Scalper1 News

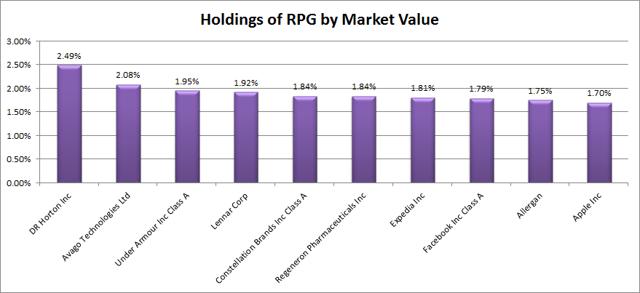

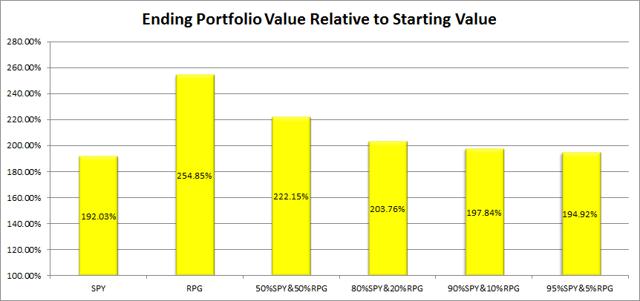

Summary The ETF looked solid all around. The standard deviation is a bit high relative to SPY, but that should be expected for tracking a smaller portion of the index. The strong liquidity may reflect many investors coming to the same conclusion about the ETF. It looks worthy of deeper consideration. Diversification within the ETF is solid, but investors should be aware that the portfolio turnover is very high. Investors should be seeking to improve their risk-adjusted returns. I’m a big fan of using ETFs to achieve the risk-adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. A substantial portion of my analysis will use modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. In this article, I’m reviewing the Guggenheim S&P 500 ® Pure Growth ETF (NYSEARCA: RPG ). What does RPG do? RPG attempts to track the investment results of S&P 500 ® Pure Growth Index. The ETF falls under the category of “Large Growth”. Standard deviation of monthly returns (dividend adjusted, measured since April 2006) The standard deviation isn’t going to make a strong case for investing in RPG. For the period I’ve chosen, the standard deviation of monthly returns was 5.210%. For SPY, it was 4.416% over the same period. The higher level of volatility for RPG is a challenge since the correlation between the two funds is 94.87%. Yield & Taxes The distribution yield is .69%. I prefer higher yields so that they are more appealing for retiring investor portfolios. Sure, they could sell shares to generate income, but that may create a temptation to change the portfolio strategy at the wrong time. Expense Ratio The ETF is posting a gross expense ratio of .35% and a net expense ratio of .35%. Unfortunately, most ETFs have expense ratios higher than I’d like to see. This is another case where I prefer lower, but it isn’t going to be high enough to make me eliminate an ETF that otherwise has a fairly strong performance. The expense ratio for RPG isn’t all profit to the manager of the fund either. The fund should be incurring substantially more costs than a passive index fund because the portfolio turnover has been running at 46%. The holdings of RPG one year may be very dramatically different than the holdings in the following year. For comparison, only 19.2% of the portfolio value is in the top 10 holdings. The fund could completely exit those positions twice per year and still have a lower portfolio turnover. Market to NAV The ETF is trading at a .06% premium to NAV currently. I think any ETF is significantly less attractive when it trades above NAV and more attractive below NAV. A .06% premium is not enough to matter though. Investors should check prior to placing an order, but the liquidity in RPG should be a great hedge against any meaningful premiums or discounts. Liquidity The liquidity is excellent. I see no concerns. Average volume has been around 100,000 shares per day with share prices around $82 per share. That’s over $8 million changing hands each day. Largest Holdings The diversification within the ETF is pretty solid. Where else will you find an ETF that includes Apple (NASDAQ: AAPL ) but only has it in 10th place for weighting? (click to enlarge) Conclusion This is another Guggenheim ETF worthy of consideration. While I’d like to see lower expense ratios, I find them reasonable for the level of turnover in the holdings. On an economic level, I find it doubtful that investors will produce alpha over the long term through frequent trading when accounting for the costs of that trading. On the other hand, RPG is precisely the fund to contract me on that. Just look at the returns on the fund and you’ll see what I mean: (click to enlarge) RPG thoroughly outperformed SPY over the sample period. I’ve included comparisons that use RPG for smaller portions of the portfolio since I think few investors would decide to invest their entire portfolio into RPG. The correlation is fairly high, but it is also expected since the ETF is tracking part of the same index. The standard deviation of returns is fairly high relative to SPY, but can be tolerated if expected returns are higher. Since the ETF is on the Schwab One Source list, regular rebalancing is definitely an option for funds with strong liquidity. All around, this appears to be a solid ETF for investors that are willing to accept additional volatility and believe that the regular trading can lead to higher risk-adjusted returns. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary The ETF looked solid all around. The standard deviation is a bit high relative to SPY, but that should be expected for tracking a smaller portion of the index. The strong liquidity may reflect many investors coming to the same conclusion about the ETF. It looks worthy of deeper consideration. Diversification within the ETF is solid, but investors should be aware that the portfolio turnover is very high. Investors should be seeking to improve their risk-adjusted returns. I’m a big fan of using ETFs to achieve the risk-adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. A substantial portion of my analysis will use modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. In this article, I’m reviewing the Guggenheim S&P 500 ® Pure Growth ETF (NYSEARCA: RPG ). What does RPG do? RPG attempts to track the investment results of S&P 500 ® Pure Growth Index. The ETF falls under the category of “Large Growth”. Standard deviation of monthly returns (dividend adjusted, measured since April 2006) The standard deviation isn’t going to make a strong case for investing in RPG. For the period I’ve chosen, the standard deviation of monthly returns was 5.210%. For SPY, it was 4.416% over the same period. The higher level of volatility for RPG is a challenge since the correlation between the two funds is 94.87%. Yield & Taxes The distribution yield is .69%. I prefer higher yields so that they are more appealing for retiring investor portfolios. Sure, they could sell shares to generate income, but that may create a temptation to change the portfolio strategy at the wrong time. Expense Ratio The ETF is posting a gross expense ratio of .35% and a net expense ratio of .35%. Unfortunately, most ETFs have expense ratios higher than I’d like to see. This is another case where I prefer lower, but it isn’t going to be high enough to make me eliminate an ETF that otherwise has a fairly strong performance. The expense ratio for RPG isn’t all profit to the manager of the fund either. The fund should be incurring substantially more costs than a passive index fund because the portfolio turnover has been running at 46%. The holdings of RPG one year may be very dramatically different than the holdings in the following year. For comparison, only 19.2% of the portfolio value is in the top 10 holdings. The fund could completely exit those positions twice per year and still have a lower portfolio turnover. Market to NAV The ETF is trading at a .06% premium to NAV currently. I think any ETF is significantly less attractive when it trades above NAV and more attractive below NAV. A .06% premium is not enough to matter though. Investors should check prior to placing an order, but the liquidity in RPG should be a great hedge against any meaningful premiums or discounts. Liquidity The liquidity is excellent. I see no concerns. Average volume has been around 100,000 shares per day with share prices around $82 per share. That’s over $8 million changing hands each day. Largest Holdings The diversification within the ETF is pretty solid. Where else will you find an ETF that includes Apple (NASDAQ: AAPL ) but only has it in 10th place for weighting? (click to enlarge) Conclusion This is another Guggenheim ETF worthy of consideration. While I’d like to see lower expense ratios, I find them reasonable for the level of turnover in the holdings. On an economic level, I find it doubtful that investors will produce alpha over the long term through frequent trading when accounting for the costs of that trading. On the other hand, RPG is precisely the fund to contract me on that. Just look at the returns on the fund and you’ll see what I mean: (click to enlarge) RPG thoroughly outperformed SPY over the sample period. I’ve included comparisons that use RPG for smaller portions of the portfolio since I think few investors would decide to invest their entire portfolio into RPG. The correlation is fairly high, but it is also expected since the ETF is tracking part of the same index. The standard deviation of returns is fairly high relative to SPY, but can be tolerated if expected returns are higher. Since the ETF is on the Schwab One Source list, regular rebalancing is definitely an option for funds with strong liquidity. All around, this appears to be a solid ETF for investors that are willing to accept additional volatility and believe that the regular trading can lead to higher risk-adjusted returns. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News