Scalper1 News

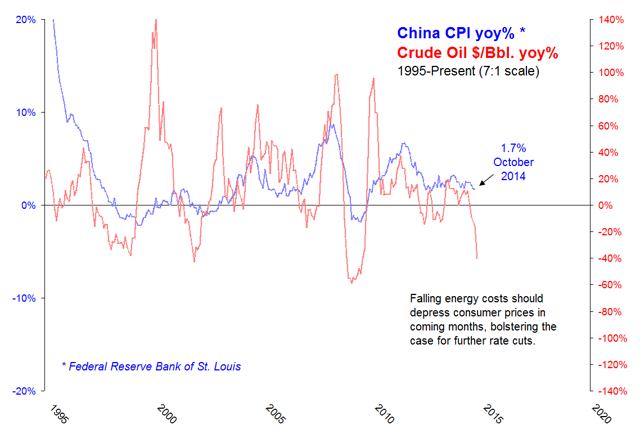

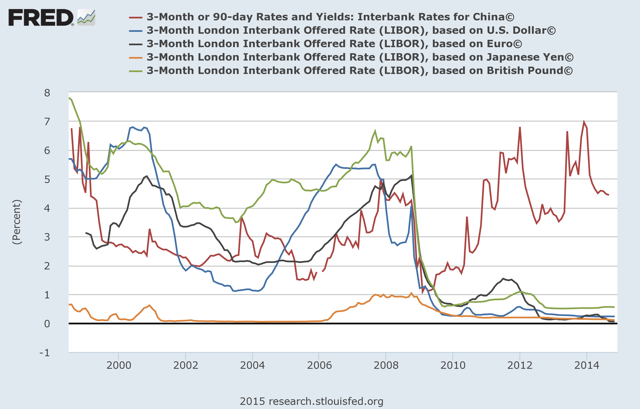

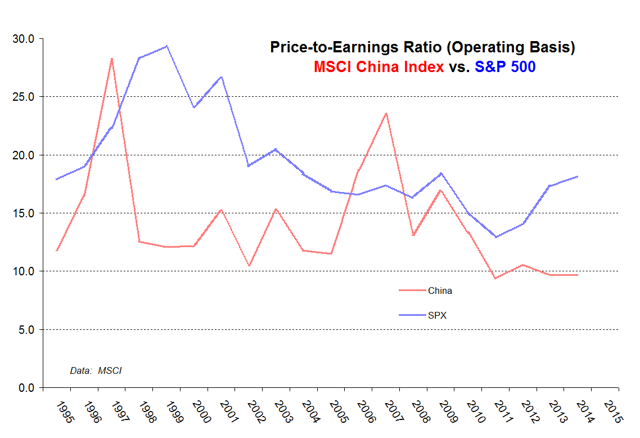

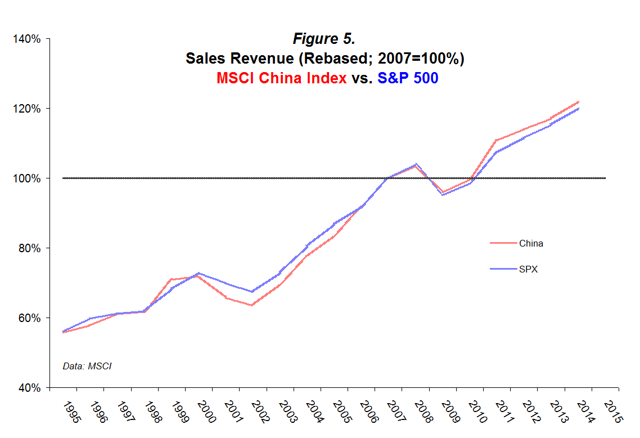

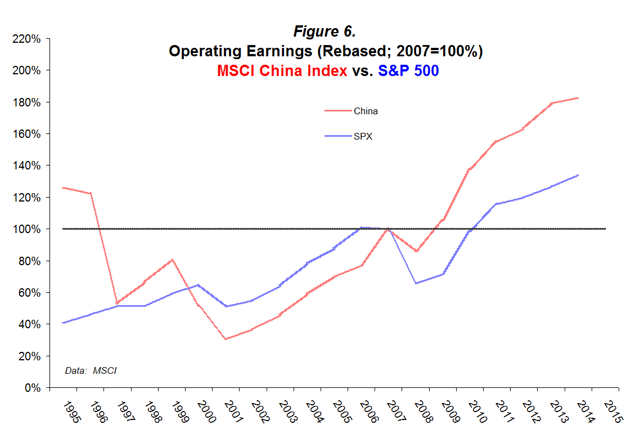

Summary Chinese equities have traded sideways for the past five years while sales and earnings have improved. In late November, the PBOC cut interest rates for the first time since 2012. China is the world’s only major economy with ample room to cut policy rates. Falling energy costs should depress consumer prices in coming months, bolstering the case for monetary stimulus. If our interest-rate thesis is correct, FXI, the most liquid equity ETF, might soon break out from a three-year-old ascending-triangle formation, generating an initial price objective of $56/share. Something interesting is happening in China. Financial stocks are surging relative to the broad market. The “hockey stick” liftoff began in late November when the People’s Bank of China (PBOC) cut policy rates for the first time since 2012. China is the world’s only large economy with room to pursue conventional monetary policy. Further rate cuts are likely as falling energy costs put downward pressure on consumer prices. Investors should keep close watch on FXI which holds about 50% financials. This bellwether index could potentially break out from a three-year-old ascending triangle, generating an initial price objective of $56/share. The conditions for a new bull market — attractive valuations plus monetary stimulus — seem to be falling into place. A technical breakout, however, is needed to confirm it. The following seven charts outline the potentially bullish case. Figure 1. Financial stocks are on the move Figure 2. Consumer Prices are headed lower (click to enlarge) Figure 3. China is the world’s only major economy with room to cut policy rates (click to enlarge) Figure 4. Valuations are attractive (click to enlarge) Figures 5 & 6. Sales and earnings are both attractive (click to enlarge) (click to enlarge) Figure 7. After years of sideways action, a technical breakout is needed to confirm a new bull market Note: FXI is similar in structure to the MSCI China Index referenced in figures 4-6. Conclusion Every investor dreams of identifying cheap or reasonably-priced securities in the early stages of a bull market. Chinese equities may soon meet both criteria. Valuations are historically attractive, but a technical breakout has yet to confirm a new bull market. Asset allocators should prepare their mindsets for such an event. The prospect of further rate cuts from the PBOC is a likely catalyst. