Scalper1 News

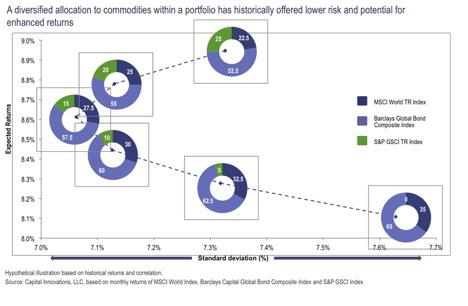

As investors continue to look for ways to diversify their portfolios away from traditional long-only stock and bond investments, real assets have become a popular alternative asset class. In fact institutional investors, such as leading endowments and foundations, have long used investments in real assets such as real estate, commodities, timber and energy as both a hedge against inflation and as a core diversifier. To provide more insight into this asset class and how institutional investors are using real assets, Michael Underhill, chief investment officer of Capital Innovations and a leading manager of multi-asset real return portfolios, answers a few questions for us on the topic. Given the increase in regional conflicts and greater overall geopolitical risks today, how is this influencing your respective portfolio positioning from both a macro and micro perspective? As geopolitical risks rise we would expect higher volatility in markets, increased risk of supply shocks to key commodities such as oil and food and a discounting of potential higher inflation and subsequent higher interest rates. As a hedge to these types of macro risks, exposure to real assets, and their relative inflation hedge qualities would become more attractive. Positioning on a more micro level we are incorporating these geopolitical risks and have been reducing our relative portfolio weighting in more interest rate sensitive groups such as electric utilities and telecomm and increasing more inflation hedge real assets such as energy, timber, agricultural commodities. What are the risks that investors should think about hedging or mitigating today and why? A common mistake investors make is to extrapolate current environment out too far and become complacent. The current environment of low interest rates, low inflation, and low volatility has afforded the opportunity to hedge the risk that this environment changes over the investment horizon. Do you want to bet that this backdrop we have had since the financial crisis does not change? The ideal time to add real asset exposure is when not many are thinking about it – buy an umbrella when the sun is shining. If we examine an allocation to real assets over the past 24 years, as shown in the chart below, we can see improved portfolio efficiency, with enhanced returns and lower volatility. Historical Effect of Allocating to Commodities (January 1980- July 2014) What are the opportunities investors should be seeking exposure to and why? In 2015, we expect improved global growth and a mid-year increase in US interest rates. The ECB and the BOJ remain in easing mode, and the policy outlook in the rest of the world varies considerably. The risk that global growth remains sluggish is high, and a lack of meaningful improvement could lead to a sharp increase in the dollar and a significant reorientation of capital flows. Most regions should see decreasing growth headwinds in 2015, although geopolitical uncertainties, volatile oil prices, and moderating Chinese growth remain concerns. It is for these reasons that we continue to advocate for a diversified, tactically managed, multi-asset portfolio that seeks to generate returns in excess of the actual rate of inflation and provides managed volatility rather than a single-asset-class solution. A broad range of real asset equity securities, including emerging markets and commodities, real estate investment trusts, and directly held positions in master limited partnerships. How does a global multi-asset real return strategy fit into a liability driven investing framework? The tangible properties of a real asset allow its price to fluctuate with overall market prices of physical assets. Real assets tend to be sensitive to inflation because of their tangible nature. Examples of real assets include direct investment in real estate, commodities, precious metals, timber, energy, farmland, precious metals, commodity-linked stocks, and commodity-linked hedge funds. Most investors are more familiar with investments in financial assets, which are contractual claims that do not generally have physical worth. In an LDI platform, real assets provide potential reductions in surplus volatility to the extent that real asset movements are not highly correlated to movements of financial assets. Returns from real assets may also boost returns since real assets are generally not as efficiently priced as the more competitively priced stocks and bonds. The return potential for real assets has become especially attractive in recent years since stocks and bonds have not performed well. From a risk management perspective, a key benefit from expanding asset classes to include real assets rests on correlations. A group of assets that have high correlations with each other but have low correlations with other groups of assets represent an asset class. There tends to be much less diversification potential from combining assets within an asset class than from combining assets from different asset classes. Real assets represent such a broad asset class that a wide range of correlations exist both within the asset class and with assets from other asset classes, allowing for attractive diversification. Our clients have found that the best performance comes from avoiding the large losses that markets often impose on passive investment portfolios. This tends to be especially important for real assets. As a first step we look behind the market consensus and identify where herding and overreaction phenomena may be at work. These phenomena occur both within and across asset classes. We perform extensive modeling with sensitivity analysis to find our best risk management strategy for an LDI structure. From there we model our best set of segments within an asset class and simulate the surplus volatility and return. This is not just simple quantitative analysis because we must also build in forward looking scenario planning. We track actual LDI performance against expected LDI performance. This type of tracking is revealing in that we can review what we were expecting when the allocations were set and identify where things developed differently. This type of learning over many years of experience is very helpful in building analysis skills. Scalper1 News

