Scalper1 News

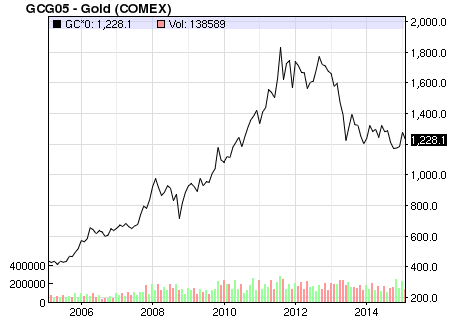

Summary Price correlations have changed. Bonds no longer trade inversely to stocks. Bonds are no longer the safe haven. Gold is the new market safe haven. Traditionally speaking, bonds and stocks have traded inversely to each other . This is evident if one looks at these charts below. In 2008, the TLT (a bond ETF) went up in value, whereas the Dow crashed. In 2009, the TLT declined in value, whereas the Dow began its new bull market. But in 2011, that traditional correlation changed. In 2011, the bond market started to rise in correlation with the stock market. The bond market didn’t rise in an esclator like fashion such as the stock market, but it did rise in correlation with the stock market. This new correlation can be attributed to foreigners buying US assets , combined with the fact that the Federal Reserve was buying US treasuries, thus suppressing interest rates. Foreigners weren’t just buying US stocks, they have also bought US real estate as well . This form of flight capital and QE, has now made all US assets rise contemporaneously. In 2011, this wasn’t the only correlation that changed, as the two charts below show. As you can see from 2005-07, the price of gold rose in correlation with the stock market. Then in 2008, during the financial crisis, the price of gold declined with the stock market. From 2009-2011, Gold and the Dow, both rose in value. In 2011, however, that correlation changed. Gold started to decline in value, while the stock market keep rising. In my opinion, the one correlation that hasn’t changed, is the one between gold and bonds. Looking at the two charts below, I think they have always traded inversely of each other. From 2005 to 2007, gold rose in value, while the bond market remained relatively flat. During the ’08 crisis, bonds rose almost vertically, while the price of gold declined briefly. After the 08 crisis, the price of gold rose drastically, while the bond market declined. Lastly, in 2011, the bond market started to rise in value, while gold started its decline. Conclusion As stated above, one can see the price correlations have changed, this is likely due to global quantitative easing . If there is another crash, or foreigners loose confidence in the US markets, stocks and bonds will have a high a probability of declining in value at the same time, and unlike previous market panics, gold will be the new safe haven, and not bonds. I am not saying there will be a market crash soon, but if there is, it won’t be bonds that will perform well (like they did in 2008), it will be gold. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Price correlations have changed. Bonds no longer trade inversely to stocks. Bonds are no longer the safe haven. Gold is the new market safe haven. Traditionally speaking, bonds and stocks have traded inversely to each other . This is evident if one looks at these charts below. In 2008, the TLT (a bond ETF) went up in value, whereas the Dow crashed. In 2009, the TLT declined in value, whereas the Dow began its new bull market. But in 2011, that traditional correlation changed. In 2011, the bond market started to rise in correlation with the stock market. The bond market didn’t rise in an esclator like fashion such as the stock market, but it did rise in correlation with the stock market. This new correlation can be attributed to foreigners buying US assets , combined with the fact that the Federal Reserve was buying US treasuries, thus suppressing interest rates. Foreigners weren’t just buying US stocks, they have also bought US real estate as well . This form of flight capital and QE, has now made all US assets rise contemporaneously. In 2011, this wasn’t the only correlation that changed, as the two charts below show. As you can see from 2005-07, the price of gold rose in correlation with the stock market. Then in 2008, during the financial crisis, the price of gold declined with the stock market. From 2009-2011, Gold and the Dow, both rose in value. In 2011, however, that correlation changed. Gold started to decline in value, while the stock market keep rising. In my opinion, the one correlation that hasn’t changed, is the one between gold and bonds. Looking at the two charts below, I think they have always traded inversely of each other. From 2005 to 2007, gold rose in value, while the bond market remained relatively flat. During the ’08 crisis, bonds rose almost vertically, while the price of gold declined briefly. After the 08 crisis, the price of gold rose drastically, while the bond market declined. Lastly, in 2011, the bond market started to rise in value, while gold started its decline. Conclusion As stated above, one can see the price correlations have changed, this is likely due to global quantitative easing . If there is another crash, or foreigners loose confidence in the US markets, stocks and bonds will have a high a probability of declining in value at the same time, and unlike previous market panics, gold will be the new safe haven, and not bonds. I am not saying there will be a market crash soon, but if there is, it won’t be bonds that will perform well (like they did in 2008), it will be gold. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News