Southern Company: A Stock For Income Investors

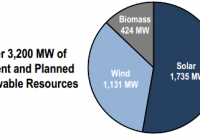

SO has been undertaking correct strategic initiatives by incurring capital spending to develop and strengthen power generation fleet. Company can opt to accelerate its capital spending targeted at renewable power sources. Southern expects to grow its long-term earnings in a range of 3%-4%. Dividend offered by SO stays secure, and the stock is a good investment prospect for income-hunting investors. Utility companies have remained a popular investment choice for income-seeking investors, as utilities offer attractive and solid dividends. In recent times, utility companies have accelerated their capital spending to expand and strengthen regulated operations. Also, utility companies have been scaling down unregulated operations, which will provide stability to their revenue and earnings. Southern Company (NYSE: SO ), which has a solid regulated asset base, stays an impressive investment prospect for long-term income investors, as it offers a solid yield of 5.1% . The company has been undertaking various construction projects and incurring capital investment to strengthen its regulated asset base, which will fuel its rate base and earnings growth in future. However, delays and cost overruns associated with the ongoing construction projects have inflated the company’s risk profile and will limit the upside to the stock price in the near term. The stock is trading at a slight discount to its peers on the basis of forward P/E, which I think is justified given risk delays and cost overruns. Financial Highlights and Stock Price Catalysts The company’s financial performance is backed by its regulated assets base; the company generates more than 90% of its earnings from regulated operations. Southern Company posted a strong performance for 2Q2015; EPS for the quarter came out to be $0.71 , ahead of consensus of $0.69 and the 2Q2014 EPS of $0.68. The performance for the second quarter was supported by rate increases, the strong performance of its subsidiary Southern Power and favorable weather conditions; total weather normalized sales increased by 1%. Also, the company enjoyed weather normalized growth for the second consecutive quarter in all of its three customer segments, including commercial, residential and industrial segments. The company maintained its 2015 EPS guidance range of $2.76-$2.88; however, I think given its strong first half performance, Southern will increase its EPS guidance range for 2015 in October during the 3Q2015 earnings call. The company has been making capital investments to strengthen its power generating fleet; the company plans to make capital spending of more than $16 billion from 2015 through 2017, which will allow its long-term earnings to grow in a range of 3%-4% . In addition, the company has been aggressively working to grow its renewable generation portfolio, and plans to have a renewable generation capacity of almost 3,200MW, including solar, wind and biomass. The company will continue to direct capital spending toward the expanding renewable energy portfolio to take advantage of the 30% solar investment tax credit before the end of 2016. Moreover, given the attractive regulatory environment for renewable capital spending, the company can opt to increase its capital spending for future years, which will positively affect its future earnings growth and the stock price. The following graph reflects the current and planned renewable resources for Southern. Source: Investors Presentation Despite the company’s strong regulated asset base, the ongoing construction of nuclear and coal gasification (IGCC) projects stay a concern for investors. The company’s nuclear project ‘Vogtle’ is on track, and unit 3 and unit 4 are expected to be in operation in 2Q2019 and 2Q2020, respectively; however, substantial construction work remains, and cost overruns and delays will weigh on the stock price. On the other side, the company registered another charge of $14 million for the Kemper project; the project is expected to be completed by 1Q2016. However, delays beyond 1Q2016 are expected to increase the project cost by $20-$30 million every month. Cost overruns and construction delays associated with the ongoing two construction projects have inflated Southern’s risk profile and will limit stock price appreciation in the near term, and the stock return will be dividend driven. The stock trades at a slight discount to peers, which I think is justified given the construction risk attached to the company; Southern is trading at a forward P/E of 15.20x , versus the utility sector’s forward P/E of 16.5x . In my opinion, the stock valuation will not expand and the stock will not trade in-line with its industry P/E multiple until the company’s construction project-related risk decrease or/and its EPS growth accelerates. Separately, the company’s management does not have any plans to issue equity until 2017 to finance its planned capital investments; however, if the company experiences delays and increases in construction costs, the management might revisit their financing assumptions and could consider to issue equity, which will adversely affect its EPS. Summation Southern Company has been undertaking the correct strategic initiatives by incurring capital spending to develop and strengthen its power generation fleet. Going forward, the company can opt to accelerate its capital spending targeted at renewable power sources, which will augur well for its long-term earnings growth; currently, Southern expects to grow its long-term earnings in a range of 3%-4%. Also, dividend offered by the company stays secure, and the stock is a good investment prospect for income-hunting investors, as it offers a yield of 5.1%. However, the construction risk will limit a stock price increase in the near term. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.