Scalper1 News

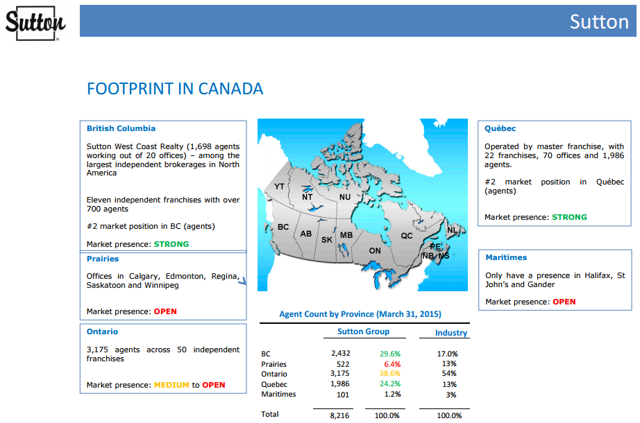

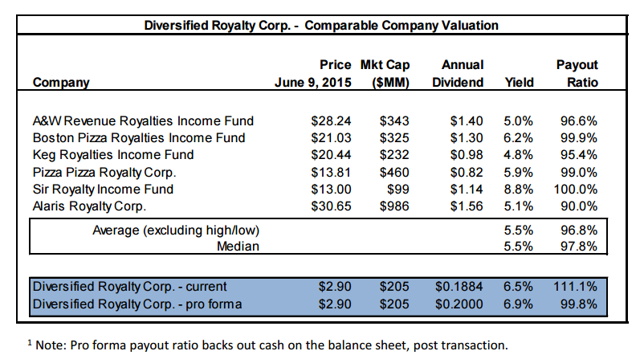

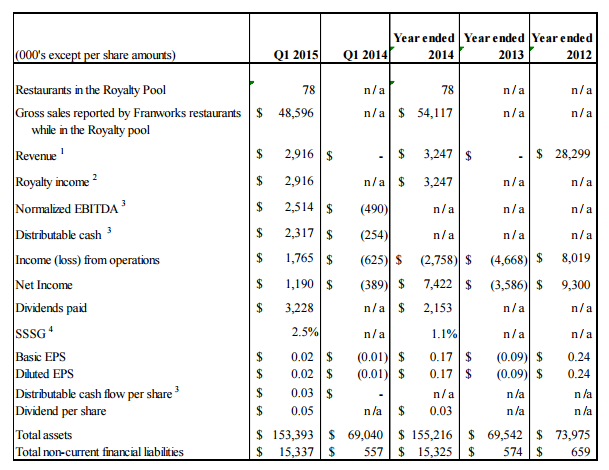

Summary Diversified Royalty transitioned from a capital pool to a royalty stream vehicle in June 2014. BEVFF took steps to prepare its capital structure to add additional royalty streams in the most cost-effective manner. Following a delay after the initial fundraising, BEVFF added a second lucrative royalty stream in early June 2015, truly diversifying itself. Diversified Royalty ( OTC:BEVFF ) (or DIV on the TSX Exchange) came into being on June 30, 2014 when a former capital pool, Benev Capital Inc., put together a transaction to acquire $12m in annual topline revenue for the purchase price of $103m ( $82m USD ) in the form of a royalty stream of income from Calgary-based Franworks Franchise Corp., the owner of the Original Joe’s, State and Main, and Elephant and Castle restaurant chains. Streaming transactions have been common in the basic materials sector for some time, utilizing with great success by Franco Nevada (NYSE: FNV ) and Silver Wheaton (NYSE: SLW ), to name a few. They serve to provide funding for business initiatives without utilizing formal debt instruments. In fact, they partially tie the vendor to the sustainability of the enterprise going forward. Due to their success in the materials sector, these transactions have gained some traction in other sectors as well, as diverse as restaurants and farming. The Franworks transaction was structured as follows: $64m ( $51m USD ) cash on hand Franworks was issued approximately 9m shares worth $14.9m ($12m USD) Maxam Opportunities LP, a venture fund, subscribed for 5.2m shares or $8.7m ($7m USD) in a private placement $15m ($12m USD) coming from borrowings Franworks’ position in DIV amounted to 16.9% of the company at the time of the deal (now 15.4% after some other transactions) so they are very vested in the success of DIV as well. Franworks has the funds from the royalty sale to accelerate growth of its brands by adding new locations, as well as by renewing older locations. Both these help to drive revenue and should provide growing royalties to DIV down the road. Franworks’ restaurants are in the “upscale, casual” dining space. This is where you pay close to upscale dining prices, but without the dress code required. Go in to any of these restaurants and you will see people dressed up for a nice night out sitting next people just off the beach in tank tops and flipflops. The margins are much better than most mass eateries while still having a broad appeal. Maxam Capital Management, the manager of the Maxam Opportunities Fund, uses an “active, opportunistic and flexible” approach to capital management. DIV’s CEO, Sean Morrisson, is also a Managing Partner at Maxam and has a very strong background in capital management, advising the Keg Restaurants, a restaurant royalty income fund in Canada (KEG.UN), among other activities in his venture capital career. Maxam is a good partner for DIV to have in expanding its business, both to generate leads as well as to help evaluate transactions initially and on an ongoing basis. The restaurant-based royalty stream transactions are quite common in Canada with several others utilizing the income fund structure, such as the A&W Revenue Royalties Income Fund (AW-UN.TO), the Boston Pizza Royalties Income Fund (BPF-UN.TO) and the Keg Royalties Income Fund (KEG-UN.TO). DIV is not setup as an income fund, which makes it more flexible to acquire new streams of income down the road, as there are some limitations with the tax structure for income funds. As well, they can simulate the tax-free structure by utilizing its $35m CAD ($28m USD) in tax losses. Like these other royalty funds, the Franworks royalty is a gross revenue royalty, earning 6% of the top-line revenue from the restaurants included in the pool. These can change over time as locations are added or subtracted. Some royalty streams are based on net revenues, where some deductions are taken prior to payment, but DIV will receive its royalty regardless of how profitably the