Scalper1 News

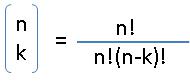

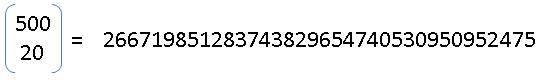

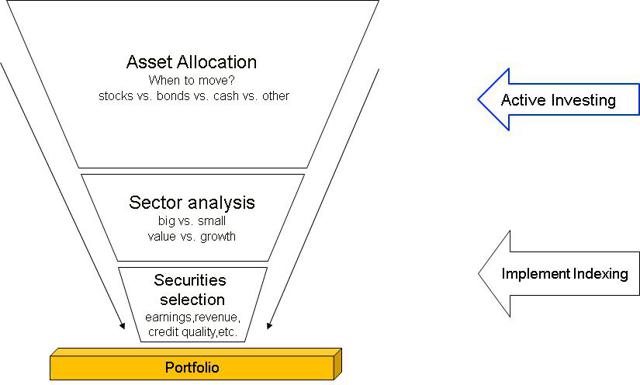

The combination from creating a 20 stock portfolio is a number beyond this earth. A simpler indexing approach provides several benefits like low unsystematic risk and low cost. You can still be active and pursue a source of alpha while also retaining the benefits of index investing. In ABC’s ‘The Bachelor’, the road to love involves weeks of flirting, romance, cat fights, twist and turns, where one guy is introduced to 25 lovely girls. Picking 1 out of 25 girls must be a lot of work. Likewise, researching stocks is a lot of work and arguably not as fun as dating. But you have many choices. The S&P 500, often used as a proxy for the total US stock market, offers 500 choices. If one were trying to create a 20 stock portfolio, how much work would be appropriate and what are the possibilities? Instead of trying to quantify the workload necessary, an especially subjective matter, let’s gauge the implications of the variables involved in picking stocks by looking at all the resulting combinations that are possible. For our group of stocks, let’s take the S&P500, consisting of 500 individual stocks. To take out capitalization weighting effects, we will actually use the S&P 500 equal weighted index, which includes the same constituents as the capitalization weighted S&P 500. Picking a certain number of stocks out of 500 is a simple calculation using binomial coefficients, mathematics used since the 10th century in India. Binomial coefficients are a family of positive integers that occur as coefficients in the binomial theorem. The coefficients that appear in the expansion are usually written as: This method is applicable because selecting stocks from a group is essentially picking k objects from a population of n distinct objects without replacement and without regard to order. If we select 20 stocks for our portfolio, there are 266719851283743829654740530950952475 combinations of selecting 20 stocks out of a group of 500, calculated from simply applying binomial coefficients: To grasp the magnitude of this amount, if each combination was the height of a flat dollar bill, the stack of dollar bills would scale up from the earth to the sun about 195 quintillion times. (quintillion is a billion billions). Likewise, the stack of dollar bills would go from our Sun to its nearest star, Proxima Centauri 726 trillion times. Comparatively, if the Voyager 1 spacecraft (speed=38000mph) were to go to Proxima Centauri, it would take over 73 thousand years to arrive. The many different possible portfolios are staggering, even when limiting selection only within the S&P500. With so many, inevitably one combination, picked arbitrarily at random could beat a combination created by a professional. This sheds light on the often heard claim that a monkey can out-pick a mutual fund manager. But nobody should pick stocks, bonds, or other securities at random. You wouldn’t pick your next boyfriend, girlfriend, potential spouse at random. You would expect a better outcome if you are discerning in your selection. Accordingly, thousands of discerning mutual fund managers seek superior performance and some actually achieve it. Of course, magazines like Forbes report time and again that the majority of professional can’t beat the index. However, the Wall Street Journal ran an expert vs. random dart throwing simulation for 14 years, but declared no clear winner. No clear winner will ever be discovered in this holy war, because of the staggering number of possibilities. One way to simplify investing is to invest in the index. Indexing provides several benefits like low cost and low unsystematic risk, even lower than a 20 stock portfolio. You do not have to be entirely passive. Instead of being active in the securities selection layer, another approach is to be active at asset allocation layer, using index investing. (click to enlarge) When constructing your portfolio, consider where you should put most of your effort. One approach employed by many professionals focuses on a top-down investment strategy attempting to exploit opportunities among a set of assets, positioning a portfolio into assets or sectors that show the most potential for gains. The strategy focuses on the relative performance of asset classes rather than on the performance of individual securities. With more focus on the asset allocation layer, one can still seek a source of alpha while also retaining the benefits of index investing. Further, the derivative securities used to actively asset allocate are highly liquid and low cost to transact for example, (NYSEARCA: SPY ),(NYSEARCA: EFA ),(NYSEARCA: BND ). Additional disclosure: Article is for educational purposes only and does not constitute financial advice. Scalper1 News

