Scalper1 News

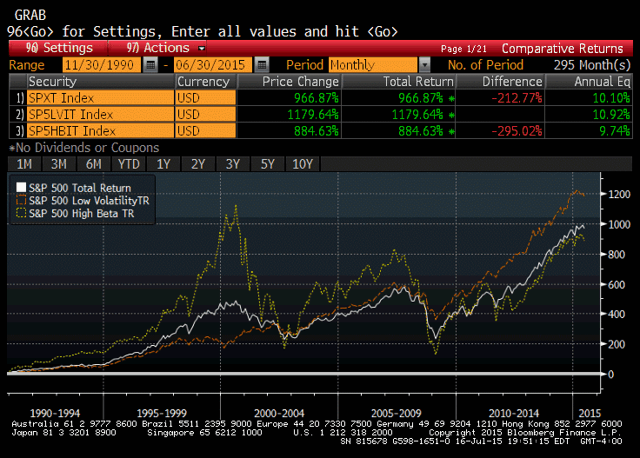

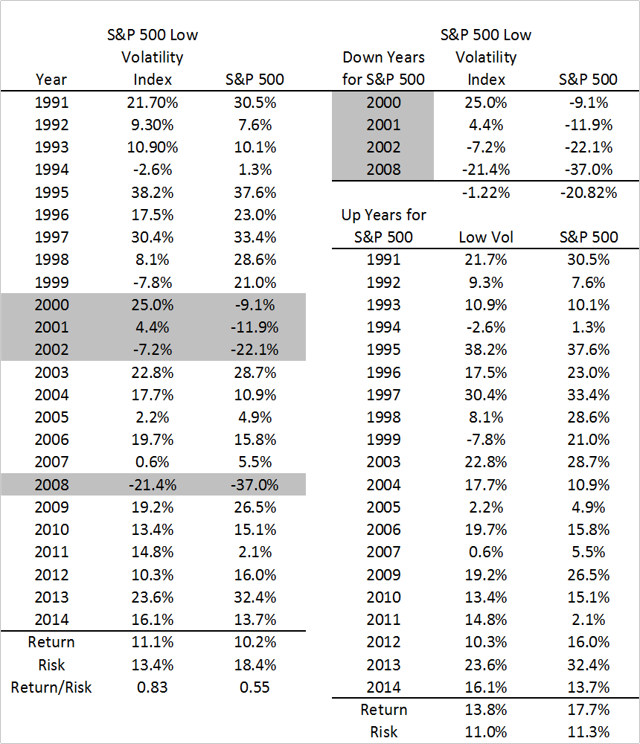

This series offers an expansive look at the Low Volatility Anomaly, or why lower-risk securities have historically produced stronger risk-adjusted returns than higher-risk securities or the broader market. This article shows in simple terms how a Low Volatility strategy would have done in both up and down markets. The downside protection in bear markets more than makes up for lagging returns in bull markets to generate higher risk-adjusted returns over time. Through this expansive series on Low Volatility Investing, I have tried to give readers a theoretical underpinning for why low volatility strategies have produced “alpha” historically while presenting empirical evidence across markets, geographies, and long time intervals. In this article, I am returning to the example of the S&P 500 Low Volatility Index (replicated by SPLV ). This index is comprised of the one-hundred constituents of the S&P 500 (NYSEARCA: SPY ) with the lowest realized volatility over the trailing one year, weighted by the inverse of their volatility, and rebalanced quarterly. As seen in the introductory article to this series and displayed again below, a low volatility factor tilt has produced higher absolute returns than the broader market or its high beta components (NYSEARCA: SPHB ) while producing its namesake lower volatility return profile. Source: Standard and Poor’s; Bloomberg Index information for the Low Volatility and High Beta Indices are back-tested, based on the methodology that was in effect on the launch date of the indices. While the higher risk-adjusted returns inherent in the Low Volatility strategy is visible in this cumulative return series, I though that it would be instructive for Seeking Alpha readers to see the annual returns of the Low Volatility strategy and S&P 500 broken down by up and down years for the broad market gauge. The historical returns of the two indices are tabled on the left. On the right, I have broken these return series into the four down years for the S&P 500 in this sample period and the up years for this broad market gauge. (click to enlarge) In up years for the broad market, the S&P 500 outperformed the S&P Low Volatility Index by 3.9% per year. However, in the down years for the broad market, the S&P 500 Low Volatility Index bested the broader market by 19.6% per year. It is this outperformance in down markets that has led to the long-run higher absolute returns for the S&P Low Volatility Index. Readers should note that the majority of the outperformance of the S&P 500 in up markets was in 1998 and 1999 when a tech-fueled S&P 500 outperformed the Low Volatility Index. The S&P 500 would produce negative returns over the subsequent three years. Some readers might posit that they will time when to pivot to Low Volatility stocks or even to zero volatility cash from the broader equity market, capturing higher returns during bull markets while crafting their own downside protection through good foresight. For practitioners with a more cloudy crystal ball, low volatility strategies may be a good buy-and-hold strategy for producing higher long-run risk-adjusted returns. In late 2014, I published Low Volatility Strategies in Bull Markets , which showed this Low Volatility gauge had captured all of the market performance over the previous five years. To outperform low volatility stocks, investors would have had to pivot quickly to riskier equity strategies very early in the market recovery in 2009. This is easier said than done, and a buy-and-hold low volatility strategy may be of value to many Seeking Alpha readers. For investors with a higher risk tolerance and an interest in capturing incremental returns from a tilt towards higher beta stocks, read tomorrow’s article on a switching strategy using low volatility stocks and momentum that has produced tremendous long-run alpha and is one of my favorite pieces in this series. Disclaimer My articles may contain statements and projections that are forward-looking in nature, and therefore, inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: I am/we are long SPLV, SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

