Scalper1 News

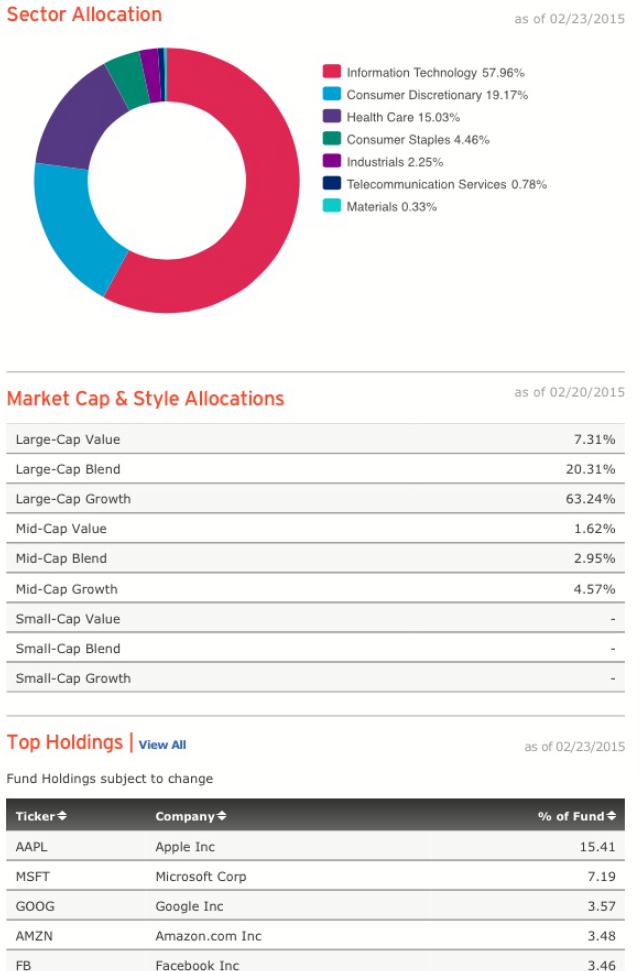

Summary QQQ has posted annual returns of 25.3% during the most recent bull market (2009-2014), outpacing the NASDAQ, S&P 500 and Dow Jones by 2.9%, 7.7%, and 9.5% annually, respectively. Since the inception of the current bull market through year-to-date, the fund has outperformed the NASDAQ, S&P 500 and Dow Jones on a cumulative basis by 46%, 108%, and 136%, respectively. QQQ presents a compelling investment opportunity in a cohort of high-quality stocks with a technology-centric ETF portfolio, specifically during bull markets. Introduction: The PowerShares QQQ Trust ETF (NASDAQ: QQQ ) provides investors with exposure to some of the best names in the technology sector, primarily in the form of domestic stocks. This non-financial concentration gives rise to some of the biggest players in innovation and growth such as Apple (NASDAQ: AAPL ), Microsoft (NASDAQ: MSFT ), Google (NASDAQ: GOOG ) (NASDAQ: GOOGL ), and Facebook (NASDAQ: FB ). Per Invesco Ltd. (NYSE: IVZ ): “PowerShares QQQ is an exchange-traded fund based on the Nasdaq-100 Index ® . The Fund will, under most circumstances, consist of all of stocks in the Index. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. The Fund and the Index are rebalanced quarterly and reconstituted annually”. The majority of the ETF is allocated towards the information technology sector and large-cap growth as depicted in figure 1. The top 5 holdings consist of Apple, Microsoft, Google, Amazon (NASDAQ: AMZN ) and Facebook and make up over a third of the entire portfolio by weight. QQQ presents a compelling investment opportunity in a cohort of high-quality stocks with a technology-centric ETF portfolio, specifically during bull markets. Figure 1 – Invesco’s sector and market capitalization breakdown within QQQ Running with the bulls: After the market crash of 2008, QQQ took off and outperformed all major indices and has never looked back. Since the inception of the current bull market run in 2009, QQQ has outperformed the NASDAQ, S&P 500, and Dow Jones on a cumulative basis by 46%, 108%, and 136%, respectively (Figure 2). The ETF outperformed all three indices on an annual basis throughout this time period as well. QQQ has posted annual returns of 25.3% during the most recent bull market (2009-2014), outpacing the NASDAQ, S&P 500 and Dow Jones by 2.9%, 7.7%, and 9.5% annually, respectively. Taken together, QQQ has posted impressive returns by significantly outperforming all major indices during the latest bull market, that’s in its 7th year both on an annual and cumulative basis. (click to enlarge) Figure 2 – Google Finance graph comparing the cumulative returns of QQQ relative to the major indices (S&P 500, Dow Jones and NASDAQ) from 2008 to year-to-date QQQ long-term returns negate underperformance in bear markets During the bear market of 2008, QQQ marginally underperformed all three major indices; NASDAQ, S&P 500, and Dow Jones by 1.9%, 3.6%, and 7.6%, respectively (Figure 3). On a cumulative basis, QQQ has outperformed all the major indices by a wide margin over the past decade. Cumulative returns over the past 10 years have outperformed the Dow Jones, S&P 500 and NASDAQ by 122%, 116% and 35%, respectively (Figure 4). Over this same time period, the ETF has boasted an impressive annual return of 13.8%. Despite the underperformance relative to the broader indices during the bear market of 2008, the overall returns in the long term, specifically during bull cycles, negate this underperformance and make a compelling case to belong in any long portfolio. (click to enlarge) Figure 3 – Google Finance graph comparing the returns of QQQ relative to the major indices (S&P 500, Dow Jones and NASDAQ) throughout the market crash of 2008 (click to enlarge) Figure 4 – Google Finance graph comparing the cumulative returns of QQQ relative to the major indices (S&P 500, Dow Jones and NASDAQ) from 2005 through year-to-date The intrinsic dividend and share buyback component: Many of the companies within the QQQ portfolio not only offer a dividend, but also reward shareholders via share buybacks. Share buybacks can serve as an effective way to drive shareholder value via returning capital by repurchasing their own stock. I’ve discussed this dual synergy in detail in my previous published Seeking Alpha premium article covering the share buyback ETF; the PowerShares Buyback Achievers Portfolio ETF (NYSEARCA: PKW ) ” PKW Presents A Compelling Investment Opportunity “. In brief, theoretically, repurchasing and retiring shares satisfies many pro-shareholder objectives: 1) Reducing the number of shares tilts the supply and demand curve, thereby removing shares will decrease supply and in turn increase demand and drive the share price higher. 