Scalper1 News

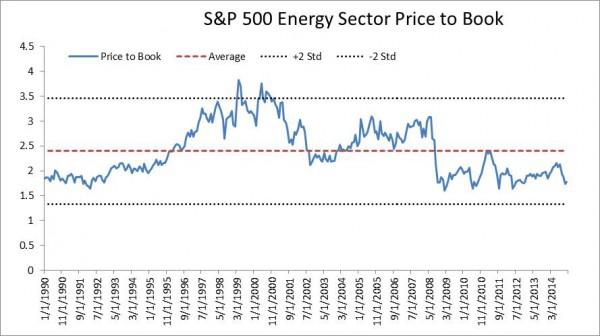

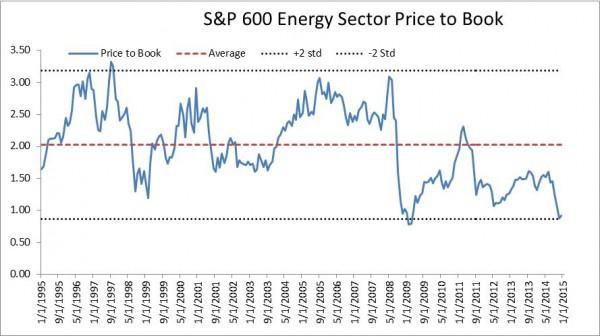

Summary For investors who are looking for inexpensively valued stocks that may be poised to benefit from mean reversion, energy stocks are now on the radar for a rebound in 2015. There are many factors that influence the outlook of energy stocks, but valuation and the price of oil are two places to start. Oil prices had a material decline in 2014. At the same time, energy stocks are showing inexpensive valuation based on their price-to-book-value ratio. By Nick Kalivas The recent plunge in oil prices has created a dramatic re-pricing of stocks in the energy sector. For investors who are looking for inexpensively valued stocks that may be poised to benefit from mean reversion (the theory that stocks move toward their average price over time), energy stocks are now on the radar for a rebound in 2015. Let’s take a look at historically large declines in the oil market and valuations in the energy sector to get some perspective. Examining historical price declines The energy sector is likely to find the most buying interest when the crude oil market is near a bottom, but picking a bottom in any market is never easy and may be a fool’s game. Over the past 10 years, the price of the S&P 500 Energy Sector has a 0.829 correlation to the price of West Texas Intermediate (NYSE: WTI ) crude oil. 1 Since the mid 1980s, there have been five times where the price of WTI has posted a decline of at least 40% from closing month high to closing month low. The table below compares those five historical periods with 2014’s price drop. (At the time of this writing, there were a few days left in December, so I used the Dec. 23 closing price of $56.52 to represent the month-end price.) Major Oil Market Declines Based on Monthly Closing Prices of WTI *Dec 23, 2014 price assumed as month-end close. Source: Bloomberg LP as of Dec. 23, 2014 Past performance is no guarantee of future results. The table indicates that the average and median durations for price declines are 10.3 and 8.0 months. If December 2014 were to mark a current low, the duration of the sell-off would be on the shorter side of history, at just six months. It seems like a bottom may be more likely in January or February 2015. The table highlights that the current decline of 46.4% (using the Dec. 23 close of $56.52) would be on the lower end of the distribution. The average and median declines are 55.2% and 54.1% respectively. The period most like the present (1985/1986, when the market was last awash in excess oil supply) saw a drop of 63.3%. The decline in 2008/2009 seems to be extreme as it was driven by a global economic and financial meltdown. Extrapolating based on historical examples is not without risk, but points 1 and 2 suggest that in 2015, we could see a close in the price of WTI in the $45 to $50 area in January or February, which could represent the bottom of the oil price plunge and lead to a cyclical recovery in energy shares. Examining energy sector valuations One way to examine the value of the energy sector is through the price-to-book-value ratio (P/B), which is affected not only by changes in companies’ stock price, but also by changes in the value of companies’ assets (book value). Monitoring this ratio over time helps to adjust for the impact of industry ups and downs. Oil properties and reserves are subject to impairment charges and changing values based on industry conditions – nonetheless, at some point the potential negatives are reflected in share prices. The P/B per share can shed light on when extremes are priced. Both the S&P 500 and the S&P SmallCap 600 Energy sectors appear to be approaching areas of perceived value based on their P/B ratios. At writing, the P/B of the S&P 500 Energy Sector was 1.78 and on the lower end of the range seen since 1990. The ratio had lifted from a low of 1.605 on Dec. 15, 2014. These P/B ratios compare to an average of 2.39 going back to 1990. 1 (The black dotted lines represent two standard deviations above and below the average price, which would be considered extreme pricing levels.) Source: Bloomberg LP as of Dec. 23, 2014. Past performance is no guarantee of future results. An investment cannot be made directly in an index. Valuation appears even more depressed looking at the S&P SmallCap 600 Energy sector where the price to book value ratio was 0.923. The ratio has lifted from a recent low of 0.78 on Dec. 15, 2014 and compares to an average of 2.02 going back to 1995. 