Scalper1 News

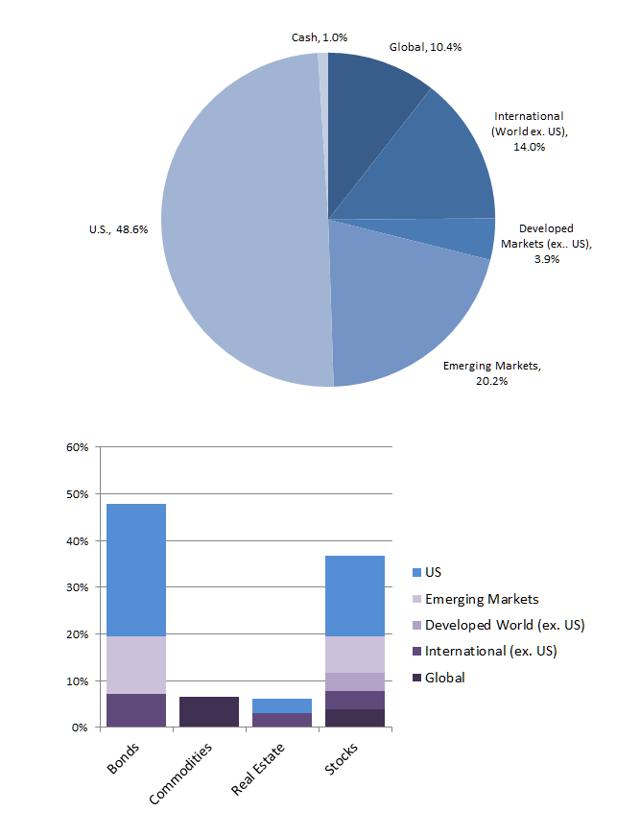

Summary Mebane Faber’s Cambria Funds has added another ETF to its stable. The fund is a fund-of-funds comprising a core global portfolio of stocks, bonds, commodities and real estate. Cambria charges no management fees for the ETF. Acquired fees for the component funds are 0.29%. A Global Core Portfolio ETF With Zero Management Fees The latest ETF from investment iconoclast Mebane Faber is poised to be an industry disrupter. The Cambria Global Asset Allocation ETF (NYSEARCA: GAA ) is a fund of funds offering a global portfolio of stocks, bonds, commodities and real estate. “So,” you say, “what’s so disruptive about that?” Well, the ETF has no management fee beyond the acquired fees of the component funds. None. Acquired fund expenses amount to a mere 0.29%. Fig. 1. Still from Treasure of the Sierra Madre (1948). More on the fee structure later, let’s take a look at the fund first. The Fund The fund is a designed as a core global market portfolio, what Faber describes on ETF.com as a “one-stop shop for core global allocation… for super-low cost.” He goes so far as to ordain the fund the “global benchmark.” The table below lists the current portfolio. Fund Ticker Percent of Holdings Vanguard Tot Bond Mkt ETF (NYSEARCA: BND ) 8.09% Vanguard Emerging Mkt ETF (NYSEARCA: VWO ) 6.75% United States Comm Index (NYSEARCA: USCI ) 6.58% Vanguard Intl Bond ETF (NASDAQ: BNDX ) 5.07% Vanguard Emerg Mkts Gov B (NASDAQ: VWOB ) 4.90% Ishares MSCI USA Momentum (NYSEARCA: MTUM ) 4.09% Vanguard Mid-Cap ETF (NYSEARCA: VO ) 4.08% Vanguard Viper (NYSEARCA: VTI ) 4.07% Vanguard Europe Pac ETF (NYSEARCA: VEA ) 3.94% Mkt Vectors Em Lc Bd ETF (NYSEARCA: EMLC ) 3.85% Cambria Gloabl Value ETF (NYSEARCA: GVAL ) 3.80% Market Vectors Emer Hy (NYSEARCA: HYEM ) 3.77% Vanguard Reit ETF (NYSEARCA: VNQ ) 3.10% Cambria Shrhldr Yld ETF (NYSEARCA: SYLD ) 3.04% Ishares Lehman 7-10yr Trs (NYSEARCA: IEF ) 3.04% Ishares Iboxx Inv Gr Corp (NYSEARCA: LQD ) 3.03% SPDR Barclays TIPS ETF (NYSEARCA: IPE ) 3.00% Schwab U.S. TIPS ETF (NYSEARCA: SCHP ) 3.00% Vanguard Gbl X U.S. Re ETF (NASDAQ: VNQI ) 2.95% Ishares 20+Yrs Treas ETF (NYSEARCA: TLT ) 2.07% Vanguard St Bond ETF (NYSEARCA: BSV ) 2.01% Vanguard-S/T Corp ETF (NASDAQ: VCSH ) 2.01% Cambria Forgn Shrhldr ETF (NYSEARCA: FYLD ) 2.00% SPDR Barclays Int Corp (NYSEARCA: IBND ) 1.99% Vanguard Ftse All World (NYSEARCA: VSS ) 1.99% Spdr Barclays High Yield (NYSEARCA: JNK ) 1.99% Wisdomtree Em Small Cap (NYSEARCA: DGS ) 1.96% Market Vectors Intl (NYSEARCA: IHY ) 1.94% Cash 0.97% Wisdomtree Emg Mkts Eq (NYSEARCA: DEM ) 0.94% Here’s a couple of charts breaking the portfolio down at high-level geographic and asset class allocations. In the charts I’ve categorized the funds as Global (all-world), International (global ex. U.S.), Developed Markets ex. U.S., Emerging Markets, and Domestic (US) based on the individual funds’ mandates. I’ve not made any effort to break down the holdings by sub-categories within the funds. Obviously, Global would encompass all of the funds and International would encompass the two ex. U.S. categories but I’ve not done that here. (click to enlarge) Fig 2 and 3. Portfolio composition of Cambria Global Asset Allocation ETF . Charts by author. Data from Cambria . As we see, the portfolio breaks down to about half U.S. and half international. Slightly under half of the holdings is in bonds which cover sovereign and corporate debt at a full range of durations. There’s a 6.6% allocation to commodities, and 6% to real estate split equally between U.S. and