Scalper1 News

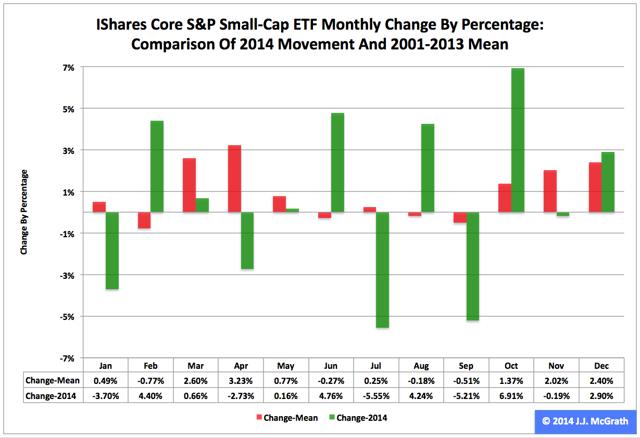

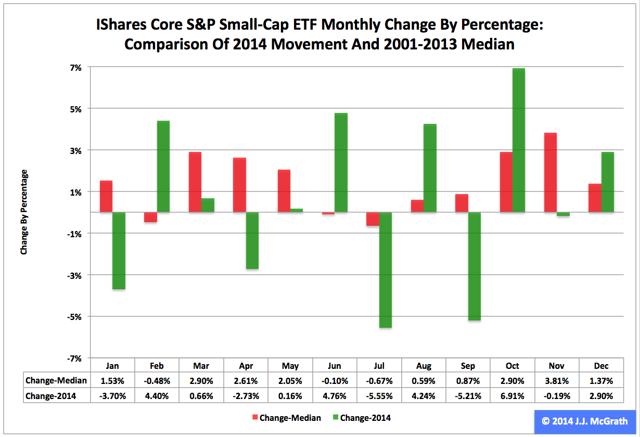

Summary The iShares Core S&P Small-Cap ETF ranked No. 3 in 2014 among the three most popular exchange-traded funds based on the S&P 1500’s constituent indexes. Most recently, the ETF’s adjusted closing daily share price last month ballooned to $114.06 from $110.85, a swelling of $3.21, or 2.90 percent. Seasonality analysis indicates the fund may move to relative weakness in the first quarter from absolute strength in the fourth quarter. The iShares Core S&P Small-Cap ETF (NYSEARCA: IJR ) ranked third by return during 2014 among the three most popular ETFs based on the S&P 1500’s constituent indexes, as it was handily outdistanced by both the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) and the SPDR S&P MidCap 400 ETF (NYSEARCA: MDY ). Measured by adjusted closing daily share prices, IJR progressed to $114.06 from $107.76, a yield of $6.30, or 5.85 percent. As a result, the small-capitalization ETF lagged the large-cap SPY by -7.62 percentage points and the middle-cap MDY by -3.55 percentage points. However, role reversal in the fourth quarter had IJR leading SPY by 4.90 percentage points and MDY by 3.49 percentage points, as the small-cap ETF soared $10.18, or 9.80 percent. Accounting for its three-to-one share split in 2005, IJR intraday Dec. 31 hit an all-time high of $115.74, a level I consider important because of its proximity to the estimate presented in my “SPY, MDY And IJR At The Fed’s QE3+ Market Top” last March. With the U.S. Federal Reserve actually announcing the end of its latest quantitative-easing program, aka QE3+, Oct. 29 and potentially announcing the beginning of its interest-rate hikes April 29, market participants may be more likely to sell than to buy IJR this quarter. It is worth noting in this context that the Fed’s conclusion of asset purchases under its first two formal QE programs this century is associated with bear markets in small-cap equities , as evidenced by the iShares Russell 2000 ETF (NYSEARCA: IWM ) sliding -21.43 percent in 2010 and -30.78 percent in 2011. Figure 1: IJR Monthly Change, 2014 Vs. 2001-2013 Mean (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance . IJR behaved a lot worse in 2014 than it did during its initial 13 full years of existence based on the monthly means calculated by employing data associated with that historical time frame (Figure 1). The same data set shows the average year’s weakest quarter was the third, with a relatively small negative return, and its strongest quarter was the fourth, with an absolutely large positive return. Generally consistent with this pattern, the ETF last year booked a huge loss in Q3 and a huge gain in Q4. Figure 2: IJR Monthly Change, 2014 Vs. 2001-2013 Median (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance. IJR performed even more worse in 2014 than it did during its initial 13 full years of existence based on the monthly medians calculated by using data associated with that historical time frame (Figure 2). The same data set shows the average year’s weakest quarter was the third, with a relatively small positive return, and its strongest quarter was the fourth, with an absolutely large positive return. It also shows there is no historical statistical tendency for the ETF to explode in Q1. Meanwhile, the small-cap category of the equity market continues to look grossly overvalued, with the Russell 2000’s price-to-earnings ratio on a trailing 12-month basis calculated as 61.83 Jan. 2, according to Birinyi Associates data published by The Wall Street Journal . Disclaimer: The opinions expressed herein by the author do not constitute an investment recommendation, and they are unsuitable for employment in the making of investment decisions. The opinions expressed herein address only certain aspects of potential investment in any securities and cannot substitute for comprehensive investment analysis. The opinions expressed herein are based on an incomplete set of information, illustrative in nature, and limited in scope. In addition, the opinions expressed herein reflect the author’s best judgment as of the date of publication, and they are subject to change without notice. Scalper1 News

