Scalper1 News

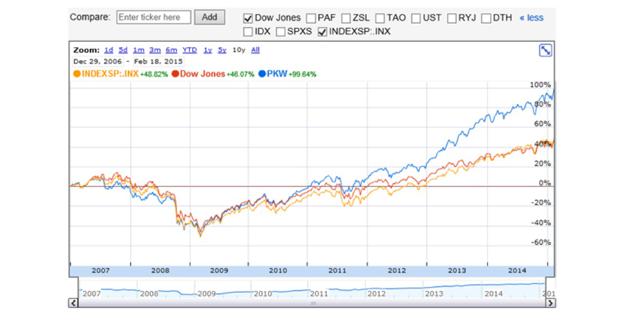

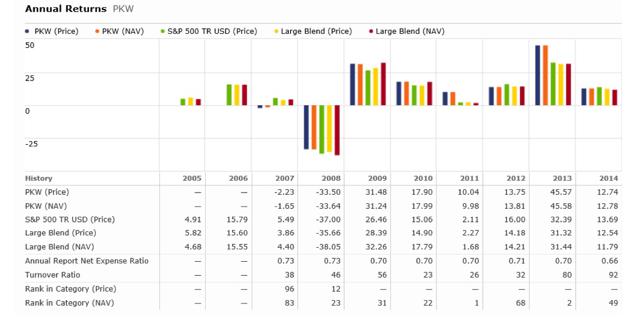

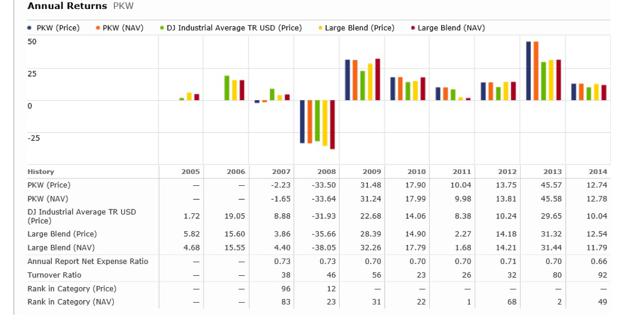

Summary Share buybacks can serve as an effective way to drive shareholder value via returning capital in the form of repurchasing stock. PKW presents an opportunistic niche in which to invest and potentially capitalize on companies that engage in aggressive buyback programs. Over the past 5 years, the annual returns of PKW have outpaced both the S&P 500 and Dow Jones by 5.2% and 7.3%, respectively. Over the past 8 years, PKW has provided more than double the return of the S&P 500 and Dow Jones. Introduction: Share buybacks can serve as an effective way to drive shareholder value via returning capital by repurchasing its own stock. Share buybacks are primarily driven by companies that strongly feel their shares are undervalued and do not reflect the appropriate valuation on the open market. Additionally, the company of interest feels a sense of bullishness and confidence on the future and sustainability of their business. Theoretically, repurchasing and retiring shares satisfies many pro-shareholder objectives: Reducing the number of shares tilts the supply and demand curve thereby removing shares will decrease supply and in turn increase demand and drive the share price higher. Earnings per share increase since earnings are now dividend over fewer shares. If share buybacks are coupled with a dividend, the dividend yield will increase since the quarterly payout amount will remain unchanged and as a result the payout will be divided over fewer shares. The PowerShares Buyback Achievers ETF (NYSEARCA: PKW ) focuses on U.S. companies that have reduced their shares outstanding by at least 5% in the previous year and weights these holdings by market capitalization, subject to a 5% cap within the ETF portfolio. PKW presents an opportunistic niche in which to invest and potentially capitalize on companies that engage in aggressive buyback programs. PKW presents a compelling investment opportunity The annual returns of PKW have been impressive when compared to the broader indices (S&P 500 and the Dow Jones). Over the past 8 years, PKW has outperformed both the S&P 500 and Dow Jones by a wide margin. From 2007 through 2014 the S&P 500 and Dow Jones posted cumulative returns of 49% and 46% respectively, while PKW racked up a return of 100% over the same period. This greater than two-fold return is largely attributed to the previous 5-year time period as the divergence in return is largely observed from 2010 through 2014 (Figure 1). Prior to 2010, the two indices and PKW largely moved in lock-step. Since 2007, PKW has boasted annual returns of 12.0% while the S&P 500 and Dow Jones posted annual returns of 10.6% and 10.3%, respectively (Figures 2 and 3). Outpacing the S&P 500 and Dow Jones by an annual clip of 1.4% and 1.7% respectively may not seem significant, however this translates into a 13.2% and 16.7% increase in annual returns. Narrowing this timeframe to the most recent 5-year period accentuates the returns of PKW relative to the S&P 500 and Dow Jones benchmarks. PKW posted an average annual return 26.3% in comparison to 21.1% and 19.0% for the S&P 500 and Dow Jones, respectively (Figures 2 and 3). Over the most recent 5-year time period, annual returns of PKW have outpaced the S&P 500 and Dow Jones indices by 5.2% and 7.3%, respectively (Figures 2 and 3). Figure 1 – Google Finance comparison of cumulative returns over the past 8 years for PKW, Dow Jones and S&P 500 (click to enlarge) Figure 2 – Morningstar comparison of PKW and S&P 500 annual returns (click to enlarge) Figure 3 – Morningstar comparison of PKW and Dow Jones annual returns (click to enlarge) This trend has continued into the start of the new year (through February 18th), albeit 6 weeks, PKW has outperformed both the S&P 500 and Dow Jones significantly as depicted in figure 4. Figure 4 – Google