Scalper1 News

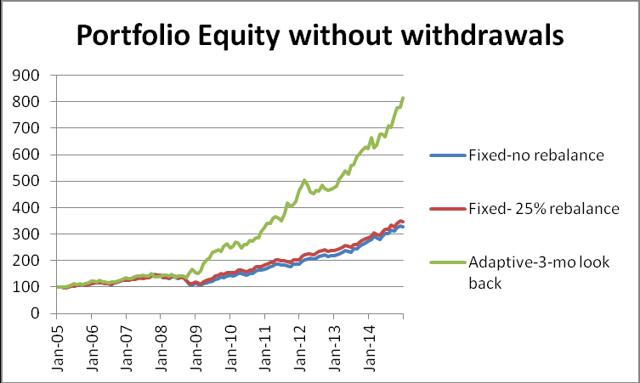

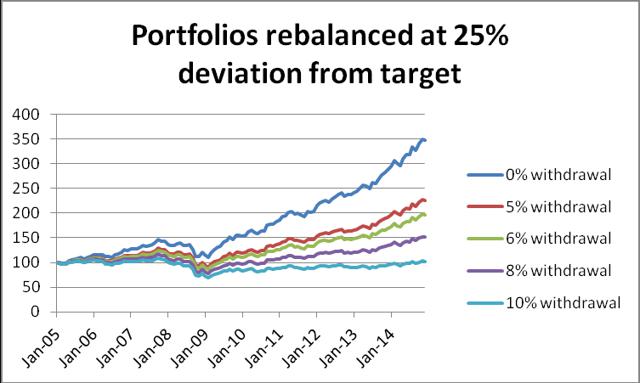

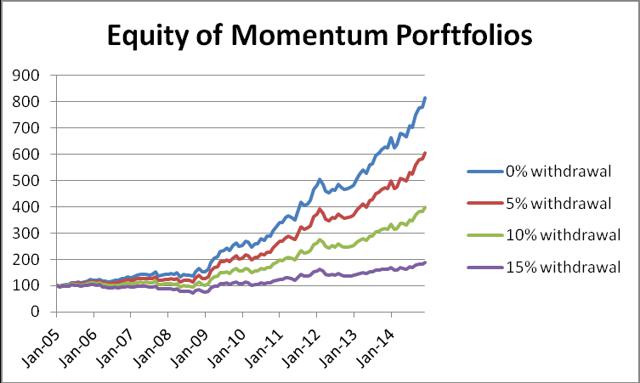

Summary T. Rowe Price offers a set of high-performing mutual funds which can be successfully used for construction of investment portfolios with good withdrawal rates. From January 2005 to December 2014, a T. Rowe Price portfolio with fixed allocation could produce a safe 5% annual withdrawal rate and 7.84% annual increase of the capital. Same portfolio with rebalancing at 25% deviation from the target allowed a safe 5% annual withdrawal rate and achieved 8.48% compound annual increase of the capital. Better performance could be achieved using adaptive asset allocation. Same portfolio could have produced a safe 15% annual withdrawal rate and 6.58% annual increase of the capital. The drawdowns of the portfolios are relatively small considering their high returns. This article belongs to a series of articles dedicated for investing in various mutual fund families. In previous articles, we reported our research on Fidelity and Vanguard mutual fund families. The current article does the same for T. Rowe Price family of mutual funds. Four mutual funds have been selected for investment. They are the following: T. Rowe Price U.S. Treasury Long-Term Bond Fund (MUTF: PRULX ) T. Rowe Price Health Sciences Fund (MUTF: PRHSX ) T. Rowe Price Media And Telecommunications Fund (MUTF: PRMTX ) T. Rowe Price Global Technology Fund (MUTF: PRGTX ) In this article, three different strategies will be considered: (1) Fixed asset allocation: The portfolio is initially invested 40% in the bond fund and 60% equally divided between the stock funds, without rebalancing. (2) Target asset allocation with rebalancing: The portfolio is initially invested 40% in the bond fund and 60% equally divided between the stock funds and is rebalanced when the allocation to any fund deviates by 25% from its target. (3) Momentum-based adaptive asset allocation: The portfolio is at all times invested 100% in only one fund. The switching, if necessary, is done monthly at closing of the last trading day of the month. All money is invested in the fund with the highest return over the previous 3 months. The data for the study were downloaded from Yahoo Finance on the Historical Prices menu for four tickers: PRULX, PRHSX, PRMTX, and PRGTX. We use the monthly price data from January 2005 to December 2014, adjusted for dividend payments. The paper is made up of two parts. In part I, we examine the performance of portfolios without any income withdrawal. In part II, we examine the performance of portfolios when income is extracted periodically from the accounts. Part I: Portfolios without withdrawals In Table 1, we show the results of the portfolios managed for 10 years, from January 2005 to December 2014. Table 1. Portfolios without withdrawals 2005-2014 Strategy Total increase% CAGR% Number trades MaxDD% Fixed-no rebalance 228.89 12.64 0 -28.82 Target-25% rebalance 247.01 13.25 4 -24.54 Adaptive 714.50 23.33 52 -11.57 The time evolution of the equity in the portfolios is shown in Figure 1. (click to enlarge) Figure 1. Equities of portfolios without withdrawals Source: This chart is based on Excel calculations using the adjusted monthly closing share prices of securities From Figure 1, it is apparent that the rate of increase of the adaptive portfolio is substantially greater than the rate of the fixed and target allocation portfolios. Part II: Portfolios with withdrawals Assume that we invest $1,000,000 for income in retirement. We plan to withdraw monthly a fixed percentage of the initial investment. That amount is increased by 2% annually in order to account for inflation. In Table 2, we show the results of the portfolios managed for 10 years, from January 2005 to December 2014. Money was withdrawn monthly at a 5% annual rate of the initial investment, plus a 2% inflation adjustment. Over the 10 years from January 2005 to December 2014, a total of $535,920 was withdrawn. Table 2. Portfolios with 5% annual withdrawal rate 2005-2014 Strategy Total increase% CAGR% Number trades MaxDD% Fixed-no rebalance 128.08 7.84 0 -30.71 Target-25% rebalance 127.68 8.48 4 -29.65 Adaptive 297.64 19.74 52 -14.08 The time evolution of the equity in the portfolios is shown in Figure 2. (click to enlarge) Figure 2. Equities of portfolios with 5% annual withdrawal rates Source: This chart is based on Excel calculations using the adjusted monthly closing share prices of securities To illustrate the effect of the withdrawal rates on the evolution of the capital, we report simulation results for two strategies: fixed target with rebalancing and momentum-based adaptive asset allocation. In Table 3, we report the results of simulations of the fixed target portfolio with the following withdrawal rates: 0%, 5%, 6%, 8%, and 10%. Table 3. Fixed Target Portfolios with rebalancing at 25% deviations for various annual withdrawal rates 2005-2014 Withdrawal rate % Total increase% CAGR% MaxDD% 0 247.00 13.25 -24.54 5 125.77 8.48 -29.65 6 95.96 6.96 -31.23 8 51.06 4.21 -34.16 10 1.32 0.13 -37.14 The time evolution of the equity in the portfolios is shown in Figure 3. (click to enlarge) Figure 3. Equities of fixed target portfolios with rebalancing at 25% deviation from targets and 5% annual withdrawal rates Source: This chart is based on Excel calculations using the adjusted monthly closing share prices of securities To illustrate the advantage of the adaptive allocation strategy and the effect of withdrawal rates on the evolution of the capital, we give in Table 4 the results of simulations for the following withdrawal rates: 0%, 5%, 10%, and 15%. Table 4. Adaptive Portfolios with various annual withdrawal rates 2005-2014 Withdrawal rate % Total increase% CAGR% MaxDD% 0 714.50 23.33 -11.57 5 506.07 19.74 -14.08 10 297.64 14.80 -19.05 15 89.21 6.58 -30.72 The time evolution of the equity in the portfolios is shown in Figure 4. (click to enlarge) Figure 4. Equities of momentum-based portfolios with various annual withdrawal rates Source: This chart is based on Excel calculations using the adjusted monthly closing share prices of securities Conclusion The set of four mutual funds, selected for this study, perform exceptionally well for all three strategies and generate high returns at relatively low drawdowns. Between 2005 and 2015, the fixed target allocation with rebalancing was able to sustain withdrawal rates of up to 10% annually. The adaptive allocation algorithm was able to sustain withdrawal rates up to 15% annually without any decrease of capital. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: This article is the third in a sequence on investing in mutual funds for retirement accounts. To help the reader compare the past performance of various mutual fund families, I selected a benchmark 10-year time interval starting on 1 January 2005 and ending on 31 December 2014. The article was written for educational purposes and should not be considered as specific investment advice. Scalper1 News