1 Source: Bloomberg LP as of Dec. 23, 2014. Past performance is no guarantee of future results. An investment cannot be made directly in an index. Evaluating energy stocks There are many factors that influence the outlook of energy stocks, but valuation and the price of oil are two places to start. Oil prices had a material decline in 2014, although it is too early to say they have bottomed and history may argue for more weakness into the New Year. At the same time, energy stocks are showing inexpensive valuation based on their P/B ratio, and valuation suggests investors may want to put the energy sector on their shopping list for 2015. Investors seeking exposure to the energy sector may want to consider the PowerShares Dynamic Energy Exploration & Production Portfolio (NYSEARCA: PXE ) or the PowerShares DWA Energy Momentum Portfolio (NYSEARCA: PXI ).* PXE tracks an index that invests in exploration and production companies based on price momentum, earnings momentum, quality, management action, and value. PXI holds stocks that are displaying relative price strength. They are two smart beta solutions for investors looking for non-market-cap-weighted investment in the oil sector. Investors focused exclusively on the small-cap sector may want to consider the PowerShares S&P SmallCap Energy Portfolio (NASDAQ: PSCE ). 1 Source: Bloomberg LP as of Dec. 23, 2014 Important Information *Effective Feb. 19, 2014, changes to the fund’s name, investment objective, investment policy, investment strategies, index and index provider were made. Dorsey Wright & Associates, LLC replaced NYSE Arca, Inc. as the index provider for the fund, and the name of the index changed from Dynamic Energy Sector IntellidexSM Index to DWA Energy Technical Leaders Index. In addition, the name of the fund changed from PowerShares Dynamic Energy Sector Portfolio to PowerShares DWA Energy Momentum Portfolio. Important information The S&P 500 Energy Index is an unmanaged index considered representative of the energy market. The S&P SmallCap 600 Energy Index is a capitalization-weighted index that includes the energy sector companies within the S&P SmallCap 600 Index. Correlation indicates the degree to which two investments have historically moved in the same direction and magnitude. Price-to-book-value ratio (P/B ratio) is the ratio of a stock’s market price to a company’s net asset value. There are risks involved with investing in ETFs, including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Ordinary brokerage commissions apply. The fund’s return may not match the return of the underlying index. Investments focused in a particular industry or sector, such as the energy sector and the oil and gas services industries are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments. The momentum style of investing is subject to the risk that the securities may be more volatile than the market as a whole, or that the returns on securities that have previously exhibited price momentum are less than returns on other styles of investing. Investing in securities of small-capitalization companies may involve greater risk than is customarily associated with investing in large companies. Beta is a measure of risk representing how a security is expected to respond to general market movements. Smart Beta represents an alternative and selection index based methodology that seeks to outperform a benchmark or reduce portfolio risk, or both. Smart beta funds may underperform cap-weighted benchmarks and increase portfolio risk. The information provided is for educational purposes only and does not constitute a recommendation of the suitability of any investment strategy for a particular investor. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE All data provided by Invesco unless otherwise noted. Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s retail products and collective trust funds. Invesco Advisers, Inc. and other affiliated investment advisers mentioned provide investment advisory services and do not sell securities. Invesco Unit Investment Trusts are distributed by the sponsor, Invesco Capital Markets, Inc., and broker-dealers including Invesco Distributors, Inc. PowerShares® is a registered trademark of Invesco PowerShares Capital Management LLC (Invesco PowerShares). Each entity is an indirect, wholly owned subsidiary of Invesco Ltd. ©2014 Invesco Ltd. All rights reserved. blog.invesco.us.com Scalper1 News

