Scalper1 News

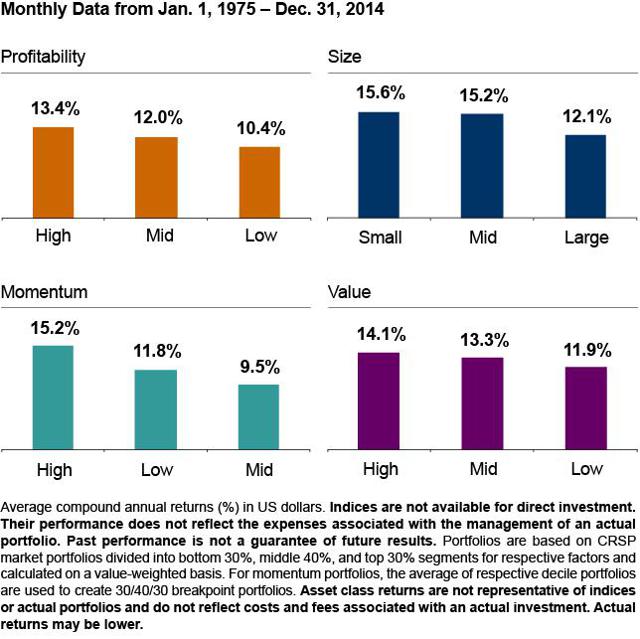

Summary Most large cap stock active fund managers underperformed their benchmarks in the 15 years to December 2014. Active large growth funds performed much better than large value funds vis-à-vis benchmarks. Virtually all of actively managed growth funds’ outperformance can be explained by quantitative multi-factor analysis. Americans have invested trillions of dollars in actively managed mutual funds in the hope of beating an index such as the S&P 500 or the Russell 1000 Growth. At Gerstein Fisher, we believe that markets tend to do a pretty good job of pricing risk and that most investors are better off “buying the market” (via an index fund) than trying to beat it. But we also think that there’s a better way to invest in equities than through either purely passive indexing or traditional active management. I’ll get to that method shortly after sharing summary results of a multi-step fund performance study that we recently conducted. Active Funds and Benchmarks We analyzed two Morningstar categories of funds, large cap growth and large cap value, from January 1, 1990 to December 31, 2014. During this 15-year period, 37% of the growth funds and 42% of the value funds disappeared-liquidated, merged, etc. We studied this aspect to eliminate survivorship bias in the study; obviously, funds that are shuttered by managers tend to be the poor performers. In the next step, we measured how many of the surviving funds outperformed their benchmarks during the 15-year time frame. Of the large cap growth survivors, 67.5% beat their benchmark (Russell 1000 Growth), while just 49% of the living value funds beat their bogey (Russell 1000 Value). All told, 42% of the large cap growth funds that existed in January 1990 beat their benchmark, compared to only 28% of large cap value funds. Moreover, the average outperformance for active growth was 2.14 percentage points per year vs. just 1.17 points for the active value funds. Two conclusions we can draw from this research are that 1) It is very difficult for professional portfolio managers to outperform an index, and 2) Growth appears to be the investing style that quite consistently performs best among actively managed funds. In fact, neither of these conclusions is either particularly new or surprising, as past research by Gerstein Fisher and others has amply demonstrated. See, for example, ” In Mutual Funds, is Active vs. Passive the Right Question? ” Explaining Outperformance But here is where the research gets really interesting. We conducted an extensive statistical analysis of the large cap growth funds that outperformed. We drilled down and studied whether quantifiable company characteristics, or “factors”, could be used to explain the outperformance. We honed in on just four factors– size, value, momentum and profitability-to measure the extent to which excess exposure (relative to the Russell 1000 Growth Index) to these factors could explain outperformance. I’ll digress very briefly to explain the theory and evolution of multi-factor investing. In 1976, Steve Ross published a landmark paper on Arbitrage Pricing Theory, which explained that security returns are best explained by more than one factor.* Since then, academics have identified dozens of quantifiable variables, such as momentum, that impact stock returns. In effect, even stocks from different industries that share similar such characteristics should generate similar returns. The Exhibit below illustrates the premiums over a 40-year period for the four factors we used to analyze the active growth funds. Note, for instance, that investors were historically rewarded with a 3-point premium (per year) for investing in more profitable companies and 3.5 points for being in smaller companies. (click to enlarge) Now back to our study. When we accounted for the momentum, size, value and profitability factors, we found that only 1.6% of the managers actually outperformed the benchmark (after adjusting for positive tilts to these four factors), or generated positive alpha (i.e., excess return of a fund relative to its benchmark). Another way of stating this is that 98.4% of the outperformers had higher factor exposure than the benchmark. For example, 95% of these winners had a positive tilt to value (relative to the Russell 1000 Growth Index) and 64% had higher-than-index exposure to smaller companies. Given this evidence that outperformance of active growth managers is almost entirely explained through their (witting or unwitting) excess exposure to certain factors, the next question is whether there is a rigorous, methodical, quantitative way to target certain factor exposures in order to outperform the index over extended time periods. We believe that there is-the Multi-Factor® quantitative investing style that underpins our three equity mutual funds. In the coming weeks, I plan to write a series of articles to elaborate on the principles and applications of multi-factor investing. In advance of that, I invite you to read a short piece we recently published on this investment strategy: ” What is a Multi-Factor Investment Approach? ” Conclusion Active fund managers have great difficulty beating passive indexes over long time periods. Actively managed growth funds perform well relative to benchmarks compared to value funds, but nearly all of the growth funds’ outperformance can be explained quantitatively by multi-factor analysis. *Finance students will recognize the factor-premium formula for portfolio return–+β11 +β22 +… … + β n n + –where portfolio return is described as the sum of the risk-free rate, factor exposures, and alpha. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Most large cap stock active fund managers underperformed their benchmarks in the 15 years to December 2014. Active large growth funds performed much better than large value funds vis-à-vis benchmarks. Virtually all of actively managed growth funds’ outperformance can be explained by quantitative multi-factor analysis. Americans have invested trillions of dollars in actively managed mutual funds in the hope of beating an index such as the S&P 500 or the Russell 1000 Growth. At Gerstein Fisher, we believe that markets tend to do a pretty good job of pricing risk and that most investors are better off “buying the market” (via an index fund) than trying to beat it. But we also think that there’s a better way to invest in equities than through either purely passive indexing or traditional active management. I’ll get to that method shortly after sharing summary results of a multi-step fund performance study that we recently conducted. Active Funds and Benchmarks We analyzed two Morningstar categories of funds, large cap growth and large cap value, from January 1, 1990 to December 31, 2014. During this 15-year period, 37% of the growth funds and 42% of the value funds disappeared-liquidated, merged, etc. We studied this aspect to eliminate survivorship bias in the study; obviously, funds that are shuttered by managers tend to be the poor performers. In the next step, we measured how many of the surviving funds outperformed their benchmarks during the 15-year time frame. Of the large cap growth survivors, 67.5% beat their benchmark (Russell 1000 Growth), while just 49% of the living value funds beat their bogey (Russell 1000 Value). All told, 42% of the large cap growth funds that existed in January 1990 beat their benchmark, compared to only 28% of large cap value funds. Moreover, the average outperformance for active growth was 2.14 percentage points per year vs. just 1.17 points for the active value funds. Two conclusions we can draw from this research are that 1) It is very difficult for professional portfolio managers to outperform an index, and 2) Growth appears to be the investing style that quite consistently performs best among actively managed funds. In fact, neither of these conclusions is either particularly new or surprising, as past research by Gerstein Fisher and others has amply demonstrated. See, for example, ” In Mutual Funds, is Active vs. Passive the Right Question? ” Explaining Outperformance But here is where the research gets really interesting. We conducted an extensive statistical analysis of the large cap growth funds that outperformed. We drilled down and studied whether quantifiable company characteristics, or “factors”, could be used to explain the outperformance. We honed in on just four factors– size, value, momentum and profitability-to measure the extent to which excess exposure (relative to the Russell 1000 Growth Index) to these factors could explain outperformance. I’ll digress very briefly to explain the theory and evolution of multi-factor investing. In 1976, Steve Ross published a landmark paper on Arbitrage Pricing Theory, which explained that security returns are best explained by more than one factor.* Since then, academics have identified dozens of quantifiable variables, such as momentum, that impact stock returns. In effect, even stocks from different industries that share similar such characteristics should generate similar returns. The Exhibit below illustrates the premiums over a 40-year period for the four factors we used to analyze the active growth funds. Note, for instance, that investors were historically rewarded with a 3-point premium (per year) for investing in more profitable companies and 3.5 points for being in smaller companies. (click to enlarge) Now back to our study. When we accounted for the momentum, size, value and profitability factors, we found that only 1.6% of the managers actually outperformed the benchmark (after adjusting for positive tilts to these four factors), or generated positive alpha (i.e., excess return of a fund relative to its benchmark). Another way of stating this is that 98.4% of the outperformers had higher factor exposure than the benchmark. For example, 95% of these winners had a positive tilt to value (relative to the Russell 1000 Growth Index) and 64% had higher-than-index exposure to smaller companies. Given this evidence that outperformance of active growth managers is almost entirely explained through their (witting or unwitting) excess exposure to certain factors, the next question is whether there is a rigorous, methodical, quantitative way to target certain factor exposures in order to outperform the index over extended time periods. We believe that there is-the Multi-Factor® quantitative investing style that underpins our three equity mutual funds. In the coming weeks, I plan to write a series of articles to elaborate on the principles and applications of multi-factor investing. In advance of that, I invite you to read a short piece we recently published on this investment strategy: ” What is a Multi-Factor Investment Approach? ” Conclusion Active fund managers have great difficulty beating passive indexes over long time periods. Actively managed growth funds perform well relative to benchmarks compared to value funds, but nearly all of the growth funds’ outperformance can be explained quantitatively by multi-factor analysis. *Finance students will recognize the factor-premium formula for portfolio return–+β11 +β22 +… … + β n n + –where portfolio return is described as the sum of the risk-free rate, factor exposures, and alpha. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News