Scalper1 News

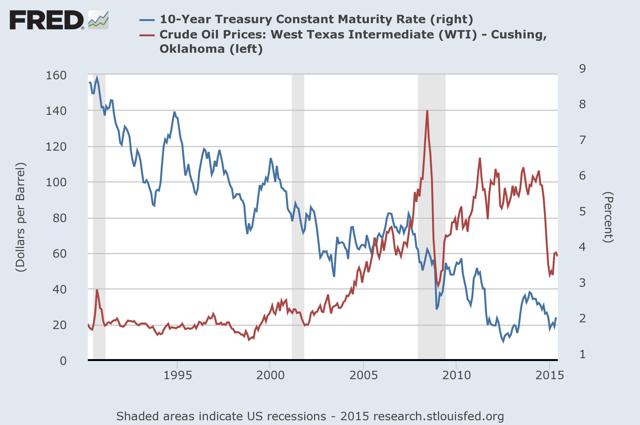

Summary The price of USO remained around $20 over the past month. The FOMC could start raising rates soon. Will it bring down oil prices? The potential rise in OPEC’s production could keep pressuring down shares of USO. The recovery in the oil market has cooled down as the price of WTI oil is around $60 – it hasn’t moved from this level the past month – and the United States Oil ETF (NYSEARCA: USO ) remained around $20. Besides the changes in supply and demand, which are the main factors shifting the fundamental conditions of the oil market, monetary policy also plays a role in the movement of oil prices. Let’s take a closer look at this issue and its potential impact on the oil market and the price of USO. Are interest rates going up? So far, the answer isn’t clear cut. Interest rates have gone up in recent weeks, but they are actually lower than where they were a year ago. For now, the market is still uncertain whether the Federal Reserve will raise rates this year and the pace of the subsequent rate hikes. And even if it does raise rates, how high can they go? Despite the high uncertainty, the current expectations are for the FOMC to start raising rates this year – in one scenario, the FOMC could start in September and bring the cash rate to 0.5% by the end of the year. But will higher interest rates push down oil prices? If interest rates were to start climbing up again, they may have some repercussions on oil prices. The effect of higher interest rates has been studied and here is one source that summarizes the intuitions and the factors that come into play in bringing oil prices down when rates go up. But, as you can see below, for oil prices to reach low levels – say falling below $40 – interest rates will have to climb back up to the high levels they were back in the 90s, when 10-year treasury rates were around 5%-7%. And the current oil market isn’t the same as it was back in the 90s or early 2000s. In any case, since rates are expected to remain very low this year and next, the main impact could come from the change in market expectations about where rates are heading once the FOMC starts to raise rates. (click to enlarge) Source of chart taken from FRED The chart also suggests, at face value, that there isn’t a strong relation between interest rates and oil prices. So, the basic intuition for the relevance of monetary policy in the context of oil prices is only one among many factors moving oil prices. The changes in supply and demand will likely be leading the way in impacting oil. When it comes to supply, OPEC is still adamant at keeping its quota of 30 million barrels per day, which has exceeded this level in the past few months. Even though Iran’s deal with the U.S. isn’t in place, the country is already preparing to ramp up production in the next couple of years – this could make it harder for OPEC to keep its 30 million barrels per day without someone else among the OPEC members reducing their market share. Thus, we should expect OPEC to de facto produce more than 30 million barrels per day. For the short term, however, oil prices could start to come down as the market adjusts its expectations regarding a possible rate hike by the FOMC and more importantly the change in policy that could lead to even higher rates down the line (albeit it could take a while before rates reach high levels, perhaps even years). The FOMC could shed some light on the timing of the rate hike or at least show if a rate hike is on the table in the coming months. For the USO investors, the price could take another beating as the market adjusts its expectations and rates start to climb back again. Thus, USO could also suffer from the changes in market expectations about the direction of interest rates. Even though the changes in demand and supply will trump up any changes in monetary policy, the potential rise in oil production by OPEC along with the stable oil output in the U.S. could start pressuring back down oil prices, at least for the short run. (For more please see: ” USO Investors – Beware of The Contango! “) Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The price of USO remained around $20 over the past month. The FOMC could start raising rates soon. Will it bring down oil prices? The potential rise in OPEC’s production could keep pressuring down shares of USO. The recovery in the oil market has cooled down as the price of WTI oil is around $60 – it hasn’t moved from this level the past month – and the United States Oil ETF (NYSEARCA: USO ) remained around $20. Besides the changes in supply and demand, which are the main factors shifting the fundamental conditions of the oil market, monetary policy also plays a role in the movement of oil prices. Let’s take a closer look at this issue and its potential impact on the oil market and the price of USO. Are interest rates going up? So far, the answer isn’t clear cut. Interest rates have gone up in recent weeks, but they are actually lower than where they were a year ago. For now, the market is still uncertain whether the Federal Reserve will raise rates this year and the pace of the subsequent rate hikes. And even if it does raise rates, how high can they go? Despite the high uncertainty, the current expectations are for the FOMC to start raising rates this year – in one scenario, the FOMC could start in September and bring the cash rate to 0.5% by the end of the year. But will higher interest rates push down oil prices? If interest rates were to start climbing up again, they may have some repercussions on oil prices. The effect of higher interest rates has been studied and here is one source that summarizes the intuitions and the factors that come into play in bringing oil prices down when rates go up. But, as you can see below, for oil prices to reach low levels – say falling below $40 – interest rates will have to climb back up to the high levels they were back in the 90s, when 10-year treasury rates were around 5%-7%. And the current oil market isn’t the same as it was back in the 90s or early 2000s. In any case, since rates are expected to remain very low this year and next, the main impact could come from the change in market expectations about where rates are heading once the FOMC starts to raise rates. (click to enlarge) Source of chart taken from FRED The chart also suggests, at face value, that there isn’t a strong relation between interest rates and oil prices. So, the basic intuition for the relevance of monetary policy in the context of oil prices is only one among many factors moving oil prices. The changes in supply and demand will likely be leading the way in impacting oil. When it comes to supply, OPEC is still adamant at keeping its quota of 30 million barrels per day, which has exceeded this level in the past few months. Even though Iran’s deal with the U.S. isn’t in place, the country is already preparing to ramp up production in the next couple of years – this could make it harder for OPEC to keep its 30 million barrels per day without someone else among the OPEC members reducing their market share. Thus, we should expect OPEC to de facto produce more than 30 million barrels per day. For the short term, however, oil prices could start to come down as the market adjusts its expectations regarding a possible rate hike by the FOMC and more importantly the change in policy that could lead to even higher rates down the line (albeit it could take a while before rates reach high levels, perhaps even years). The FOMC could shed some light on the timing of the rate hike or at least show if a rate hike is on the table in the coming months. For the USO investors, the price could take another beating as the market adjusts its expectations and rates start to climb back again. Thus, USO could also suffer from the changes in market expectations about the direction of interest rates. Even though the changes in demand and supply will trump up any changes in monetary policy, the potential rise in oil production by OPEC along with the stable oil output in the U.S. could start pressuring back down oil prices, at least for the short run. (For more please see: ” USO Investors – Beware of The Contango! “) Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News