Summary T. Rowe Price offers a set of high-performing mutual funds which can be successfully used for construction of investment portfolios with good withdrawal rates. From January 2005 to December 2014, a T. Rowe Price portfolio with fixed allocation could produce a safe 5% annual withdrawal rate and 7.84% annual increase of the capital. Same portfolio with rebalancing at 25% deviation from the target allowed a safe 5% annual withdrawal rate and achieved 8.48% compound annual increase of the capital. Better performance could be achieved using adaptive asset allocation. Same portfolio could have produced a safe 15% annual withdrawal rate and 6.58% annual increase of the capital. The drawdowns of the portfolios are relatively small considering their high returns. This article belongs to a series of articles dedicated for investing in various mutual fund families. In previous articles, we reported our research on Fidelity and Vanguard mutual fund families. The current article does the same for T. Rowe Price family of mutual funds. Four mutual funds have been selected for investment. They are the following: T. Rowe Price U.S. Treasury Long-Term Bond Fund (MUTF: PRULX ) T. Rowe Price Health Sciences Fund (MUTF: PRHSX ) T. Rowe Price Media And Telecommunications Fund (MUTF: PRMTX ) T. Rowe Price Global Technology Fund (MUTF: PRGTX ) In this article, three different strategies will be considered: (1) Fixed asset allocation: The portfolio is initially invested 40% in the bond fund and 60% equally divided between the stock funds, without rebalancing. (2) Target asset allocation with rebalancing: The portfolio is initially invested 40% in the bond fund and 60% equally divided between the stock funds and is rebalanced when the allocation to any fund deviates by 25% from its target. (3) Momentum-based adaptive asset allocation: The portfolio is at all times invested 100% in only one fund. The switching, if necessary, is done monthly at closing of the last trading day of the month. All money is invested in the fund with the highest return over the previous 3 months. The data for the study were downloaded from Yahoo Finance on the Historical Prices menu for four tickers: PRULX, PRHSX, PRMTX, and PRGTX. We use the monthly price data from January 2005 to December 2014, adjusted for dividend payments. The paper is made up of two parts. In part I, we examine the performance of portfolios without any income withdrawal. In part II, we examine the performance of portfolios when income is extracted periodically from the accounts. Part I: Portfolios without withdrawals In Table 1, we show the results of the portfolios managed for 10 years, from January 2005 to December 2014. Table 1. Portfolios without withdrawals 2005-2014 Strategy Total increase% CAGR% Number trades MaxDD% Fixed-no rebalance 228.89 12.64 0 -28.82 Target-25% rebalance 247.01 13.25 4 -24.54 Adaptive 714.50 23.33 52 -11.57 The time evolution of the equity in the portfolios is shown in Figure 1. (click to enlarge) Figure 1. Equities of portfolios without withdrawals Source: This chart is based on Excel calculations using the adjusted monthly closing share prices of securities From Figure 1, it is apparent that the rate of increase of the adaptive portfolio is substantially greater than the rate of the fixed and target allocation portfolios. Part II: Portfolios with withdrawals Assume that we invest $1,000,000 for income in retirement. We plan to withdraw monthly a fixed percentage of the initial investment. That amount is increased by 2% annually in order to account for inflation. In Table 2, we show the results of the portfolios managed for 10 years, from January 2005 to December 2014. Money was withdrawn monthly at a 5% annual rate of the initial investment, plus a 2% inflation adjustment. Over the 10 years from January 2005 to December 2014, a total of $535,920 was withdrawn. Table 2. Portfolios with 5% annual withdrawal rate 2005-2014 Strategy Total increase% CAGR% Number trades MaxDD% Fixed-no rebalance 128.08 7.84 0 -30.71 Target-25% rebalance 127.68 8.48 4 -29.65 Adaptive 297.64 19.74 52 -14.08 The time evolution of the equity in the portfolios is shown in Figure 2. (click to enlarge) Figure 2. Equities of portfolios with 5% annual withdrawal rates Source: This chart is based on Excel calculations using the adjusted monthly closing share prices of securities To illustrate the effect of the withdrawal rates on the evolution of the capital, we report simulation results for two strategies: fixed target with rebalancing and momentum-based adaptive asset allocation. In Table 3, we report the results of simulations of the fixed target portfolio with the following withdrawal rates: 0%, 5%, 6%, 8%, and 10%. Table 3. Fixed Target Portfolios with rebalancing at 25% deviations for various annual withdrawal rates 2005-2014 Withdrawal rate % Total increase% CAGR% MaxDD% 0 247.00 13.25 -24.54 5 125.77 8.48 -29.65 6 95.96 6.96 -31.23 8 51.06 4.21 -34.16 10 1.32 0.13 -37.14 The time evolution of the equity in the portfolios is shown in Figure 3. (click to enlarge) Figure 3. Equities of fixed target portfolios with rebalancing at 25% deviation from targets and 5% annual withdrawal rates Source: This chart is based on Excel calculations using the adjusted monthly closing share prices of securities To illustrate the advantage of the adaptive allocation strategy and the effect of withdrawal rates on the evolution of the capital, we give in Table 4 the results of simulations for the following withdrawal rates: 0%, 5%, 10%, and 15%. Table 4. Adaptive Portfolios with various annual withdrawal rates 2005-2014 Withdrawal rate % Total increase% CAGR% MaxDD% 0 714.50 23.33 -11.57 5 506.07 19.74 -14.08 10 297.64 14.80 -19.05 15 89.21 6.58 -30.72 The time evolution of the equity in the portfolios is shown in Figure 4. (click to enlarge) Figure 4. Equities of momentum-based portfolios with various annual withdrawal rates Source: This chart is based on Excel calculations using the adjusted monthly closing share prices of securities Conclusion The set of four mutual funds, selected for this study, perform exceptionally well for all three strategies and generate high returns at relatively low drawdowns. Between 2005 and 2015, the fixed target allocation with rebalancing was able to sustain withdrawal rates of up to 10% annually. The adaptive allocation algorithm was able to sustain withdrawal rates up to 15% annually without any decrease of capital. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: This article is the third in a sequence on investing in mutual funds for retirement accounts. To help the reader compare the past performance of various mutual fund families, I selected a benchmark 10-year time interval starting on 1 January 2005 and ending on 31 December 2014. The article was written for educational purposes and should not be considered as specific investment advice. Scalper1 News

Scalper1 News