Scalper1 News

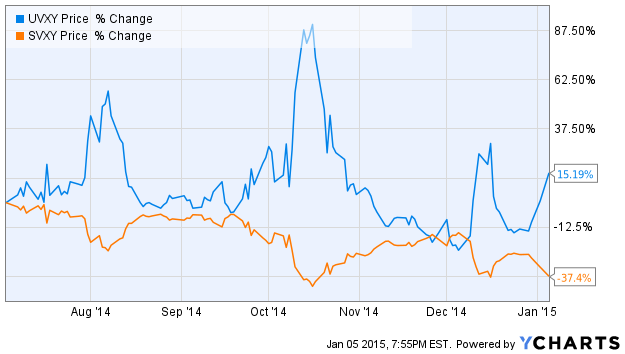

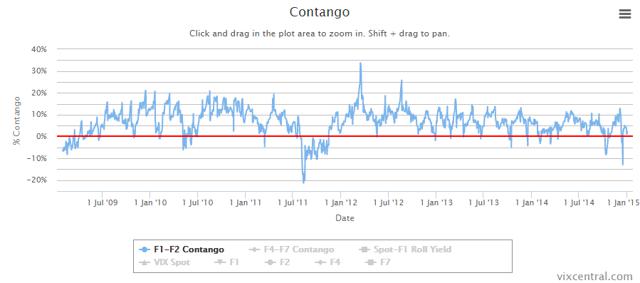

Futures are only trading slightly above their historical mean. UVXY and SVXY have both proved they are not buy and hold vehicles. Monitoring backwardation levels provides a better read on trading risks. Hello everyone, I hope your new year is off to the right start. A recent run-up in the VIX futures is cause for an update. I have been closely monitoring the VIXs trend over the last several months. Octobers spike was higher than anything we have seen since late 2011 and mid-2012. This is when investors’ fear of a double-dip recession were beginning to fade. The October spike was a combination of a perfect storm of events including the worldwide Ebola scare. The December spike only speaks to reinforce my theory that investors are on edge and leery of global economic weakness spreading over to the United States. The Eurozone has not been healthy for quite some time. Russia’s economy was put into free-fall with falling oil prices and ongoing sanctions. China has been showing slower than normal growth for some time. The million dollar question is whether or not global weakness will affect the United States. For that I do not currently have an answer. I could sit here and make up data to fit any hypothesis but you know that’s not the kind of writer I am. My personal belief is the United States will lead the world to growth over the next several years. This takes into account many factors such as continued low interest rates, a firming housing market, and managing government and personal debt levels. If the above factors change then things could easily go the other way. I like to be optimistic. Back to the VIX. Let’s take a look at my two favorite VIX ETFs: ProShares Ultra VIX Short-Term Futures (NYSEARCA: UVXY ) and ProShares Short VIX Short-Term Futures (NYSEARCA: SVXY ) I would like to point out that I have consistently written about how neither of these vehicles are buy and hold investments. I have, at times, faced push back from SVXY buy and hold investors. However, the above chart speaks for itself that even over longer periods of time, both vehicles carry significant risk. At the end of this article there is a link to how both instruments would have performed in 2008 and 2011. Contango and Backwardation I have moved away from the traditional strategy of simply watching for futures to enter backwardation and reenter contango. I am now more focused on the level of backwardation. The higher the level of backwardation, the more oversold the market is (in my opinion). Here is a look at the longer-term chart: (click to enlarge) During the double dip recession fears of 2011 the VIX futures (front and second month) hit a backwardation percentage of just over 20%. In contrast, the October event produced a 13% level of backwardation. Any event that pushes backwardation levels beyond 5% is significant. My short-term change in strategy: I currently see too much risk in shorting the VIX, even at current elevated levels. Therefore, I will be more closely tracking the percentage of backwardation in the VIX futures. In the higher risk environment, waiting for futures to reenter contango can take much of the reward away. By monitoring the level of backwardation, this gives you a clearer indication of when the pendulum has begun to swing back towards contango. Unless futures are over a 5% level of backwardation, I will be waiting on the sidelines for a better opportunity. I believe much of the current market weakness is related to commodities and not economic weakness in the United States. Lower oil prices, for a prolonged period of time, do have negative consequences for the economy. A predicted recession in Texas, loss of jobs tied to the shale boom, and many smaller oil and gas companies struggling is not the bright shining star that helped pull us out of the recession. Oil will eventually settle into a range higher than where it is currently trading. Saudi Arabia is playing chicken and the U.S. and Canada are already dropping rigs in response. The world cannot afford oil this cheap (oxymoron?). If you are a regular reader you know I focus a lot on wage growth (economic articles). This week provides more data to either disprove or cement indications that we finally have positive wage growth momentum. The market will be closely monitoring these reports. My advice to you: Be aware of the risks involved with volatility. It is historically trading slightly above its mean. This is not a huge spike by any account. Focus on backwardation levels and if futures are in contango wait on the sideline for a better opportunity. Even in 2008 UVXY would have not returned a profit if held for more than one year. For more data please review my article How UVXY and SVXY would have performed in 2008 and 2011. Purchasing SVXY in a period like this also poses significant risk should things turn south. I worry the last several years have created many complacent investors in inverse volatility products. Patience in volatility will pay off. Trust me, I have been in the position of missed opportunities many times. This only leads to irrational decisions and usually a loss of capital. Don’t feel like you’ve missed any opportunity if the VIX dips to 15 by weeks end. Just sit it out and wait for the next wave, just like a surfer. You can always catch the next one, you just have to be ready. Scalper1 News