international. The 36.7% that’s in stocks is split with about half in U.S. equity. If one adds the U.S. portion of the global funds, the mix would be slightly more than half in domestic securities. Zero Management Fee Now, about those fees. Or shall I say, the lack of fees? Surely no one opens an ETF without some reasonable expectation of turning a profit on it. How can they do that without charging fees? Two factors contribute to answer this question. First, according to Faber, this is an extremely low-cost fund to manage. GAA is essentially buy and hold. Although one assumes there will be some periodic rebalancing, the details are not discussed in the literature I examined. Furthermore, Faber claims that management is sufficiently lean and the fund is sufficiently cost-efficient that should it fails to raise a single dollar, the cost to Cambria will only be about $100,000. Or, to put it another way, the fund need only generate that $100,000 for Cambria to break even on it. But, with no fees, how can they generate even that amount? This raises the second point, and it is the key to making GAA viable. Three of the holdings are Cambria funds: SYLD, FYLD and GVAL, representing 8.84% of the portfolio. Faber claims that for a fund value of about $100M for GAA, the fees from those funds will generate sufficient revenue to Cambria for GAA to break even. To sum up, I see GAA an intriguing experiment. It provides exposure to a core global portfolio of 29 ETFs at absolutely minimal cost. An investor could buy the world market in its entirety with this single fund and simply forget about it. Doing so provides a truly passive, index investment. It will be interesting to follow how investors respond. If it succeeds it may well be remembered as the disruptive force Faber considers it to be. Scalper1 News

Summary Mebane Faber’s Cambria Funds has added another ETF to its stable. The fund is a fund-of-funds comprising a core global portfolio of stocks, bonds, commodities and real estate. Cambria charges no management fees for the ETF. Acquired fees for the component funds are 0.29%. A Global Core Portfolio ETF With Zero Management Fees The latest ETF from investment iconoclast Mebane Faber is poised to be an industry disrupter. The Cambria Global Asset Allocation ETF (NYSEARCA: GAA ) is a fund of funds offering a global portfolio of stocks, bonds, commodities and real estate. “So,” you say, “what’s so disruptive about that?” Well, the ETF has no management fee beyond the acquired fees of the component funds. None. Acquired fund expenses amount to a mere 0.29%. Fig. 1. Still from Treasure of the Sierra Madre (1948). More on the fee structure later, let’s take a look at the fund first. The Fund The fund is a designed as a core global market portfolio, what Faber describes on ETF.com as a “one-stop shop for core global allocation… for super-low cost.” He goes so far as to ordain the fund the “global benchmark.” The table below lists the current portfolio. Fund Ticker Percent of Holdings Vanguard Tot Bond Mkt ETF (NYSEARCA: BND ) 8.09% Vanguard Emerging Mkt ETF (NYSEARCA: VWO ) 6.75% United States Comm Index (NYSEARCA: USCI ) 6.58% Vanguard Intl Bond ETF (NASDAQ: BNDX ) 5.07% Vanguard Emerg Mkts Gov B (NASDAQ: VWOB ) 4.90% Ishares MSCI USA Momentum (NYSEARCA: MTUM ) 4.09% Vanguard Mid-Cap ETF (NYSEARCA: VO ) 4.08% Vanguard Viper (NYSEARCA: VTI ) 4.07% Vanguard Europe Pac ETF (NYSEARCA: VEA ) 3.94% Mkt Vectors Em Lc Bd ETF (NYSEARCA: EMLC ) 3.85% Cambria Gloabl Value ETF (NYSEARCA: GVAL ) 3.80% Market Vectors Emer Hy (NYSEARCA: HYEM ) 3.77% Vanguard Reit