locations are operated. That said, it is clearly to their advantage to have successful restaurants available in the future. DIV’s future is clear: The royalty acquisition from Franworks is a platform transaction for BCI and the first step in our recently announced strategy to purchase top-line royalty streams from a number of growing multi-location businesses and franchisors. Franworks is a fast growing chain with strong unit-level economics and a superb management team – key success factors for a top-line royalty acquisition. With the successful completion of this transformational transaction, BCI intends to focus its efforts on acquiring additional royalties from growing multi-location businesses and franchisors. In October 2014, DIV received final approval for the transaction and completed its name changed to Diversified Royalty Corp. This followed quickly with a promotion of the company on to the TSX big board , providing it a better avenue to raise equity funds than they would have had with a Venture Exchange listing. They quickly utilized this, closing a $34.5m bought deal financing in November 2014 ($27.6m USD). Now all they needed was another royalty stream. So shareholders waited. And waited. And waited. Message boards on stock forums complained about DIV’s lack of action. Analysts on business TV poked fun at its name “how can it be Diversified with just one royalty stream.” On April 1, 2015, DIV added 5 new restaurants to its Franworks deal, increasing annual royalties by $0.6m ($0.5m USD) annually, at a consideration of $6.2m ($5.0m) , $4.8m ($3.9m USD) payable upfront in DIV shares, valued at $2.69 CAD ($2.15 USD), with the remainder due in a year depending on performance of these locations. However, this didn’t move the needle for most shareholders. However, patience was rewarded as on June 9, 2015, DIV announced it had purchased its second royalty stream from real estate company Sutton Realty. (click to enlarge) Sutton is a very strong realtor brand in Canada and has had a relatively stable level of agents throughout the past decade, despite not having the funding available to acquire smaller brokerages or to grow organically. This transaction with DIV will allow it to jumpstart its growth, which will be a positive for both Sutton and DIV. DIV receives, in exchange for $30.6m ($24.5m USD), a fixed royalty payment for licensing the Sutton brand back to Sutton of $3.5m ($2.8m USD) annually plus a $100,000 CAD ($80,000 USD) annual management fee. The royalty payment escalates 2% each year, the management fee 10% every four years and the entire deal is for 99 years. This fee has 40% coverage by Sutton based on EBITDA so there is a good margin of safety to ensure DIV receives their fees each year. Sutton can increase the rate by 10% on four occasions during the life of the deal or choose to add additional agents to the pool in exchange for further investment by DIV based on a pre-set formula. DIV will fund this transaction using $24.3m ($19.4m USD) in cash and an additional $6.3m in debt. This will leave DIV with a roughly $10m ($8m USD) cash on its balance sheet with debt of $21m ($16.8m USD) , a small portion compared to its equity valuation and covered by its future cashflows. Going Forward In its presentation to shareholders, DIV provided the following competitor analysis and forecasted cashflow coverage: (click to enlarge) The first 5 royalty companies all are strictly food-based royalty companies, while Alaris is significantly more diversified than the others. DIV is more hedged with its two current streams than the restaurant only funds, though not as much as Alaris. Its 6.9% dividend yield is significantly higher than the mean of 5.5%. These payouts are made monthly rather than quarterly like most dividends so they are in your hands sooner. The high payout rate is common with these types of corporate structures, as shown above. In some cases, high dividends can be a sign of trouble at the company as the market doesn’t believe they are sustainable; however, in this case it is due to a lack of market awareness. DIV has only one quarter as a royalty company, and