Scalper1 News

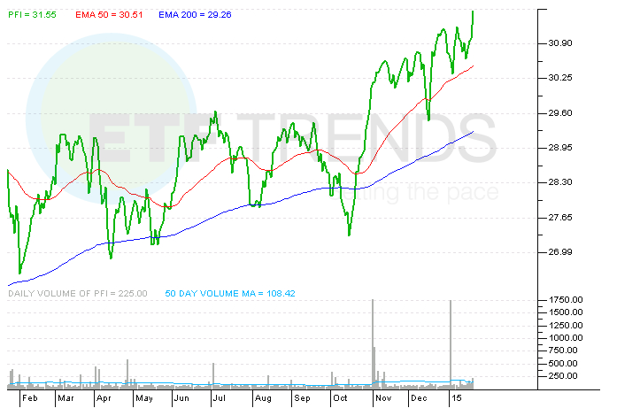

Summary Financial stocks have been underperforming in the new year. However, one financial ETF that focuses on momentum plays has been outperforming. A look at the PowerShares DWA Financial Momentum Portfolio ETF. By Todd Shriber & Tom Lydon It is no secret that the financial services sector, the second-largest sector weight in the S&P 500 behind technology, has struggled to start 2015. For example, the Vanguard Financials ETF (NYSEARCA: VFH ) is down nearly 2%. With a similar loss, the Financial Select Sector SPDR ETF (NYSEARCA: XLF ) is the worst performer of the nine sector SPDR ETFs to start 2015, but all is not lost for ETFs tracking financials. On Thursday, 37 ETFs made fresh all-time highs. The PowerShares DWA Financial Momentum Portfolio ETF (NYSEARCA: PFI ) was one of those 37. PFI was one of 10 PowerShares ETFs, including nine sector funds, that transitioned to momentum-based Dorsey Wright indices in February. Those indices focus on identifying stocks with impressive relative strength, and have fostered performance advantages for several other ETFs in that PowerShares stable. In the past year, PFI has trade in line with rival cap-weighted financial services ETFs, but over the past six months, the momentum-driven PFI has started to pull away from its competitors. In that time, PFI has surged 9%, double the performance of VFH over the same period. Its industry mix is a big reason why. While traditional financial services ETFs have been plagued by slack earnings results, increased regulatory burdens and high legal fees for big money center banks, PFI has been somewhat immune to those themes, because the ETF currently allocates just 18% of its combined weight to banks and capital market firms. The ETF is home to just one money center bank: Wells Fargo (NYSE: WFC ). No investment banks are found in the fund. Conversely, PFI allocates nearly 46% of its weight to real estate investment trusts (REITs), and with Treasury yields tumbling for over a year, that has been a boon for PFI. The heavy REIT allocation exposes PFI to interest rate risk. Some may be concerned that REITs are sensitive to changes in interest rates. Notably, the fall in interest rates have made the asset more attractive as a yield-generating alternative, but some fear the asset will fall out of favor once rates rise. PFI’s 11.6% weight to the insurance sub-sector provides some relief in the event rates do rise. Rate-sensitive insurance companies and the corresponding ETFs have been decent, though market-lagging performers as the group waits on higher interest rates to drive further share price appreciation. PowerShares DWA Financial Momentum Portfolio ETF (click to enlarge) Scalper1 News

Summary Financial stocks have been underperforming in the new year. However, one financial ETF that focuses on momentum plays has been outperforming. A look at the PowerShares DWA Financial Momentum Portfolio ETF. By Todd Shriber & Tom Lydon It is no secret that the financial services sector, the second-largest sector weight in the S&P 500 behind technology, has struggled to start 2015. For example, the Vanguard Financials ETF (NYSEARCA: VFH ) is down nearly 2%. With a similar loss, the Financial Select Sector SPDR ETF (NYSEARCA: XLF ) is the worst performer of the nine sector SPDR ETFs to start 2015, but all is not lost for ETFs tracking financials. On Thursday, 37 ETFs made fresh all-time highs. The PowerShares DWA Financial Momentum Portfolio ETF (NYSEARCA: PFI ) was one of those 37. PFI was one of 10 PowerShares ETFs, including nine sector funds, that transitioned to momentum-based Dorsey Wright indices in February. Those indices focus on identifying stocks with impressive relative strength, and have fostered performance advantages for several other ETFs in that PowerShares stable. In the past year, PFI has trade in line with rival cap-weighted financial services ETFs, but over the past six months, the momentum-driven PFI has started to pull away from its competitors. In that time, PFI has surged 9%, double the performance of VFH over the same period. Its industry mix is a big reason why. While traditional financial services ETFs have been plagued by slack earnings results, increased regulatory burdens and high legal fees for big money center banks, PFI has been somewhat immune to those themes, because the ETF currently allocates just 18% of its combined weight to banks and capital market firms. The ETF is home to just one money center bank: Wells Fargo (NYSE: WFC ). No investment banks are found in the fund. Conversely, PFI allocates nearly 46% of its weight to real estate investment trusts (REITs), and with Treasury yields tumbling for over a year, that has been a boon for PFI. The heavy REIT allocation exposes PFI to interest rate risk. Some may be concerned that REITs are sensitive to changes in interest rates. Notably, the fall in interest rates have made the asset more attractive as a yield-generating alternative, but some fear the asset will fall out of favor once rates rise. PFI’s 11.6% weight to the insurance sub-sector provides some relief in the event rates do rise. Rate-sensitive insurance companies and the corresponding ETFs have been decent, though market-lagging performers as the group waits on higher interest rates to drive further share price appreciation. PowerShares DWA Financial Momentum Portfolio ETF (click to enlarge) Scalper1 News

Scalper1 News