Scalper1 News

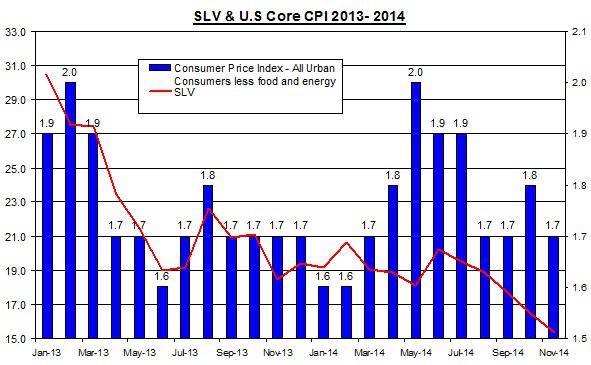

The price of SLV rallied by 5% during the year, up to date. Falling U.S. inflation may pull up SLV via the drop in U.S. treasury yields. The recent Non-farm payroll was inline with market expectations, but it didn’t drag down SLV. After losing nearly 8% during the last quarter of 2014, the iShares Silver Trust ETF (NYSEARCA: SLV ) showed some signs of recovery as its price added over 5% during this month. Even the strong results from the last non-farm payroll report didn’t curb down the price of SLV from picking up. Let’s review the relation among the developments in the U.S. labor market, inflation and the progress of SLV. The non-farm payroll report was published on Friday. It showed a 252 thousand of jobs added during December. Moreover, the previous two months were revised up by 50 thousand jobs. The rate of unemployment slipped to 5.6%. The table below shows the changes in SLV and the non-farm payroll results in 2014. Source of data taken from Bureau of Labor Statistics As you can see, the correlation between the changes in the gap between market projections and actual figures and the price of SLV is mid-strong and negative at -0.45 – this result suggests that as long as the number of jobs added doesn’t exceed market expectations, the price of SLV is likely to rally. Despite the recent rise of SLV last week, the ongoing recovery of the U.S. labor market doesn’t play in favor of SLV. This recovery, however, still has a long way to go until the U.S. labor market shows a full recovery – mainly in wages. Based on the recent report, hourly wages grew by only 1.7% on an annual pace. This is still a low level and remains well below the levels recorded before the 2008 economic meltdown. The other major report related to the U.S. labor market is the upcoming JOLTS report, which will be published this week. (click to enlarge) Source of data taken from Bureau of Labor Statistics Albeit the price of SLV doesn’t have as strong relation to the JOLTS figures as it does with the non-farm payroll. This is still an important report that could indicate the progress of the U.S. economy. The current estimates are for the report to show a 4.91 million jobs opening. The upcoming U.S. CPI and PPI, which will be released this week, could provide another measurement about the changes of the U.S. inflation. If the U.S. core inflation continues to slowly come down, this doesn’t vote well for rise in U.S. wages. The fall in U.S. inflation, however, could actually play in favor of SLV. At the very least, it may play this year in two roles when it comes to SLV. Usually, lower inflation tends to steer away investors, who fear of a potential spike in inflation, from precious metals investments such as SLV. The chart below presents the relation between core CPI and SLV during 2013-2014. Source of data taken from Bureau of Labor Statistics and Google finance Most of the drop in U.S. inflation was stemmed, as you well know, from falling oil prices. During the past few months, the correlation between SLV and oil prices was mid-strong and positive at 0.4. Albeit the price of SLV remained relatively flat, oil prices tumbled down by more than 40% in the past three months. So why falling oil prices could actually be good for SLV? As U.S. inflation falls, this is likely to reduce the odds of the FOMC raising rates. For now, the market still expects the FOMC to raise rates by the middle of the year. Alas, if U.S. inflation does tumble down, it could eventually influence FOMC members to reevaluate their policy. Finally, falling U.S. inflation is also likely to keep down U.S. long term treasuries yields, which tend to have a negative relation with the price of SLV. Therefore, falling long term treasuries yields driven, in part, by lower inflation provide the environment needed to keep pulling up SLV. For more see: Choosing Between Gold and Silver Scalper1 News

The price of SLV rallied by 5% during the year, up to date. Falling U.S. inflation may pull up SLV via the drop in U.S. treasury yields. The recent Non-farm payroll was inline with market expectations, but it didn’t drag down SLV. After losing nearly 8% during the last quarter of 2014, the iShares Silver Trust ETF (NYSEARCA: SLV ) showed some signs of recovery as its price added over 5% during this month. Even the strong results from the last non-farm payroll report didn’t curb down the price of SLV from picking up. Let’s review the relation among the developments in the U.S. labor market, inflation and the progress of SLV. The non-farm payroll report was published on Friday. It showed a 252 thousand of jobs added during December. Moreover, the previous two months were revised up by 50 thousand jobs. The rate of unemployment slipped to 5.6%. The table below shows the changes in SLV and the non-farm payroll results in 2014. Source of data taken from Bureau of Labor Statistics As you can see, the correlation between the changes in the gap between market projections and actual figures and the price of SLV is mid-strong and negative at -0.45 – this result suggests that as long as the number of jobs added doesn’t exceed market expectations, the price of SLV is likely to rally. Despite the recent rise of SLV last week, the ongoing recovery of the U.S. labor market doesn’t play in favor of SLV. This recovery, however, still has a long way to go until the U.S. labor market shows a full recovery – mainly in wages. Based on the recent report, hourly wages grew by only 1.7% on an annual pace. This is still a low level and remains well below the levels recorded before the 2008 economic meltdown. The other major report related to the U.S. labor market is the upcoming JOLTS report, which will be published this week. (click to enlarge) Source of data taken from Bureau of Labor Statistics Albeit the price of SLV doesn’t have as strong relation to the JOLTS figures as it does with the non-farm payroll. This is still an important report that could indicate the progress of the U.S. economy. The current estimates are for the report to show a 4.91 million jobs opening. The upcoming U.S. CPI and PPI, which will be released this week, could provide another measurement about the changes of the U.S. inflation. If the U.S. core inflation continues to slowly come down, this doesn’t vote well for rise in U.S. wages. The fall in U.S. inflation, however, could actually play in favor of SLV. At the very least, it may play this year in two roles when it comes to SLV. Usually, lower inflation tends to steer away investors, who fear of a potential spike in inflation, from precious metals investments such as SLV. The chart below presents the relation between core CPI and SLV during 2013-2014. Source of data taken from Bureau of Labor Statistics and Google finance Most of the drop in U.S. inflation was stemmed, as you well know, from falling oil prices. During the past few months, the correlation between SLV and oil prices was mid-strong and positive at 0.4. Albeit the price of SLV remained relatively flat, oil prices tumbled down by more than 40% in the past three months. So why falling oil prices could actually be good for SLV? As U.S. inflation falls, this is likely to reduce the odds of the FOMC raising rates. For now, the market still expects the FOMC to raise rates by the middle of the year. Alas, if U.S. inflation does tumble down, it could eventually influence FOMC members to reevaluate their policy. Finally, falling U.S. inflation is also likely to keep down U.S. long term treasuries yields, which tend to have a negative relation with the price of SLV. Therefore, falling long term treasuries yields driven, in part, by lower inflation provide the environment needed to keep pulling up SLV. For more see: Choosing Between Gold and Silver Scalper1 News

Scalper1 News