Futures are only trading slightly above their historical mean. UVXY and SVXY have both proved they are not buy and hold vehicles. Monitoring backwardation levels provides a better read on trading risks. Hello everyone, I hope your new year is off to the right start. A recent run-up in the VIX futures is cause for an update. I have been closely monitoring the VIXs trend over the last several months. Octobers spike was higher than anything we have seen since late 2011 and mid-2012. This is when investors’ fear of a double-dip recession were beginning to fade. The October spike was a combination of a perfect storm of events including the worldwide Ebola scare. The December spike only speaks to reinforce my theory that investors are on edge and leery of global economic weakness spreading over to the United States. The Eurozone has not been healthy for quite some time. Russia’s economy was put into free-fall with falling oil prices and ongoing sanctions. China has been showing slower than normal growth for some time. The million dollar question is whether or not global weakness will affect the United States. For that I do not currently have an answer. I could sit here and make up data to fit any hypothesis but you know that’s not the kind of writer I am. My personal belief is the United States will lead the world to growth over the next several years. This takes into account many factors such as continued low interest rates, a firming housing market, and managing government and personal debt levels. If the above factors change then things could easily go the other way. I like to be optimistic. Back to the VIX. Let’s take a look at my two favorite VIX ETFs: ProShares Ultra VIX Short-Term Futures (NYSEARCA: UVXY ) and ProShares Short VIX Short-Term Futures (NYSEARCA: SVXY ) I would like to point out that I have consistently written about how neither of these vehicles are buy and hold investments. I have, at times, faced push back from SVXY buy and hold investors. However, the above chart speaks for itself that even over longer periods of time, both vehicles carry significant risk. At the end of this article there is a link to how both instruments would have performed in 2008 and 2011. Contango and Backwardation I have moved away from the traditional strategy of simply watching for futures to enter backwardation and reenter contango. I am now more focused on the level of backwardation. The higher the level of backwardation, the more oversold the market is (in my opinion). Here is a look at the longer-term chart: (click to enlarge) During the double dip recession fears of 2011 the VIX futures (front and second month) hit a backwardation percentage of just over 20%. In contrast, the October event produced a 13% level of backwardation. Any event that pushes backwardation levels beyond 5% is significant. My short-term change in strategy: I currently see too much risk in shorting the VIX, even at current elevated levels. Therefore, I will be more closely tracking the percentage of backwardation in the VIX futures. In the higher risk environment, waiting for futures to reenter contango can take much of the reward away. By monitoring the level of backwardation, this gives you a clearer indication of when the pendulum has begun to swing back towards contango. Unless futures are over a 5% level of backwardation, I will be waiting on the sidelines for a better opportunity. I believe much of the current market weakness is related to commodities and not economic weakness in the United States. Lower oil prices, for a prolonged period of time, do have negative consequences for the economy. A predicted recession in Texas, loss of jobs tied to the shale boom, and many smaller oil and gas companies struggling is not the bright shining star that helped pull us out of the recession. Oil will eventually settle into a range higher than where it is currently trading. Saudi Arabia is playing chicken and the U.S. and Canada are already dropping rigs in response. The world cannot afford oil this cheap (oxymoron?). If you are a regular reader you know I focus a lot on wage growth (economic articles). This week provides more data to either disprove or cement indications that we finally have positive wage growth momentum. The market will be closely monitoring these reports. My advice to you: Be aware of the risks involved with volatility. It is historically trading slightly above its mean. This is not a huge spike by any account. Focus on backwardation levels and if futures are in contango wait on the sideline for a better opportunity. Even in 2008 UVXY would have not returned a profit if held for more than one year. For more data please review my article How UVXY and SVXY would have performed in 2008 and 2011. Purchasing SVXY in a period like this also poses significant risk should things turn south. I worry the last several years have created many complacent investors in inverse volatility products. Patience in volatility will pay off. Trust me, I have been in the position of missed opportunities many times. This only leads to irrational decisions and usually a loss of capital. Don’t feel like you’ve missed any opportunity if the VIX dips to 15 by weeks end. Just sit it out and wait for the next wave, just like a surfer. You can always catch the next one, you just have to be ready. Scalper1 News

Scalper1 News