Scalper1 News

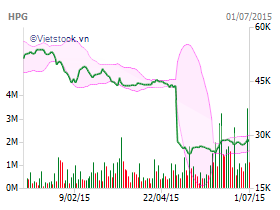

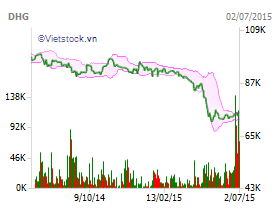

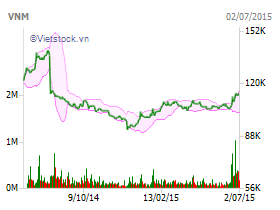

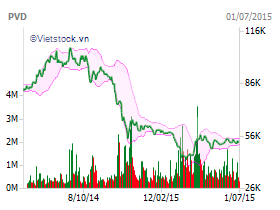

Summary Vietnam Holdings Ltd. had a 1 Year Return of 23.25%, which is substantially higher than the VN Index gain of 8.88%. A further increase in the fund’s price is highly likely for the following reasons: low valuation, recovery of multiple industries, and irrational drops in stock prices that will recover. Vietnam Holdings Ltd. is the best option for investors to gain exposure to Vietnam through US Exchanges. In a previous article , I mentioned the opportunities of investing in Vietnam, and how the Market Vectors Vietnam ETF (NYSEARCA: VNM ) was not the best means to profit off of the growth in Vietnam. When an investment fund is unable to outperform the index and has a negative return in a country with substantial growth, skepticism is befitting. The Market Vectors Vietnam ETF has had a 1 year return of -6.82% , while VN index has had a return of 8.88% . While the most successful funds are generally not listed on US Exchanges, Vietnam Holding Ltd.(OTC: VNMHF ) is a superior alternative that has outperformed the VN Index. Investors, who are bullish on Vietnam and want to trade on US Exchanges, should consider this fund as the most appropriate vehicle. Vietnam Holdings Ltd. is a closed end investment holding company in Vietnam that is listed on the US OTC market. The advantages of this fund include more attractive valuation, consistently higher returns, and its investment in two companies fully held by foreign investors. Performance Comparison Market Vectors Vietnam ETF Vietnam Holdings Ltd. P/E Ratio 15 5.33 Number of companies held with full foreign ownership None 2 1 year return -8.53% 23.25% 3 year return 2.68% 19.4% 5 Year Return -3.70% 14.7% ROE 12% 24.35% Vietnam Holding Ltd. has a very strong portfolio, with extreme low valuation, and more than double the ROE of the top listed equity holdings of the Market Vectors Vietnam ETF. Moreover, the fund’s financial performance has been excellent, particularly in the past year with a return of 23.25% . The current low valuation, coupled with specific companies that demonstrate high potential, will attribute to future success. Its success is mostly attributed to very recent successful performance in the past year, and the growth appears to be in the initial stages. The portfolio is holistically very strong, while I would say that the greatest potential will result from the performance of DHG Pharmaceutical, Petrovietnam Drilling and Well Services, Vinamilk, and Hoa Phat Group. Hoa Phat Group Hoa Phat Group is the most undervalued company, as its share prices have dropped substantially over the past months. The company is currently rated as one of the top 50 best listed companies in Vietnam Forbes and No. 7 for enterprises with the largest turnover. The company has the largest market share for steel production and steel pipe segments, with approximately 18% and 19.8%, respectively . The stock’s price has been constantly declining, although the sharp decline in the middle of May represents an adjustment of stock price due to the issuance of dividends and bonus stocks. I am currently holding Hoa Phat Group at a 9.15% loss, after investing initially in late April and buying down after this drop. Financial performance of the company has been consistent, with strong growth in net income, net revenue, and ROE since 2012. Moreover, Net Income increased by 37% in the 1st quarter of 2015. An increase in steel prices is projected for the future, which will result in recovery of the stock’s price. Vinamilk and DHG Pharmaceutical JSC Although it does not represent a large portion of the fund’s portfolio, the holding of Vinamilk and DHG Pharmaceutical JSC is very strategic, as these companies are fully held by foreign investors. Vinamilk is one of the most sought after companies by foreign investors, as many foreign investors are willing to pay a premium of up to 20% for shares of this company. The slight decline in net income in 2014, coupled with valuation that is not relatively attractive for Vietnam, has not been enough to deter investment away from this company; considerable growth is ahead for the company and its share price will surely increase. Its key position in the dairy market in Vietnam is crucial, as the industry is expected to grow by 9% up to 2020 . DHG Pharmaceutical is another very strategic holding of this portfolio, with average valuation for Vietnam and consistent growth. The company’s EPS is projected to grow by 34% in 2015 , making a rebound in its stock price extremely likely. These two holdings can be considered a major strength of this portfolio, although they only represent 13.7% of the fund’s portfolio. Moreover, there are certainly other companies fully held by foreign investors with better valuation and more potential for growth; some of these include Refrigeration Electrical Engineering Company, Military Commercial Joint Stock Bank, and FPT Corporation. The removal of the foreign ownership limitation in Vietnam, which will begin in some industries in September , will be extremely beneficial