Scalper1 News

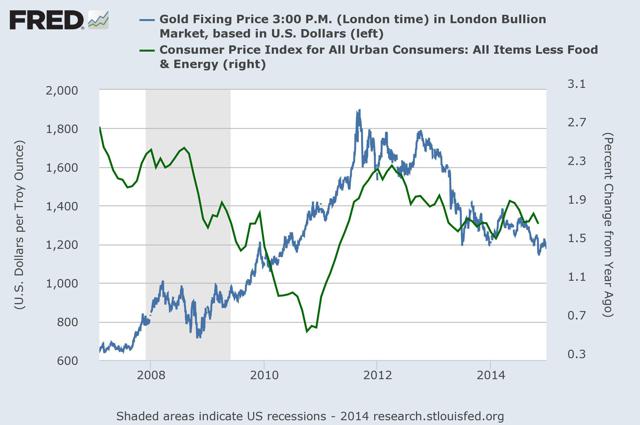

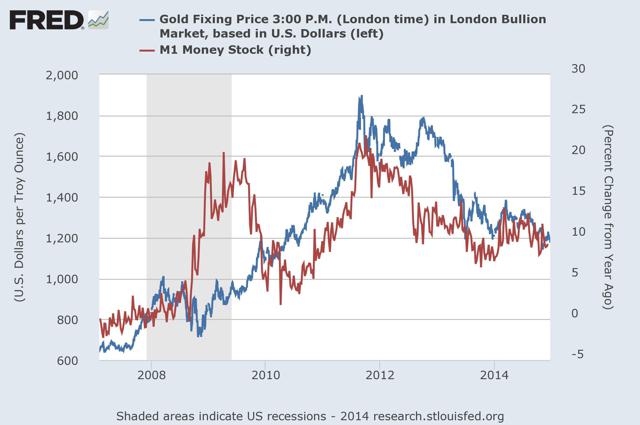

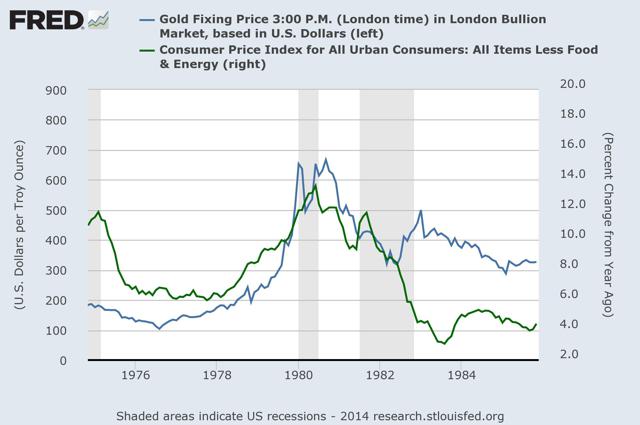

Summary The recent higher-than-expected GDP report may also suggest the rise in U.S. economy will steer investors away from gold and into other assets. The recent PCE report showed a core inflation of only 1.4%. The ongoing lower inflation is likely to keep dragging down the price of GLD. The gold market continued to show a high level of volatility in the past several weeks. Nonetheless, the SPDR Gold Trust (NYSEARCA: GLD ) is nearly flat for December and only 1.2% during 2014. But the ongoing low inflation and signs of recovery in the U.S. economy are likely to further drive down GLD over the coming months. This week didn’t offer a whole lot of news items but there were two reports that came out from the Bureau of Economic Analysis: the final update on the U.S. GDP for the third quarter and the PCE monthly update. On the one hand, the GDP growth rate was revised up again to 5%. The revision was from 3.9% back in the second estimate. Even after subtracting the change in private inventories, the growth rate remains at 5% – so the growth mostly came from private and public sectors. Part of this revision came from higher real nonresidential fixed investments that grew by 8.9%. The recovery of the U.S. economy is a step in the direction towards the FOMC raising rates next year, which is likely to bring down the price of GLD further. Another issue to consider is the progress in the U.S. inflation: The recent PCE report showed that the core PCE annual rate slipped to 1.4%. The relation between GLD and inflation concerns is a close one and may have played a major role in the progress of GLD. (click to enlarge) Source of chart is from FRED’s web site Albeit the U.S. inflation remained low in the recent year, the progress in other measures, most notably the U.S. money base, drove bullion bugs towards GLD. Even M1 showed a sharp rise. If we were to examine the change in M1 and the progress of the gold during the past few years, we can see that following the economic recession, as the growth rate in M1 picked up, so did gold rally. (click to enlarge) Source of chart is from FRED’s web site But after the end of QE2 and then QE3, the growth in M1 has tapered down, which also coincided with the drop in GLD. This doesn’t mean we are in a situation where inflation actually substantially increased. Only that the steps the FOMC implemented, including low rates and QE programs, led to higher concerns over a potential rise in inflation – all the rise in M1 and U.S. money base had some people think prices are about to pick up anytime soon (some still think so) and may reach double digits. The last time U.S. inflation reached double digits was back in the early 80’s – back then gold prices reached their highest level, for that time. This high inflation led the Fed to raise rates, which soon brought down inflation expectations – and then gold soon followed. This time around, however, the circumstances are a bit different. Some were concerned about higher inflation that led to higher GLD prices. Nevertheless, the U.S. inflation remained low. (click to enlarge) Source of chart is from FRED’s web site But the current depressed prices, which are likely to come further down considering oil is at its current low level and the FOMC’s decision to end QE3 and perhaps even raise rates by mid-2015 have only reduced the fear factor of the U.S. inflation rearing its head. Some still think that the FOMC’s cash injections to the U.S. economy may eventually result in a spike in inflation down the line – like a time-release bomb. But this scenario seems, for now, less likely. As times passes, the price of GLD is likely to further suffer from U.S. inflation remaining well below 2%. The potential rise in the Federal Reserve’s cash rate is also likely to raise the yields of U.S. treasuries, which could diminish the appeal of GLD as an investment. I have referred to this point in the past . It’s a competing theory but it too plays the same role the inflation based theory plays. So where does it leave GLD? The recovery of U.S. economy and a little growth in inflation don’t vote well for GLD. The FOMC’s policy is still likely to play the main role in the progress of GLD. This year, the tapering of QE3 didn’t have a strong adverse impact on GLD as it slipped by only 1.2% (year to date). Most of the impact was already priced in when Bernanke announced this decision back in June 2013. The main change will be the rate hike and subsequent raises. For now, the FOMC keeps dropping hints of a rate raise soon but keeps us guessing because, well, perhaps some FOMC members aren’t so sure about making this rate hike next year. Until we get a clear guidance, the price of GLD isn’t likely to do much and only slowly come down. For more see: What are the advantages of GLD? Scalper1 News

