Dividend Growth Stock Overview: SJW Corporation

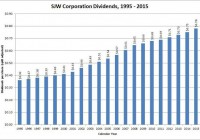

About SJW Corporation SJW Corporation (NYSE: SJW ) provides water services to customers in the San Jose, CA metropolitan area and to customers in the region between San Antonio and Austin, TX. The company was incorporated in California in February 1985, and is headquartered in San Jose. SJW has 395 full-time employees. The company is organized into four subsidiaries: (1) the San Jose Water Company; (2) SJWTX, Inc.; (3) SJW Land Company; and (4) the Texas Water Alliance. SJW Corporation does not report financial information for each of the subsidiaries separately. Originally incorporated in 1866, San Jose Water Company is the predecessor organization to SJW Corporation. In the 1985 reorganization, San Jose Water Company became a wholly-owned subsidiary of SJW Corporation. San Jose Water is a public utility that provides water service to over 1 million people in the metropolitan San Jose area. The company’s supply comes from a variety of sources, including groundwater, surface water, reclaimed water and imported water. Roughly 40-50% of its annual water production is purchased. SJWTX was incorporated in Texas in 1985, and does business as Canyon Lake Water Service Company. This subsidiary provides water service to roughly 36,000 people located in the region between San Antonio and Austin, TX. SJW Land Company owns undeveloped land in California and Tennessee, owns and operates commercial buildings in California, Arizona and Tennessee, and has a 70% interest in a real estate limited partnership. Finally, the Texas Water Alliance subsidiary is developing a water supply project in Texas to ensure future water supplies for the Canyon Lake Water Service Company. As a regulated utility, local and state authorities dictate SJW’s revenues and income. In 2014, the company had operating revenue of $320 million, which was up 15.5% from 2013. Net income more than doubled from 2013 to $51.8 million. Earnings per share did the same, coming in at $2.54, which gives the company a payout ratio of about 31% using the current annualized dividend of 78 cents per share. The revenue and income increase was due to approved rate changes, slightly offset by a reduction in customer water usage. The revenue increase continued in the 1st quarter of the year, with a 13.7% increase in revenue and a more than quadrupling of net income for the quarter year-over-year. In addition to the rate increases, the significant increase in net income was also due to a reduction of groundwater extraction costs. As a company that predominantly operates public utilities, SJW has had, and expects to have, large capital improvement expenditures. The company spent nearly $92 million on capital expenditures in 2014. In 2015, it plans to spend over $133 million as part of more than $660 million in capital improvements from 2015 to 2019. The company is a member of the Russell 2000 index and trades under the ticker symbol SJW. As of mid-July, the stock yielded 2.5%. SJW Corporation’s Dividend and Stock Split History (click to enlarge) SJW has grown dividends at less than 4% a year since 1995. SJW Corporation and its predecessor companies have paid dividends since 1944, and increased them since 1968. It announces annual dividend increases at the end of January, with the stock going ex-dividend in the first half of February. In January 2015, SJW announced a 4% dividend increase to an annualized rate of 78 cents per share. The company should announce its 49th consecutive annual dividend increase in January 2016. SJW Corp. historically increases its dividend in the low- to mid-single digit percentages, and the dividend growth rates reflect this. The company’s 5-year compounded annual dividend growth rate (CADGR) is 2.78%. Longer term, the CADGRs are slightly higher: the 10-year CADGR is 3.81%, the 20-year CADGR is 3.94% and the 25-year CADGR is 3.76%. SJW has split its stock twice. The splits occurred in close succession, with the company splitting the stock 3-for-1 in March 2004 and then 2-for-1 in March 2006. A single share purchased prior to March 2004 would have split into 6 shares. Over the 5 years ending December 31, 2014, SJW Corporation stock appreciated at an annualized rate of 10.40%, from a split-adjusted $19.35 to $31.73. This underperformed the 13.0% compounded return of the S&P 500 index and the 14.0% compounded return of the Russell 2000 Small Cap index over the same period. SJW Corporation’s Direct Purchase and Dividend Reinvestment Plans SJW does not have a direct purchase or dividend reinvestment plan. (The company initiated one for investors in 2011, but terminated it in 2014.) In order to invest in the stock, you’ll need to purchase it through a broker; most will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up, if you are interested. Helpful Links SJW Corporation’s Investor Relations Website Current quote and financial summary for SJW Corporation (finviz.com) Disclosure: I do not currently have, nor do I plan to take positions in SJW.