Scalper1 News

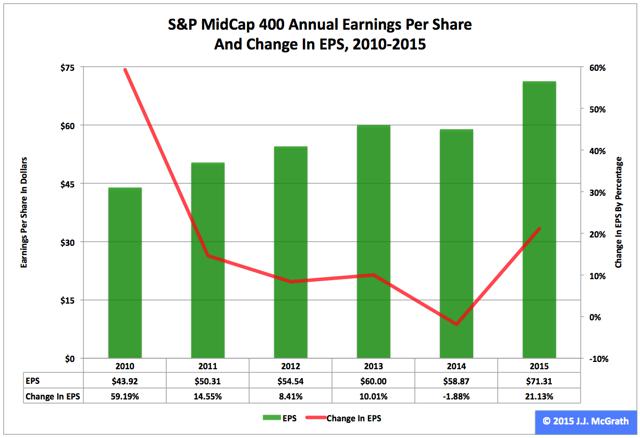

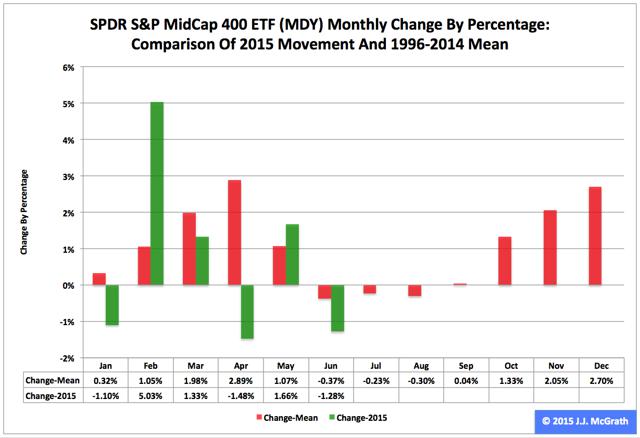

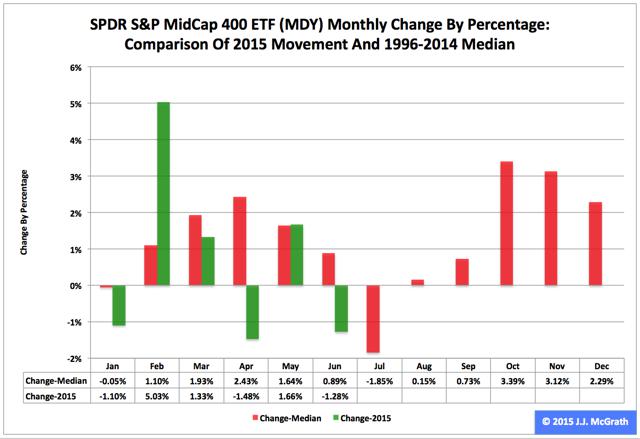

Summary The SPDR S&P MidCap 400 ETF in the first half ranked No. 1 among the three most popular exchange-traded funds based on the S&P Composite 1500’s constituent indexes. In the second quarter, the ETF’s adjusted closing daily share price dipped by -1.12 percent. And in June, the fund’s share price dropped by -1.28 percent. The SPDR S&P MidCap 400 ETF (NYSEARCA: MDY ) during 2015’s first half was first by return among the three most popular ETFs based on the S&P Composite 1500’s constituent indexes: It expanded to $273.24 from $262.52, an increase of $10.72, or 4.08 percent. Over the same period, MDY behaved better than the iShares Core S&P Small-Cap ETF (NYSEARCA: IJR ) by 6 basis points and the SPDR S&P 500 ETF (NYSEARCA: SPY ) by 2.91 percentage points. In contrast, MDY last quarter performed worse than SPY and IJR by -1.34 and -1.29 percentage points, in that order. Most recently, MDY last month lagged IJR by -2.34 percentage points and led SPY by 73 basis points. Comparisons of changes by percentages in SPY, MDY, IJR, the small-capitalization iShares Russell 2000 ETF (NYSEARCA: IWM ) and the large-cap PowerShares QQQ (NASDAQ: QQQ ) during the first half, over Q2 and in June can be found in charts published in “SPY’s 2015 2nd-Quarter Performance And Seasonality.” Figure 1: S&P 400 EPS , 2010-2014 Actual And 2015 Projected (click to enlarge) Notes: (1) Estimates are employed for the 2015 data. (2) The EPS scale is on the left, and the change-in-EPS scale is on the right. Source: This J.J.’s Risky Business chart is based on analyses of data in the S&P 500 Earnings and Estimate Report released June 30. MDY may have behaved OK in the first half, but the ETF might have a hard time performing OK in the second half. As Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, indicated in the S&P 500 Earnings and Estimate Report series this year, the analysts’ average earnings-per-share estimate for the S&P 400 index underlying MDY for 2015 slipped to $71.31 June 30 from $75.06 March 26 (Figure 1). And I believe this EPS estimate continues to be highly unrealistic, as it would require growth of 21.13 percent over last year. As a result, I think there will be more downward revisions in this estimate, which collectively will not constitute an MDY tailwind. Figure 2: MDY Monthly Change, 2015 Vs. 1996-2014 Mean (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance . MDY behaved worse in the first half of this year than it did during the comparable periods in its initial 19 full years of existence based on the monthly means calculated by employing data associated with that historical time frame (Figure 2). The same data set shows the average year’s strongest quarter was the fourth, with an absolutely large positive return, and its weakest quarter was the third, with an absolutely small negative return. Figure 3: MDY Monthly Change, 2015 Vs. 1996-2014 Median (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance. MDY also performed worse in the first half of this year than it did during the comparable periods in its initial 19 full years of existence based on the monthly medians calculated by using data associated with that historical time frame (Figure 3). The same data set shows the average year’s strongest quarter was the fourth, with an absolutely large positive return, and its weakest quarter was the third, with an absolutely small negative return. Disclaimer: The opinions expressed herein by the author do not constitute an investment recommendation, and they are unsuitable for employment in the making of investment decisions. The opinions expressed herein address only certain aspects of potential investment in any securities and cannot substitute for comprehensive investment analysis. The opinions expressed herein are based on an incomplete set of information, illustrative in nature, and limited in scope. In addition, the opinions expressed herein reflect the author’s best judgment as of the date of publication, and they are subject to change without notice. