Scalper1 News

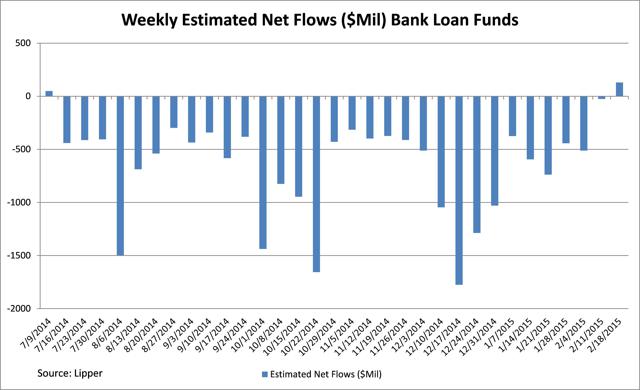

By Tom Roseen Despite U.S. stocks pushing to record highs for the first time in 2015 during the flows week ended February 18, investors continued to pad the coffers of fixed income funds. At the end of the week the minutes of the Federal Reserve’s latest policy meeting indicated officials were not in any hurry to raise interest rates, with many Fed members opining that a premature hike in rates could harm the economy. And, while the stock market showed a muted reaction to the minutes, the benchmark ten-year Treasury yield declined 6 basis points to close the flows week down to 2.07%-but still considerably higher than the lows seen at the beginning of February. During the flows week fund investors injected net new money into three of Lipper’s four broad-based fund macro-groups (including conventional funds and exchange-traded funds [ETFs]). Bond funds (+$5.9 billion) took in the largest haul, followed by equity funds (+$3.7 billion) and municipal bond funds (+$0.1 billion), while money market funds handed back some $14.1 billion-for their largest weekly net redemption since the week ended October 17, 2014. (click to enlarge) Source: Lipper, a Thomson Reuters company For the seventh consecutive week corporate investment-grade debt funds attracted the largest sum of net new money of the fixed income macro-group, taking in a net $3.0 billion for the week, while corporate high-yield funds took in some $1.6 billion-for their fourth week of net inflows in a row. Despite investors’ embracing the thought that the Fed will not be raising interest rates anytime soon, a subset of the corporate investment-grade debt funds group – bank loan funds – witnessed net inflows (+$130 million) for the first week in thirty-two. Share this article with a colleague Scalper1 News

By Tom Roseen Despite U.S. stocks pushing to record highs for the first time in 2015 during the flows week ended February 18, investors continued to pad the coffers of fixed income funds. At the end of the week the minutes of the Federal Reserve’s latest policy meeting indicated officials were not in any hurry to raise interest rates, with many Fed members opining that a premature hike in rates could harm the economy. And, while the stock market showed a muted reaction to the minutes, the benchmark ten-year Treasury yield declined 6 basis points to close the flows week down to 2.07%-but still considerably higher than the lows seen at the beginning of February. During the flows week fund investors injected net new money into three of Lipper’s four broad-based fund macro-groups (including conventional funds and exchange-traded funds [ETFs]). Bond funds (+$5.9 billion) took in the largest haul, followed by equity funds (+$3.7 billion) and municipal bond funds (+$0.1 billion), while money market funds handed back some $14.1 billion-for their largest weekly net redemption since the week ended October 17, 2014. (click to enlarge) Source: Lipper, a Thomson Reuters company For the seventh consecutive week corporate investment-grade debt funds attracted the largest sum of net new money of the fixed income macro-group, taking in a net $3.0 billion for the week, while corporate high-yield funds took in some $1.6 billion-for their fourth week of net inflows in a row. Despite investors’ embracing the thought that the Fed will not be raising interest rates anytime soon, a subset of the corporate investment-grade debt funds group – bank loan funds – witnessed net inflows (+$130 million) for the first week in thirty-two. Share this article with a colleague Scalper1 News

Scalper1 News