finance comparison of 2015 YTD returns for PKW, Dow Jones and S&P 500 (click to enlarge) These data suggest that returns are significantly greater than the border indices when specifically focused on an aggregate of companies that deploy capital primarily in the form of share buybacks and secondarily in the form of a cash dividend. Driving shareholder value by combining share buybacks with dividends Share buybacks can be an effective alternative to paying dividends however in some cases these programs are combined with dividend payouts. In this case, shareholders are doubly rewarded with capital returned in the form of share buybacks and a quarterly cash dividend distribution. Dividends coupled with share buybacks can serve as an effective synergy in returning value to shareholders; Apple (NASDAQ: AAPL ) and Boeing (NYSE: BA ) are great examples of this dual capital return. PKW holdings consist of numerous companies that offer both share buybacks and dividends for maximum appreciation. PKW holds stable large-cap stocks across all categories in growth, blend and value with strong cash positions for an overall category status of large value. Apple, Home Depot (NYSE: HD ), International Business Machines (NYSE: IBM ), Boeing, Twenty-First Century Fox (NASDAQ: FOX ), Lowe’s (NYSE: LOW ), Time Warner (NYSE: TWX ), Express Scripts (NASDAQ: ESRX ) and Monsanto (NYSE: MON ) make up the top ten holdings and over a third of the entire portfolio by weight. All of these companies pay a divided with the exception of Express Scripts. Many other companies within the portfolio provide the same share buybacks and dividend combination for optimal capital return such as FedEx (NYSE: FDX ), Anthem (NYSE: ANTM ), Northrop Grumman (NYSE: NOC ), Deere and Co. (NYSE: DE ), and Corning (NYSE: GLW ) all of which pay a dividend with varying yields. Collectively, all the companies that comprise PKW translate into a current overall yield of 1.00% at the current price of $49.53. This provides a competitive yield to augment the share buyback component of the ETF. Not all companies that initiate buybacks benefit from an increase in share price: Not all companies that engage in share buyback programs are created equally and some companies have alternative motives in initiating a repurchase program. Some leadership boards may want to increase earnings per share by purchasing and retiring shares to demonstrate an ostensibly growing business or to meet executive benchmarks, artificially. There are also share buyback companies that underperform the broader indices thus it may prove to be difficult in identifying individual stocks in this area. Collective exposure across companies with varying market capitalizations via PKW may prove a compelling alternative. Summary: Over the past 5 years, the annual returns of PKW have outpaced both the S&P 500 and Dow Jones by 5.2% and 7.3%, respectively. PKW currently holds a 5-star rating on Morningstar for both its 3 and 5-year timeframes. PKW has an investment return rating of high and a risk rating of below average for its 5-year performance. PKW offers a healthy rate of return with low to moderate risk exposure across large value companies. While PKW charges a very high expense ratio in comparison to other ETFs, considering the strong fundamentals and past performance with focusing on companies that return capital in the form of share buybacks and dividends, this ETF presents a compelling case to belong in any long portfolio Disclosure: The author currently holds shares of PKW and is long PKW. The author has no business relationship with any companies mentioned in this article. I am not a professional financial advisor or tax professional. I am an individual investor who analyzes investment strategies and disseminates my analyses. I encourage all investors to conduct their own research and due diligence. Please feel free to comment and provide feedback, I value all responses. Disclosure: The author is long PKW. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Share buybacks can serve as an effective way to drive shareholder value via returning capital in the form of repurchasing stock. PKW presents an opportunistic niche in which to invest and potentially capitalize on companies that engage in aggressive buyback programs. Over the past 5 years, the annual returns of PKW have outpaced both the S&P 500 and Dow Jones by 5.2% and 7.3%, respectively. Over the past 8 years, PKW has provided more than double the return of the S&P 500 and Dow Jones. Introduction: Share buybacks can serve as an effective way to drive shareholder value via returning capital by repurchasing its own stock. Share buybacks are primarily driven by companies that strongly feel their shares are undervalued and do not reflect the appropriate valuation on the open market. Additionally, the company of interest feels a sense of bullishness and confidence on the future and sustainability of their business. Theoretically, repurchasing and retiring shares satisfies many pro-shareholder objectives: Reducing the number of shares tilts the supply and demand curve thereby removing shares will decrease supply and in turn increase demand and drive the share price higher. Earnings per share increase since earnings are now dividend over fewer shares. If share buybacks are coupled with a dividend, the dividend yield will increase since the quarterly payout amount will remain unchanged and as a result the payout will be divided over fewer shares. The PowerShares Buyback Achievers ETF (NYSEARCA: PKW ) focuses on U.S. companies that have reduced their shares outstanding by at least 5% in the previous year and weights these holdings by market capitalization, subject to a 5% cap within the ETF portfolio. PKW presents an opportunistic niche in which to invest and potentially capitalize on companies that engage in aggressive buyback programs. PKW presents a compelling investment opportunity The annual returns of PKW have been impressive when compared to the broader indices (S&P 500 and the Dow Jones). Over the past 8 years, PKW has outperformed both the S&P 500 and Dow Jones by a wide margin. From 2007 through 2014 the S&P 500 and Dow Jones posted cumulative returns of 49% and 46% respectively, while PKW racked up a return of 100% over the same period. This greater than two-fold return is largely attributed to the previous 5-year time period as the divergence in return is largely observed from 2010 through 2014 (Figure 1). Prior to 2010, the two indices and PKW largely moved in lock-step. Since 2007, PKW has boasted annual returns of 12.0% while the S&P 500 and Dow Jones posted annual returns of 10.6% and 10.3%, respectively (Figures 2 and 3). Outpacing the S&P 500 and Dow Jones by an annual clip of 1.4% and 1.7% respectively may not seem significant, however this translates into a 13.2% and 16.7% increase in annual returns. Narrowing this timeframe to the most recent 5-year period accentuates the returns of PKW relative to the S&P 500 and Dow Jones benchmarks. PKW posted an average annual return 26.3% in comparison to 21.1% and 19.0% for the S&P 500 and Dow Jones, respectively (Figures 2 and 3). Over the most recent 5-year time period, annual returns of PKW have outpaced the S&P 500 and Dow Jones indices by 5.2% and 7.3%, respectively (Figures 2 and 3). Figure 1 – Google Finance comparison of cumulative returns over the past 8 years for PKW, Dow Jones and S&P 500 (click to enlarge) Figure 2 – Morningstar comparison of PKW and S&P 500 annual returns (click to enlarge) Figure 3 – Morningstar comparison of PKW and Dow Jones annual returns (click to enlarge) This trend has continued into the start of the new year (through February 18th), albeit 6 weeks, PKW has outperformed both the S&P 500 and Dow Jones significantly as depicted in figure 4. Figure 4 – Google finance comparison of 2015 YTD returns for PKW, Dow Jones and S&P 500 (click