this is only with the Franworks royalty stream. However, I wanted to see if they were roughly on track. From the first quarter 2015 MD&A: While they clearly paid out more than planned in this quarter, several extra events impacted the result: $700K CAD ($560K USD) in costs associated with litigation from a former CEO (who left the company in 2004, long before the business model change) $300K ($240K USD) in financing related costs $400K ($320K USD) in taxes; the company has losses that will be applied going forward to minimize these costs. I don’t believe the 2015 first quarter excess distribution over distributable cash is a concern. DIV has undergone a very drastic transformation and will have some costs associated with this, which should normalize in the next couple of quarters. The fact that revenue delivered as expected, despite economic headwinds in the Alberta oil patch, is positive. DIV should also see some economies of scale when the Sutton royalty starts to show up in its results. DIV is not without some risk. Most of the Franworks locations are in Western Canada, which makes it somewhat susceptible to the fortunes of the oil patch; that said, Q1 gives a pretty good indication that they should not be significantly affected by this as this was when the oil price drop was most severe. The frothiness of Canadian real estate is also well known . If there were a downturn in housing, eventually you would likely see some agents take down their shingles. That said, Sutton has maintained its levels of realtors consistently over the past decade so they likely wouldn’t need to retrench much in a downturn. The coverage provided by the EBITDA levels also will ensure Sutton makes its minimum payments to DIV. DIV gives an investor diversified exposure to the Canadian consumer with steady, growing businesses that hit two of the necessities of life — food and shelter, all while receiving an above-average yield ( 6.9% ). Well worth the wait. All figures in CAD, except where indicated. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I am/we are long BEVFF. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Diversified Royalty transitioned from a capital pool to a royalty stream vehicle in June 2014. BEVFF took steps to prepare its capital structure to add additional royalty streams in the most cost-effective manner. Following a delay after the initial fundraising, BEVFF added a second lucrative royalty stream in early June 2015, truly diversifying itself. Diversified Royalty ( OTC:BEVFF ) (or DIV on the TSX Exchange) came into being on June 30, 2014 when a former capital pool, Benev Capital Inc., put together a transaction to acquire $12m in annual topline revenue for the purchase price of $103m ( $82m USD ) in the form of a royalty stream of income from Calgary-based Franworks Franchise Corp., the owner of the Original Joe’s, State and Main, and Elephant and Castle restaurant chains. Streaming transactions have been common in the basic materials sector for some time, utilizing with great success by Franco Nevada (NYSE: FNV ) and Silver Wheaton (NYSE: SLW ), to name a few. They serve to provide funding for business initiatives without utilizing formal debt instruments. In fact, they partially tie the vendor to the sustainability of the enterprise going forward. Due to their success in the materials sector, these transactions have gained some traction in other sectors as well, as diverse as restaurants and farming. The Franworks transaction was structured as follows: $64m ( $51m USD ) cash on hand Franworks was issued approximately 9m shares worth $14.9m ($12m USD) Maxam Opportunities LP, a venture fund, subscribed for 5.2m shares or $8.7m ($7m USD) in a private placement $15m ($12m USD) coming from borrowings Franworks’ position in DIV amounted to 16.9% of the company at the time of the deal (now 15.4% after some other transactions) so they are very vested in the success of DIV as well. Franworks has the funds from the royalty sale to accelerate growth of its brands by adding new locations, as well as by renewing older locations. Both these help to drive revenue and