ETF (NYSEARCA: VNQ ) 3.10% Cambria Shrhldr Yld ETF (NYSEARCA: SYLD ) 3.04% Ishares Lehman 7-10yr Trs (NYSEARCA: IEF ) 3.04% Ishares Iboxx Inv Gr Corp (NYSEARCA: LQD ) 3.03% SPDR Barclays TIPS ETF (NYSEARCA: IPE ) 3.00% Schwab U.S. TIPS ETF (NYSEARCA: SCHP ) 3.00% Vanguard Gbl X U.S. Re ETF (NASDAQ: VNQI ) 2.95% Ishares 20+Yrs Treas ETF (NYSEARCA: TLT ) 2.07% Vanguard St Bond ETF (NYSEARCA: BSV ) 2.01% Vanguard-S/T Corp ETF (NASDAQ: VCSH ) 2.01% Cambria Forgn Shrhldr ETF (NYSEARCA: FYLD ) 2.00% SPDR Barclays Int Corp (NYSEARCA: IBND ) 1.99% Vanguard Ftse All World (NYSEARCA: VSS ) 1.99% Spdr Barclays High Yield (NYSEARCA: JNK ) 1.99% Wisdomtree Em Small Cap (NYSEARCA: DGS ) 1.96% Market Vectors Intl (NYSEARCA: IHY ) 1.94% Cash 0.97% Wisdomtree Emg Mkts Eq (NYSEARCA: DEM ) 0.94% Here’s a couple of charts breaking the portfolio down at high-level geographic and asset class allocations. In the charts I’ve categorized the funds as Global (all-world), International (global ex. U.S.), Developed Markets ex. U.S., Emerging Markets, and Domestic (US) based on the individual funds’ mandates. I’ve not made any effort to break down the holdings by sub-categories within the funds. Obviously, Global would encompass all of the funds and International would encompass the two ex. U.S. categories but I’ve not done that here. (click to enlarge) Fig 2 and 3. Portfolio composition of Cambria Global Asset Allocation ETF . Charts by author. Data from Cambria . As we see, the portfolio breaks down to about half U.S. and half international. Slightly under half of the holdings is in bonds which cover sovereign and corporate debt at a full range of durations. There’s a 6.6% allocation to commodities, and 6% to real estate split equally between U.S. and international. The 36.7% that’s in stocks is split with about half in U.S. equity. If one adds the U.S. portion of the global funds, the mix would be slightly more than half in domestic securities. Zero Management Fee Now, about those fees. Or shall I say, the lack of fees? Surely no one opens an ETF without some reasonable expectation of turning a profit on it. How can they do that without charging fees? Two factors contribute to answer this question. First, according to Faber, this is an extremely low-cost fund to manage. GAA is essentially buy and hold. Although one assumes there will be some periodic rebalancing, the details are not discussed in the literature I examined. Furthermore, Faber claims that management is sufficiently lean and the fund is sufficiently cost-efficient that should it fails to raise a single dollar, the cost to Cambria will only be about $100,000. Or, to put it another way, the fund need only generate that $100,000 for Cambria to break even on it. But, with no fees, how can they generate even that amount? This raises the second point, and it is the key to making GAA viable. Three of the holdings are Cambria funds: SYLD, FYLD and GVAL, representing 8.84% of the portfolio. Faber claims that for a fund value of about $100M for GAA, the fees from those funds will generate sufficient revenue to Cambria for GAA to break even. To sum up, I see GAA an intriguing experiment. It provides exposure to a core global portfolio of 29 ETFs at absolutely minimal cost. An investor could buy the world market in its entirety with this single fund and simply forget about it. Doing so provides a truly passive, index investment. It will be interesting to follow how investors respond. If it succeeds it may well be remembered as the disruptive force Faber considers it to be. Scalper1 News

Scalper1 News