Scalper1 News

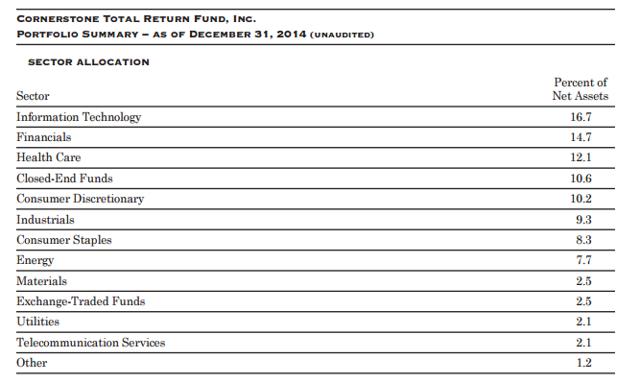

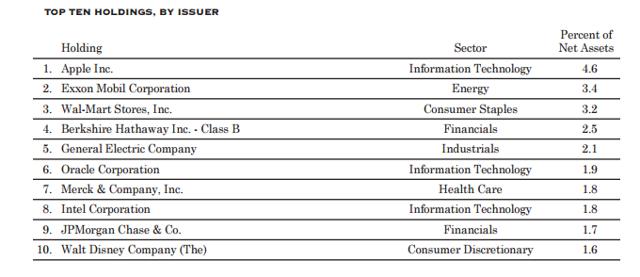

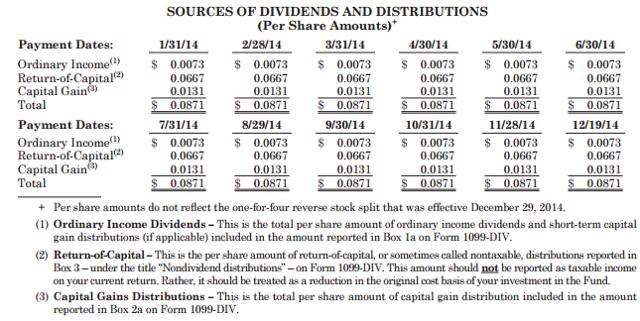

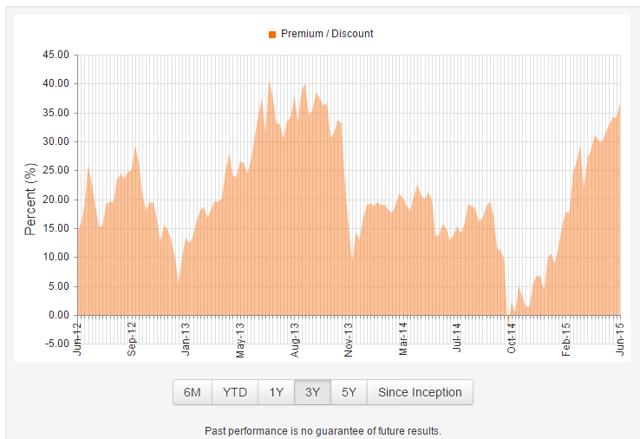

Summary CRF trades at a ~40% premium to NAV. Rich valuation driven by retail investors’ perception of high dividend yield. However, the yield is predominately just a return of investors’ own capital. Background on Closed End Funds A closed-end fund is a publicly traded investment company that raises a fixed amount of capital, and is then structured, listed and traded like a stock on a stock exchange. Whereas conventional mutual funds and ETFs frequently redeem / issue new shares to ensure that the price per share remains in line with the net asset value of the underlying holdings in the funds, this is not the case for CEFs. Rather the share price of CEFs is driven by the market forces of supply and demand, and can at times trade at either large discounts or premiums to NAV of the funds’ actual holdings. This is particularly the case given that the natural investor base for CEFs tends to be small, retail investors that in some cases do not fully understand the products that they are investing in. The Cornerstone Total Return Fund (NYSEMKT: CRF ) is one extreme example, which currently trades at among the most significant premiums to NAV in the CEF universe. Overview of CRF CRF is managed by Cornerstone Advisors, and is composed of a broadly diversified portfolio of stocks, with the largest holdings being some U.S. blue chips. A more comprehensive overview can be viewed in the fund’s annual report : (click to enlarge) (click to enlarge) Source: CRF 2014 Annual Report CRF’s expense ratio (based on 2014 figures) has been just over 1.4% of NAV. Unsustainable Yield Despite the relatively traditional composition of the fund, CRF currently pays a monthly dividend of $0.332 (equating to an annual yield of ~16.6%, or ~23% of the fund’s NAV). You might be asking yourself how this could be possible. The answer is simply that the bulk of the dividend is coming from a return of capital rather than ordinary income/capital gains. In other words, investors are being returned their own money in the fund. (click to enlarge) Source: CRF 2014 Annual Report. Note that per share figures in the table above do not reflect the one-for-four reverse stock split in Dec 2014. Unsurprisingly, the fund’s NAV has declined in turn, as shown in the chart below. (click to enlarge) Source: Yahoo Finance Rich Premium to NAV So now the question is, what do you think is the fair value of this CEF? I certainly wouldn’t pay any premium to NAV for a vanilla portfolio of equities with a ~1.4% expense ratio. Rather, I would prefer to buy a much cheaper ETF like SPY and simply sell part of the holdings each year if I needed the income. But apparently many retail investors disagree (institutional holdings of CRF stand at ~1%, according to Nasdaq), and have been lured in by the siren’s song of this CEF’s “dividend.” In fact CRF is currently trading at a 40% premium to NAV (and has been even higher in some past years). In other words, investors are willing to pay more than $1.40 for each $1 of the fund’s net assets. (click to enlarge) Source: CEF Connect Conclusion Though I hold a small short position in CRF, this is admittedly somewhat speculative given that the fund has in the past traded at any even more extreme premium to NAV, and the borrow cost has been in the mid-single to double digits. However, retail investors should be mindful of the risks that come with owning CEFs trading far above NAV. Disclosure: The author is short CRF. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary CRF trades at a ~40% premium to NAV. Rich valuation driven by retail investors’ perception of high dividend yield. However, the yield is predominately just a return of investors’ own capital. Background on Closed End Funds A closed-end fund is a publicly traded investment company that raises a fixed amount of capital, and is then structured, listed and traded like a stock on a stock exchange. Whereas conventional mutual funds and ETFs frequently redeem / issue new shares to ensure that the price per share remains in line with the net asset value of the underlying holdings in the funds, this is not the case for CEFs. Rather the share price of CEFs is driven by the market forces of supply and demand, and can at times trade at either large discounts or premiums to NAV of the funds’ actual holdings. This is particularly the case given that the natural investor base for CEFs tends to be small, retail investors that in some cases do not fully understand the products that they are investing in. The Cornerstone Total Return Fund (NYSEMKT: CRF ) is one extreme example, which currently trades at among the most significant premiums to NAV in the CEF universe. Overview of CRF CRF is managed by Cornerstone Advisors, and is composed of a broadly diversified portfolio of stocks, with the largest holdings being some U.S. blue chips. A more comprehensive overview can be viewed in the fund’s annual report : (click to enlarge) (click to enlarge) Source: CRF 2014 Annual Report CRF’s expense ratio (based on 2014 figures) has been just over 1.4% of NAV. Unsustainable Yield Despite the relatively traditional composition of the fund, CRF currently pays a monthly dividend of $0.332 (equating to an annual yield of ~16.6%, or ~23% of the fund’s NAV). You might be asking yourself how this could be possible. The answer is simply that the bulk of the dividend is coming from a return of capital rather than ordinary income/capital gains. In other words, investors are being returned their own money in the fund. (click to enlarge) Source: CRF 2014 Annual Report. Note that per share figures in the table above do not reflect the one-for-four reverse stock split in Dec 2014. Unsurprisingly, the fund’s NAV has declined in turn, as shown in the chart below. (click to enlarge) Source: Yahoo Finance Rich Premium to NAV So now the question is, what do you think is the fair value of this CEF? I certainly wouldn’t pay any premium to NAV for a vanilla portfolio of equities with a ~1.4% expense ratio. Rather, I would prefer to buy a much cheaper ETF like SPY and simply sell part of the holdings each year if I needed the income. But apparently many retail investors disagree (institutional holdings of CRF stand at ~1%, according to Nasdaq), and have been lured in by the siren’s song of this CEF’s “dividend.” In fact CRF is currently trading at a 40% premium to NAV (and has been even higher in some past years). In other words, investors are willing to pay more than $1.40 for each $1 of the fund’s net assets. (click to enlarge) Source: CEF Connect Conclusion Though I hold a small short position in CRF, this is admittedly somewhat speculative given that the fund has in the past traded at any even more extreme premium to NAV, and the borrow cost has been in the mid-single to double digits. However, retail investors should be mindful of the risks that come with owning CEFs trading far above NAV. Disclosure: The author is short CRF. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News