for this fund. Both companies are trading very near to their 52 week lows, and an increase in share price in the near future is highly likely, due to company’s valuation, projected growth, and prestige of being fully held by foreign investors. Petrovietnam Drilling and Well Services Petrovietnam Drilling and Well Services is another holding that is extremely undervalued and holding this company will be beneficial, as a rebound in price is inevitable. The sharp drop in price has been very irrational, resulting from the fear of the declining price of oil and some large investment funds selling holdings of this company. Despite the sharp drop in its share price, a large number of foreign investment funds are still keeping this company in their portfolio, in anticipation of a rebound in price. Beyond having extremely attractive valuation, the company has had consistent growth in net revenue since 2003 , even when oil prices fell below $40/barrel in 2009; net revenue increased by 9.9% and net income only fell by 9.5% in 2009. History has shown that the company is capable of continual growth, and its financial performance will not suffer if the price of oil plunges further. Currently trading at 53,000 dong, opportunity for a rebound is substantial as the company is extremely undervalued; the company’s share price dropped to its 52 week low at 42,800 dong earlier this year. General Strengths A large number of companies that this investment fund holds will have a significant increase in their share prices. This will result from a wide variety of factors, including: High value of companies fully held by foreign investors, and the removal of the foreign ownership limitation for some industries beginning in September . Adverse performance of industries, which are on track for recovery. Irrational drops in stock prices, which will be reconciled. A portfolio of companies with low valuation, that have demonstrated consistent financial performance. Favorable outlook for Vietnam stocks, as the VN Index was projected to increase to a seven year high to 655 : it is currently at 605.7 Conclusion I recommend Vietnam Holdings Ltd. as the best option for US investors wishing to invest in Vietnam. Moreover, investment into this fund should be a long-term endeavor, to ensure that investors profit off of the recovery of all industries and the reconciliation of companies that are undervalued. For those wishing to venture further and explore options not listed on US Exchanges, the following investment funds are most suitable: PXP Vietnam Emerging Equity Fund, Asia Frontier Capital’s Vietnam Fund, Tundra Vietnam Fund, and PYN Elite Fund. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Vietnam Holdings Ltd. had a 1 Year Return of 23.25%, which is substantially higher than the VN Index gain of 8.88%. A further increase in the fund’s price is highly likely for the following reasons: low valuation, recovery of multiple industries, and irrational drops in stock prices that will recover. Vietnam Holdings Ltd. is the best option for investors to gain exposure to Vietnam through US Exchanges. In a previous article , I mentioned the opportunities of investing in Vietnam, and how the Market Vectors Vietnam ETF (NYSEARCA: VNM ) was not the best means to profit off of the growth in Vietnam. When an investment fund is unable to outperform the index and has a negative return in a country with substantial growth, skepticism is befitting. The Market Vectors Vietnam ETF has had a 1 year return of -6.82% , while VN index has had a return of 8.88% . While the most successful funds are generally not listed on US Exchanges, Vietnam Holding Ltd.(OTC: VNMHF ) is a superior alternative that has outperformed the VN Index. Investors, who are bullish on Vietnam and want to trade on US Exchanges, should consider this fund as the most appropriate vehicle. Vietnam Holdings Ltd. is a closed end investment holding company in Vietnam that is listed on the US OTC market. The advantages of this fund include more attractive valuation, consistently higher returns, and its investment in two companies fully held by foreign investors. Performance Comparison Market Vectors Vietnam ETF Vietnam Holdings Ltd. P/E Ratio 15 5.33 Number of companies held with full foreign ownership None 2 1 year return -8.53% 23.25% 3 year return 2.68% 19.4% 5 Year Return -3.70% 14.7% ROE 12% 24.35% Vietnam Holding Ltd. has a very strong portfolio, with extreme low valuation, and more than double the ROE of the top listed equity holdings of the Market Vectors Vietnam ETF. Moreover, the fund’s financial performance has been excellent, particularly in the past year with a return of 23.25% . The current low valuation, coupled with specific companies that demonstrate high potential, will attribute to future success. Its success is mostly attributed to very recent successful performance in the past year, and the growth appears to be in the initial stages. The portfolio is holistically very strong, while I would say that the greatest potential will result from the performance of DHG Pharmaceutical, Petrovietnam Drilling and Well Services, Vinamilk, and Hoa Phat Group. Hoa Phat Group Hoa Phat Group is the most undervalued company, as