Scalper1 News

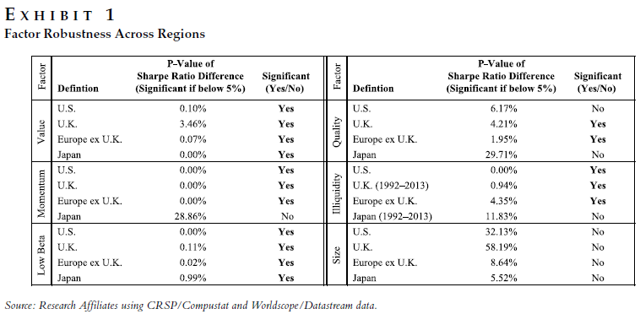

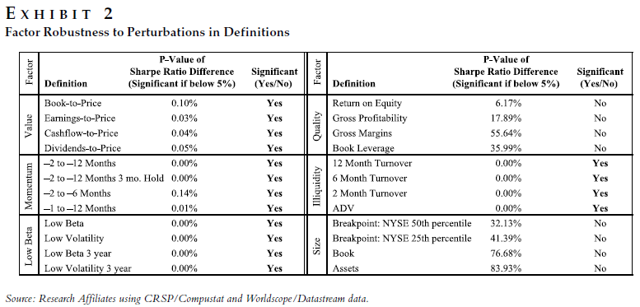

By DailyAlts Staff The proliferation of smart beta ETFs may be a relatively recent phenomenon, but the risk factors used to construct smart-beta indexes – most notably value, momentum, low beta, quality, illiquidity, and size – have been a popular topic for financial researchers for nearly three decades. Building off the early handful of factors, factor-based investing has since been expanded to as many as 250 distinct factors that have allegedly generated historical outperformance, but Research Affiliates’ Jason Hsu, Vitali Kalesnik, and Vivek Viswanathan argue that the supposed outperformance of most (if not all) of these new factors is illusory, based on cherry-picking by researchers and “artifacts” of the data. In fact, Mr. Hsu and his colleagues believe at least one of the traditional factors may be unlikely to generate superior risk-adjusted returns going forward. The researchers make their case in the Summer 2015 edition of The Journal of Index Investing , in an article titled “A Framework for Assessing Factors and Implementing Smart Beta Strategies.” Factor Robustness Hsu, et al. allege that economists, financial researchers, and other quantitative analysts are constantly trying to determine new factors, and that only their positive results are likely to get published. New research undermining an existing and semi-popular factor is unlikely to make it to the stage of peer review, according to Research Affiliates. This means that investors, advisors, and other decision-makers must test would-be factors for robustness themselves. Behind the quantitative data, Hsu, et al. insist that factors must be based on economic intuition and make sense within a theoretical framework – otherwise, they’re likely to be statistical noise. Factor premiums can be based on risk or behavioral issues, but in either case, they should span across geographic markets. If back-testing reveals a factor premium for U.S. stocks, that same premium should be evident in Japan and elsewhere. But when analyzed across geographic regions, only the value and low-beta factors consistently hold up; while momentum, quality, and illiquidity are mixed; and size shows no consistency whatsoever. (click to enlarge) Factor Perturbations Since legitimate factors must make intuitive sense, it stands to reason that they should hold up under “perturbations” of their definitions. For example, the value factor is typically defined with book-to-price ratio, but dividend yield and earnings yield (earnings-to-price) also make sense. Therefore, if the value premium were only evident when measured according to book-to-price, the theoretical framework would crumble. Fortunately for value investors, Research Affiliates’ research indicates that value holds up well under a variety of definitions – as do the momentum, low-beta, and illiquidity factors – but quality and size do not. (click to enlarge) Size Doesn’t Matter? According to Hsu, et al., the small-size factor premium is based on back-testing that includes several months of major small-cap outperformance back in the 1930s, and the factor has not generated alpha since its discovery in the early 1980s. Of course, the 1930s were a time of deflation (strengthening dollar) and the 1980s kicked off a 30-year bull market in bonds (weakening the dollar), which could play a significant role in the data. Today, it is generally assumed that small-cap stocks – with a higher degree of U.S. dollar exposure – benefit from a strong currency. Implementation and Allocation Hsu, et al.’s paper looks into implementation and allocation issues, as well, and notes that transaction costs are rarely taken into account by factor-based investors – and this is a mistake. To maximize risk-adjusted returns, factor-based investors should rotate their portfolios only as often as is necessary to capture the factor premium, and no more. The authors say that factor allocation faces many of the same challenges as asset allocation, and that smart-beta solutions should be customized to meet individual investors’ unique risk tolerances. For more information, visit researchaffiliates.com to download a pdf copy of the paper . Scalper1 News