This series offers an expansive look at the Low Volatility Anomaly, or why lower-risk securities have historically produced stronger risk-adjusted returns than higher-risk securities or the broader market. This article shows in simple terms how a Low Volatility strategy would have done in both up and down markets. The downside protection in bear markets more than makes up for lagging returns in bull markets to generate higher risk-adjusted returns over time. Through this expansive series on Low Volatility Investing, I have tried to give readers a theoretical underpinning for why low volatility strategies have produced “alpha” historically while presenting empirical evidence across markets, geographies, and long time intervals. In this article, I am returning to the example of the S&P 500 Low Volatility Index (replicated by SPLV ). This index is comprised of the one-hundred constituents of the S&P 500 (NYSEARCA: SPY ) with the lowest realized volatility over the trailing one year, weighted by the inverse of their volatility, and rebalanced quarterly. As seen in the introductory article to this series and displayed again below, a low volatility factor tilt has produced higher absolute returns than the broader market or its high beta components (NYSEARCA: SPHB ) while producing its namesake lower volatility return profile. Source: Standard and Poor’s; Bloomberg Index information for the Low Volatility and High Beta Indices are back-tested, based on the methodology that was in effect on the launch date of the indices. While the higher risk-adjusted returns inherent in the Low Volatility strategy is visible in this cumulative return series, I though that it would be instructive for Seeking Alpha readers to see the annual returns of the Low Volatility strategy and S&P 500 broken down by up and down years for the broad market gauge. The historical returns of the two indices are tabled on the left. On the right, I have broken these return series into the four down years for the S&P 500 in this sample period and the up years for this broad market gauge. (click to enlarge) In up years for the broad market, the S&P 500 outperformed the S&P Low Volatility Index by 3.9% per year. However, in the down years for the broad market, the S&P 500 Low Volatility Index bested the broader market by 19.6% per year. It is this outperformance in down markets that has led to the long-run higher absolute returns for the S&P Low Volatility Index. Readers should note that the majority of the outperformance of the S&P 500 in up markets was in 1998 and 1999 when a tech-fueled S&P 500 outperformed the Low Volatility Index. The S&P 500 would produce negative returns over the subsequent three years. Some readers might posit that they will time when to pivot to Low Volatility stocks or even to zero volatility cash from the broader equity market, capturing higher returns during bull markets while crafting their own downside protection through good foresight. For practitioners with a more cloudy crystal ball, low volatility strategies may be a good buy-and-hold strategy for producing higher long-run risk-adjusted returns. In late 2014, I published Low Volatility Strategies in Bull Markets , which showed this Low Volatility gauge had captured all of the market performance over the previous five years. To outperform low volatility stocks, investors would have had to pivot quickly to riskier equity strategies very early in the market recovery in 2009. This is easier said than done, and a buy-and-hold low volatility strategy may be of value to many Seeking Alpha readers. For investors with a higher risk tolerance and an interest in capturing incremental returns from a tilt towards higher beta stocks, read tomorrow’s article on a switching strategy using low volatility stocks and momentum that has produced tremendous long-run alpha and is one of my favorite pieces in this series. Disclaimer My articles may contain statements and projections that are forward-looking in nature, and therefore, inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon. Disclosure: I am/we are long SPLV, SPY. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News