Scalper1 News

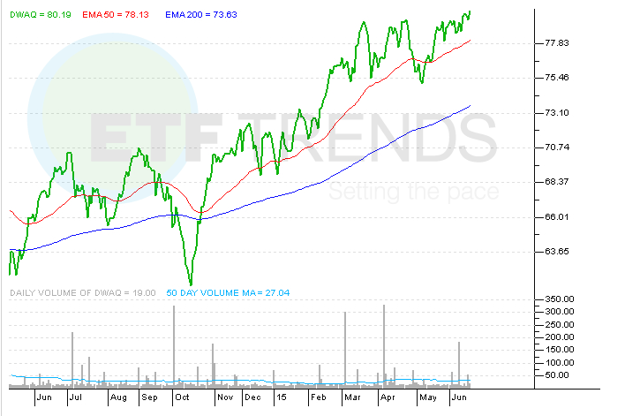

Summary The Nasdaq provides tilts toward more growth-oriented stocks. Growth stock investors can add even more momentum to their Nasdaq exposure through a relatively new smart-beta Nasdaq ETF. A closer look at the PowerShares DWA Nasdaq Momentum Portfolio. By Todd Shriber & Tom Lydon Home to a bevy of growth stocks, many hailing from the biotechnology, Internet and technology spaces, the Nasdaq-100 and Nasdaq Composite offer investors easy access to growth and momentum fare. Investors that want to add some more momentum to their Nasdaq exposure can do so with the PowerShares DWA NASDAQ Momentum Portfolio (NasdaqGM: DWAQ ) , an overlooked, momentum-laden alternative to the widely followed PowerShares QQQ (NasdaqGM: QQQ ) , the NASDAQ-100 tracking exchange traded fund. DWAQ tracks the Dorsey Wright NASDAQ Technical Leaders Index. That index is comprised of “a universe of approximately 1,000 common stocks having the largest market capitalizations and traded on the NASDAQ exchange,” according to PowerShares . Like the other PowerShares ETFs that track Dorsey Wright’s relative strength-based indices, DWAQ is passively managed. However, the relative strength methodology lends itself to increased flexibility in weighting and component selection compared to traditional cap-weighted ETFs. Depending on what individual investors are looking for, DWAQ offers some perks relative to QQQ. As a cap-weighted ETF, QQQ throws almost 21% of its combined weight at Apple (NASDAQGS: AAPL ) and Microsoft (NASDAQGS: MSFT ). Conversely, DWAQ’s largest holding is biotech giant Gilead (NASDAQGS: GILD ), which commands a weight of just 3.2% in the ETF, according to issuer data. Speaking of healthcare and biotech stocks, oft-cited catalysts behind QQQ’s ability to return and exceed dot-com era highs, DWAQ does not short change investors on healthcare exposure, either. The $36 million DWAQ sports a healthcare weight of almost 37%, more than double the 15.4% QQQ allocates to the same sector. Six of DWAQ’s top 10 holdings are healthcare stocks. The ETF’s second-largest sector weight is 22.4% to technology, which includes a 2.9% allocation to Apple. Like the other PowerShares ETFs that track Dorsey Wright’s relative strength-based indices, DWAQ is passively managed. However, the relative strength methodology lends itself to increased flexibility in weighting and component selection compared to traditional cap-weighted ETFs. QQQ’s consumer discretionary weight is nearly 400 basis points higher than DWAQ’s and the latter takes a notably different approach to that sector than the former. For example, DWAQ does not own Amazon (NASDAQGS: AMZN ), Priceline (NASDAQGS: PCLN ) and Starbucks (NASDAQGS: SBUX ), opting for mid- and small-cap discretionary names, such as Papa John’s (NASDAQGS: PZZA ), Sonic (NASDAQGS: SONC ) and Jack in the Box (NASDAQGS: JACK ). DWAQ is up 12.6% this year and has double in price in less than five years. PowerShares DWA NASDAQ Momentum Portfolio (click to enlarge) Disclosure: I am/we are long QQQ. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The Nasdaq provides tilts toward more growth-oriented stocks. Growth stock investors can add even more momentum to their Nasdaq exposure through a relatively new smart-beta Nasdaq ETF. A closer look at the PowerShares DWA Nasdaq Momentum Portfolio. By Todd Shriber & Tom Lydon Home to a bevy of growth stocks, many hailing from the biotechnology, Internet and technology spaces, the Nasdaq-100 and Nasdaq Composite offer investors easy access to growth and momentum fare. Investors that want to add some more momentum to their Nasdaq exposure can do so with the PowerShares DWA NASDAQ Momentum Portfolio (NasdaqGM: DWAQ ) , an overlooked, momentum-laden alternative to the widely followed PowerShares QQQ (NasdaqGM: QQQ ) , the NASDAQ-100 tracking exchange traded fund. DWAQ tracks the Dorsey Wright NASDAQ Technical Leaders Index. That index is comprised of “a universe of approximately 1,000 common stocks having the largest market capitalizations and traded on the NASDAQ exchange,” according to PowerShares . Like the other PowerShares ETFs that track Dorsey Wright’s relative strength-based indices, DWAQ is passively managed. However, the relative strength methodology lends itself to increased flexibility in weighting and component selection compared to traditional cap-weighted ETFs. Depending on what individual investors are looking for, DWAQ offers some perks relative to QQQ. As a cap-weighted ETF, QQQ throws almost 21% of its combined weight at Apple (NASDAQGS: AAPL ) and Microsoft (NASDAQGS: MSFT ). Conversely, DWAQ’s largest holding is biotech giant Gilead (NASDAQGS: GILD ), which commands a weight of just 3.2% in the ETF, according to issuer data. Speaking of healthcare and biotech stocks, oft-cited catalysts behind QQQ’s ability to return and exceed dot-com era highs, DWAQ does not short change investors on healthcare exposure, either. The $36 million DWAQ sports a healthcare weight of almost 37%, more than double the 15.4% QQQ allocates to the same sector. Six of DWAQ’s top 10 holdings are healthcare stocks. The ETF’s second-largest sector weight is 22.4% to technology, which includes a 2.9% allocation to Apple. Like the other PowerShares ETFs that track Dorsey Wright’s relative strength-based indices, DWAQ is passively managed. However, the relative strength methodology lends itself to increased flexibility in weighting and component selection compared to traditional cap-weighted ETFs. QQQ’s consumer discretionary weight is nearly 400 basis points higher than DWAQ’s and the latter takes a notably different approach to that sector than the former. For example, DWAQ does not own Amazon (NASDAQGS: AMZN ), Priceline (NASDAQGS: PCLN ) and Starbucks (NASDAQGS: SBUX ), opting for mid- and small-cap discretionary names, such as Papa John’s (NASDAQGS: PZZA ), Sonic (NASDAQGS: SONC ) and Jack in the Box (NASDAQGS: JACK ). DWAQ is up 12.6% this year and has double in price in less than five years. PowerShares DWA NASDAQ Momentum Portfolio (click to enlarge) Disclosure: I am/we are long QQQ. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News