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Summary Chinese equities have traded sideways for the past five years while sales and earnings have improved. In late November, the PBOC cut interest rates for the first time since 2012. China is the world’s only major economy with ample room to cut policy rates. Falling energy costs should depress consumer prices in coming months, bolstering the case for monetary stimulus. If our interest-rate thesis is correct, FXI, the most liquid equity ETF, might soon break out from a three-year-old ascending-triangle formation, generating an initial price objective of $56/share. Something interesting is happening in China. Financial stocks are surging relative to the broad market. The “hockey stick” liftoff began in late November when the People’s Bank of China (PBOC) cut policy rates for the first time since 2012. China is the world’s only large economy with room to pursue conventional monetary policy. Further rate cuts are likely as falling energy costs put downward pressure on consumer prices. Investors should keep close watch on FXI which holds about 50% financials. This bellwether index could potentially break out from a three-year-old ascending triangle, generating an initial price objective of $56/share. The conditions for a new bull market — attractive valuations plus monetary stimulus — seem to be falling into place. A technical breakout, however, is needed to confirm it. The following seven charts outline the potentially bullish case. Figure 1. Financial stocks are on the move Figure 2. Consumer Prices are headed lower (click to enlarge) Figure 3. China is the world’s only major economy with room to cut policy rates (click to enlarge) Figure 4. Valuations are attractive (click to enlarge) Figures 5 & 6. Sales and earnings are both attractive (click to enlarge) (click to enlarge) Figure 7. After years of sideways action, a technical breakout is needed to confirm a new bull market Note: FXI is similar in structure to the MSCI China Index referenced in figures 4-6. Conclusion Every investor dreams of identifying cheap or reasonably-priced securities in the early stages of a bull market. Chinese equities may soon meet both criteria. Valuations are historically attractive, but a technical breakout has yet to confirm a new bull market. Asset allocators should prepare their mindsets for such an event. The prospect of further rate cuts from the PBOC is a likely catalyst. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News