should provide growing royalties to DIV down the road. Franworks’ restaurants are in the “upscale, casual” dining space. This is where you pay close to upscale dining prices, but without the dress code required. Go in to any of these restaurants and you will see people dressed up for a nice night out sitting next people just off the beach in tank tops and flipflops. The margins are much better than most mass eateries while still having a broad appeal. Maxam Capital Management, the manager of the Maxam Opportunities Fund, uses an “active, opportunistic and flexible” approach to capital management. DIV’s CEO, Sean Morrisson, is also a Managing Partner at Maxam and has a very strong background in capital management, advising the Keg Restaurants, a restaurant royalty income fund in Canada (KEG.UN), among other activities in his venture capital career. Maxam is a good partner for DIV to have in expanding its business, both to generate leads as well as to help evaluate transactions initially and on an ongoing basis. The restaurant-based royalty stream transactions are quite common in Canada with several others utilizing the income fund structure, such as the A&W Revenue Royalties Income Fund (AW-UN.TO), the Boston Pizza Royalties Income Fund (BPF-UN.TO) and the Keg Royalties Income Fund (KEG-UN.TO). DIV is not setup as an income fund, which makes it more flexible to acquire new streams of income down the road, as there are some limitations with the tax structure for income funds. As well, they can simulate the tax-free structure by utilizing its $35m CAD ($28m USD) in tax losses. Like these other royalty funds, the Franworks royalty is a gross revenue royalty, earning 6% of the top-line revenue from the restaurants included in the pool. These can change over time as locations are added or subtracted. Some royalty streams are based on net revenues, where some deductions are taken prior to payment, but DIV will receive its royalty regardless of how profitably the locations are operated. That said, it is clearly to their advantage to have successful restaurants available in the future. DIV’s future is clear: The royalty acquisition from Franworks is a platform transaction for BCI and the first step in our recently announced strategy to purchase top-line royalty streams from a number of growing multi-location businesses and franchisors. Franworks is a fast growing chain with strong unit-level economics and a superb management team – key success factors for a top-line royalty acquisition. With the successful completion of this transformational transaction, BCI intends to focus its efforts on acquiring additional royalties from growing multi-location businesses and franchisors. In October 2014, DIV received final approval for the transaction and completed its name changed to Diversified Royalty Corp. This followed quickly with a promotion of the company on to the TSX big board , providing it a better avenue to raise equity funds than they would have had with a Venture Exchange listing. They quickly utilized this, closing a $34.5m bought deal financing in November 2014 ($27.6m USD). Now all they needed was another royalty stream. So shareholders waited. And waited. And waited. Message boards on stock forums complained about DIV’s lack of action. Analysts on business TV poked fun at its name “how can it be Diversified with just one royalty stream.” On April 1, 2015, DIV added 5 new restaurants to its Franworks deal, increasing annual royalties by $0.6m ($0.5m USD) annually, at a consideration of $6.2m ($5.0m) , $4.8m ($3.9m USD) payable upfront in DIV shares, valued at $2.69 CAD ($2.15 USD), with the remainder due in a year depending on performance of these locations. However, this didn’t move the needle for most shareholders. However, patience was rewarded as on June 9, 2015, DIV announced it had purchased its second royalty stream from real estate company Sutton Realty. (click to enlarge) Sutton is a very strong realtor brand in Canada and has had a relatively stable level of agents throughout the past decade, despite not having the funding available to acquire smaller brokerages