By DailyAlts Staff The proliferation of smart beta ETFs may be a relatively recent phenomenon, but the risk factors used to construct smart-beta indexes – most notably value, momentum, low beta, quality, illiquidity, and size – have been a popular topic for financial researchers for nearly three decades. Building off the early handful of factors, factor-based investing has since been expanded to as many as 250 distinct factors that have allegedly generated historical outperformance, but Research Affiliates’ Jason Hsu, Vitali Kalesnik, and Vivek Viswanathan argue that the supposed outperformance of most (if not all) of these new factors is illusory, based on cherry-picking by researchers and “artifacts” of the data. In fact, Mr. Hsu and his colleagues believe at least one of the traditional factors may be unlikely to generate superior risk-adjusted returns going forward. The researchers make their case in the Summer 2015 edition of The Journal of Index Investing , in an article titled “A Framework for Assessing Factors and Implementing Smart Beta Strategies.” Factor Robustness Hsu, et al. allege that economists, financial researchers, and other quantitative analysts are constantly trying to determine new factors, and that only their positive results are likely to get published. New research undermining an existing and semi-popular factor is unlikely to make it to the stage of peer review, according to Research Affiliates. This means that investors, advisors, and other decision-makers must test would-be factors for robustness themselves. Behind the quantitative data, Hsu, et al. insist that factors must be based on economic intuition and make sense within a theoretical framework – otherwise, they’re likely to be statistical noise. Factor premiums can be based on risk or behavioral issues, but in either case, they should span across geographic markets. If back-testing reveals a factor premium for U.S. stocks, that same premium should be evident in Japan and elsewhere. But when analyzed across geographic regions, only the value and low-beta factors consistently hold up; while momentum, quality, and illiquidity are mixed; and size shows no consistency whatsoever. (click to enlarge) Factor Perturbations Since legitimate factors must make intuitive sense, it stands to reason that they should hold up under “perturbations” of their definitions. For example, the value factor is typically defined with book-to-price ratio, but dividend yield and earnings yield (earnings-to-price) also make sense. Therefore, if the value premium were only evident when measured according to book-to-price, the theoretical framework would crumble. Fortunately for value investors, Research Affiliates’ research indicates that value holds up well under a variety of definitions – as do the momentum, low-beta, and illiquidity factors – but quality and size do not. (click to enlarge) Size Doesn’t Matter? According to Hsu, et al., the small-size factor premium is based on back-testing that includes several months of major small-cap outperformance back in the 1930s, and the factor has not generated alpha since its discovery in the early 1980s. Of course, the 1930s were a time of deflation (strengthening dollar) and the 1980s kicked off a 30-year bull market in bonds (weakening the dollar), which could play a significant role in the data. Today, it is generally assumed that small-cap stocks – with a higher degree of U.S. dollar exposure – benefit from a strong currency. Implementation and Allocation Hsu, et al.’s paper looks into implementation and allocation issues, as well, and notes that transaction costs are rarely taken into account by factor-based investors – and this is a mistake. To maximize risk-adjusted returns, factor-based investors should rotate their portfolios only as often as is necessary to capture the factor premium, and no more. The authors say that factor allocation faces many of the same challenges as asset allocation, and that smart-beta solutions should be customized to meet individual investors’ unique risk tolerances. For more information, visit researchaffiliates.com to download a pdf copy of the paper . Scalper1 News

Scalper1 News