Scalper1 News

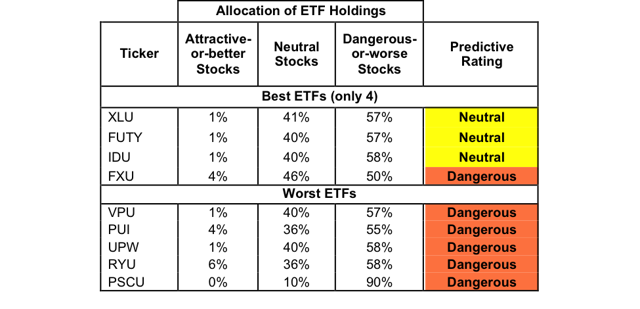

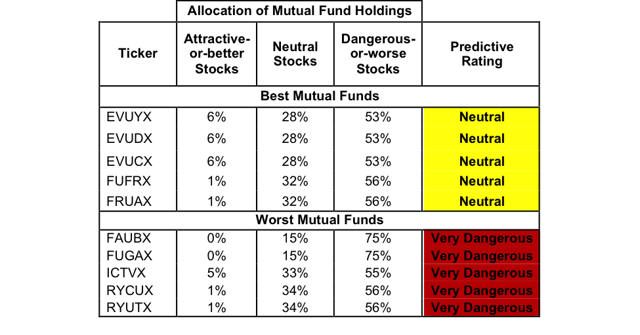

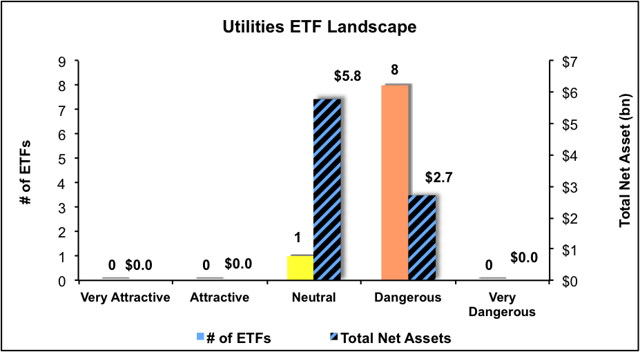

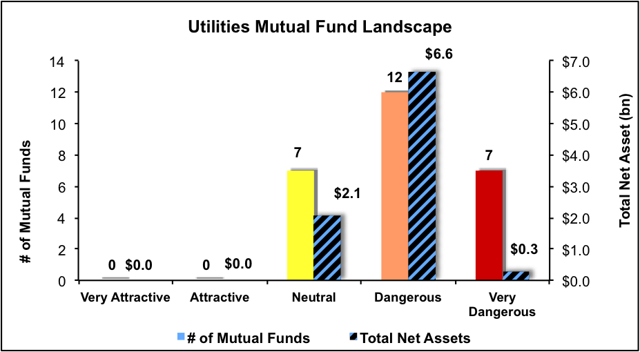

Summary Utilities sector ranks eighth in Q3’15. Based on an aggregation of ratings of nine ETFs and 26 mutual funds. XLU is the top-rated Utilities ETF and EVUYX is the top-rated Utilities mutual fund. The Utilities sector ranks eighth out of the 10 sectors as detailed in our Q3’15 Sector Ratings for ETFs and Mutual Funds report. It gets our Dangerous rating, which is based on an aggregation of ratings of nine ETFs and 26 mutual funds in the Utilities sector. See a recap of our Q2’15 Sector Ratings here. Figure 1 ranks from best to worst all nine Utilities ETFs and Figure 2 shows the five best and worst-rated Utilities mutual funds. Not all Utilities sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 20 to 81). This variation creates drastically different investment implications and, therefore, ratings. Investors should not buy any Utilities ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this sector, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off. Figure 1: ETFs with the Best & Worst Ratings – Top 5 (click to enlarge) * Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings The Utilities Select Sector SPDR ETF (NYSEARCA: XLU ) is the top-rated Utilities ETF and the Wells Fargo Advantage Utility & Telecommunications Fund (MUTF: EVUYX ) is the top-rated Utilities mutual fund. Both earn a Neutral rating. The PowerShares S&P SmallCap Utilities Portfolio ETF (NASDAQ: PSCU ) is the worst-rated Utilities ETF and the Rydex Utilities Fund (MUTF: RYUTX ) is the worst-rated Utilities mutual fund. PSCU earns a Dangerous rating and RYUTX earns a Very Dangerous rating. 80 stocks of the 3000+ we cover are classified as Utilities stocks, but due to style drift, Utilities ETFs and mutual funds hold 81 stocks. SCANA Corporation (NYSE: SCG ) is one of our favorite stocks held by Utilities ETF and mutual funds and earns our Attractive rating. Since 2010, the company has grown after-tax profit ( NOPAT ) by 6% compounded annually. This profit growth is supported by SCANA’s 16% NOPAT margin, which is much higher than the 12% achieved in 2010. Despite SCANA’s steady business improvements, the stock price reflects a different picture. At its current price of ~$56/share, SCANA has a price to economic book value ( PEBV ) ratio of 0.9. This ratio implies that the market expects the company’s profits to permanently decline by 10%. If SCANA can grow NOPAT by only 4% compounded annually over the next five years , the stock is worth $72/share today – a 28% upside. Northwest Natural Gas Company (NYSE: NWN ) is one of our least favorite stocks held by Utilities ETF and mutual funds and earns our Dangerous rating. Over the past five years, Northwest’s NOPAT has declined by 3% compounded annually. Northwest currently earns a bottom quintile return on invested capital ( ROIC ) of 3%. Despite the declining profits, investors have stuck with NWN, most likely for its 4% dividend yield. However, dividend aside, Northwest’s stock price is overvalued. To justify its current price of $44/share, Northwest must grow NOPAT by 4% compounded annually for 12 years . 4% NOPAT growth might not seem like much, but for a Utility company that has seen profits decline for years, this growth expectation is rather optimistic. Figures 3 and 4 show the rating landscape of all Utilities ETFs and mutual funds. Figure 3: Separating the Best ETFs From the Worst ETFs (click to enlarge) Sources: New Constructs, LLC and company filings Figure 4: Separating the Best Mutual Funds From the Worst Mutual Funds (click to enlarge) Sources: New Constructs, LLC and company filings D isclosure: David Trainer, Kyle Guske II, and Max Lee receive no compensation to write about any specific stock, sector or theme. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Utilities sector ranks eighth in Q3’15. Based on an aggregation of ratings of nine ETFs and 26 mutual funds. XLU is the top-rated Utilities ETF and EVUYX is the top-rated Utilities mutual fund. The Utilities sector ranks eighth out of the 10 sectors as detailed in our Q3’15 Sector Ratings for ETFs and Mutual Funds report. It gets our Dangerous rating, which is based on an aggregation of ratings of nine ETFs and 26 mutual funds in the Utilities sector. See a recap of our Q2’15 Sector Ratings here. Figure 1 ranks from best to worst all nine Utilities ETFs and Figure 2 shows the five best and worst-rated Utilities mutual funds. Not all Utilities sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 20 to 81). This variation creates drastically different investment implications and, therefore, ratings. Investors should not buy any Utilities ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this sector, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off. Figure 1: ETFs with the Best & Worst Ratings – Top 5 (click to enlarge) * Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings The Utilities Select Sector SPDR ETF (NYSEARCA: XLU ) is the top-rated Utilities ETF and the Wells Fargo Advantage Utility & Telecommunications Fund (MUTF: EVUYX ) is the top-rated Utilities mutual fund. Both earn a Neutral rating. The PowerShares S&P SmallCap Utilities Portfolio ETF (NASDAQ: PSCU ) is the worst-rated Utilities ETF and the Rydex Utilities Fund (MUTF: RYUTX ) is the worst-rated Utilities mutual fund. PSCU earns a Dangerous rating and RYUTX earns a Very Dangerous rating. 80 stocks of the 3000+ we cover are classified as Utilities stocks, but due to style drift, Utilities ETFs and mutual funds hold 81 stocks. SCANA Corporation (NYSE: SCG ) is one of our favorite stocks held by Utilities ETF and mutual funds and earns our Attractive rating. Since 2010, the company has grown after-tax profit ( NOPAT ) by 6% compounded annually. This profit growth is supported by SCANA’s 16% NOPAT margin, which is much higher than the 12% achieved in 2010. Despite SCANA’s steady business improvements, the stock price reflects a different picture. At its current price of ~$56/share, SCANA has a price to economic book value ( PEBV ) ratio of 0.9. This ratio implies that the market expects the company’s profits to permanently decline by 10%. If SCANA can grow NOPAT by only 4% compounded annually over the next five years , the stock is worth $72/share today – a 28% upside. Northwest Natural Gas Company (NYSE: NWN ) is one of our least favorite stocks held by Utilities ETF and mutual funds and earns our Dangerous rating. Over the past five years, Northwest’s NOPAT has declined by 3% compounded annually. Northwest currently earns a bottom quintile return on invested capital ( ROIC ) of 3%. Despite the declining profits, investors have stuck with NWN, most likely for its 4% dividend yield. However, dividend aside, Northwest’s stock price is overvalued. To justify its current price of $44/share, Northwest must grow NOPAT by 4% compounded annually for 12 years . 4% NOPAT growth might not seem like much, but for a Utility company that has seen profits decline for years, this growth expectation is rather optimistic. Figures 3 and 4 show the rating landscape of all Utilities ETFs and mutual funds. Figure 3: Separating the Best ETFs From the Worst ETFs (click to enlarge) Sources: New Constructs, LLC and company filings Figure 4: Separating the Best Mutual Funds From the Worst Mutual Funds (click to enlarge) Sources: New Constructs, LLC and company filings D isclosure: David Trainer, Kyle Guske II, and Max Lee receive no compensation to write about any specific stock, sector or theme. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News