to enlarge) These data suggest that returns are significantly greater than the border indices when specifically focused on an aggregate of companies that deploy capital primarily in the form of share buybacks and secondarily in the form of a cash dividend. Driving shareholder value by combining share buybacks with dividends Share buybacks can be an effective alternative to paying dividends however in some cases these programs are combined with dividend payouts. In this case, shareholders are doubly rewarded with capital returned in the form of share buybacks and a quarterly cash dividend distribution. Dividends coupled with share buybacks can serve as an effective synergy in returning value to shareholders; Apple (NASDAQ: AAPL ) and Boeing (NYSE: BA ) are great examples of this dual capital return. PKW holdings consist of numerous companies that offer both share buybacks and dividends for maximum appreciation. PKW holds stable large-cap stocks across all categories in growth, blend and value with strong cash positions for an overall category status of large value. Apple, Home Depot (NYSE: HD ), International Business Machines (NYSE: IBM ), Boeing, Twenty-First Century Fox (NASDAQ: FOX ), Lowe’s (NYSE: LOW ), Time Warner (NYSE: TWX ), Express Scripts (NASDAQ: ESRX ) and Monsanto (NYSE: MON ) make up the top ten holdings and over a third of the entire portfolio by weight. All of these companies pay a divided with the exception of Express Scripts. Many other companies within the portfolio provide the same share buybacks and dividend combination for optimal capital return such as FedEx (NYSE: FDX ), Anthem (NYSE: ANTM ), Northrop Grumman (NYSE: NOC ), Deere and Co. (NYSE: DE ), and Corning (NYSE: GLW ) all of which pay a dividend with varying yields. Collectively, all the companies that comprise PKW translate into a current overall yield of 1.00% at the current price of $49.53. This provides a competitive yield to augment the share buyback component of the ETF. Not all companies that initiate buybacks benefit from an increase in share price: Not all companies that engage in share buyback programs are created equally and some companies have alternative motives in initiating a repurchase program. Some leadership boards may want to increase earnings per share by purchasing and retiring shares to demonstrate an ostensibly growing business or to meet executive benchmarks, artificially. There are also share buyback companies that underperform the broader indices thus it may prove to be difficult in identifying individual stocks in this area. Collective exposure across companies with varying market capitalizations via PKW may prove a compelling alternative. Summary: Over the past 5 years, the annual returns of PKW have outpaced both the S&P 500 and Dow Jones by 5.2% and 7.3%, respectively. PKW currently holds a 5-star rating on Morningstar for both its 3 and 5-year timeframes. PKW has an investment return rating of high and a risk rating of below average for its 5-year performance. PKW offers a healthy rate of return with low to moderate risk exposure across large value companies. While PKW charges a very high expense ratio in comparison to other ETFs, considering the strong fundamentals and past performance with focusing on companies that return capital in the form of share buybacks and dividends, this ETF presents a compelling case to belong in any long portfolio Disclosure: The author currently holds shares of PKW and is long PKW. The author has no business relationship with any companies mentioned in this article. I am not a professional financial advisor or tax professional. I am an individual investor who analyzes investment strategies and disseminates my analyses. I encourage all investors to conduct their own research and due diligence. Please feel free to comment and provide feedback, I value all responses. Disclosure: The author is long PKW. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News