ETFs For The Unquestioned ‘Wall Of Worry’

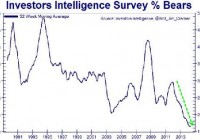

Wall Street stocks often climb in the face of negativity, pessimism and rational fears. With the Fed ending its electronic money printing in the U.S. while hinting at raising overnight lending rates, a continuation of the stock uptrend requires fuel from elsewhere. For now, the bond “wall of worry” and the “stock wall of worry” are not as important as the definitive uptrends for the assets. The crises of yesteryear almost seem quaint. Did investors really need to fret the possibility of the world’s 44th economy (Greece) exiting the euro-zone back in 2011? The stock market ultimately prevailed. Why did the fiscal cliff, sequestration and government shutdown concerns cause so much anxiety in 2012? U.S. stocks eventually powered ahead by roughly 14% that year. Discussion in 2013 of the Federal Reserve tapering its bond purchases in 2014? Please. Equities not only handled the notion of Fed stimulus ending, they knocked doubters on their backsides with two additional years of double-digit percentage gains. Indeed, Wall Street stocks often climb in the face of negativity, pessimism and rational fears. That is what bull markets are made of. On the other hand, when the investing community no longer worries – when the overwhelming majority of participants have no expectation of loss – dreams of risk-free wealth often turn to nightmares. Consider the chart below. The Investors Intelligence Survey’s percentage of self-described bears – those who believe the market will drop – has declined steadily over the last three years. It sits at the lowest level ever. And why not? U.S. stocks have rocketed ahead for three consecutive calendar cycles without so much as a 10% pullback. If every 4%-8% downward movement becomes a “buy-the-dip” opportunity – if people cannot recall the odious feelings associated with a correction of 10%-19% – they’re more likely to chalk up a bearish decline of 30%-plus as an aberration. Trillions in electronic currency creation, zero percent rate policy, corporate stock buybacks, margin debt, carry trade activity, a quest for yield as well as signs of domestic economic improvement have contributed to the amazing six-year performance for U.S. stocks. Of course, none of these things occurred independently. With the Fed ending its electronic money printing in the U.S. while hinting at raising overnight lending rates, a continuation of the stock uptrend requires fuel from elsewhere. Perhaps literally. Unfortunately, and yes, I do mean unfortunately, collapsing oil prices are not a windfall for the U.S. economy. Since 2009, employment in the oil industry has soared by as much as 50%. I have seen reports that energy jobs accounted for 40% of the national job growth since 2000. And these are high-paying careers that we are talking about, as opposed to the low-paying nature of retail, health service professionals and part-time work. The rapid descent in oil prices is a signal of a weakening global economy. Either we see the rest of the globe lose its fight against deflation, eventually dragging the U.S. down with it, or oil prices revert back to a spot price near $75 per barrel and stabilize the world order. I believe the latter is more probable. In fact, if oil fails to find a base that the world and the U.S. energy industry can live with, I believe the Fed will push off its rate normalization plans into the fall or wintertime. (More stimulus, more easy money… that will power stocks in 2015, right?) Indeed, I am long Exxon Mobil (NYSE: XOM ) as a dividend aristocrat that will benefit from greater oil price stability. And while client portfolios stopped out of a profitable position in UBS MLP Alerian Infrastructure (NYSEARCA: MLPI ) back in October, I may revisit the theme of energy infrastructure in the near future. If any sector could benefit from an unquestioned ascent on a “wall of worry,” it could be energy. Or, in contrast, energy could supplant the tech sector circa 2000-2002 and the financial sector circa 2007-2009. A great deal would depend on how Fed policy acts in the face of domestic and global economic deceleration. Will it be the dovish Fed that has maintained zero percent interest rates throughout the six-year bull market? Or will it be a more determined Fed that wants to give itself more breathing room by raising short-term rates, so that it does not need to sign on for QE4? Regardless, investors that have been suckered in by endless promises of rising interest rates need to recognize the unanimous refrain is almost always incorrect. Last year’s Bloomberg poll of the top 55 economists found that all 55 expect the 10-year yield to rise from 3.0%. The average forecast? 3.4%. Only a few folks like myself pointed to the relative value of U.S. treasuries compared with lesser quality sovereign debt abroad as well as the global economic slowdown. As we all know now, the 10-year fell to 2.2% from 3.0%. The economists are at it again. Nearly all of them say the 10-year yield will go higher, with an average forecast of 3.0% by 2015 year-end. I think the 10-year yield will probably be closer to 2%, especially with comparable German bunds below 1% and Japanese government 10-year bonds at 0.31%. Just like last year, I am quite content to keep utilizing longer-duration treasuries in funds like Vanguard Long Term Government Bond (NASDAQ: VGLT ) as well as iShares 10-20 Year Treasury (NYSEARCA: TLH ), as the yield curve continues to compress. Most of my clients have exposure to Vanguard Extend Duration (NYSEARCA: EDV ), though I would look for a bit of a shakedown before considering the longest end of the curve. Bottom line? Check your bond bearishness and stock bullishness at the door. Let the trendlines do the talking for both assets. For now, the bond “wall of worry” and the “stock wall of worry” are not as important as the definitive uptrends for the assets. One should let the uptrends in a stock stalwart like iShares USA Minimum Volatility (NYSEARCA: USMV ) as well as a bond winner like Vanguard Long Term Government ( VGLT ) speak for themselves. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.