2) Earnings per share increase since earnings are now divided over fewer shares. 3) If share buybacks are coupled with a dividend, the dividend yield will increase as long as the quarterly payout amount remains unchanged, and as a result, the payout will be divided over fewer shares. Apple and Microsoft are great examples of stocks within the ETF that reward shareholders with dividends and share buybacks. A number of constituents within the ETF help to drive share value with share buybacks while the aggregate holdings pay out a dividend of 1.00% to augment total return. QQQ provides a competitive yield to augment the growth component of the ETF, thus appears to be attractive as a potential candidate for any long portfolio. Summary: QQQ presents a compelling investment opportunity in a cohort of high-quality stocks with a technology-centric ETF portfolio, specifically during bull markets. The ETF currently holds an overall five-star Morningstar rating for its 3, 5, and 10-year time frames. Over the same time periods, QQQ has a return rating of high and risk rating of above-average. Taken together, this ETF offers great returns unparalleled by any index with above-average risk. Considering the annual and cumulative returns that are accentuated coming out of bear markets, the mix of high-quality, large, non-financial growth stocks, the intrinsic dividend and share buyback component, and the sound fundamentals of these large growth companies to drive growth and innovation presents a compelling investment opportunity for any long portfolio. Disclosure: The author currently holds shares of QQQ and is long QQQ. The author has no business relationship with any companies mentioned in this article. I am not a professional financial advisor or tax professional. I am an individual investor who analyzes investment strategies and disseminates my analyses. I encourage all investors to conduct their own research and due diligence. Please feel free to comment and provide feedback, I value all responses. Disclosure: The author is long QQQ. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary QQQ has posted annual returns of 25.3% during the most recent bull market (2009-2014), outpacing the NASDAQ, S&P 500 and Dow Jones by 2.9%, 7.7%, and 9.5% annually, respectively. Since the inception of the current bull market through year-to-date, the fund has outperformed the NASDAQ, S&P 500 and Dow Jones on a cumulative basis by 46%, 108%, and 136%, respectively. QQQ presents a compelling investment opportunity in a cohort of high-quality stocks with a technology-centric ETF portfolio, specifically during bull markets. Introduction: The PowerShares QQQ Trust ETF (NASDAQ: QQQ ) provides investors with exposure to some of the best names in the technology sector, primarily in the form of domestic stocks. This non-financial concentration gives rise to some of the biggest players in innovation and growth such as Apple (NASDAQ: AAPL ), Microsoft (NASDAQ: MSFT ), Google (NASDAQ: GOOG ) (NASDAQ: GOOGL ), and Facebook (NASDAQ: FB ). Per Invesco Ltd. (NYSE: IVZ ): “PowerShares QQQ is an exchange-traded fund based on the Nasdaq-100 Index ® . The Fund will, under most circumstances, consist of all of stocks in the Index. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. The Fund and the Index are rebalanced quarterly and reconstituted annually”. The majority of the ETF is allocated towards the information technology sector and large-cap growth as depicted in figure 1. The top 5 holdings consist of Apple, Microsoft, Google, Amazon (NASDAQ: AMZN ) and Facebook and make up over a third of the entire portfolio by weight. QQQ presents a compelling investment opportunity in a cohort of high-quality stocks with a technology-centric ETF portfolio, specifically during bull markets. Figure 1 – Invesco’s sector and market capitalization breakdown within QQQ Running with the bulls: After the market crash of 2008, QQQ took off and outperformed all major indices and has never looked back. Since the inception of the current bull market run in 2009, QQQ has outperformed the NASDAQ, S&P 500, and Dow Jones on a cumulative basis by 46%, 108%, and 136%, respectively (Figure 2). The ETF outperformed all three indices on an annual basis throughout this time period as well. QQQ has posted annual returns of 25.3% during the most recent bull market (2009-2014), outpacing the NASDAQ, S&P 500 and Dow Jones by 2.9%, 7.7%, and 9.5% annually, respectively. Taken together, QQQ has posted impressive returns by significantly outperforming all major indices during the latest bull market, that’s in its 7th year both on an annual and cumulative basis. (click to enlarge) Figure 2 – Google Finance graph comparing the cumulative returns of QQQ relative to the major indices (S&P 500, Dow Jones and NASDAQ) from 2008 to year-to-date QQQ long-term returns negate underperformance in bear markets During the bear market of 2008, QQQ marginally underperformed all three major indices; NASDAQ, S&P 500, and Dow Jones by 1.9%, 3.6%, and 7.6%, respectively (Figure 3). On a cumulative basis, QQQ has outperformed all the major indices by a wide margin over the past decade. Cumulative returns over the past 10 years have outperformed the Dow Jones, S&P 500 and NASDAQ by 122%, 116% and 35%, respectively (Figure 4). Over this same time period, the ETF has boasted an impressive annual return of 13.8%. Despite the underperformance relative to the broader indices during the bear market of 2008, the overall returns in the long term, specifically during bull cycles, negate this underperformance and make a compelling case to belong in any long portfolio. (click to enlarge) Figure 3 – Google Finance graph comparing the returns of QQQ relative to the major indices (S&P 500, Dow Jones and NASDAQ) throughout the market crash of 2008 (click to enlarge) Figure 4 – Google Finance graph comparing the cumulative returns of QQQ relative to the major indices (S&P 500, Dow Jones and NASDAQ) from 2005 through year-to-date The intrinsic dividend and share buyback component: Many of the companies within the QQQ portfolio not only offer a dividend, but also reward shareholders via share buybacks. Share buybacks can serve as an effective way to drive shareholder value via returning capital by repurchasing their own stock. I’ve discussed this dual synergy in detail in my previous published Seeking Alpha premium article covering the share buyback ETF; the PowerShares Buyback Achievers Portfolio ETF (NYSEARCA: PKW ) ” PKW Presents A Compelling Investment Opportunity “. In brief, theoretically, repurchasing and retiring shares satisfies many pro-shareholder objectives: 1) Reducing the number of shares tilts the supply and demand curve, thereby removing shares will decrease supply and in turn increase demand and drive the share price higher. 2) Earnings per share increase since earnings are now divided over fewer shares. 3) If share buybacks are coupled with a dividend, the dividend yield will increase as long as the quarterly payout amount remains unchanged, and as a result, the payout will be divided over fewer shares. Apple and Microsoft are great examples of stocks within the ETF that reward shareholders with dividends and share buybacks. A number of constituents within the ETF help to drive share value with share buybacks while the aggregate holdings pay out a dividend of 1.00% to augment total return. QQQ provides a competitive yield to augment the growth component of the ETF, thus appears to be attractive as a potential candidate for any long portfolio. Summary: QQQ presents a compelling investment opportunity in a cohort of high-quality stocks with a technology-centric ETF portfolio, specifically during bull markets. The ETF currently holds an overall five-star Morningstar rating for its 3, 5, and 10-year time frames. Over the same time periods, QQQ has a return rating of high and risk rating of above-average. Taken together, this ETF offers great returns unparalleled by any index with above-average risk. Considering the annual and cumulative returns that are accentuated coming out of bear markets, the mix of high-quality, large, non-financial growth stocks, the intrinsic dividend and share buyback component, and the sound fundamentals of these large growth companies to drive growth and innovation presents a compelling investment opportunity for any long portfolio. Disclosure: The author currently holds shares of QQQ and is long QQQ. The author has no business relationship with any companies mentioned in this article. I am not a professional financial advisor or tax professional. I am an individual investor who analyzes investment strategies and disseminates my analyses. I encourage all investors to conduct their own research and due diligence. Please feel free to comment and provide feedback, I value all responses. Disclosure: The author is long QQQ. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News