Summary The iShares Core S&P Small-Cap ETF ranked No. 3 in 2014 among the three most popular exchange-traded funds based on the S&P 1500’s constituent indexes. Most recently, the ETF’s adjusted closing daily share price last month ballooned to $114.06 from $110.85, a swelling of $3.21, or 2.90 percent. Seasonality analysis indicates the fund may move to relative weakness in the first quarter from absolute strength in the fourth quarter. The iShares Core S&P Small-Cap ETF (NYSEARCA: IJR ) ranked third by return during 2014 among the three most popular ETFs based on the S&P 1500’s constituent indexes, as it was handily outdistanced by both the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) and the SPDR S&P MidCap 400 ETF (NYSEARCA: MDY ). Measured by adjusted closing daily share prices, IJR progressed to $114.06 from $107.76, a yield of $6.30, or 5.85 percent. As a result, the small-capitalization ETF lagged the large-cap SPY by -7.62 percentage points and the middle-cap MDY by -3.55 percentage points. However, role reversal in the fourth quarter had IJR leading SPY by 4.90 percentage points and MDY by 3.49 percentage points, as the small-cap ETF soared $10.18, or 9.80 percent. Accounting for its three-to-one share split in 2005, IJR intraday Dec. 31 hit an all-time high of $115.74, a level I consider important because of its proximity to the estimate presented in my “SPY, MDY And IJR At The Fed’s QE3+ Market Top” last March. With the U.S. Federal Reserve actually announcing the end of its latest quantitative-easing program, aka QE3+, Oct. 29 and potentially announcing the beginning of its interest-rate hikes April 29, market participants may be more likely to sell than to buy IJR this quarter. It is worth noting in this context that the Fed’s conclusion of asset purchases under its first two formal QE programs this century is associated with bear markets in small-cap equities , as evidenced by the iShares Russell 2000 ETF (NYSEARCA: IWM ) sliding -21.43 percent in 2010 and -30.78 percent in 2011. Figure 1: IJR Monthly Change, 2014 Vs. 2001-2013 Mean (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance . IJR behaved a lot worse in 2014 than it did during its initial 13 full years of existence based on the monthly means calculated by employing data associated with that historical time frame (Figure 1). The same data set shows the average year’s weakest quarter was the third, with a relatively small negative return, and its strongest quarter was the fourth, with an absolutely large positive return. Generally consistent with this pattern, the ETF last year booked a huge loss in Q3 and a huge gain in Q4. Figure 2: IJR Monthly Change, 2014 Vs. 2001-2013 Median (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance. IJR performed even more worse in 2014 than it did during its initial 13 full years of existence based on the monthly medians calculated by using data associated with that historical time frame (Figure 2). The same data set shows the average year’s weakest quarter was the third, with a relatively small positive return, and its strongest quarter was the fourth, with an absolutely large positive return. It also shows there is no historical statistical tendency for the ETF to explode in Q1. Meanwhile, the small-cap category of the equity market continues to look grossly overvalued, with the Russell 2000’s price-to-earnings ratio on a trailing 12-month basis calculated as 61.83 Jan. 2, according to Birinyi Associates data published by The Wall Street Journal . Disclaimer: The opinions expressed herein by the author do not constitute an investment recommendation, and they are unsuitable for employment in the making of investment decisions. The opinions expressed herein address only certain aspects of potential investment in any securities and cannot substitute for comprehensive investment analysis. The opinions expressed herein are based on an incomplete set of information, illustrative in nature, and limited in scope. In addition, the opinions expressed herein reflect the author’s best judgment as of the date of publication, and they are subject to change without notice. Scalper1 News

Scalper1 News