Scalper1 News

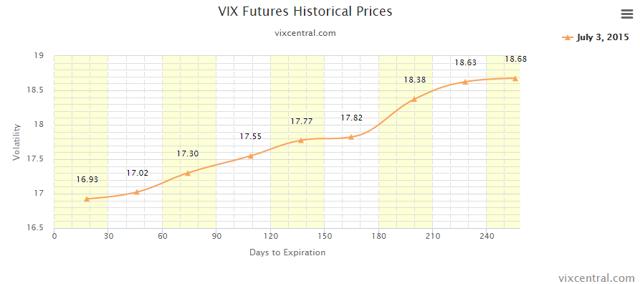

Summary U.S. economics still remain positive. Historical patterns for UVXY show us that further upside risk in this environment is limited. The Greece situation is way overblown. Hello everyone, Last week we discussed why all of the people that shouted “short volatility” the second it spiked were incorrect. On the night of 7/5 futures spiked to 19 but have settled to between 17-18. There are a couple ways to play this scenario. My favorite VIX candidates are the Proshares Ultra VIX Short-Term VIX Futures ETF (NYSEARCA: UVXY ) and its sister, the Proshares Short VIX Short-Term Futures ETF (NYSEARCA: SVXY ). UVXY This ETF invests in front and second month VIX futures, which can be found on the CBOE website here . As of writing vixcentral.com continues to be down and I would use that link until it is back up. I have a library of articles on UVXY if you need additional information and reading. Below is a look at VIX futures at the close of market Thursday July 2, 2015. Markets were closed Friday. Futures were still in contango at the end of last week, however they have entered backwardation several times now. This metric is my preferred measure of when to short volatility. (click to enlarge) UVXY benefits when futures are in backwardation. For more on contango and backwardation, watch this short video . I do not expect contango to hang around for more than a week. U.S. Economics For the best view on the U.S. economy each week, I recommend Jeff Miller’s “Weighing the Week Ahead” series. Here is a link to his author page on Seeking Alpha. This is, hands down, the best free review of the previous week and summary of the week ahead. I highly recommend having Jeff as one of your followings. My view is that the economy is still improving. Our GDP has been looking like Amazons earnings lately but we may now have that permanent seasonal economy. Da Fed If you read my article on Janet Yellen then you know what Fed speak can do for the markets. We have a lot of Fed speech this week and I expect that to have an overall soothing effect. If the dollar remains stronger I believe this will delay the Feds rate hike from September. As I have previously stated, they are in no hurry to raise rates and will be carefully looking over incoming data. At the first sign of weakness I would expect them to blink. SVXY This ETF works in the opposite way UVXY does. You could look into purchasing shares but I would warn that if conditions worsen or backwardation persists, it will have negative implications. Options I will be shopping and hopefully purchasing SVXY and selling UVXY call options sometime this week. Greece I highly appreciate the Greek people providing us with this opportunity. However, as with any volatility spike people are usually suffering. I wish them the best in their recovery and I hope they are able to work out a fair and equitable solution that enables their economy and quality of life to grow. Disclaimer Although I am shorting volatility this week, it is not for everyone. I could be wrong on my assessment and lose a lot of money. If you are not ok with losing money, then you should not be trading volatility or anything else for that matter. Historically speaking this situation will resolve itself and the market has entered oversold conditions. The only other surprises I see here should be positive. If you don’t understand how UVXY and SVXY work, you should check out my library of educational resources here on Seeking Alpha before investing in either of these products. Coverage For live coverage of volatility you can follow me here on Seeking Alpha, on Twitter, or on StockTwits, just search Nathan Buehler. I recommend following me on at least one of these to prevent any editorial delays associated with publishing full articles. Disclosure: I am/we are short UVXY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary U.S. economics still remain positive. Historical patterns for UVXY show us that further upside risk in this environment is limited. The Greece situation is way overblown. Hello everyone, Last week we discussed why all of the people that shouted “short volatility” the second it spiked were incorrect. On the night of 7/5 futures spiked to 19 but have settled to between 17-18. There are a couple ways to play this scenario. My favorite VIX candidates are the Proshares Ultra VIX Short-Term VIX Futures ETF (NYSEARCA: UVXY ) and its sister, the Proshares Short VIX Short-Term Futures ETF (NYSEARCA: SVXY ). UVXY This ETF invests in front and second month VIX futures, which can be found on the CBOE website here . As of writing vixcentral.com continues to be down and I would use that link until it is back up. I have a library of articles on UVXY if you need additional information and reading. Below is a look at VIX futures at the close of market Thursday July 2, 2015. Markets were closed Friday. Futures were still in contango at the end of last week, however they have entered backwardation several times now. This metric is my preferred measure of when to short volatility. (click to enlarge) UVXY benefits when futures are in backwardation. For more on contango and backwardation, watch this short video . I do not expect contango to hang around for more than a week. U.S. Economics For the best view on the U.S. economy each week, I recommend Jeff Miller’s “Weighing the Week Ahead” series. Here is a link to his author page on Seeking Alpha. This is, hands down, the best free review of the previous week and summary of the week ahead. I highly recommend having Jeff as one of your followings. My view is that the economy is still improving. Our GDP has been looking like Amazons earnings lately but we may now have that permanent seasonal economy. Da Fed If you read my article on Janet Yellen then you know what Fed speak can do for the markets. We have a lot of Fed speech this week and I expect that to have an overall soothing effect. If the dollar remains stronger I believe this will delay the Feds rate hike from September. As I have previously stated, they are in no hurry to raise rates and will be carefully looking over incoming data. At the first sign of weakness I would expect them to blink. SVXY This ETF works in the opposite way UVXY does. You could look into purchasing shares but I would warn that if conditions worsen or backwardation persists, it will have negative implications. Options I will be shopping and hopefully purchasing SVXY and selling UVXY call options sometime this week. Greece I highly appreciate the Greek people providing us with this opportunity. However, as with any volatility spike people are usually suffering. I wish them the best in their recovery and I hope they are able to work out a fair and equitable solution that enables their economy and quality of life to grow. Disclaimer Although I am shorting volatility this week, it is not for everyone. I could be wrong on my assessment and lose a lot of money. If you are not ok with losing money, then you should not be trading volatility or anything else for that matter. Historically speaking this situation will resolve itself and the market has entered oversold conditions. The only other surprises I see here should be positive. If you don’t understand how UVXY and SVXY work, you should check out my library of educational resources here on Seeking Alpha before investing in either of these products. Coverage For live coverage of volatility you can follow me here on Seeking Alpha, on Twitter, or on StockTwits, just search Nathan Buehler. I recommend following me on at least one of these to prevent any editorial delays associated with publishing full articles. Disclosure: I am/we are short UVXY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News