Scalper1 News

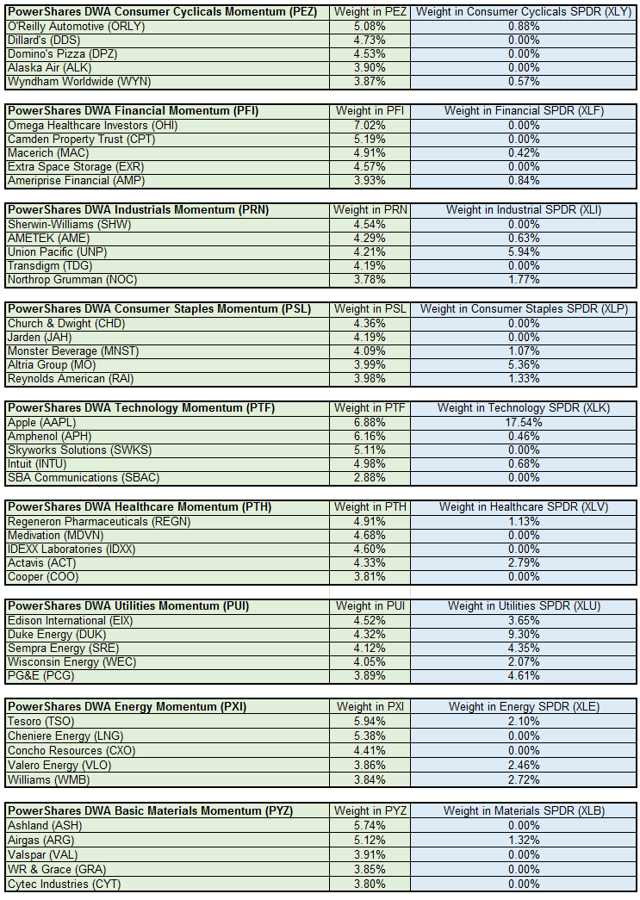

In February of 2014, we were hired to be the index provider for 9 PowerShares sector ETFs and they then became the PowerShares DWA Momentum Sector ETFs. This was an extension of the work that we were already doing with PowerShares in creating the indexes used for PDP , PIE , PIZ , and DWAS . The idea behind these Momentum sectors was to identify the top momentum names from each sector and then weight the stocks in the index by momentum. This is a clear departure from creating a sector index that is just weighted by market capitalization. To get an idea of just how different a momentum-weighted and a capitalization-weighted sector ETF can be, consider the table below. It shows the top 5 holdings and weights of those holdings in each of our momentum sectors and compares that exposure to a capitalization-weighted ETF. (click to enlarge) Source: PowerShares and State Street, As of 2/4/15 As you can see, there can be significant differences in exposure. Two key reasons for the differences: We weight the stocks by momentum and not by capitalization. Our investment universe also consists of Small, Mid, and Large Cap stocks. Weighting sector ETFs by momentum, we believe, will lead to superior results over time. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. See www.powershares.com for more information. Dorsey Wright is the index provider for a suite of momentum ETFs with PowerShares. Are you Bullish or Bearish on ? Bullish Bearish Neutral Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

In February of 2014, we were hired to be the index provider for 9 PowerShares sector ETFs and they then became the PowerShares DWA Momentum Sector ETFs. This was an extension of the work that we were already doing with PowerShares in creating the indexes used for PDP , PIE , PIZ , and DWAS . The idea behind these Momentum sectors was to identify the top momentum names from each sector and then weight the stocks in the index by momentum. This is a clear departure from creating a sector index that is just weighted by market capitalization. To get an idea of just how different a momentum-weighted and a capitalization-weighted sector ETF can be, consider the table below. It shows the top 5 holdings and weights of those holdings in each of our momentum sectors and compares that exposure to a capitalization-weighted ETF. (click to enlarge) Source: PowerShares and State Street, As of 2/4/15 As you can see, there can be significant differences in exposure. Two key reasons for the differences: We weight the stocks by momentum and not by capitalization. Our investment universe also consists of Small, Mid, and Large Cap stocks. Weighting sector ETFs by momentum, we believe, will lead to superior results over time. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. See www.powershares.com for more information. Dorsey Wright is the index provider for a suite of momentum ETFs with PowerShares. Are you Bullish or Bearish on ? Bullish Bearish Neutral Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News