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The SPDR S&P MidCap 400 ETF in the first half ranked No. 1 among the three most popular exchange-traded funds based on the S&P Composite 1500’s constituent indexes. In the second quarter, the ETF’s adjusted closing daily share price dipped by -1.12 percent. And in June, the fund’s share price dropped by -1.28 percent. The SPDR S&P MidCap 400 ETF (NYSEARCA: MDY ) during 2015’s first half was first by return among the three most popular ETFs based on the S&P Composite 1500’s constituent indexes: It expanded to $273.24 from $262.52, an increase of $10.72, or 4.08 percent. Over the same period, MDY behaved better than the iShares Core S&P Small-Cap ETF (NYSEARCA: IJR ) by 6 basis points and the SPDR S&P 500 ETF (NYSEARCA: SPY ) by 2.91 percentage points. In contrast, MDY last quarter performed worse than SPY and IJR by -1.34 and -1.29 percentage points, in that order. Most recently, MDY last month lagged IJR by -2.34 percentage points and led SPY by 73 basis points. Comparisons of changes by percentages in SPY, MDY, IJR, the small-capitalization iShares Russell 2000 ETF (NYSEARCA: IWM ) and the large-cap PowerShares QQQ (NASDAQ: QQQ ) during the first half, over Q2 and in June can be found in charts published in “SPY’s 2015 2nd-Quarter Performance And Seasonality.” Figure 1: S&P 400 EPS , 2010-2014 Actual And 2015 Projected (click to enlarge) Notes: (1) Estimates are employed for the 2015 data. (2) The EPS scale is on the left, and the change-in-EPS scale is on the right. Source: This J.J.’s Risky Business chart is based on analyses of data in the S&P 500 Earnings and Estimate Report released June 30. MDY may have behaved OK in the first half, but the ETF might have a hard time performing OK in the second half. As Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, indicated in the S&P 500 Earnings and Estimate Report series this year, the analysts’ average earnings-per-share estimate for the S&P 400 index underlying MDY for 2015 slipped to $71.31 June 30 from $75.06 March 26 (Figure 1). And I believe this EPS estimate continues to be highly unrealistic, as it would require growth of 21.13 percent over last year. As a result, I think there will be more downward revisions in this estimate, which collectively will not constitute an MDY tailwind. Figure 2: MDY Monthly Change, 2015 Vs. 1996-2014 Mean (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance . MDY behaved worse in the first half of this year than it did during the comparable periods in its initial 19 full years of existence based on the monthly means calculated by employing data associated with that historical time frame (Figure 2). The same data set shows the average year’s strongest quarter was the fourth, with an absolutely large positive return, and its weakest quarter was the third, with an absolutely small negative return. Figure 3: MDY Monthly Change, 2015 Vs. 1996-2014 Median (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance. MDY also performed worse in the first half of this year than it did during the comparable periods in its initial 19 full years of existence based on the monthly medians calculated by using data associated with that historical time frame (Figure 3). The same data set shows the average year’s strongest quarter was the fourth, with an absolutely large positive return, and its weakest quarter was the third, with an absolutely small negative return. Disclaimer: The opinions expressed herein by the author do not constitute an investment recommendation, and they are unsuitable for employment in the making of investment decisions. The opinions expressed herein address only certain aspects of potential investment in any securities and cannot substitute for comprehensive investment analysis. The opinions expressed herein are based on an incomplete set of information, illustrative in nature, and limited in scope. In addition, the opinions expressed herein reflect the author’s best judgment as of the date of publication, and they are subject to change without notice. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News