As investors continue to look for ways to diversify their portfolios away from traditional long-only stock and bond investments, real assets have become a popular alternative asset class. In fact institutional investors, such as leading endowments and foundations, have long used investments in real assets such as real estate, commodities, timber and energy as both a hedge against inflation and as a core diversifier. To provide more insight into this asset class and how institutional investors are using real assets, Michael Underhill, chief investment officer of Capital Innovations and a leading manager of multi-asset real return portfolios, answers a few questions for us on the topic. Given the increase in regional conflicts and greater overall geopolitical risks today, how is this influencing your respective portfolio positioning from both a macro and micro perspective? As geopolitical risks rise we would expect higher volatility in markets, increased risk of supply shocks to key commodities such as oil and food and a discounting of potential higher inflation and subsequent higher interest rates. As a hedge to these types of macro risks, exposure to real assets, and their relative inflation hedge qualities would become more attractive. Positioning on a more micro level we are incorporating these geopolitical risks and have been reducing our relative portfolio weighting in more interest rate sensitive groups such as electric utilities and telecomm and increasing more inflation hedge real assets such as energy, timber, agricultural commodities. What are the risks that investors should think about hedging or mitigating today and why? A common mistake investors make is to extrapolate current environment out too far and become complacent. The current environment of low interest rates, low inflation, and low volatility has afforded the opportunity to hedge the risk that this environment changes over the investment horizon. Do you want to bet that this backdrop we have had since the financial crisis does not change? The ideal time to add real asset exposure is when not many are thinking about it – buy an umbrella when the sun is shining. If we examine an allocation to real assets over the past 24 years, as shown in the chart below, we can see improved portfolio efficiency, with enhanced returns and lower volatility. Historical Effect of Allocating to Commodities (January 1980- July 2014) What are the opportunities investors should be seeking exposure to and why? In 2015, we expect improved global growth and a mid-year increase in US interest rates. The ECB and the BOJ remain in easing mode, and the policy outlook in the rest of the world varies considerably. The risk that global growth remains sluggish is high, and a lack of meaningful improvement could lead to a sharp increase in the dollar and a significant reorientation of capital flows. Most regions should see decreasing growth headwinds in 2015, although geopolitical uncertainties, volatile oil prices, and moderating Chinese growth remain concerns. It is for these reasons that we continue to advocate for a diversified, tactically managed, multi-asset portfolio that seeks to generate returns in excess of the actual rate of inflation and provides managed volatility rather than a single-asset-class solution. A broad range of real asset equity securities, including emerging markets and commodities, real estate investment trusts, and directly held positions in master limited partnerships. How does a global multi-asset real return strategy fit into a liability driven investing framework? The tangible properties of a real asset allow its price to fluctuate with overall market prices of physical assets. Real assets tend to be sensitive to inflation because of their tangible nature. Examples of real assets include direct investment in real estate, commodities, precious metals, timber, energy, farmland, precious metals, commodity-linked stocks, and commodity-linked hedge funds. Most investors are more familiar with investments in financial assets, which are contractual claims that do not generally have physical worth. In an LDI platform, real assets provide potential reductions in surplus volatility to the extent that real asset movements are not highly correlated to movements of financial assets. Returns from real assets may also boost returns since real assets are generally not as efficiently priced as the more competitively priced stocks and bonds. The return potential for real assets has become especially attractive in recent years since stocks and bonds have not performed well. From a risk management perspective, a key benefit from expanding asset classes to include real assets rests on correlations. A group of assets that have high correlations with each other but have low correlations with other groups of assets represent an asset class. There tends to be much less diversification potential from combining assets within an asset class than from combining assets from different asset classes. Real assets represent such a broad asset class that a wide range of correlations exist both within the asset class and with assets from other asset classes, allowing for attractive diversification. Our clients have found that the best performance comes from avoiding the large losses that markets often impose on passive investment portfolios. This tends to be especially important for real assets. As a first step we look behind the market consensus and identify where herding and overreaction phenomena may be at work. These phenomena occur both within and across asset classes. We perform extensive modeling with sensitivity analysis to find our best risk management strategy for an LDI structure. From there we model our best set of segments within an asset class and simulate the surplus volatility and return. This is not just simple quantitative analysis because we must also build in forward looking scenario planning. We track actual LDI performance against expected LDI performance. This type of tracking is revealing in that we can review what we were expecting when the allocations were set and identify where things developed differently. This type of learning over many years of experience is very helpful in building analysis skills. Scalper1 News

Scalper1 News