its share prices have dropped substantially over the past months. The company is currently rated as one of the top 50 best listed companies in Vietnam Forbes and No. 7 for enterprises with the largest turnover. The company has the largest market share for steel production and steel pipe segments, with approximately 18% and 19.8%, respectively . The stock’s price has been constantly declining, although the sharp decline in the middle of May represents an adjustment of stock price due to the issuance of dividends and bonus stocks. I am currently holding Hoa Phat Group at a 9.15% loss, after investing initially in late April and buying down after this drop. Financial performance of the company has been consistent, with strong growth in net income, net revenue, and ROE since 2012. Moreover, Net Income increased by 37% in the 1st quarter of 2015. An increase in steel prices is projected for the future, which will result in recovery of the stock’s price. Vinamilk and DHG Pharmaceutical JSC Although it does not represent a large portion of the fund’s portfolio, the holding of Vinamilk and DHG Pharmaceutical JSC is very strategic, as these companies are fully held by foreign investors. Vinamilk is one of the most sought after companies by foreign investors, as many foreign investors are willing to pay a premium of up to 20% for shares of this company. The slight decline in net income in 2014, coupled with valuation that is not relatively attractive for Vietnam, has not been enough to deter investment away from this company; considerable growth is ahead for the company and its share price will surely increase. Its key position in the dairy market in Vietnam is crucial, as the industry is expected to grow by 9% up to 2020 . DHG Pharmaceutical is another very strategic holding of this portfolio, with average valuation for Vietnam and consistent growth. The company’s EPS is projected to grow by 34% in 2015 , making a rebound in its stock price extremely likely. These two holdings can be considered a major strength of this portfolio, although they only represent 13.7% of the fund’s portfolio. Moreover, there are certainly other companies fully held by foreign investors with better valuation and more potential for growth; some of these include Refrigeration Electrical Engineering Company, Military Commercial Joint Stock Bank, and FPT Corporation. The removal of the foreign ownership limitation in Vietnam, which will begin in some industries in September , will be extremely beneficial for this fund. Both companies are trading very near to their 52 week lows, and an increase in share price in the near future is highly likely, due to company’s valuation, projected growth, and prestige of being fully held by foreign investors. Petrovietnam Drilling and Well Services Petrovietnam Drilling and Well Services is another holding that is extremely undervalued and holding this company will be beneficial, as a rebound in price is inevitable. The sharp drop in price has been very irrational, resulting from the fear of the declining price of oil and some large investment funds selling holdings of this company. Despite the sharp drop in its share price, a large number of foreign investment funds are still keeping this company in their portfolio, in anticipation of a rebound in price. Beyond having extremely attractive valuation, the company has had consistent growth in net revenue since 2003 , even when oil prices fell below $40/barrel in 2009; net revenue increased by 9.9% and net income only fell by 9.5% in 2009. History has shown that the company is capable of continual growth, and its financial performance will not suffer if the price of oil plunges further. Currently trading at 53,000 dong, opportunity for a rebound is substantial as the company is extremely undervalued; the company’s share price dropped to its 52 week low at 42,800 dong earlier this year. General Strengths A large number of companies that this investment fund holds will have a significant increase in their share prices. This will result from a wide variety of factors, including: High value of companies fully held by foreign investors, and the removal of the foreign ownership limitation for some industries beginning in September . Adverse performance of industries, which are on track for recovery. Irrational drops in stock prices, which will be reconciled. A portfolio of companies with low valuation, that have demonstrated consistent financial performance. Favorable outlook for Vietnam stocks, as the VN Index was projected to increase to a seven year high to 655 : it is currently at 605.7 Conclusion I recommend Vietnam Holdings Ltd. as the best option for US investors wishing to invest in Vietnam. Moreover, investment into this fund should be a long-term endeavor, to ensure that investors profit off of the recovery of all industries and the reconciliation of companies that are undervalued. For those wishing to venture further and explore options not listed on US Exchanges, the following investment funds are most suitable: PXP Vietnam Emerging Equity Fund, Asia Frontier Capital’s Vietnam Fund, Tundra Vietnam Fund, and PYN Elite Fund. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News