Scalper1 News

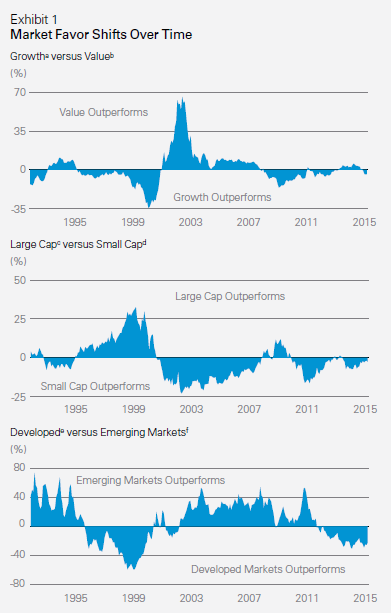

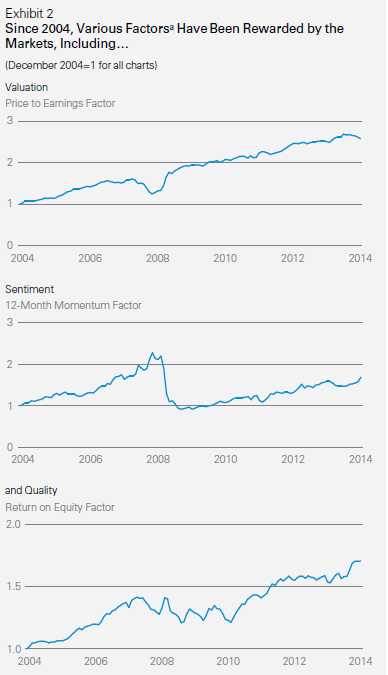

By DailyAlts Staff Core investments are those that anchor the portfolio. Typically, investors pursue exposure to broad-market benchmarks, such as S&P 500 or MSCI indexes for stocks, and the Barclays Aggregate Index for bonds, as part of their core holdings, with the intent of minimizing the unexpected. But rather than passively investing in index funds, Lazard (NYSE: LAZ ) thinks investors should take a systematic approach to implementing core investing strategies, and that is the subject of the firm’s latest Investment Focus white paper: Core Advantage: The Case for a Systematic Approach to Core Investing . The Non-Systematic Approach Managers pursuing non-systematic approaches to providing core exposure suffer from several pitfalls, first among which is the tendency for them to introduce unwanted risks to a portfolio in pursuit of benchmark-beating returns. This can happen from overweighting stocks according to style, market cap, or geographic region. While it might prove rewarding under certain market environments, it can result in outsized losses when trends unexpectedly reverse, and this is not what most investors are looking for from their core holdings. The image below shows how market favor has vacillated over time, shifting between growth and value stocks; large caps and small; and developed and emerging markets: The Systematic Approach The authors of Lazard’s paper believe the systematic approach is the best for core investing, because it allows managers to maintain stricter parameters relative to their benchmark, by ensuring against concentration according to market cap, sector, or country. Additionally, using a rules-based, data-driven, and systematic approach allows managers to analyze hundreds, even thousands of stocks within a given universe, in real-time using a bottom-up process; and to combine “robust risk management” with stock selection. How does it work? Well, according to Lazard, various risk factors have been rewarded by markets over time, including valuation, sentiment, and quality, as depicted in the image below: Valuation compares a company’s price to its peers and its own historical record, and favors companies that are inexpensive and offer long-term value. It’s a contrarian approach, and investors need to be prepared to endure short-term, unrealized losses. Sentiment is gauged by looking at the stock’s price strength, relative to the other stocks in its sector and broader benchmark, as well as analyst upgrades. In Lazard’s approach, liquidity is also taken into account by looking at volume-weighted momentum, and companies with strengthening momentum are favored while those with weakening momentum are disfavored. Quality is assessed by stability of returns and low earnings-volatility. According to Lazard, quality stocks are often those in the process of “migrating” from the realm of growth stocks to that of value. Systematic Evolution Systematic investing avoids concentrating investments in any one area and seeks to maintain a composition similar to that of its benchmark. This requires what Lazard calls an “evolving approach,” wherein investment professionals are constantly researching and testing potential improvements to the investment process. Lazard’s own approach, as implemented by the Lazard Equity Advantage team, is “uniquely positioned to help clients achieve their investment goals,” according to Lazard. “This has proved to be a solid foundation on which to build equity asset class exposure – especially through core approaches – and long-term investment program success.” For more information, download a pdf copy of the white paper . Scalper1 News

By DailyAlts Staff Core investments are those that anchor the portfolio. Typically, investors pursue exposure to broad-market benchmarks, such as S&P 500 or MSCI indexes for stocks, and the Barclays Aggregate Index for bonds, as part of their core holdings, with the intent of minimizing the unexpected. But rather than passively investing in index funds, Lazard (NYSE: LAZ ) thinks investors should take a systematic approach to implementing core investing strategies, and that is the subject of the firm’s latest Investment Focus white paper: Core Advantage: The Case for a Systematic Approach to Core Investing . The Non-Systematic Approach Managers pursuing non-systematic approaches to providing core exposure suffer from several pitfalls, first among which is the tendency for them to introduce unwanted risks to a portfolio in pursuit of benchmark-beating returns. This can happen from overweighting stocks according to style, market cap, or geographic region. While it might prove rewarding under certain market environments, it can result in outsized losses when trends unexpectedly reverse, and this is not what most investors are looking for from their core holdings. The image below shows how market favor has vacillated over time, shifting between growth and value stocks; large caps and small; and developed and emerging markets: The Systematic Approach The authors of Lazard’s paper believe the systematic approach is the best for core investing, because it allows managers to maintain stricter parameters relative to their benchmark, by ensuring against concentration according to market cap, sector, or country. Additionally, using a rules-based, data-driven, and systematic approach allows managers to analyze hundreds, even thousands of stocks within a given universe, in real-time using a bottom-up process; and to combine “robust risk management” with stock selection. How does it work? Well, according to Lazard, various risk factors have been rewarded by markets over time, including valuation, sentiment, and quality, as depicted in the image below: Valuation compares a company’s price to its peers and its own historical record, and favors companies that are inexpensive and offer long-term value. It’s a contrarian approach, and investors need to be prepared to endure short-term, unrealized losses. Sentiment is gauged by looking at the stock’s price strength, relative to the other stocks in its sector and broader benchmark, as well as analyst upgrades. In Lazard’s approach, liquidity is also taken into account by looking at volume-weighted momentum, and companies with strengthening momentum are favored while those with weakening momentum are disfavored. Quality is assessed by stability of returns and low earnings-volatility. According to Lazard, quality stocks are often those in the process of “migrating” from the realm of growth stocks to that of value. Systematic Evolution Systematic investing avoids concentrating investments in any one area and seeks to maintain a composition similar to that of its benchmark. This requires what Lazard calls an “evolving approach,” wherein investment professionals are constantly researching and testing potential improvements to the investment process. Lazard’s own approach, as implemented by the Lazard Equity Advantage team, is “uniquely positioned to help clients achieve their investment goals,” according to Lazard. “This has proved to be a solid foundation on which to build equity asset class exposure – especially through core approaches – and long-term investment program success.” For more information, download a pdf copy of the white paper . Scalper1 News

Scalper1 News