Scalper1 News

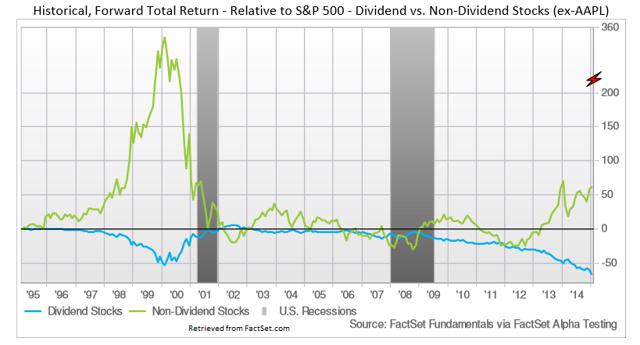

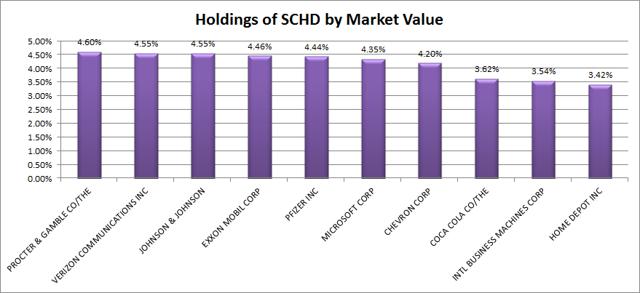

Summary SCHD offers a great portfolio for dividend investors to build around. During previous recessions (and corrections) the dividend paying companies of the S&P 500 held up better than those without dividends. With the high P/E ratios climbing over the last few years we have seen the market become more dangerous. Dividend stocks underperformed the last few years as the market became more bullish (expensive). A more bullish market makes me prefer SCHD over SPY. The holdings offer some great stocks and exposures that create natural hedges to the macroeconomic challenges. Dividend growth stocks offer investors a solid combination of current income and growth, but some investors still don’t understand their power. One of my favorite ETFs for this sector is the Schwab U.S. Dividend Equity ETF (NYSEARCA: SCHD ). Some investors will point out that they can pick and choose which individual dividend stocks offer the most compelling investments and there is nothing wrong with that plan. If an investor feels comfortable picking out individual stocks, they are welcome to do so. However, every investor needs to remember to stay diversified and that is where a low fee dividend ETF comes in. The Schwab U.S. Dividend Equity ETF has an expense ratio of only .07, is free for trading in Schwab accounts, and offers investors a yield of 2.88%. That isn’t a great yield, but it isn’t bad when considering how many companies the ETF needs to provide solid diversification. In this area I favor enhanced indexing. SCHD doesn’t need to be the only dividend investment in the portfolio, but it provides a solid piece to build around. Dividend Growth Performance Investors looking at returns over the last few years may feel like SCHD is failing to keep up with the market, but that is a natural consequence of the market getting bullish on stocks that don’t pay dividends. I prefer stocks with solid dividends. While investors should consider total return, I see no reason to move away from dividend stocks. Instead, I see the recent underperformance as making them more attractive. Since early November 2011, right after SCHD was formed, it has delivered returns of 64.6% compared to the SPDR S&P 500 Trust ETF ( SPY) delivering 79.13%. That weakness for SCHD has been a reflection of the large dividend stocks underperforming the index as shown in the chart below. (click to enlarge) Dividend stocks are out of favor and appeared to be going out of favor since 2012. As the P/E ratios climb to dangerously high levels, I would rather invest in the companies that are paying out dividends and delivering a meaningful portion of their earnings. I would rather invest in industries with strong dividend payouts. During the weakest markets, these stocks have held up better. If this market overheats, then SCHD looks like a great option to survive the weakness. If investors want to avoid losing by selling out at the bottom of a market, they would be wise to hold an investment where they can focus on the dividends rather than the panic. Holdings The following chart shows the top holdings of the Schwab U.S. Dividend Equity ETF ranked by their values. (click to enlarge) What dividend growth investor doesn’t like these companies? In my opinion, this is precisely the kind of diversification a dividend investor should be seeking. Who doesn’t like Procter and Gamble (NYSE: PG )? Some analysts can get bearish on it or argue that it is over-valued, but the point of the diversification is to protect investors from overpaying for a few companies. Verizon Communications Inc. (NYSE: VZ ) is one of the high yielding stocks (4.66%) that concern me because the telecommunications industry looks far less attractive when Sprint (NYSE: S ) is waging a price war that could severely damage earnings throughout the industry. I love the yield, but I have tried holding companies that in highly competitive industries marked by excessive growth of capacity and battles to deliver the lowest price. That was the investment where I had my worst losses and it taught me to be very wary of price based competition with excessive building of capacity. Exxon Mobile Corp. (NYSE: XOM ) is a great play on the oil industry and either it or another major oil company belongs in every dividend growth investor’s portfolio. The beauty of oil is that crashing prices on oil mean more income for middle class and lower class consumers. Cheap oil means lower costs for transporting materials. Cheap oil is good for most of the portfolio. On the other hand, expensive oil is a headwind for many major companies and a tailwind for the big oil players like XOM. This should be a natural holding for dividend growth investors. Conclusion SCHD is a solid way for investors to get a core holding for their dividend growth portfolio. It offers an excellent selection of major dividend growth champions which allows investors to build their portfolio around those champions by overweighting the companies that best align with their risk tolerance and goals. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary SCHD offers a great portfolio for dividend investors to build around. During previous recessions (and corrections) the dividend paying companies of the S&P 500 held up better than those without dividends. With the high P/E ratios climbing over the last few years we have seen the market become more dangerous. Dividend stocks underperformed the last few years as the market became more bullish (expensive). A more bullish market makes me prefer SCHD over SPY. The holdings offer some great stocks and exposures that create natural hedges to the macroeconomic challenges. Dividend growth stocks offer investors a solid combination of current income and growth, but some investors still don’t understand their power. One of my favorite ETFs for this sector is the Schwab U.S. Dividend Equity ETF (NYSEARCA: SCHD ). Some investors will point out that they can pick and choose which individual dividend stocks offer the most compelling investments and there is nothing wrong with that plan. If an investor feels comfortable picking out individual stocks, they are welcome to do so. However, every investor needs to remember to stay diversified and that is where a low fee dividend ETF comes in. The Schwab U.S. Dividend Equity ETF has an expense ratio of only .07, is free for trading in Schwab accounts, and offers investors a yield of 2.88%. That isn’t a great yield, but it isn’t bad when considering how many companies the ETF needs to provide solid diversification. In this area I favor enhanced indexing. SCHD doesn’t need to be the only dividend investment in the portfolio, but it provides a solid piece to build around. Dividend Growth Performance Investors looking at returns over the last few years may feel like SCHD is failing to keep up with the market, but that is a natural consequence of the market getting bullish on stocks that don’t pay dividends. I prefer stocks with solid dividends. While investors should consider total return, I see no reason to move away from dividend stocks. Instead, I see the recent underperformance as making them more attractive. Since early November 2011, right after SCHD was formed, it has delivered returns of 64.6% compared to the SPDR S&P 500 Trust ETF ( SPY) delivering 79.13%. That weakness for SCHD has been a reflection of the large dividend stocks underperforming the index as shown in the chart below. (click to enlarge) Dividend stocks are out of favor and appeared to be going out of favor since 2012. As the P/E ratios climb to dangerously high levels, I would rather invest in the companies that are paying out dividends and delivering a meaningful portion of their earnings. I would rather invest in industries with strong dividend payouts. During the weakest markets, these stocks have held up better. If this market overheats, then SCHD looks like a great option to survive the weakness. If investors want to avoid losing by selling out at the bottom of a market, they would be wise to hold an investment where they can focus on the dividends rather than the panic. Holdings The following chart shows the top holdings of the Schwab U.S. Dividend Equity ETF ranked by their values. (click to enlarge) What dividend growth investor doesn’t like these companies? In my opinion, this is precisely the kind of diversification a dividend investor should be seeking. Who doesn’t like Procter and Gamble (NYSE: PG )? Some analysts can get bearish on it or argue that it is over-valued, but the point of the diversification is to protect investors from overpaying for a few companies. Verizon Communications Inc. (NYSE: VZ ) is one of the high yielding stocks (4.66%) that concern me because the telecommunications industry looks far less attractive when Sprint (NYSE: S ) is waging a price war that could severely damage earnings throughout the industry. I love the yield, but I have tried holding companies that in highly competitive industries marked by excessive growth of capacity and battles to deliver the lowest price. That was the investment where I had my worst losses and it taught me to be very wary of price based competition with excessive building of capacity. Exxon Mobile Corp. (NYSE: XOM ) is a great play on the oil industry and either it or another major oil company belongs in every dividend growth investor’s portfolio. The beauty of oil is that crashing prices on oil mean more income for middle class and lower class consumers. Cheap oil means lower costs for transporting materials. Cheap oil is good for most of the portfolio. On the other hand, expensive oil is a headwind for many major companies and a tailwind for the big oil players like XOM. This should be a natural holding for dividend growth investors. Conclusion SCHD is a solid way for investors to get a core holding for their dividend growth portfolio. It offers an excellent selection of major dividend growth champions which allows investors to build their portfolio around those champions by overweighting the companies that best align with their risk tolerance and goals. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News