Summary For investors who are looking for inexpensively valued stocks that may be poised to benefit from mean reversion, energy stocks are now on the radar for a rebound in 2015. There are many factors that influence the outlook of energy stocks, but valuation and the price of oil are two places to start. Oil prices had a material decline in 2014. At the same time, energy stocks are showing inexpensive valuation based on their price-to-book-value ratio. By Nick Kalivas The recent plunge in oil prices has created a dramatic re-pricing of stocks in the energy sector. For investors who are looking for inexpensively valued stocks that may be poised to benefit from mean reversion (the theory that stocks move toward their average price over time), energy stocks are now on the radar for a rebound in 2015. Let’s take a look at historically large declines in the oil market and valuations in the energy sector to get some perspective. Examining historical price declines The energy sector is likely to find the most buying interest when the crude oil market is near a bottom, but picking a bottom in any market is never easy and may be a fool’s game. Over the past 10 years, the price of the S&P 500 Energy Sector has a 0.829 correlation to the price of West Texas Intermediate (NYSE: WTI ) crude oil. 1 Since the mid 1980s, there have been five times where the price of WTI has posted a decline of at least 40% from closing month high to closing month low. The table below compares those five historical periods with 2014’s price drop. (At the time of this writing, there were a few days left in December, so I used the Dec. 23 closing price of $56.52 to represent the month-end price.) Major Oil Market Declines Based on Monthly Closing Prices of WTI *Dec 23, 2014 price assumed as month-end close. Source: Bloomberg LP as of Dec. 23, 2014 Past performance is no guarantee of future results. The table indicates that the average and median durations for price declines are 10.3 and 8.0 months. If December 2014 were to mark a current low, the duration of the sell-off would be on the shorter side of history, at just six months. It seems like a bottom may be more likely in January or February 2015. The table highlights that the current decline of 46.4% (using the Dec. 23 close of $56.52) would be on the lower end of the distribution. The average and median declines are 55.2% and 54.1% respectively. The period most like the present (1985/1986, when the market was last awash in excess oil supply) saw a drop of 63.3%. The decline in 2008/2009 seems to be extreme as it was driven by a global economic and financial meltdown. Extrapolating based on historical examples is not without risk, but points 1 and 2 suggest that in 2015, we could see a close in the price of WTI in the $45 to $50 area in January or February, which could represent the bottom of the oil price plunge and lead to a cyclical recovery in energy shares. Examining energy sector valuations One way to examine the value of the energy sector is through the price-to-book-value ratio (P/B), which is affected not only by changes in companies’ stock price, but also by changes in the value of companies’ assets (book value). Monitoring this ratio over time helps to adjust for the impact of industry ups and downs. Oil properties and reserves are subject to impairment charges and changing values based on industry conditions – nonetheless, at some point the potential negatives are reflected in share prices. The P/B per share can shed light on when extremes are priced. Both the S&P 500 and the S&P SmallCap 600 Energy sectors appear to be approaching areas of perceived value based on their P/B ratios. At writing, the P/B of the S&P 500 Energy Sector was 1.78 and on the lower end of the range seen since 1990. The ratio had lifted from a low of 1.605 on Dec. 15, 2014. These P/B ratios compare to an average of 2.39 going back to 1990. 1 (The black dotted lines represent two standard deviations above and below the average price, which would be considered extreme pricing levels.) Source: Bloomberg LP as of Dec. 23, 2014. Past performance is no guarantee of future results. An investment cannot be made directly in an index. Valuation appears even more depressed looking at the S&P SmallCap 600 Energy sector where the price to book value ratio was 0.923. The ratio has lifted from a recent low of 0.78 on Dec. 15, 2014 and compares to an average of 2.02 going back to 1995. 