Low Risk And Long-Term Success Portfolio Update 2015

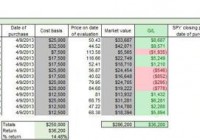

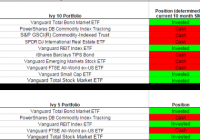

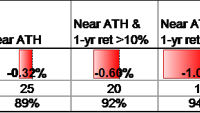

2015 will be a year of minimal returns for broad S&P 500 funds, but will be a good year for international funds and gold. High yielding investments in vehicles such as REITs could see lots of volatility due to interest rate risks. Investors should consider taking some profit off of U.S. equities and diversifying internationally to take advantage of lower valuations and room for P/E expansion. The last few years have been fantastic for exchange-traded funds (ETFs), according to data accessed by ETF.com. In fact, U.S. stock ETFs have surpassed last year’s inflow records, and for the first time ever, U.S. ETFs have surpassed $2 trillion. A popular S&P 500 ETF, the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ), has seen the heaviest inflows at nearly $25 billion in 2014. In contrast, emerging market ETFs (NYSEARCA: EEM ) and gold ETFs (NYSEARCA: GLD ) have seen outflows. This marks a perfect opportunity for a trite quote from Warren Buffet, “Be fearful when others are greedy and greedy when others are fearful.” My theory is that many investors have missed out on the upswing of the market and are now “performance chasing” because they feel left out. I am taking the contrarian position and urging to shift some money out of direct investments in the U.S. equity market, and consider larger allocations to international markets, and even emerging market exposure. The original portfolio I created on April 9, 2013, can be accessed here . My portfolio has underperformed the S&P 500 by a significant extent; however, the portfolio I created also contained 18% allocation to bonds, 17% international exposure, emerging markets, and gold. This diversification has led to lackluster performance as the S&P has surged. Keep in mind this is not a portfolio built for everyone. Based on your tolerance for risk and your investment objectives, the amount of money you allocate to certain asset classes must make sense for your goals. In my asset allocation methodology for this year and beyond, I am making some key assumptions that are worth noting. Firstly, I believe the market is fairly valued to slightly overvalued based on historical price-to-earnings ratios. Due to the low interest rate environment, low inflation rate, and the quantitative easing actions of the Federal Reserve, I believe that inflated price-to-earnings ratios makes sense. With that being said, I feel that rates will increase to some extent in this year and that investors seeking high yield investments should be wary. Instead of riding out the high yield environment, my first action will be to remove the allocation to the Vanguard REIT Index ETF (NYSEARCA: VNQ ), and keep my position in the Vanguard High Dividend Yield ETF (NYSEARCA: VYM ). The reason that I am not recommending a reduction in VYM is because of the amount of high quality value stocks found in this fund. What I am certain many people hear all too often are obscure references to the stock market stating it is too high or too low. What I rarely hear are defined examples of why they believe the market is high or low, or by what measuring stick they are referencing. I tend to favor the simplistic. A quick answer to the “Why?” that many investors ask is an indicator of market valuation by economist and well-known author of Irrational Exuberance – Robert Shiller. The Shiller price-to-earnings ratio is calculated using the annual earnings of the S&P 500 over the past 10 years. The past earnings are adjusted for inflation using CPI, bringing them to today’s dollars. The regular price-to-earnings ratio is just shy of 20, which is right at the historical average. (click to enlarge) Based on this information, I believe the market is fully valued. Most agree with the contention that the price-to-earnings ratio of the S&P isn’t trading at a huge bargain. The actions of the Federal Reserve may push the S&P to further valuations above historical averages. My personal view is that while you cannot time the market, you also should avoid pouring into the market when it appears fully valued as many appear to be doing. In fact, at this point I would be doing the opposite of the crowd. Emerging markets and precious metals offer value, and I believe smart money is moving into these asset classes. Using the proceeds from my sale of VNQ, I would purchase the Schwab International Equity ETF (NYSEARCA: SCHF ). This is an international large blend style ETF, sector weighted in financials at an expense ratio of only .08% that will reward patient investors in the long run. I also like that their top holding is Nestle SA ( OTCPK:NSRGY ). The regional breakout provided by Morningstar is roughly 18% exposure to the United Kingdom, 37% exposure to Europe developed, 20% exposure to Japan, 7% Australia, 8% Asia developed, and 8% to the U.S. Gold and the U.S. dollar are inversely related, as you can see from the chart from Macrotrends . While I do not believe gold will experience incredible growth and I cannot promise grandeur, I do believe gold should be a part of your portfolio. I will trust my judgement to raise my portfolio bet in gold to 4% from 3% in my theoretical portfolio. (click to enlarge) Oil seems to be a hot topic today so I wouldn’t want to ignore it in my portfolio construction. While I cannot predict the future – I tend to bet that things “return to normalcy” over the long haul. Thus, my view is that oil will return to a pricing level around $75-$85. In the passive investing space, I am not making an actionable bet on the price action of oil. However, I do believe an opportunity exists for active investors who are diligent about researching quality businesses that are now discounted due to the fall in oil prices. One example I found was Schlumberger Limited (NYSE: SLB ). In another article , I discuss the benefits of individual selection in the oil and gas space. (click to enlarge) In my original portfolio, I made favorable S&P sector bets in the Utilities (NYSEARCA: XLU ) and Health Care (NYSEARCA: XLV ) sector ETFs. In the sector rotation model, it is clear that these two outperformed in the last year, signaling a potential business cycle decline. I do not live or die by sector rotation investing strategies; however, I do not think they should be ignored completely. I tend to look at the relative valuation of companies by sector and make my own judgments as to whether or not they are fairly valued. Interestingly, the financial sector does seem to be an unloved sector which could provide excess returns. Bill Nygren, a fund manager that I follow from Oakmark, is also overweight financials. With a belief that interest rates will rise, supporting sector rotation modeling, and the support of a successful value investing manager, I can remove the clouds and make a clear decision to shift my sector bet from Utilities to Financials (NYSEARCA: XLF ). I am holding onto Health Care because the long-term outlook remains positive. A close third would be the Technology sector (NYSEARCA: XLK ). In summary, I would sell my position in the high yield REIT ETF and use the sources to purchase SCHF to gain more international exposure. I would sell the Utilities sector ETF and purchase the Financials sector ETF with the proceeds. I would also sell a portion of my position in the Vanguard Short-Term Bond ETF (NYSEARCA: BSV ) and purchase additional amounts of the gold ETF until I reach the 4% of total portfolio allocation mark. Given the facts of today, I can only make what I feel is the best decision possible given a certain risk tolerance and investment objective. I hope you find this article useful as you too adjust your portfolio to the current market conditions. As always, best of luck in the new year!