The combination from creating a 20 stock portfolio is a number beyond this earth. A simpler indexing approach provides several benefits like low unsystematic risk and low cost. You can still be active and pursue a source of alpha while also retaining the benefits of index investing. In ABC’s ‘The Bachelor’, the road to love involves weeks of flirting, romance, cat fights, twist and turns, where one guy is introduced to 25 lovely girls. Picking 1 out of 25 girls must be a lot of work. Likewise, researching stocks is a lot of work and arguably not as fun as dating. But you have many choices. The S&P 500, often used as a proxy for the total US stock market, offers 500 choices. If one were trying to create a 20 stock portfolio, how much work would be appropriate and what are the possibilities? Instead of trying to quantify the workload necessary, an especially subjective matter, let’s gauge the implications of the variables involved in picking stocks by looking at all the resulting combinations that are possible. For our group of stocks, let’s take the S&P500, consisting of 500 individual stocks. To take out capitalization weighting effects, we will actually use the S&P 500 equal weighted index, which includes the same constituents as the capitalization weighted S&P 500. Picking a certain number of stocks out of 500 is a simple calculation using binomial coefficients, mathematics used since the 10th century in India. Binomial coefficients are a family of positive integers that occur as coefficients in the binomial theorem. The coefficients that appear in the expansion are usually written as: This method is applicable because selecting stocks from a group is essentially picking k objects from a population of n distinct objects without replacement and without regard to order. If we select 20 stocks for our portfolio, there are 266719851283743829654740530950952475 combinations of selecting 20 stocks out of a group of 500, calculated from simply applying binomial coefficients: To grasp the magnitude of this amount, if each combination was the height of a flat dollar bill, the stack of dollar bills would scale up from the earth to the sun about 195 quintillion times. (quintillion is a billion billions). Likewise, the stack of dollar bills would go from our Sun to its nearest star, Proxima Centauri 726 trillion times. Comparatively, if the Voyager 1 spacecraft (speed=38000mph) were to go to Proxima Centauri, it would take over 73 thousand years to arrive. The many different possible portfolios are staggering, even when limiting selection only within the S&P500. With so many, inevitably one combination, picked arbitrarily at random could beat a combination created by a professional. This sheds light on the often heard claim that a monkey can out-pick a mutual fund manager. But nobody should pick stocks, bonds, or other securities at random. You wouldn’t pick your next boyfriend, girlfriend, potential spouse at random. You would expect a better outcome if you are discerning in your selection. Accordingly, thousands of discerning mutual fund managers seek superior performance and some actually achieve it. Of course, magazines like Forbes report time and again that the majority of professional can’t beat the index. However, the Wall Street Journal ran an expert vs. random dart throwing simulation for 14 years, but declared no clear winner. No clear winner will ever be discovered in this holy war, because of the staggering number of possibilities. One way to simplify investing is to invest in the index. Indexing provides several benefits like low cost and low unsystematic risk, even lower than a 20 stock portfolio. You do not have to be entirely passive. Instead of being active in the securities selection layer, another approach is to be active at asset allocation layer, using index investing. (click to enlarge) When constructing your portfolio, consider where you should put most of your effort. One approach employed by many professionals focuses on a top-down investment strategy attempting to exploit opportunities among a set of assets, positioning a portfolio into assets or sectors that show the most potential for gains. The strategy focuses on the relative performance of asset classes rather than on the performance of individual securities. With more focus on the asset allocation layer, one can still seek a source of alpha while also retaining the benefits of index investing. Further, the derivative securities used to actively asset allocate are highly liquid and low cost to transact for example, (NYSEARCA: SPY ),(NYSEARCA: EFA ),(NYSEARCA: BND ). Additional disclosure: Article is for educational purposes only and does not constitute financial advice. Scalper1 News

Scalper1 News