Scalper1 News

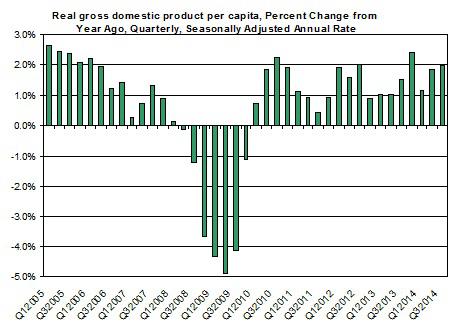

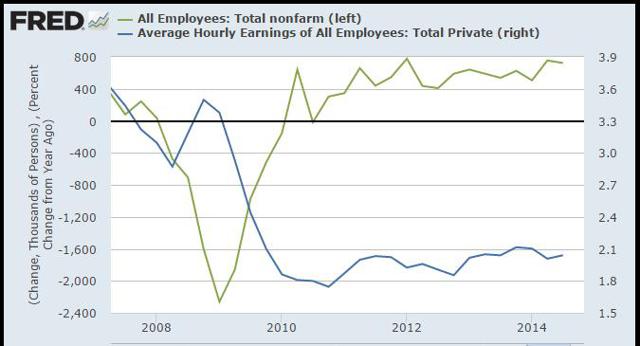

Summary The progress of the U.S. economy is keeping down SLV. The minutes of the last FOMC meeting may shed light on the next FOMC move. The upcoming non-farm payroll could also bring down SLV if it reaches or passes market expectations. The recovery of iShares Silver Trust (NYSEARCA: SLV ) any time soon remains questionable as the U.S. economy keeps showing signs of recovery and the FOMC is slowly setting the groundwork for a rate hike, which could be another blow for silver. Let’s take a closer look at the progress of the U.S. economy, examine what’s next for the FOMC and the relation to SLV. Is the U.S. economy doing better? The U.S. economy has improved in the past few quarters, albeit it has yet to return to its pre crisis levels (before the recent economic meltdown); let’s examine the U.S. GDP per capita. Data taken from FRED Between 2012 and 2014 the average annual growth rate (per quarter) was around 1.6% – back in 2000-2006 the average growth rate was 1.8% and in the second half of the ’90s this figure was 2.8%. Conversely, during 2010-2011 the average rise in GDP per capita was only 1.3%. So the growth rate has picked up, but it still has more room to improve. The progress of the U.S. economy is one factor that influences SLV investors whether or not to hold on to their investment. As the U.S. economy recovers, the demand for silver on paper tends to diminish as it did back in 2013-2014. Another important aspect to consider is the progress in the U.S. labor market, including employment and wages. (click to enlarge) Data taken from FRED Even though the number of non-farm payrolls have picked up, the U.S. hourly wages remained relatively flat in recent quarters. This turn of events could actually also play against SLV. If wages were to remain flat, this could suggest little growth in core inflation. If the U.S. inflation doesn’t rise, this could actually also reduce the demand for precious metals investments, including SLV. The upcoming non-farm payroll report will be released on Friday. (click to enlarge) Data taken from Bureau of Labor Statistics The market’s reaction tends to be negative to the news about the change in number of non-farm payroll. Current estimates put the number of added jobs at 241,000 – lower than in previous months but still inline with the average growth in jobs over the past year. Reaching this figure could set SLV for another tumble by the end of the week. Finally, this week the minutes of the last FOMC meeting will be released. This will come after the last meeting of 2014 revealed a change in wording of the statement. The Federal Reserve monetary policy tends to have a strong relation with the progress of the price of SLV. If the Fed were to turn more hawkish as it did in the past couple of years, this is likely to further reduce the demand for silver for investment purposes. Last time, the FOMC made some changes in the policy including omitting the term “considerable time” as a time frame for the next rate hike. But the wording didn’t seem to go down well as there were three dissenters to the decision. The minutes could provide some clarification about where the majority of the FOMC is leaning towards and additional information about their deliberations. In the past meeting, the FOMC members’ median outlook for the Fed’s rate at the end of 2015 was also slightly revised down from 1.375% to 1.125%. This is another indication that even though we could still see a rate hike by the middle of the year, the pace of increase may be slower than previously estimated. A rise in the rate and the progress of the subsequent rate hikes could adversely impact the price of SLV, which tends to be related to the Fed’s cash rate. If the U.S. economy keeps showing signs of improvement, the FOMC will be more likely to raise rates. This scenario isn’t likely to play off well for SLV. For more see: Will Higher Physical Demand for Silver Drive Up SLV? Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The progress of the U.S. economy is keeping down SLV. The minutes of the last FOMC meeting may shed light on the next FOMC move. The upcoming non-farm payroll could also bring down SLV if it reaches or passes market expectations. The recovery of iShares Silver Trust (NYSEARCA: SLV ) any time soon remains questionable as the U.S. economy keeps showing signs of recovery and the FOMC is slowly setting the groundwork for a rate hike, which could be another blow for silver. Let’s take a closer look at the progress of the U.S. economy, examine what’s next for the FOMC and the relation to SLV. Is the U.S. economy doing better? The U.S. economy has improved in the past few quarters, albeit it has yet to return to its pre crisis levels (before the recent economic meltdown); let’s examine the U.S. GDP per capita. Data taken from FRED Between 2012 and 2014 the average annual growth rate (per quarter) was around 1.6% – back in 2000-2006 the average growth rate was 1.8% and in the second half of the ’90s this figure was 2.8%. Conversely, during 2010-2011 the average rise in GDP per capita was only 1.3%. So the growth rate has picked up, but it still has more room to improve. The progress of the U.S. economy is one factor that influences SLV investors whether or not to hold on to their investment. As the U.S. economy recovers, the demand for silver on paper tends to diminish as it did back in 2013-2014. Another important aspect to consider is the progress in the U.S. labor market, including employment and wages. (click to enlarge) Data taken from FRED Even though the number of non-farm payrolls have picked up, the U.S. hourly wages remained relatively flat in recent quarters. This turn of events could actually also play against SLV. If wages were to remain flat, this could suggest little growth in core inflation. If the U.S. inflation doesn’t rise, this could actually also reduce the demand for precious metals investments, including SLV. The upcoming non-farm payroll report will be released on Friday. (click to enlarge) Data taken from Bureau of Labor Statistics The market’s reaction tends to be negative to the news about the change in number of non-farm payroll. Current estimates put the number of added jobs at 241,000 – lower than in previous months but still inline with the average growth in jobs over the past year. Reaching this figure could set SLV for another tumble by the end of the week. Finally, this week the minutes of the last FOMC meeting will be released. This will come after the last meeting of 2014 revealed a change in wording of the statement. The Federal Reserve monetary policy tends to have a strong relation with the progress of the price of SLV. If the Fed were to turn more hawkish as it did in the past couple of years, this is likely to further reduce the demand for silver for investment purposes. Last time, the FOMC made some changes in the policy including omitting the term “considerable time” as a time frame for the next rate hike. But the wording didn’t seem to go down well as there were three dissenters to the decision. The minutes could provide some clarification about where the majority of the FOMC is leaning towards and additional information about their deliberations. In the past meeting, the FOMC members’ median outlook for the Fed’s rate at the end of 2015 was also slightly revised down from 1.375% to 1.125%. This is another indication that even though we could still see a rate hike by the middle of the year, the pace of increase may be slower than previously estimated. A rise in the rate and the progress of the subsequent rate hikes could adversely impact the price of SLV, which tends to be related to the Fed’s cash rate. If the U.S. economy keeps showing signs of improvement, the FOMC will be more likely to raise rates. This scenario isn’t likely to play off well for SLV. For more see: Will Higher Physical Demand for Silver Drive Up SLV? Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News