1 Source: Bloomberg LP as of Dec. 23, 2014. Past performance is no guarantee of future results. An investment cannot be made directly in an index. Evaluating energy stocks There are many factors that influence the outlook of energy stocks, but valuation and the price of oil are two places to start. Oil prices had a material decline in 2014, although it is too early to say they have bottomed and history may argue for more weakness into the New Year. At the same time, energy stocks are showing inexpensive valuation based on their P/B ratio, and valuation suggests investors may want to put the energy sector on their shopping list for 2015. Investors seeking exposure to the energy sector may want to consider the PowerShares Dynamic Energy Exploration & Production Portfolio (NYSEARCA: PXE ) or the PowerShares DWA Energy Momentum Portfolio (NYSEARCA: PXI ).* PXE tracks an index that invests in exploration and production companies based on price momentum, earnings momentum, quality, management action, and value. PXI holds stocks that are displaying relative price strength. They are two smart beta solutions for investors looking for non-market-cap-weighted investment in the oil sector. Investors focused exclusively on the small-cap sector may want to consider the PowerShares S&P SmallCap Energy Portfolio (NASDAQ: PSCE ). 1 Source: Bloomberg LP as of Dec. 23, 2014 Important Information *Effective Feb. 19, 2014, changes to the fund’s name, investment objective, investment policy, investment strategies, index and index provider were made. Dorsey Wright & Associates, LLC replaced NYSE Arca, Inc. as the index provider for the fund, and the name of the index changed from Dynamic Energy Sector IntellidexSM Index to DWA Energy Technical Leaders Index. In addition, the name of the fund changed from PowerShares Dynamic Energy Sector Portfolio to PowerShares DWA Energy Momentum Portfolio. Important information The S&P 500 Energy Index is an unmanaged index considered representative of the energy market. The S&P SmallCap 600 Energy Index is a capitalization-weighted index that includes the energy sector companies within the S&P SmallCap 600 Index. Correlation indicates the degree to which two investments have historically moved in the same direction and magnitude. Price-to-book-value ratio (P/B ratio) is the ratio of a stock’s market price to a company’s net asset value. There are risks involved with investing in ETFs, including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Ordinary brokerage commissions apply. The fund’s return may not match the return of the underlying index. Investments focused in a particular industry or sector, such as the energy sector and the oil and gas services industries are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments. The momentum style of investing is subject to the risk that the securities may be more volatile than the market as a whole, or that the returns on securities that have previously exhibited price momentum are less than returns on other styles of investing. Investing in securities of small-capitalization companies may involve greater risk than is customarily associated with investing in large companies. Beta is a measure of risk representing how a security is expected to respond to general market movements. Smart Beta represents an alternative and selection index based methodology that seeks to outperform a benchmark or reduce portfolio risk, or both. Smart beta funds may underperform cap-weighted benchmarks and increase portfolio risk. The information provided is for educational purposes only and does not constitute a recommendation of the suitability of any investment strategy for a particular investor. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE All data provided by Invesco unless otherwise noted. Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s retail products and collective trust funds. Invesco Advisers, Inc. and other affiliated investment advisers mentioned provide investment advisory services and do not sell securities. Invesco Unit Investment Trusts are distributed by the sponsor, Invesco Capital Markets, Inc., and broker-dealers including Invesco Distributors, Inc. PowerShares® is a registered trademark of Invesco PowerShares Capital Management LLC (Invesco PowerShares). Each entity is an indirect, wholly owned subsidiary of Invesco Ltd. ©2014 Invesco Ltd. All rights reserved. blog.invesco.us.com Scalper1 News

Scalper1 News