S&P. The S&P tracks the top 500 companies and is a good representation of the U.S. market. I have a lot of international positions and I already mentioned how all those were negative. Taking out those I would have had a return of over 12.5%. However, I am invested in those because I believe in diversification. Transactions: The fourth quarter was busy for trading. I had 72 trades which was more than the number of trades I had in the third quarter. Most of the trades were in the first few weeks of October as the market was dropping. I like to buy when everyone else sells and hold when everyone buys. I had a few major sells. I finished selling off all my positions in VCLT, BLV, and EDV. Interest rates were still low and when the market dropped in early October government bonds increased. I sold them and used most of profits to invest in VDE. The number of investments remained the same from the third quarter at 34. The chart below shows the ETFs that had more than a 2% weight. This is much different than the weights in the third quarter. The weights are more diverse. 20 ETFs are over 2%. VCLT was replaced by VDE as the highest weight. (click to enlarge) End of year comments: From looking back at my third quarter comments I stuck to my plan in the fourth quarter. When the market dipped at the start of October I was in buying mode and added to all my positions. From the middle of October to the end of the year the market went higher and I stopped trading and let the returns ride. I think overall my strategy worked out. This was the second best thing than to trading individual stocks. Most of my ETFs were positive. There were a few losers, but that’s how it goes. I was at the higher end of my 7-10% prediction. I didn’t expect the S&P to do a lot better, I thought I was closely tied to the market and that my portfolio should have tracked it almost perfectly. At the midpoint of the year my return was already up 9.77%. That means I was flat for the rest of the year. I expected much more at that point. 9.88% still beat 2 of the 3 benchmarks so I can’t be too disappointed. I think I am in a good position for the future. I think my positions in VDE and in the international ETFs will turn around next year. Since my portfolio did well there is nothing from deterring me from continuing the same strategy into next year. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News