Scalper1 News

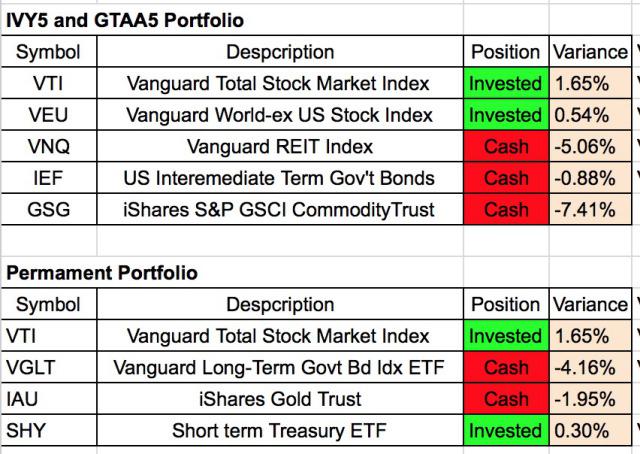

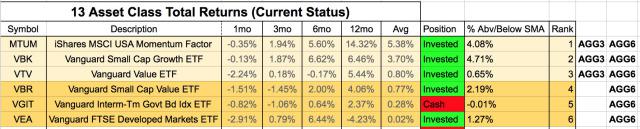

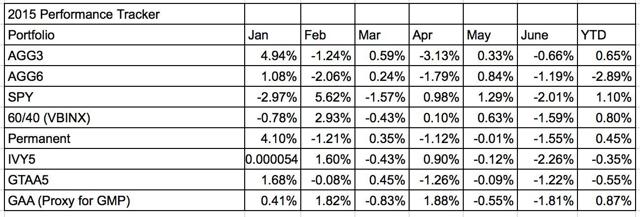

“}); $$(‘#article_top_info .info_content div’)[0].insert(bottom: $(‘mover’)); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function() setEvents();); Here are the tactical asset allocation updates for July 2015. All portfolio updates are online as part of Paul’s GTAA 13 Portfolio New sheet. First, for the basic portfolios – the GTAA5 and the Permanent Portfolio. There was one change in the GTAA5 portfolio. Bonds (via the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF )) went to cash this month. GTAA5 is now 40% invested and 60% cash. For the timing version of the Permanent Portfolio there were no changes this month. The TAA version of the Permanent Portfolio is 50% invested and 50% in cash just like last month. Now for the more aggressive GTAA AGG3 and AGG6 portfolios. There is one change for AGG3 this month. The Vanguard Value ETF (NYSEARCA: VTV ) has replaced the Vanguard Small Cap Value ETF (NYSEARCA: VBR ) in the top 3 although not by much. For AGG6, there is no change this month. While the Vanguard Intermediate-Term Government Bond Index ETF (NASDAQ: VGIT ) replaced the Vanguard Long-Term Government Bond Index ETF (NASDAQ: VGLT ) in the top 6, VGIT is below its 200 day SMA and thus there in no investment in the ETF. AGG6 like last month only has 5 holdings for July. Performance for the portfolios so far this year is in the table below. Numbers are for each month. The figures are estimates taken from a variety of sources. I don’t do detailed performance tracking until the end of the year. (click to enlarge) If you’re a fan of the Antonacci dual momentum GEM and GBM portfolios, GEM continues to be invested in U.S. stocks (via the Vanguard Total Stock Market ETF (NYSEARCA: VTI ) ), and the bond momentum option of the GBM portfolio continues to be invested in U.S. long term gov’t bonds (via the Vanguard Long-Term Government Bond Index ETF ( VGLT )). No changes from last month. That’s it for this month. These portfolios signals are valid for the whole month of July. As always, post any questions you have in the comments. Share this article with a colleague Scalper1 News

“}); $$(‘#article_top_info .info_content div’)[0].insert(bottom: $(‘mover’)); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function() setEvents();); Here are the tactical asset allocation updates for July 2015. All portfolio updates are online as part of Paul’s GTAA 13 Portfolio New sheet. First, for the basic portfolios – the GTAA5 and the Permanent Portfolio. There was one change in the GTAA5 portfolio. Bonds (via the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF )) went to cash this month. GTAA5 is now 40% invested and 60% cash. For the timing version of the Permanent Portfolio there were no changes this month. The TAA version of the Permanent Portfolio is 50% invested and 50% in cash just like last month. Now for the more aggressive GTAA AGG3 and AGG6 portfolios. There is one change for AGG3 this month. The Vanguard Value ETF (NYSEARCA: VTV ) has replaced the Vanguard Small Cap Value ETF (NYSEARCA: VBR ) in the top 3 although not by much. For AGG6, there is no change this month. While the Vanguard Intermediate-Term Government Bond Index ETF (NASDAQ: VGIT ) replaced the Vanguard Long-Term Government Bond Index ETF (NASDAQ: VGLT ) in the top 6, VGIT is below its 200 day SMA and thus there in no investment in the ETF. AGG6 like last month only has 5 holdings for July. Performance for the portfolios so far this year is in the table below. Numbers are for each month. The figures are estimates taken from a variety of sources. I don’t do detailed performance tracking until the end of the year. (click to enlarge) If you’re a fan of the Antonacci dual momentum GEM and GBM portfolios, GEM continues to be invested in U.S. stocks (via the Vanguard Total Stock Market ETF (NYSEARCA: VTI ) ), and the bond momentum option of the GBM portfolio continues to be invested in U.S. long term gov’t bonds (via the Vanguard Long-Term Government Bond Index ETF ( VGLT )). No changes from last month. That’s it for this month. These portfolios signals are valid for the whole month of July. As always, post any questions you have in the comments. Share this article with a colleague Scalper1 News

Scalper1 News