Scalper1 News

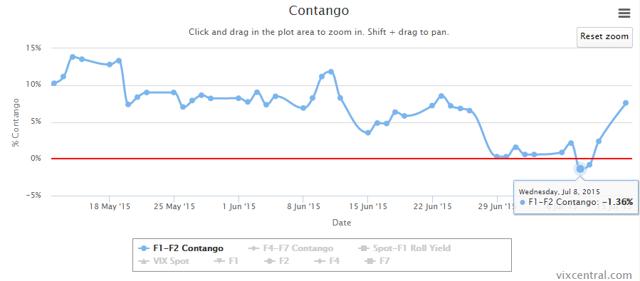

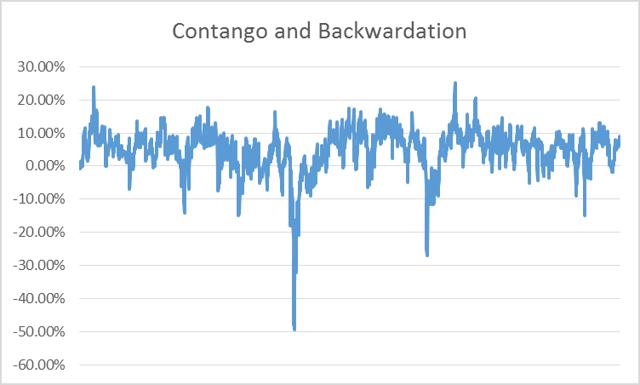

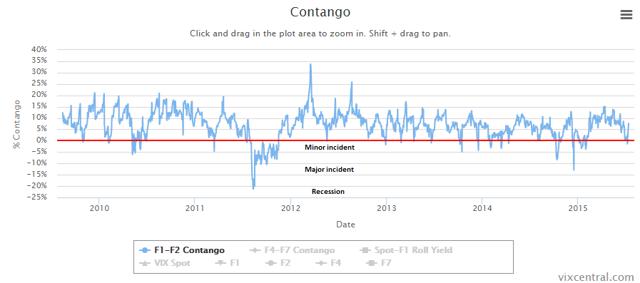

Summary The Greek/Chinese event didn’t even come close to causing a market freakout. We need bigger and better freakouts for the most profitable results. Freakout! Queue “Le Freak” by Chic. This article will focus on historical levels of contango and backwardation and how that can guide your volatility investments. Even though it was a point of contention with some of my readers, we saw a swift and sudden drop off in volatility, just as I predicted. Why? China and Greece. Two very different countries with very different problems. China: China is hunting for market manipulators while banning short selling of stocks and selling in general. Who is manipulating whom over there? Eventually fundamentals will begin to rule the Chinese market, but it will trade at a discount for some time based on a lack of trust from global investors. Greece: Speaking of trust, the Eurozone ran out of it for Greece. After agreeing to a deal that was worse than the one it rejected, Greece is now begging to stay part of the family. I was sure we would get more drama out of this one, but for now fears have subsided. Still a volatility wildcard in the short-term. The continuing question I have on Greece is, what was resolved? Nothing is set in stone yet and you have the IMF stating that the current deal will never work. I personally think the best thing for Greece and the Greek people would be to return to their own currency. Just my two cents. UVXY The ProShares Ultra VIX Short-Term Futures ETF (NYSEARCA: UVXY ) had quite a run over the past few weeks. We will take a look at the chart below after reviewing what drives UVXY (regular readers can skip to the chart). UVXY profits from increasing VIX futures. By investing in second month contracts, usually priced at a premium known as contango, it hopes they will increase in value before being sold off to roll into the new second month. Backwardation is when second month futures are priced higher than from month futures. This benefits UVXY and reverses the usual time value decay caused by contango. For more on contango and backwardation, click here . (click to enlarge) As we spoke about before, UVXY benefits from backwardation. See below for the contango/backwardation in the VIX futures over the past few weeks. (click to enlarge) The VIX futures reached 1.36% into backwardation (higher in intraday) and receded into backwardation several times (again during intraday). Warning If you have been a regular reader of mine you know my strategy is cut and dry. Always avoid trying to catch a spike up in volatility. Wait until VIX futures spike and then initiate a short position. During the next year, you need to be very careful about when to short volatility. As previously pointed out, some writers on Seeking Alpha were screaming “short volatility” the second it spiked after the Greek news came out. This is purely bad advice. Sure you may win some battles, but you will lose the war. Not all spikes in volatility are created equal which is why there isn’t a science that works 100% of the time when investing in volatility. My point is, eventually and I believe in the next year, a market pullback will turn into a correction. Right now the U.S. is a safe haven because things are more risky around the globe. Are you going to go all in shorting volatility 3% into a possible correction? I would hope not. Telling signs The phrase “it will get better” doesn’t always apply to the stock market in the short-term (which is what you should be focused on with volatility). The market has bred a new class of investor that believes every pullback will be followed by a subsequent recovery and market rally. This is simply not true. Advice The contango and backwardation indicators are one of the best resources to use for when to short volatility. The other is your brain. See below: (click to enlarge) I created this chart myself using historical data from The Intelligent Investor Blog . Dates are not included in the chart due to some issues I am having with Excel and axis placements. The chart begins in 2004 and runs to present in 2015. When removing 2008 the normal contango and backwardation events would look like the ones below: (click to enlarge) I have added wording to the chart which describes my personal opinion on events and the level of backwardation they would warrant. Depending on the level of a recession you would most likely see backwardation in excess of 25%. In this period of ultra low volatility I would expect a correction to possibly produce a backwardation event in the 20% range. Conclusion My point in these charts are that 1.36% backwardation should not cause you to go “all in” on volatility, ever. You could bet more when the economy is great, but I would not use that word to describe the current state of the economy. I need much healthier and organic growth to feel rosy about the U.S. economy. UVXY Call Spread (Options) I have posted a call spread strategy to my blog which you can view here . UVXY Recommendation The shorting opportunity for UVXY has passed. I never recommend purchasing or holding UVXY to bet on rising volatility. For more information on my strategy of only shorting volatility, please view my past articles. Patience is key and greed will eventually destroy you with volatility. Now is again a time to be patient and wait for another spike in the VIX. Keep an eye on the backwardation meter to judge the proper timing. Wait until things feel like they can’t get much worse, then wait some more. Thanks for reading and I hope you have a profitable week! Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The Greek/Chinese event didn’t even come close to causing a market freakout. We need bigger and better freakouts for the most profitable results. Freakout! Queue “Le Freak” by Chic. This article will focus on historical levels of contango and backwardation and how that can guide your volatility investments. Even though it was a point of contention with some of my readers, we saw a swift and sudden drop off in volatility, just as I predicted. Why? China and Greece. Two very different countries with very different problems. China: China is hunting for market manipulators while banning short selling of stocks and selling in general. Who is manipulating whom over there? Eventually fundamentals will begin to rule the Chinese market, but it will trade at a discount for some time based on a lack of trust from global investors. Greece: Speaking of trust, the Eurozone ran out of it for Greece. After agreeing to a deal that was worse than the one it rejected, Greece is now begging to stay part of the family. I was sure we would get more drama out of this one, but for now fears have subsided. Still a volatility wildcard in the short-term. The continuing question I have on Greece is, what was resolved? Nothing is set in stone yet and you have the IMF stating that the current deal will never work. I personally think the best thing for Greece and the Greek people would be to return to their own currency. Just my two cents. UVXY The ProShares Ultra VIX Short-Term Futures ETF (NYSEARCA: UVXY ) had quite a run over the past few weeks. We will take a look at the chart below after reviewing what drives UVXY (regular readers can skip to the chart). UVXY profits from increasing VIX futures. By investing in second month contracts, usually priced at a premium known as contango, it hopes they will increase in value before being sold off to roll into the new second month. Backwardation is when second month futures are priced higher than from month futures. This benefits UVXY and reverses the usual time value decay caused by contango. For more on contango and backwardation, click here . (click to enlarge) As we spoke about before, UVXY benefits from backwardation. See below for the contango/backwardation in the VIX futures over the past few weeks. (click to enlarge) The VIX futures reached 1.36% into backwardation (higher in intraday) and receded into backwardation several times (again during intraday). Warning If you have been a regular reader of mine you know my strategy is cut and dry. Always avoid trying to catch a spike up in volatility. Wait until VIX futures spike and then initiate a short position. During the next year, you need to be very careful about when to short volatility. As previously pointed out, some writers on Seeking Alpha were screaming “short volatility” the second it spiked after the Greek news came out. This is purely bad advice. Sure you may win some battles, but you will lose the war. Not all spikes in volatility are created equal which is why there isn’t a science that works 100% of the time when investing in volatility. My point is, eventually and I believe in the next year, a market pullback will turn into a correction. Right now the U.S. is a safe haven because things are more risky around the globe. Are you going to go all in shorting volatility 3% into a possible correction? I would hope not. Telling signs The phrase “it will get better” doesn’t always apply to the stock market in the short-term (which is what you should be focused on with volatility). The market has bred a new class of investor that believes every pullback will be followed by a subsequent recovery and market rally. This is simply not true. Advice The contango and backwardation indicators are one of the best resources to use for when to short volatility. The other is your brain. See below: (click to enlarge) I created this chart myself using historical data from The Intelligent Investor Blog . Dates are not included in the chart due to some issues I am having with Excel and axis placements. The chart begins in 2004 and runs to present in 2015. When removing 2008 the normal contango and backwardation events would look like the ones below: (click to enlarge) I have added wording to the chart which describes my personal opinion on events and the level of backwardation they would warrant. Depending on the level of a recession you would most likely see backwardation in excess of 25%. In this period of ultra low volatility I would expect a correction to possibly produce a backwardation event in the 20% range. Conclusion My point in these charts are that 1.36% backwardation should not cause you to go “all in” on volatility, ever. You could bet more when the economy is great, but I would not use that word to describe the current state of the economy. I need much healthier and organic growth to feel rosy about the U.S. economy. UVXY Call Spread (Options) I have posted a call spread strategy to my blog which you can view here . UVXY Recommendation The shorting opportunity for UVXY has passed. I never recommend purchasing or holding UVXY to bet on rising volatility. For more information on my strategy of only shorting volatility, please view my past articles. Patience is key and greed will eventually destroy you with volatility. Now is again a time to be patient and wait for another spike in the VIX. Keep an eye on the backwardation meter to judge the proper timing. Wait until things feel like they can’t get much worse, then wait some more. Thanks for reading and I hope you have a profitable week! Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News