or to grow organically. This transaction with DIV will allow it to jumpstart its growth, which will be a positive for both Sutton and DIV. DIV receives, in exchange for $30.6m ($24.5m USD), a fixed royalty payment for licensing the Sutton brand back to Sutton of $3.5m ($2.8m USD) annually plus a $100,000 CAD ($80,000 USD) annual management fee. The royalty payment escalates 2% each year, the management fee 10% every four years and the entire deal is for 99 years. This fee has 40% coverage by Sutton based on EBITDA so there is a good margin of safety to ensure DIV receives their fees each year. Sutton can increase the rate by 10% on four occasions during the life of the deal or choose to add additional agents to the pool in exchange for further investment by DIV based on a pre-set formula. DIV will fund this transaction using $24.3m ($19.4m USD) in cash and an additional $6.3m in debt. This will leave DIV with a roughly $10m ($8m USD) cash on its balance sheet with debt of $21m ($16.8m USD) , a small portion compared to its equity valuation and covered by its future cashflows. Going Forward In its presentation to shareholders, DIV provided the following competitor analysis and forecasted cashflow coverage: (click to enlarge) The first 5 royalty companies all are strictly food-based royalty companies, while Alaris is significantly more diversified than the others. DIV is more hedged with its two current streams than the restaurant only funds, though not as much as Alaris. Its 6.9% dividend yield is significantly higher than the mean of 5.5%. These payouts are made monthly rather than quarterly like most dividends so they are in your hands sooner. The high payout rate is common with these types of corporate structures, as shown above. In some cases, high dividends can be a sign of trouble at the company as the market doesn’t believe they are sustainable; however, in this case it is due to a lack of market awareness. DIV has only one quarter as a royalty company, and this is only with the Franworks royalty stream. However, I wanted to see if they were roughly on track. From the first quarter 2015 MD&A: While they clearly paid out more than planned in this quarter, several extra events impacted the result: $700K CAD ($560K USD) in costs associated with litigation from a former CEO (who left the company in 2004, long before the business model change) $300K ($240K USD) in financing related costs $400K ($320K USD) in taxes; the company has losses that will be applied going forward to minimize these costs. I don’t believe the 2015 first quarter excess distribution over distributable cash is a concern. DIV has undergone a very drastic transformation and will have some costs associated with this, which should normalize in the next couple of quarters. The fact that revenue delivered as expected, despite economic headwinds in the Alberta oil patch, is positive. DIV should also see some economies of scale when the Sutton royalty starts to show up in its results. DIV is not without some risk. Most of the Franworks locations are in Western Canada, which makes it somewhat susceptible to the fortunes of the oil patch; that said, Q1 gives a pretty good indication that they should not be significantly affected by this as this was when the oil price drop was most severe. The frothiness of Canadian real estate is also well known . If there were a downturn in housing, eventually you would likely see some agents take down their shingles. That said, Sutton has maintained its levels of realtors consistently over the past decade so they likely wouldn’t need to retrench much in a downturn. The coverage provided by the EBITDA levels also will ensure Sutton makes its minimum payments to DIV. DIV gives an investor diversified exposure to the Canadian consumer with steady, growing businesses that hit two of the necessities of life — food and shelter, all while receiving an above-average yield ( 6.9% ). Well worth the wait. All figures in CAD, except where indicated. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I am/we are long BEVFF. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News