Summary The recent higher-than-expected GDP report may also suggest the rise in U.S. economy will steer investors away from gold and into other assets. The recent PCE report showed a core inflation of only 1.4%. The ongoing lower inflation is likely to keep dragging down the price of GLD. The gold market continued to show a high level of volatility in the past several weeks. Nonetheless, the SPDR Gold Trust (NYSEARCA: GLD ) is nearly flat for December and only 1.2% during 2014. But the ongoing low inflation and signs of recovery in the U.S. economy are likely to further drive down GLD over the coming months. This week didn’t offer a whole lot of news items but there were two reports that came out from the Bureau of Economic Analysis: the final update on the U.S. GDP for the third quarter and the PCE monthly update. On the one hand, the GDP growth rate was revised up again to 5%. The revision was from 3.9% back in the second estimate. Even after subtracting the change in private inventories, the growth rate remains at 5% – so the growth mostly came from private and public sectors. Part of this revision came from higher real nonresidential fixed investments that grew by 8.9%. The recovery of the U.S. economy is a step in the direction towards the FOMC raising rates next year, which is likely to bring down the price of GLD further. Another issue to consider is the progress in the U.S. inflation: The recent PCE report showed that the core PCE annual rate slipped to 1.4%. The relation between GLD and inflation concerns is a close one and may have played a major role in the progress of GLD. (click to enlarge) Source of chart is from FRED’s web site Albeit the U.S. inflation remained low in the recent year, the progress in other measures, most notably the U.S. money base, drove bullion bugs towards GLD. Even M1 showed a sharp rise. If we were to examine the change in M1 and the progress of the gold during the past few years, we can see that following the economic recession, as the growth rate in M1 picked up, so did gold rally. (click to enlarge) Source of chart is from FRED’s web site But after the end of QE2 and then QE3, the growth in M1 has tapered down, which also coincided with the drop in GLD. This doesn’t mean we are in a situation where inflation actually substantially increased. Only that the steps the FOMC implemented, including low rates and QE programs, led to higher concerns over a potential rise in inflation – all the rise in M1 and U.S. money base had some people think prices are about to pick up anytime soon (some still think so) and may reach double digits. The last time U.S. inflation reached double digits was back in the early 80’s – back then gold prices reached their highest level, for that time. This high inflation led the Fed to raise rates, which soon brought down inflation expectations – and then gold soon followed. This time around, however, the circumstances are a bit different. Some were concerned about higher inflation that led to higher GLD prices. Nevertheless, the U.S. inflation remained low. (click to enlarge) Source of chart is from FRED’s web site But the current depressed prices, which are likely to come further down considering oil is at its current low level and the FOMC’s decision to end QE3 and perhaps even raise rates by mid-2015 have only reduced the fear factor of the U.S. inflation rearing its head. Some still think that the FOMC’s cash injections to the U.S. economy may eventually result in a spike in inflation down the line – like a time-release bomb. But this scenario seems, for now, less likely. As times passes, the price of GLD is likely to further suffer from U.S. inflation remaining well below 2%. The potential rise in the Federal Reserve’s cash rate is also likely to raise the yields of U.S. treasuries, which could diminish the appeal of GLD as an investment. I have referred to this point in the past . It’s a competing theory but it too plays the same role the inflation based theory plays. So where does it leave GLD? The recovery of U.S. economy and a little growth in inflation don’t vote well for GLD. The FOMC’s policy is still likely to play the main role in the progress of GLD. This year, the tapering of QE3 didn’t have a strong adverse impact on GLD as it slipped by only 1.2% (year to date). Most of the impact was already priced in when Bernanke announced this decision back in June 2013. The main change will be the rate hike and subsequent raises. For now, the FOMC keeps dropping hints of a rate raise soon but keeps us guessing because, well, perhaps some FOMC members aren’t so sure about making this rate hike next year. Until we get a clear guidance, the price of GLD isn’t likely to do much and only slowly come down. For more see: What are the advantages of GLD? Scalper1 News

Scalper1 News